Blog > Advanced Sage 100 Payment Automation Strategies

Advanced Sage 100 Payment Automation Strategies

Managing accounts receivable in today’s business environment is a constant balancing act between the wants/needs of CFOs, AR managers, and Accountants.

Picture this: invoices go out instantly, customers pay within hours, and your team never has to key in the same payment twice. Reports are always accurate, collections are ahead of schedule, and the month-end close feels routine instead of frantic. For many Sage 100 users this efficiency level sounds out of reach, but it’s not.

Sage 100 provides a strong foundation for handling receivables, but getting the most out of it means going beyond the basics. Advanced automation strategies can integrate payment capture into your existing workflows, automatically post transactions in real time, and remove the need for entering the same data twice. The result is fewer errors, faster collections, and better visibility for everyone involved.

This guide outlines advanced payment automation strategies for Sage 100, featuring proven accounts receivable best practices and real-world examples to help implement these ideas. Each section addresses a common challenge, explains the strategy for solving it, and shows how to create a system where your team spends less time on the process and more time delivering results.

Advanced Sage 100 Payment Automation Strategies

| Strategy | Pain Point | Overview | Key Benefits | Example Application in Sage 100 |

|---|---|---|---|---|

| Multi-Channel Self-Service Payment Access | Limited payment options slow collections and increase AR workload. Customers expect to pay online, by email, or on mobile instantly. | Offer customers multiple secure self-service channels that all sync directly with Sage 100. | Faster payments, improved customer experience, and reduced manual reconciliation. | EBizCharge Connect publishes invoices to a portal, sends pay links, and processes mobile payments. |

| Automated Payment Capture for Repeat Transactions | Manually billing repeat customers each cycle wastes time and risks late payment. | Store customer payment methods securely and set up automated charging upon invoice creation or on schedule. | Predictable revenue, fewer missed payments, reduced manual work. | EBizCharge stores tokenized cards/ACH and charges them automatically, posting to invoices instantly in Sage 100. |

| Instant Payment Posting and GL Synchronization | Payments sit unposted while AR manually matches them to invoices and the GL. This delays visibility and increases error risk. | Integrate payment capture so all transactions post instantly to AR and GL from any payment source. | Accurate, real-time financial reporting and faster reconciliation. | Payments via EBizCharge post instantly to Sage 100 with matching deposits. |

| Advanced AR Performance Analytics | Without real-time data, AR teams react late to slow payers and cannot track KPIs effectively. | Use dashboards and reports that pull live AR and payment data from Sage 100 to monitor performance daily. | Data-driven collections strategy, improved cash flow, proactive AR management. | EBizCharge logs all transactions and enables KPI tracking. |

| Interchange Optimization and Payment Cost Control | High processing fees cut into margins, especially for B2B transactions without enhanced data. | Automate Level II/III data submission for eligible transactions and promote ACH for large invoices. | Lower processing costs without slowing payment speed. | EBizCharge sends detailed invoice data automatically and accepts ACH for larger balances in its portal. |

| Multi-Stage Payment Collection Automation | Single due-date reminders are easy to overlook, leading to late payments and manual chasing. | Automate a sequence of reminders—before, on, and after due date—with secure payment links. | Reduced late payments, fewer collection calls, and more predictable revenue. | EBizCharge sends scheduled reminders with pay links for Sage 100 invoices, auto-applying payments to AR. |

| Integrated Dispute and Chargeback Management | Disputes are often discovered late and managed outside AR workflows, delaying response. | Connect dispute alerts and case management directly to invoice records for faster resolution. | Higher win rates, reduced revenue loss, and centralized tracking. | EBizCharge alerts AR teams to disputes, pulls Sage 100 invoice docs, and updates AR with resolution results. |

| Advanced Fraud Detection Tailored to AR Workflows | Lax fraud controls risk losses; overly strict ones block legitimate payments. | Apply layered fraud filters, risk scoring, and custom rules for different payment channels. | Reduced fraud risk without harming customer experience. | EBizCharge applies configurable fraud rules and flags suspicious payments. |

| Payment Method Diversification with Automated Routing | Customers may use high-cost methods unnecessarily, driving up processing expenses. | Offer multiple methods, but route transactions to the most efficient and cost-effective based on rules. | Lower costs, faster settlement, and maintain payment flexibility. | EBizCharge provides various tools for accepting multiple types of payments. |

| Role-Based Payment Workflow Controls | Without defined permissions, payment actions can be misused or cause confusion. | Assign role-based permissions for payment functions and log all actions for accountability. | Tighter security, clear responsibility, better compliance. | EBizCharge restricts payment actions by user role in Sage 100 and records all activities in an audit log. |

1. Multi-Channel self-service payment access

Pain point: When customers are limited to mailing checks or calling in payments, collections slow, and AR teams spend more time chasing invoices than closing them. Customers expect to pay online, on mobile, or via links in seconds. Without that flexibility, payment delays compound, cash flow suffers, and staff workloads increase.

Strategy: An advanced approach is to provide multiple secure, self-service channels such as online portals, embedded invoice pay links, and mobile-friendly forms that all connect directly to Sage 100. The moment a payment is made, it should reflect in AR and the general ledger.

Result: Payments are collected faster, customers have a better experience, and your AR team no longer needs to reconcile multiple payment sources manually.

Features that make it possible

- Real-time invoice publishing to customer-facing portals

- Secure, device-agnostic payment forms

- Partial payment options and account history access

- Automatic posting of all transactions into Sage 100

Example in Sage 100 with EBizCharge

EBizCharge integrates with Sage 100 to publish invoices directly to a branded, PCI-compliant portal. Customers can also pay from an email link or mobile form. Every payment (regardless of channel) updates AR and GL in Sage 100 in real time, without manual reconciliation.

2. Automated payment capture for repeat transactions

Pain point: Businesses with repeat-billing customers often spend hours every month sending reminders, taking payments, and re-entering details. This manual loop risks late payments and creates unnecessary labor for the AR team.

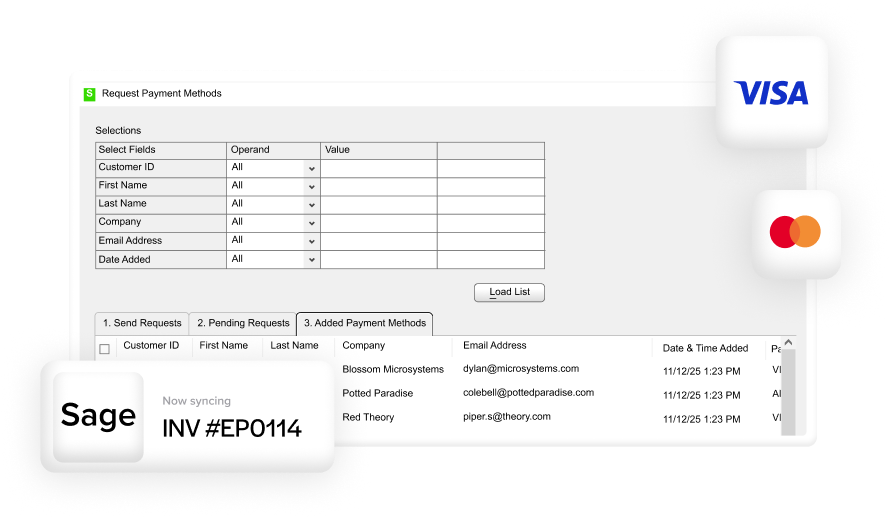

Strategy: Securely store each customer’s preferred payment method and set automated rules to charge it upon invoice creation or on a recurring schedule. Payments should link directly to invoices in Sage 100 and update balances automatically, so the only exceptions AR handles are failed or expired payment methods.

Result: Recurring revenue streams are consistent, payment delays shrink, and AR teams save hours of manual work each billing cycle.

Features that make it possible

- Tokenized storage of credit card and ACH credentials

- Scheduled auto-charging rules

- Automatic invoice-level payment application

- Expiration and decline handling alerts

Example in Sage 100 with EBizCharge

EBizCharge lets you store cards or bank accounts securely in Sage 100 and set Auto Pay rules for instant or scheduled charging. Payments post directly to the correct invoice, and failed or expired methods trigger alerts so AR staff only intervene when necessary.

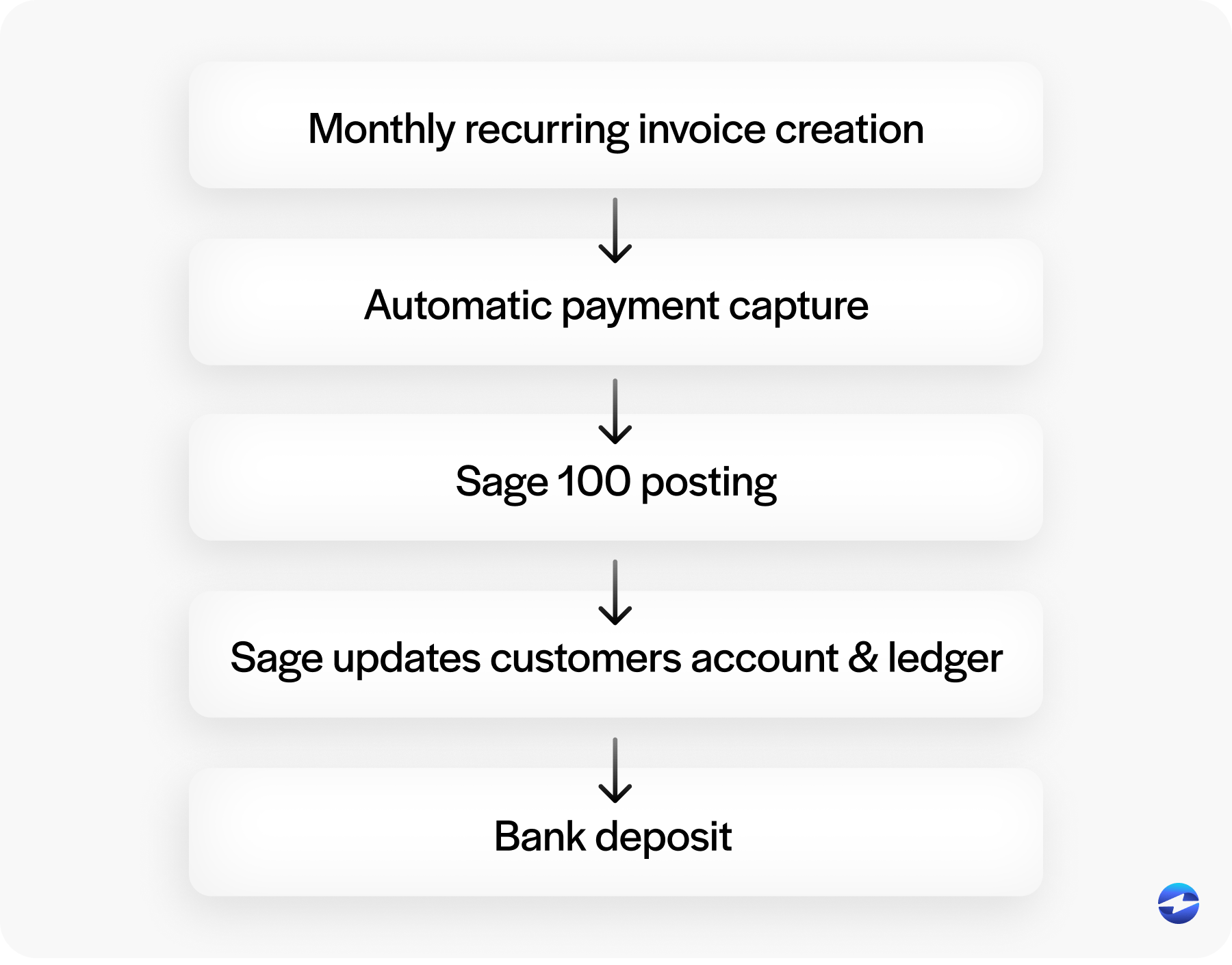

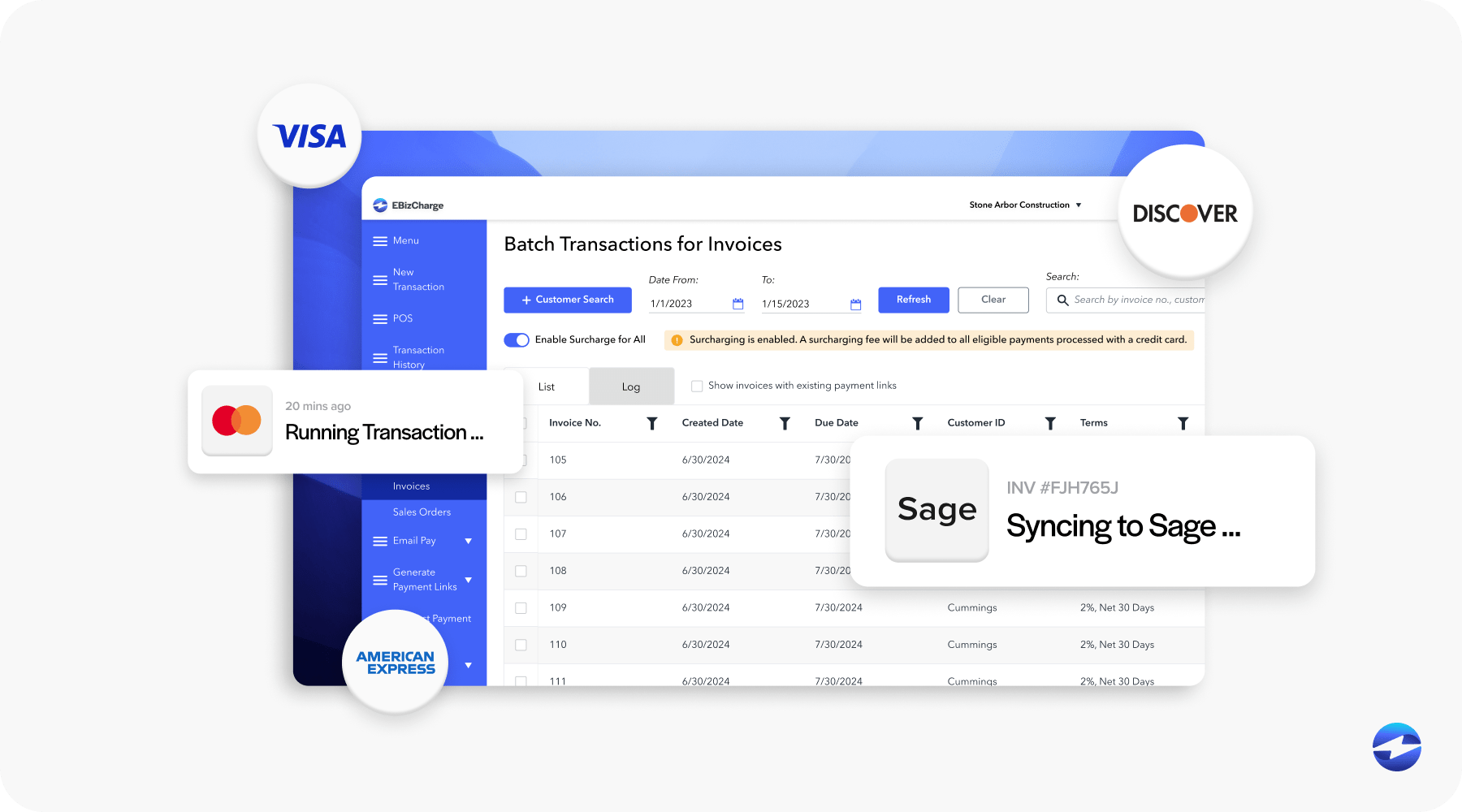

3. Instant payment posting and GL synchronization

Pain point: Even when payments come in quickly, they often sit unposted while AR staff manually match them to invoices and create entries in the general ledger. This delay distorts financial visibility and increases the risk of data entry errors.

Strategy: Integrate payment capture with Sage 100 so that every transaction from a customer portal, mobile device, or in-office payment applies instantly to the right invoice while also updating the GL in real time.

Result: Finance leaders get accurate, up-to-the-minute reporting, AR spends less time on clerical work, and reconciliation is faster and cleaner.

Features that make it possible

- Real-time AR and GL updates from any channel

- Automatic cash receipt generation

- Invoice status updates without manual matching

- Full audit trail for compliance

Example in Sage 100 with EBizCharge

Payments through EBizCharge (whether from sales orders, invoices, mobile, or the portal) post instantly in Sage 100, closing the invoice, updating the ledger, and matching deposits to batches automatically.

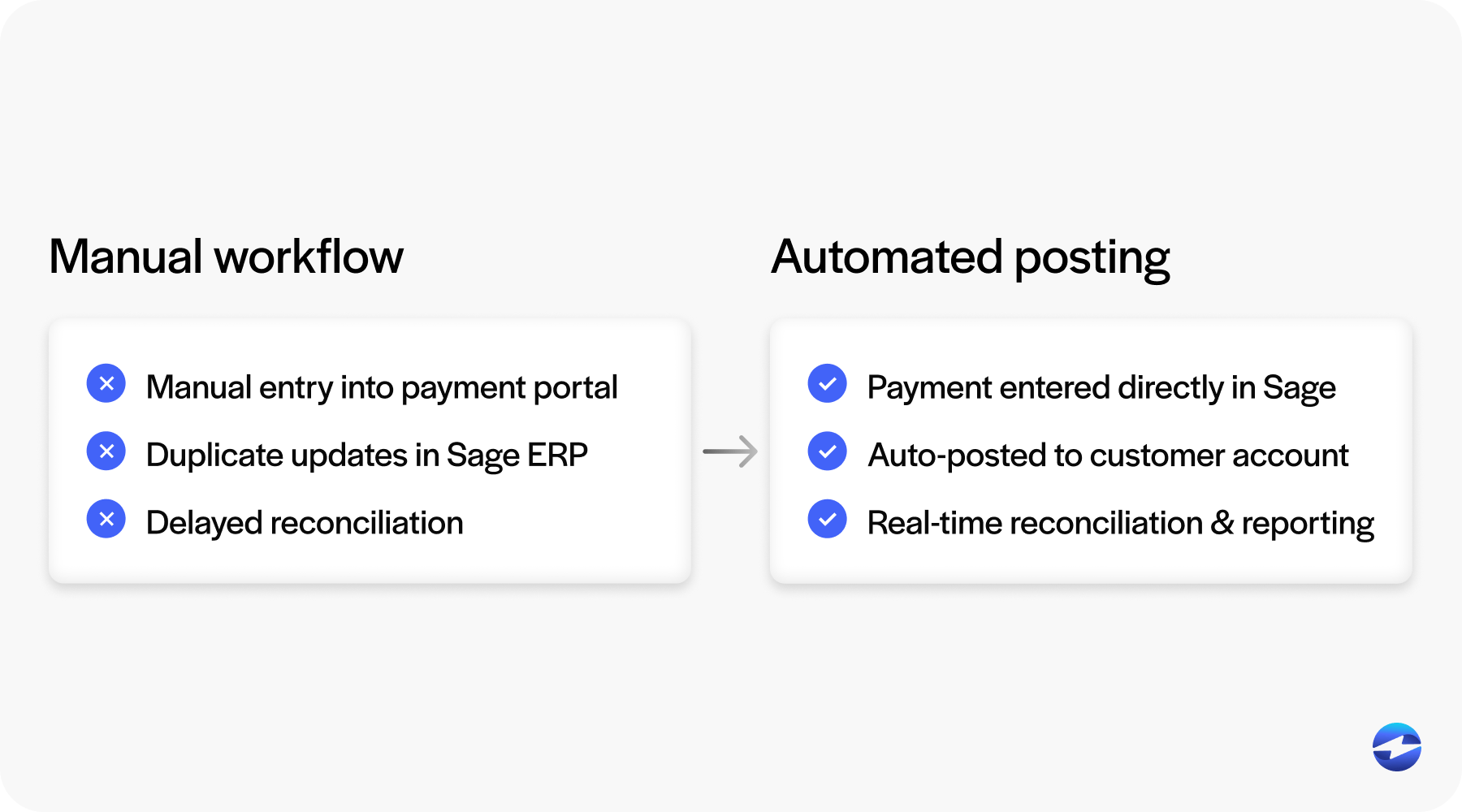

Manual vs. automated accounts receivable process overview

| AR Process Step | Manual Process (Without Automation) | Automated Process (With EBizCharge & Sage 100) |

|---|---|---|

| Invoice Delivery | Printed or manually emailed invoice. No immediate payment option for the customer. | Invoice emailed with a secure Pay Now link. The customer can pay instantly online. |

| Customer Payment | The customer writes a check or calls with credit card information. Delay in receiving funds. | Customer submits payment electronically via portal or link (card or ACH), and funds are authorized in real time. |

| Data Entry of Payment | AR staff manually enter check details or card transactions into Sage 100. Possible typos or misapplication. | No data re-entry needed. Payment integration automatically records the transaction in Sage 100 and is linked to the invoice. |

| Applying Payment to Invoice | Staff matches payment to open invoice(s) and applies it. If done incorrectly, it causes reconciliation issues. | Auto-application of payment to correct the invoice. Invoice status is updated immediately upon payment. |

| Reconciliation | The accountant reconciles bank deposits with Sage 100 receipts at the day’s end. Discrepancies require investigation. | Real-time posting means Sage 100 reflects the bank deposit contents exactly, simplifying reconciliation. Reports can be generated for batch totals. |

| Security of Payment Data | Paper checks or written card numbers expose sensitive data. Compliance relies on manual processes. | Secure tokenization and encryption are used for all stored payment data; staff never handle raw card details. |

| Customer Experience | It takes days for the invoice, and then manual payment must be initiated (mail or phone). Inconvenient and slow. | Receives invoice immediately via email/portal and can pay in minutes with a few clicks. Fast and convenient. |

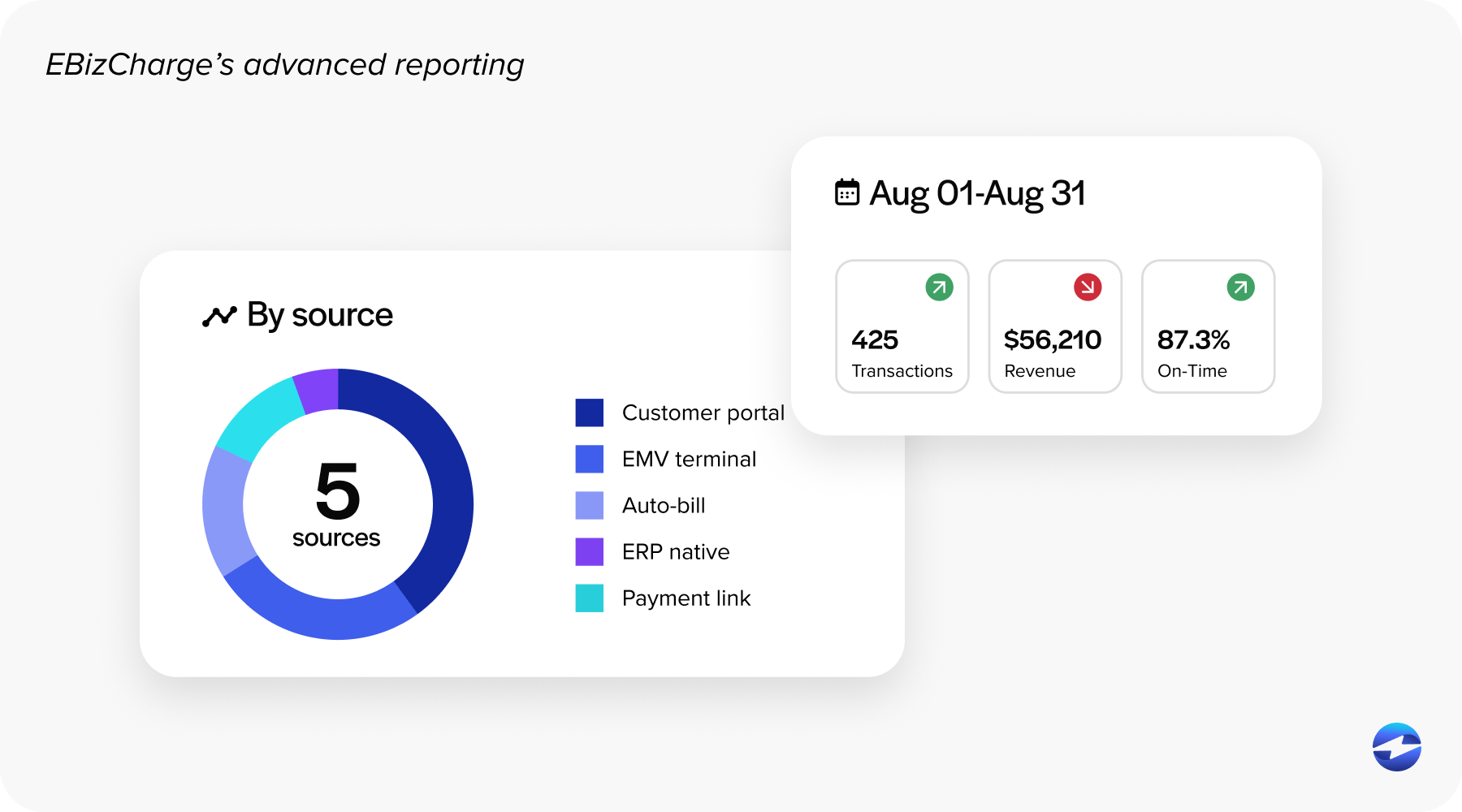

4. Advanced AR performance analytics

Pain point: Many AR teams operate reactively, waiting until month-end to review payment trends or identify late-paying customers. Without real-time analytics, opportunities to improve collections or prevent delays are missed.

Strategy: Instantly capture all payment/AR activity and consolidate it into dashboards that track KPIs like DSO, collection effectiveness index, and overdue balances. This allows for daily adjustments instead of monthly course corrections.

Result: Leaders can quickly identify bottlenecks, refine customer outreach, and measure the impact of changes, improving overall cash flow performance.

Features that make it possible

- Real-time AR and payment data capture

- Customizable cash flow and collections reports

- KPI tracking like DSO and collection effectiveness index

- Export-ready datasets for audits

Example in Sage 100 with EBizCharge

EBizCharge logs every transaction with invoice numbers, timestamps, and user IDs. Reports can be run in the EBizCharge dashboard or through Sage 100 queries, giving decision-makers up-to-date AR insights.

5. Interchange optimization and payment cost control

Pain point: Processing fees on card payments can quietly erode margins, especially in B2B transactions. Without passing enhanced transaction data, businesses miss out on reduced interchange rates.

Strategy: Automate the inclusion of Level II and Level III data in eligible card transactions and route large payments toward lower-cost ACH methods, all without adding extra steps for customers.

Result: Lower processing costs without sacrificing payment speed or convenience.

Features that make it possible

- Level II and III card data submission

- ACH support for large invoices

- Payment routing rules for least-cost processing

- Integrated gateway with no extra monthly fee

Example in Sage 100 with EBizCharge

EBizCharge automatically sends detailed line-item and tax data from Sage 100 invoices for eligible transactions, improving rate qualification. The portal can also accept ACH for larger balances while still offering card payment flexibility.

6. Multi-Stage payment collection automation

Pain point: Many AR teams rely on a single due-date reminder, which leaves too much room for customer oversight and late payments. Manual follow-up is inconsistent and drains resources.

Strategy: Implement multi-stage automation that sends branded reminders at multiple intervals before, on, and after the due date each with secure pay links. Use customer engagement data to prioritize follow-up for accounts most likely to pay late.

Result: Reduced late payments, fewer manual collection calls, and more predictable cash flow.

Features that make it possible

- Automated reminder scheduling

- Customizable messages with secure pay links

- Tracking of open, click, and payment actions

- Escalation triggers for overdue accounts

Example in Sage 100 with EBizCharge

With EBizCharge, you can set automated reminder sequences for Sage 100 invoices. You can start with an initial email on the issue, a reminder before the due date, and a final notice afterward. Each includes a pay link, and all payments sync instantly to Sage 100.

7. Integrated dispute and chargeback management

Pain point: Disputes and chargebacks can take days to discover and even longer to resolve if they’re not connected to the original transaction and invoice data.

Strategy: Integrate dispute alerts and management directly into your AR workflow so that the moment a case is opened, you can access related invoice data, submit evidence, and track resolution progress in real time.

Result: Faster responses, higher win rates, and reduced revenue loss from unresolved disputes.

Features that make it possible

- Real-time dispute alerts

- Evidence submission from within the payment platform

- Link disputes to original invoices

- Status tracking for active cases

Example in Sage 100 with EBizCharge

EBizCharge alerts you to disputes, lets you pull supporting docs directly from Sage 100, and submit evidence without leaving the payment dashboard. Resolutions and recovered funds update AR automatically.

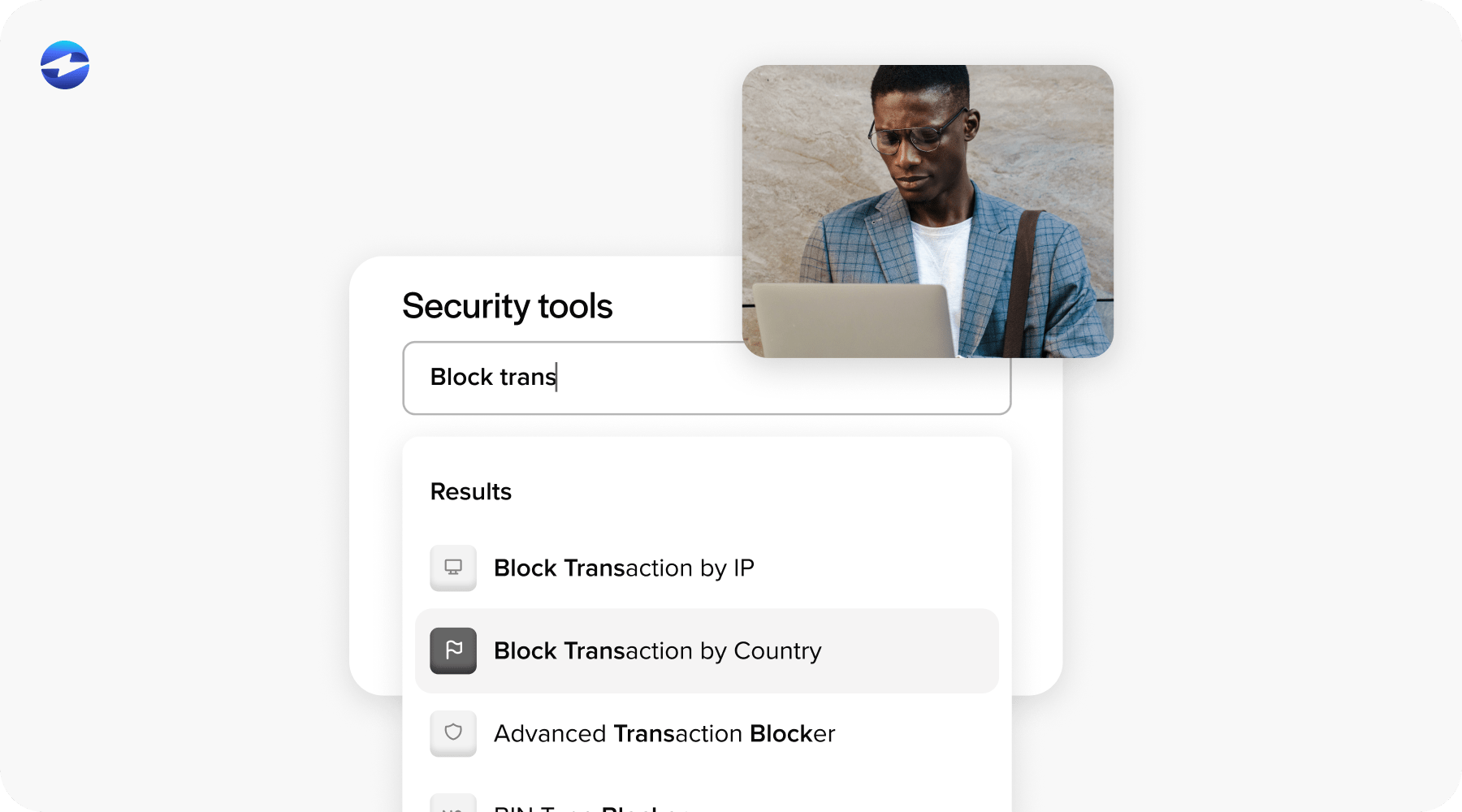

8. Advanced fraud detection tailored to AR workflows

Pain point: Fraud prevention in AR must balance security with customer convenience. Overly strict controls can block legitimate payments, while lax rules expose the business to risk.

Strategy: Use layered fraud detection that adapts rules based on transaction type, customer history, and payment channel, all integrated into the AR process.

Result: Stronger security with minimal disruption to legitimate customer payments.

Features that make it possible

- Adjustable fraud filters per workflow

- Real-time risk scoring

- Auto-blocking or flagging suspicious transactions

- Reporting for risk trend analysis

Example in Sage 100 with EBizCharge

EBizCharge applies customizable fraud rules to all inbound payments. High-risk transactions are flagged and still appear in Sage 100 with a pending status, so AR teams can investigate without breaking workflow continuity.

9. Payment method diversification with automated routing

Pain point: Customers have different payment preferences, but not all methods are equally efficient or cost-effective. Without routing logic, high-cost methods may be used unnecessarily.

Strategy: Offer multiple payment methods but use automated rules to steer transactions toward the most efficient and cost-effective option for each situation.

Result: Lower processing costs and faster settlement without sacrificing customer choice.

Features that make it possible

- Acceptance of credit, debit, ACH, eCheck

- Routing rules by invoice size or customer type

- Least-cost transaction routing

- Real-time method switching in portals

Example in Sage 100 with EBizCharge

EBizCharge’s hosted forms can prioritize ACH for large balances while allowing card payments for smaller ones, routing each through the least expensive available processing path while updating Sage 100 instantly.

10. Role-Based payment workflow controls

Pain point: In multi-user AR environments, lack of defined permissions can create security risks and confusion over payment responsibilities.

Strategy: Implement role-based controls that define who can take payments, issue refunds, approve large transactions, or access reports. Backed by audit logs for every action.

Result: Tighter security, clearer accountability, and a cleaner audit trail.

Features that make it possible

- Role-specific permissions for payment actions

- Approval workflows for high-value transactions

- Full audit logs of user activity

- Segmented reporting by user

Example in Sage 100 with EBizCharge

EBizCharge lets you define roles so, for example, customer service can take payments but only accounting can issue refunds. All actions are logged and tied to Sage 100 invoice records for full visibility.

Advanced payment automation in Sage 100

Advanced payment automation in Sage 100 can completely change how your finance team approaches accounts receivable. Combining strategies like self-service portals, email payment links, saved payment methods, mobile payments, automated posting, advanced reporting, strong security, and cost optimization removes much of the manual work that slows down cash flow. Each approach strengthens the others. The result is a faster, more accurate AR process that supports strategic business goals rather than just keeping up with day-to-day tasks.

For Sage 100 users, integrations such as EBizCharge make these strategies easier to put into practice. It works within the ERP environment to connect payments directly to your workflows, update records automatically, and give customers simple, secure ways to pay. Features can be layered in as your team is ready, so you see results quickly without overhauling everything at once.

The most successful implementations start small and build momentum. Kick things off by trying out one or two automation strategies. Once you see how well they work, you can start adding more. When you communicate these gains to stakeholders, each group sees a clear win.

- CFOs gain better cash management and lower costs

- AR managers get a more efficient collections process

- accountants enjoy cleaner records with less manual entry

Businesses that have embraced these advanced Sage 100 strategies often move their AR from being a manual cost center to a streamlined, data-driven part of the organization. Taking the steps outlined in this guide positions you to collect payments faster, reduce headaches, and strengthen your financial foundation for long-term growth.

- 1. Multi-Channel self-service payment access

- 2. Automated payment capture for repeat transactions

- 3. Instant payment posting and GL synchronization

- 4. Advanced AR performance analytics

- 5. Interchange optimization and payment cost control

- 6. Multi-Stage payment collection automation

- 7. Integrated dispute and chargeback management

- 8. Advanced fraud detection tailored to AR workflows

- 9. Payment method diversification with automated routing

- 10. Role-Based payment workflow controls

- Advanced payment automation in Sage 100