Blog > B2B Credit Card Surcharging Strategies and Best Practices

B2B Credit Card Surcharging Strategies and Best Practices

In today’s B2B world, accepting credit cards is expected. But with rising credit card processing fees, B2B businesses are caught between convenience and margin protection. That’s where credit card surcharging comes in: a legal and innovative way to offset processing costs.

When done right, surcharging allows businesses to stay profitable while still offering flexibility. But navigating legal compliance, customer communication, and operational setup requires thought. This guide shows how B2B businesses can implement compliant surcharge strategies.

What is a B2B Credit Card Surcharge?

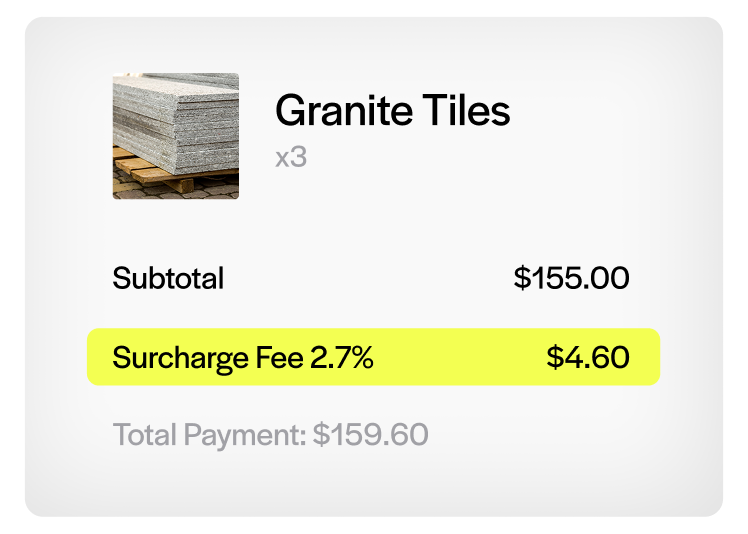

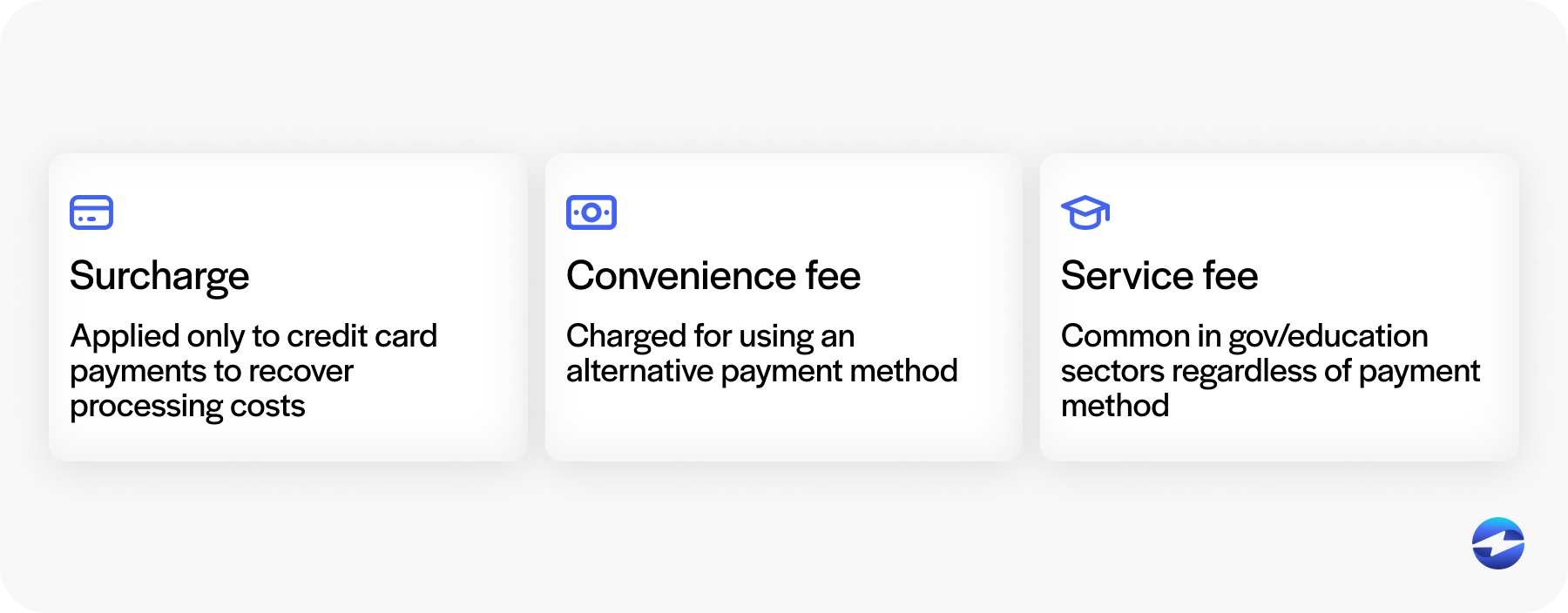

A surcharge is an additional fee passed to the customer to cover the cost of credit card processing. In B2B transactions, this often applies to large invoices or recurring payments where fees add up quickly. Note the difference between a surcharge and similar fees:

- A surcharge is applied only to credit card payments to recover processing costs.

- A convenience fee is charged for using an alternative payment method, like an online portal.

- A service fee is common in government or education sectors regardless of payment method.

Everyday use cases include manufacturers invoicing large credit card payments, SaaS companies billing subscriptions, and wholesalers offering card payments with clear surcharge terms.

Is It Legal for B2B Businesses to Add a Surcharge for Credit Card Payments?

Yes—with the right compliance, it is legal for B2B businesses to add surcharges to credit card transactions. U.S. laws and card brand rules allow surcharging in many cases, but compliance is key.

Federally, surcharging is generally allowed, but state laws vary. For a comprehensive overview, refer to the National Conference of State Legislatures. Some states, like Connecticut and Massachusetts, still prohibit surcharging, while others have specific rules. Visa and Mastercard allow surcharging up to 3%, but you can’t exceed your actual processing cost and must register with the card brands at least 30 days prior to implementation. You can find more details directly from Visa’s surcharge requirements and Mastercard’s rules.

For B2B transactions, disclosure is crucial. You must notify customers before they complete a transaction, and debit cards can’t be surcharged—even when processed as credit. This is a core rule across all major card brands and enforced under federal regulation by the Consumer Financial Protection Bureau.

How to Write Clear Credit Card Surcharge Fee Disclosure

Clear language is key to compliance and trust. Wording must be transparent and consistent across invoices, checkout pages, and email communications.

Invoice Template Example: “A 3% credit card processing surcharge will be applied to cover transaction fees. No fee applies to ACH or check payments.”

Checkout Page Message Example: “Paying with a credit card? A 3% processing fee will be added. You can avoid this fee by selecting ACH.”

To minimize customer friction, use clear, upfront messages and ensure terminology is consistent. Avoid ambiguous terms like “convenience fee” unless used accurately.

How to Implement Credit Card Surcharging in B2B Transactions

Start with tools that support compliance. Platforms like EBizCharge automate surcharge calculation and ensure accuracy across every transaction.

Apply surcharges on:

- Invoices or sales orders

- Online/eCommerce payments

- Recurring billing cycles

Follow these rules: keep the surcharge at or below 3%, or the amount charged by the processor, complete required registrations, and disclose the fee before finalizing payment.

With EBizCharge, following these rules is easy—the platform automates nearly every aspect of compliance, so surcharges are applied correctly and consistently. Staff should still be trained to explain the surcharge clearly to customers using approved scripts or email templates.

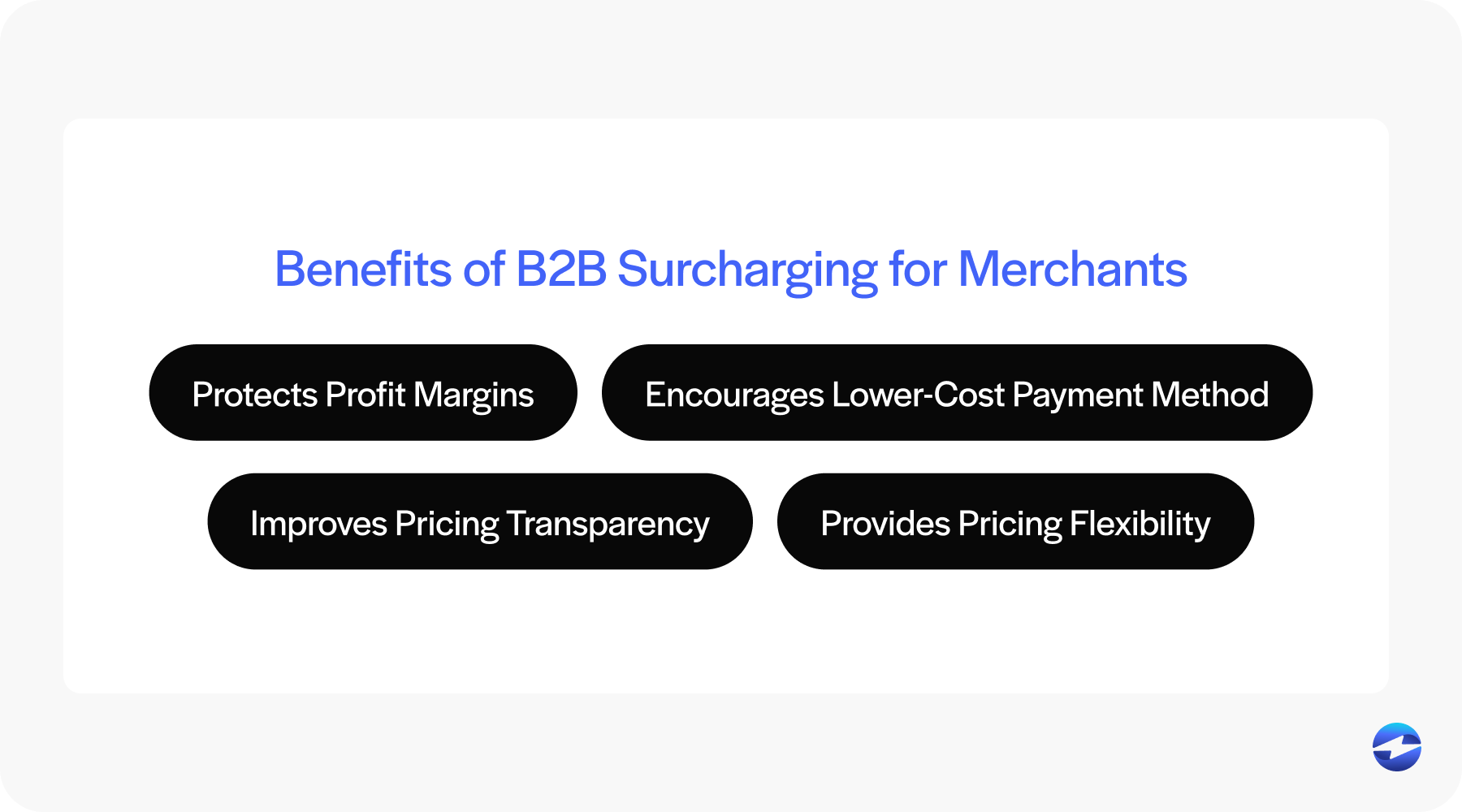

Benefits of B2B Surcharging for Merchants

Implementing surcharges in a B2B environment offers more than just cost recovery. When done right, it can change how businesses manage pricing, customer expectations, and operational expenses. Here are the main advantages:

Protects Profit Margins

Surcharging allows merchants to offset costs without inflating prices across the board. By shifting processing fees to customers who choose to pay by credit card, businesses can maintain healthy profit margins.

Encourages Lower-Cost Payment Methods

This approach also promotes the use of lower-cost alternatives like ACH or checks. Customers who want to avoid the fee may choose these more economical methods.

Improves Pricing Transparency

Surcharging builds trust through transparent pricing. Customers see the true cost of using credit cards rather than paying inflated prices that cover hidden fees.

Provides Pricing Flexibility

Merchants get the flexibility to keep base prices competitive and apply fees only where applicable, without raising prices across the board that affect all customers.

Common Mistakes to Avoid when Surcharging

Despite the benefits, surcharging must be done right. Common mistakes include:

- Not disclosing the surcharge clearly

- Applying surcharges to debit cards, which is not allowed

- Inconsistent surcharging across sales channels

- Poor communication that leads to customer confusion or chargebacks

These mistakes can lead to chargebacks, customer complaints, fines, card brand violations and loss of payment processing. They can also harm your business’s reputation or get you kicked off the payment processing grid.

To avoid these issues, use solutions that automate surcharge compliance and standardize customer communication. This minimizes risk and keeps processes simple and customer-friendly.

How EBizCharge Makes Surcharging Easy for B2B

EBizCharge makes surcharging easy for B2B merchants. The platform calculates surcharges, ensures compliance, and integrates with major ERP and accounting systems like QuickBooks, NetSuite, and Sage.

With branded payment portals and customizable invoice tools, EBizCharge helps businesses look professional and save money. Real-time compliance monitoring and transparent reporting are the icing on the cake.

B2B Credit Card Surcharging Takeaways

- Surcharging is legal in most states if done right.

- B2B merchants can use it to keep margins while offering credit card convenience.

- Clarity, consistency, and the right tools are key.

Next Step: Ready to lower your processing costs? Book a demo with EBizCharge to see surcharging in action.

FAQs

FAQs

- What is a B2B Credit Card Surcharge?

- Is It Legal for B2B Businesses to Add a Surcharge for Credit Card Payments?

- How to Write Clear Credit Card Surcharge Fee Disclosure

- How to Implement Credit Card Surcharging in B2B Transactions

- Benefits of B2B Surcharging for Merchants

- Common Mistakes to Avoid when Surcharging

- How EBizCharge Makes Surcharging Easy for B2B

- B2B Credit Card Surcharging Takeaways

- FAQs