Blog > Automating Account Reconciliation in NetSuite

Automating Account Reconciliation in NetSuite

Account reconciliation may not be the flashiest part of your finance operations, but it’s one of the most important. Getting your numbers right at the end of each month, quarter, or year depends on clean, accurate, and timely reconciliation. But for many teams, this process still involves manual spreadsheets, hours of digging, and a lot of second-guessing.

If you’re working in NetSuite, you already have a strong ERP foundation. But relying solely on manual steps—or even partially automated ones—can introduce unnecessary delays, errors, and compliance headaches. This article will explore how to automate NetSuite account reconciliation using a mix of native tools and smart integrations, helping you work more efficiently and accurately.

What Is Account Reconciliation?

Account reconciliation is the process of comparing internal records with external data to ensure everything aligns. In practice, this might include matching bank deposits with recorded cash entries, syncing credit card transactions, or confirming that subledger entries match your general ledger.

It’s a task that’s done regularly—monthly for most teams, sometimes even weekly or quarterly. Whether reconciling customer payments, vendor balances, or intercompany transfers, it’s foundational to accurate financial reporting.

Manual Reconciliation in NetSuite: Limitations

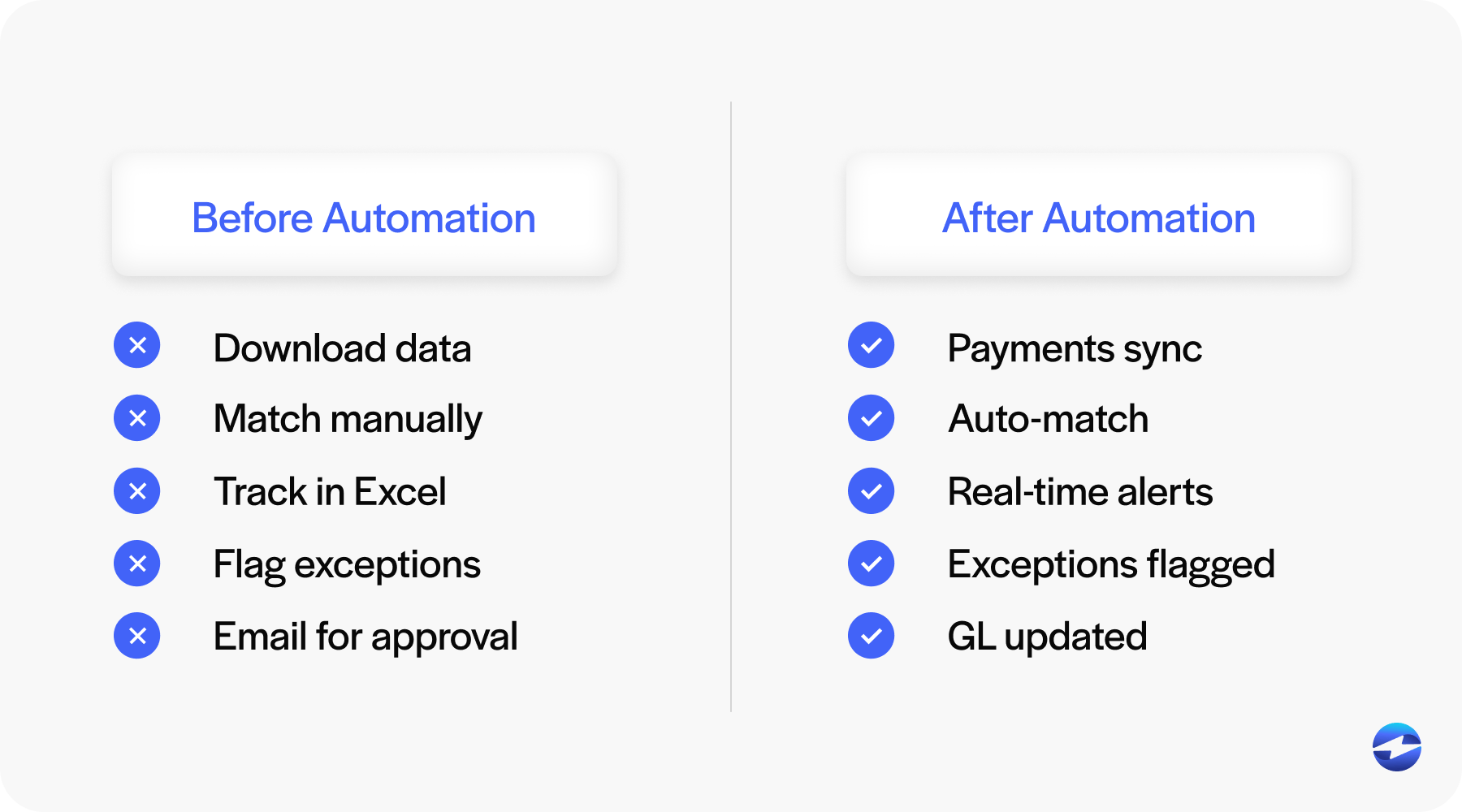

While NetSuite provides some great tools, manual reconciliation still crops up in many organizations. You might be exporting data into spreadsheets, manually matching transactions, and tracking exceptions in separate documents. This process is slow, labor-intensive, and risky.

Worse, it often depends on tribal knowledge—someone who “just knows” how the reconciliation works or where errors usually hide. That’s not a scalable system, especially if you’re growing or trying to meet strict audit standards. It also creates gaps in visibility and weakens your control environment.

Benefits of Automating Reconciliation in NetSuite

Automating your NetSuite account reconciliation process doesn’t just save time—it transforms how your finance team operates. When reconciliation is automated, you get faster closes, cleaner books, and better control over financial data.

Automation also reduces the risk of human error. There’s less room for accidental duplication or missed transactions. Plus, with reliable audit trails and consistent rules in place, you’ll be more prepared for compliance reviews and reporting requirements.

And let’s not forget visibility. With automated reconciliation, you can track issues in real time, drill into mismatches quickly, and share accurate numbers across the organization without delay.

Tools and Features for Automation in NetSuite

NetSuite has some built-in functionality to help with reconciliation. Its bank reconciliation tools and transaction matching features are useful starting points. You can also build saved searches and workflows to automate parts of the process.

Still, for many teams, the real magic happens when you bring in advanced tools and NetSuite integration partners. A robust payment processing solution, for example, can automatically post incoming transactions and match them to invoices. Integration with your payment processor or bank feed ensures everything stays in sync.

If you’re accepting online payments, having a NetSuite payment portal tied to your reconciliation process can help as well. With payments coming in through the same system, there’s less need for double entry or rekeying data.

Getting Started with Automation

Before you overhaul your entire process, it’s smart to identify the biggest pain points. Where are errors happening most often? Which reconciliation tasks take the most time? Are there certain accounts or transaction types—like refunds, chargebacks, or partial payments—that consistently cause delays or confusion? Start by mapping out your current reconciliation process step-by-step, including how you handle exceptions and how data flows between systems. The goal isn’t just to document what’s broken, but to understand where automation can have the most immediate impact.

Once you’ve outlined your current state, evaluate whether you can achieve your goals using NetSuite’s built-in functionality or if a third-party NetSuite payment automation solution is necessary. For businesses processing a large volume of transactions—especially through credit card processing or ACH—manual matching becomes unsustainable fast. Adding tools that integrate directly with your NetSuite payment solution or payment processor can relieve major bottlenecks and allow your team to focus on review and exception handling, not data entry.

Finally, any shift toward automation requires thoughtful planning. This means selecting the right tools and preparing for testing, phased rollouts, and team training. Include time to document your new workflows and create checks for accuracy. Change management is key, especially when the success of NetSuite account reconciliation relies on buy-in from multiple departments. When your team knows how and why the process is changing, they’re more likely to help it succeed.

EBizCharge and Automated Reconciliation

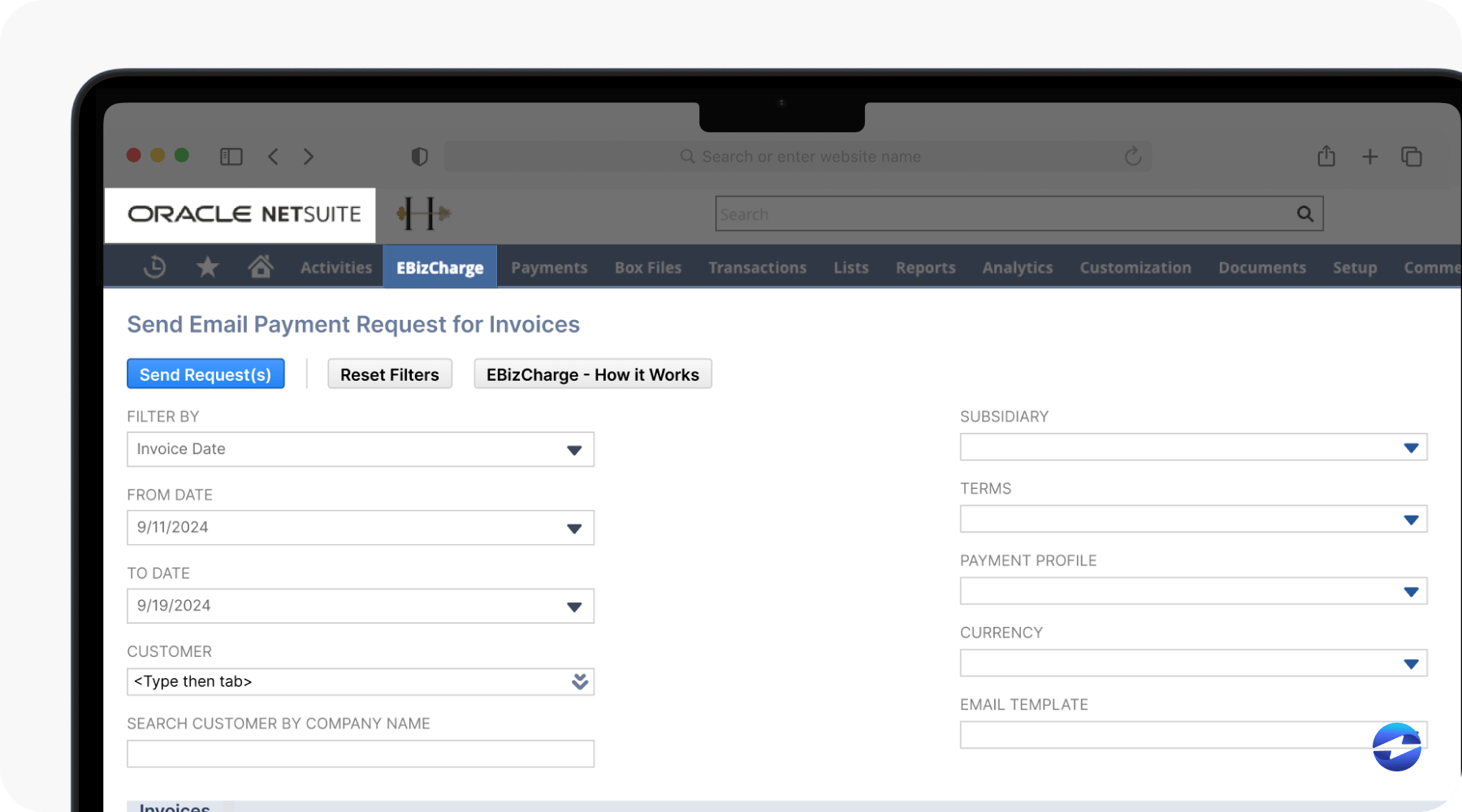

One powerful option for streamlining NetSuite account reconciliation is EBizCharge. This tool integrates directly into NetSuite, simplifying payment processing and reconciliation through real-time data syncing.

With EBizCharge, payments post directly against invoices in real time. That eliminates the need to manually match payments from your credit card processing system or go hunting through bank statements. It also significantly reduces errors and delays caused by duplicate entry.

EBizCharge works hand-in-hand with your NetSuite payment solution, syncing financial records so you always have a current view of what’s been paid and what’s still open. And because it’s designed with native NetSuite integration, there’s no need for external spreadsheets or extra platforms. It’s all right there.

Teams that use EBizCharge often highlight how much time they save—not just on reconciliation, but on customer support as well. With a branded NetSuite payment portal, customers can pay online, and those payments automatically sync back to the ERP. It’s seamless, clean, and accurate.

Why Automated Reconciliation in NetSuite Just Makes Sense

Automating your NetSuite account reconciliation process is one of those upgrades that pays off fast. It saves time, reduces errors, and gives you more confidence in your numbers.

Whether you stick with NetSuite’s native tools or explore third-party options, your goal should be to reduce friction, increase visibility, and improve how you handle payment processing. A reliable NetSuite payment solution should support everything from credit card processing to customer self-service and work well with your existing payment processor.

If you’re serious about improving your close process and strengthening your financial operations, now’s the time to explore automation. With the right tools, and the right NetSuite integration, you can turn reconciliation from a recurring pain point into a streamlined strength.