Blog > Alternative to Sage Payment Solutions: Better Options for Intacct Users

Alternative to Sage Payment Solutions: Better Options for Intacct Users

From billing customers to reconciling transactions, an efficient payment system can determine how smoothly your finance department runs. While Sage Payment Solutions is often the default option for users, more companies are now exploring other platforms that offer better pricing, flexibility, and control. Unfortunately, there’s no one-size-fits-all payment system that works for every business. Understanding your options can lead to major savings and fewer workflow headaches.

This article explores the leading Sage Intacct alternatives, including why businesses choose an alternative to Sage, what costs to expect from Sage’s native tools, and how a platform like EBizCharge compares.

Understanding Sage Intacct Payment Solutions

Sage Intacct payment solutions are designed to integrate directly into the Sage Intacct ERP system. They handle credit card processing, ACH payments, and invoice automation within the same financial platform. On the surface, the setup is convenient—it keeps payment data in one place and helps businesses manage their receivables without needing to rely on outside tools.

The strengths of Sage payment solutions are clear. You get native automation, built-in compliance, and straightforward reporting. For smaller teams or those new to ERP systems, that can be enough to get started. However, as businesses scale or need more control over their transaction costs, limitations become noticeable. Sage’s payment tools can be rigid in customization, and their pricing structure doesn’t always favor high-volume or recurring billing models.

For instance, many finance leaders report that while Sage offers smooth Sage Intacct integration, the platform can feel closed off when trying to connect with outside payment processors. That lack of flexibility can lead to higher costs and fewer opportunities to negotiate rates or introduce advanced automation features.

Sage Intacct Payment Processing Costs

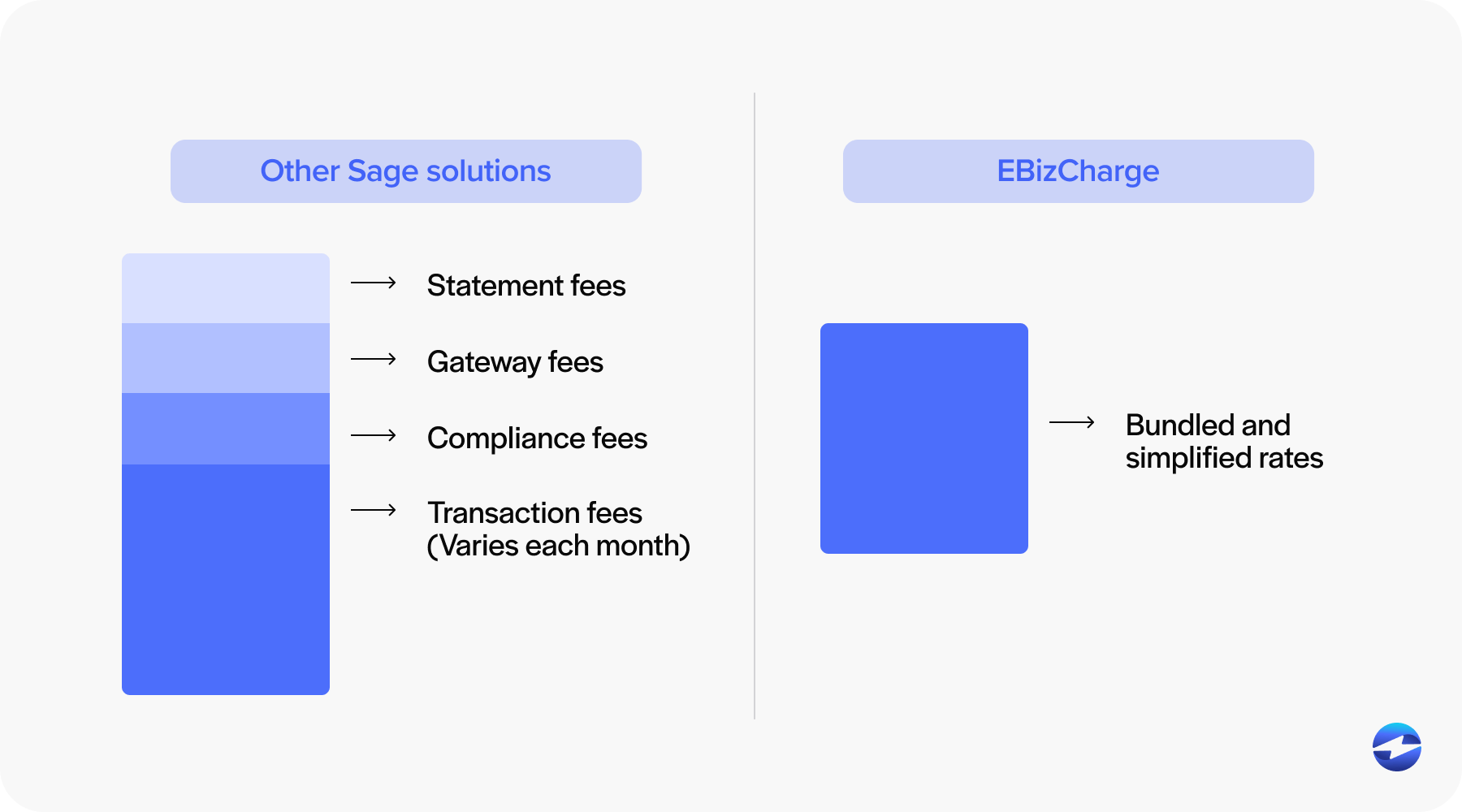

When it comes to Sage Intacct pricing, the numbers depend on your transaction volume and the types of payments you process. Sage Intacct payment processing generally includes three core components: transaction fees, gateway fees, and monthly service charges. The more transactions you run through the system, the more noticeable those small percentages become.

Another factor often overlooked is how card type affects cost. Credit card transactions, particularly rewards or business cards, can carry higher interchange fees that add up quickly. While Sage Payment Solutions bundles its rates for simplicity, that same structure can hide where costs are coming from.

Then there’s the time cost. Manual reconciliation or adjusting payments between systems drains both time and resources. Compared to more flexible Sage alternative platforms, Sage’s built-in solution can take longer to manage complex businesses with multiple revenue streams.

That’s where alternatives like EBizCharge begin to shine. They offer transparency in pricing, deeper integration options, and built-in automation that reduces manual tasks—helping finance teams save both time and money over the long term.

Why Sage Intacct Users Like EBizCharge

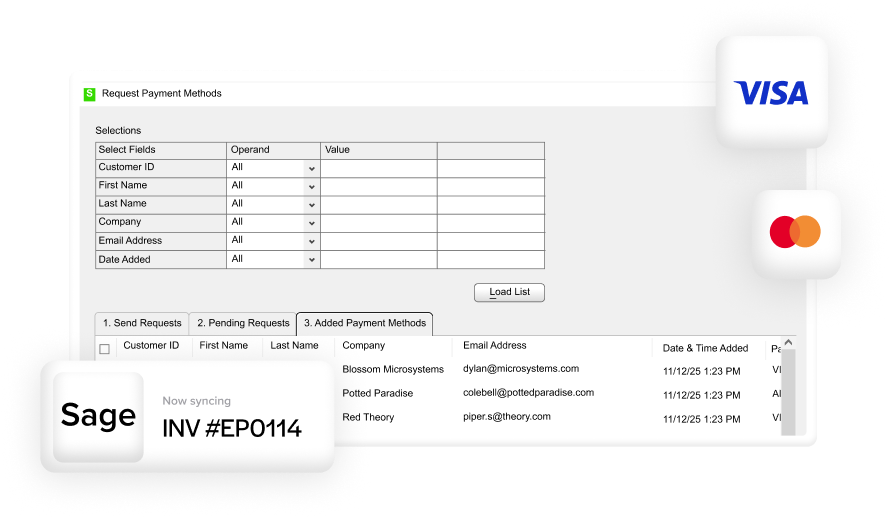

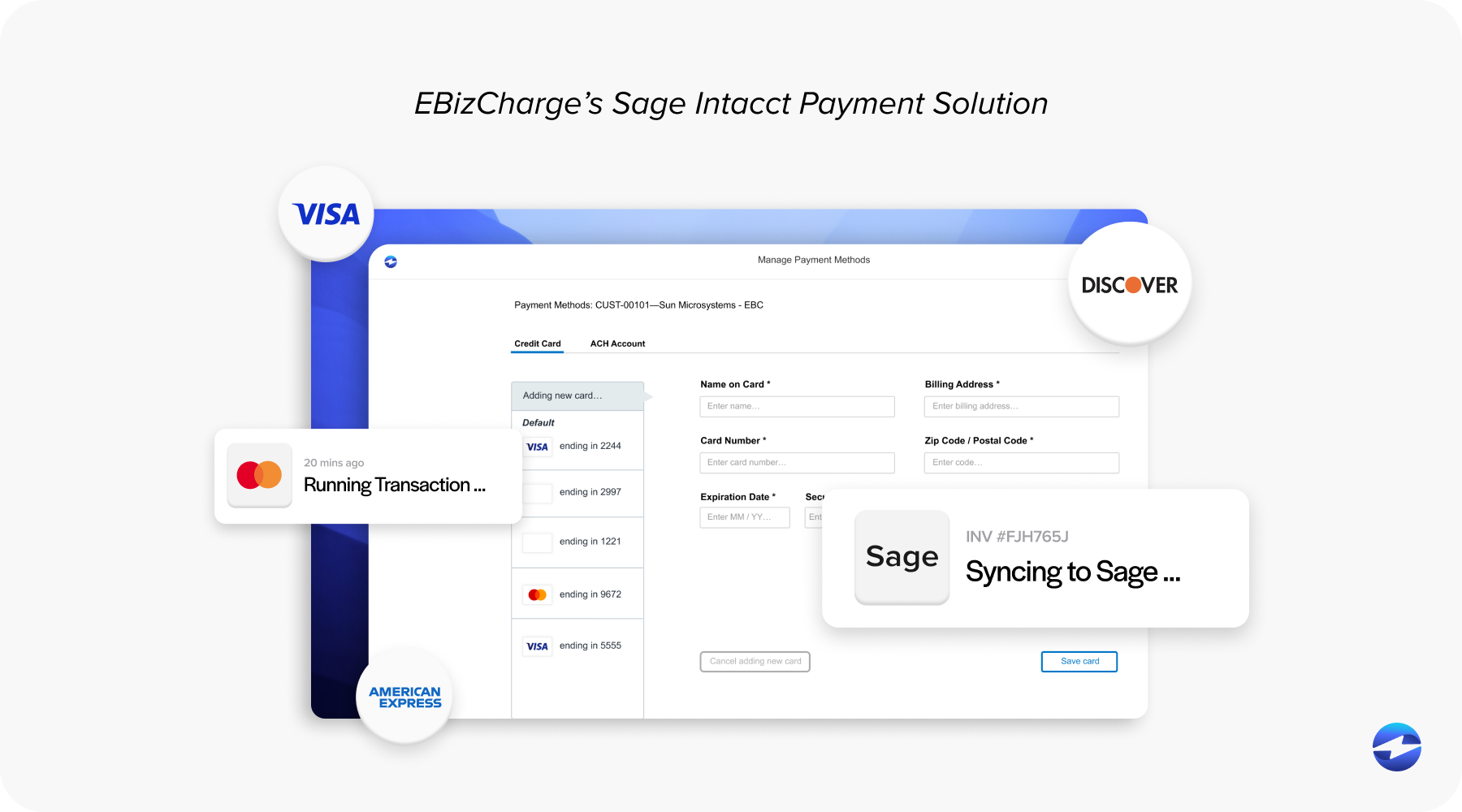

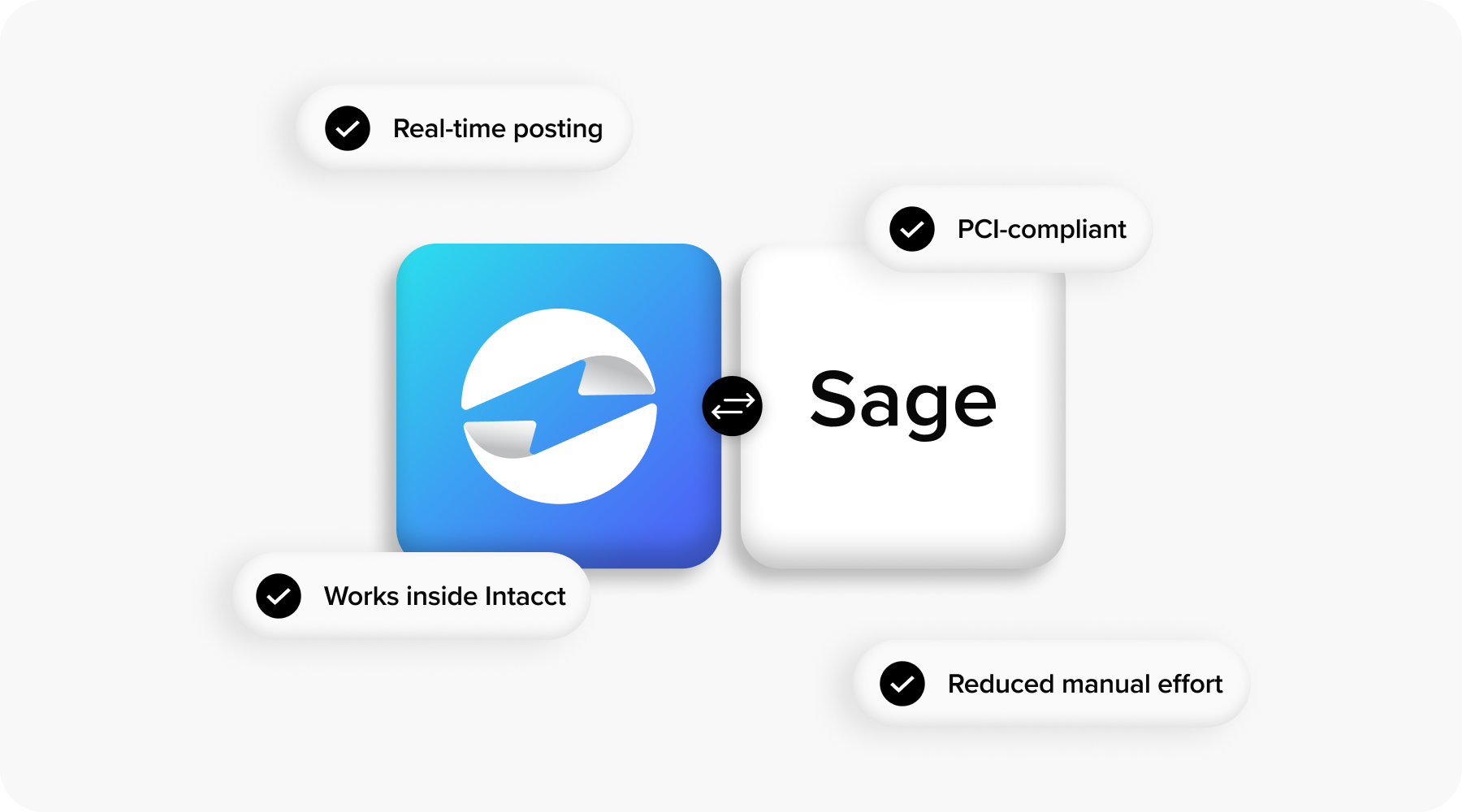

EBizCharge has become one of the most trusted Sage Intacct alternatives, and for good reason. It’s built specifically for Sage Intacct users who want a seamless experience without paying more than necessary. Unlike generic gateways, EBizCharge integrates natively into Sage Intacct, allowing payments to post directly to invoices, accounts, and projects in real time.

Finance teams appreciate that EBizCharge simplifies daily work. Payments reconcile automatically, reports update instantly, and data remains secure through built-in tokenization and encryption. This kind of Sage Intacct integration means fewer errors, faster processing, and less time spent troubleshooting.

One of EBizCharge’s biggest advantages is cost savings. Its interchange optimization system automatically routes transactions through the lowest-cost processing categories available. That alone can reduce total processing expenses by a noticeable margin each month. Add in bundled fraud protection, PCI compliance, and flexible customer payment portals, and you have a payment processing solution that not only works better but also costs less to maintain.

EBizCharge users also praise its customer support. Since the platform was built with ERP systems in mind, the support teams understand the nuances of accounting workflows—something that’s often missing in general-purpose payment gateways.

EBizCharge vs Sage Payment Solutions

When comparing EBizCharge vs Sage payment solutions, the difference usually comes down to flexibility and cost. Sage offers convenience with its native setup, but EBizCharge provides that same level of convenience with more control over how payments are managed and priced.

Sage’s payment tools function as part of a closed ecosystem, while EBizCharge operates as both a payment processor and a gateway. That dual capability eliminates the need for external services and simplifies the tech stack. For finance professionals, it means one less integration to manage and more accurate reporting.

In terms of cost, EBizCharge typically offers lower rates due to its interchange optimization and lack of unnecessary markups. For companies processing a high volume of transactions, these savings add up fast. Where Sage may focus on standardization, EBizCharge focuses on customization—letting businesses set up billing workflows, customer portals, and reconciliation methods that fit their unique needs.

Over the long term, that customization pays off. Many finance teams find that using EBizCharge as an alternative to Sage leads to cleaner reporting, faster collections, and better insight into cash flow performance.

Choosing the Right Alternative for Your Business

Finding the right Sage Intacct alternatives depends on your priorities. Some organizations value simplicity over savings, while others want a system that scales with them as they grow. Before choosing a provider, it’s worth evaluating three things: pricing transparency, integration depth, and support.

If your current system doesn’t let you see where fees are going—or forces you to depend on outside reconciliation tools—it might be time to explore an alternative to Sage. Platforms like EBizCharge make it easier to see and control your payment ecosystem. They offer competitive pricing, native ERP connections, and flexible setups that reduce administrative burden.

Remember, the best payment processing solution is the one that complements your existing workflow. It should simplify—not complicate—your financial operations. Whether that means switching to EBizCharge or another provider, the goal is the same: gain more control, reduce costs, and keep data accurate across all systems.

Building a Payment System That Works for You

As businesses evolve, so do their payment needs. While Sage payment solutions have helped many organizations handle transactions inside Sage Intacct ERP, alternatives like EBizCharge offer stronger customization, clearer pricing, and more advanced automation.

Choosing the right Sage alternative isn’t just about finding a cheaper processor—it’s about building a system that supports your team’s growth and keeps financial data consistent across every department. With tools like EBizCharge, Sage users can finally bridge the gap between simplicity and flexibility, gaining a payment processor that works just as hard as their ERP.

In the end, the best system is the one that fits your business—not the other way around. Whether you stay with Sage or explore new Sage Intacct payment solutions, the key is to focus on efficiency, integration, and long-term value.