Blog > Acumatica Credit Card Processing: Benefits and Getting Started

Acumatica Credit Card Processing: Benefits and Getting Started

In today’s fast-paced environment, efficient payment processing is a crucial component of any business. It directly influences cash flow, customer satisfaction, and operational efficiency. Businesses are increasingly embracing Acumatica for its ability to streamline payment processing seamlessly, as it offers hassle-free, digitized transactions that befit the speed of modern commerce.

What is Acumatica?

Acumatica is a cloud-based enterprise resource planning (ERP) system that offers a full suite of business management applications, including financials, distribution, project accounting, and CRM. Known for its adaptability, the platform allows businesses to tailor their functionalities to their specific industry needs and to scale up as they grow. Because it’s cloud-based, Acumatica provides real-time access to business data from any location, facilitating remote work and business continuity. It’s also praised for its user-friendly interface and robust payment integration capabilities, allowing it to seamlessly connect with various third-party applications and services, enhancing overall business processes and efficiency.

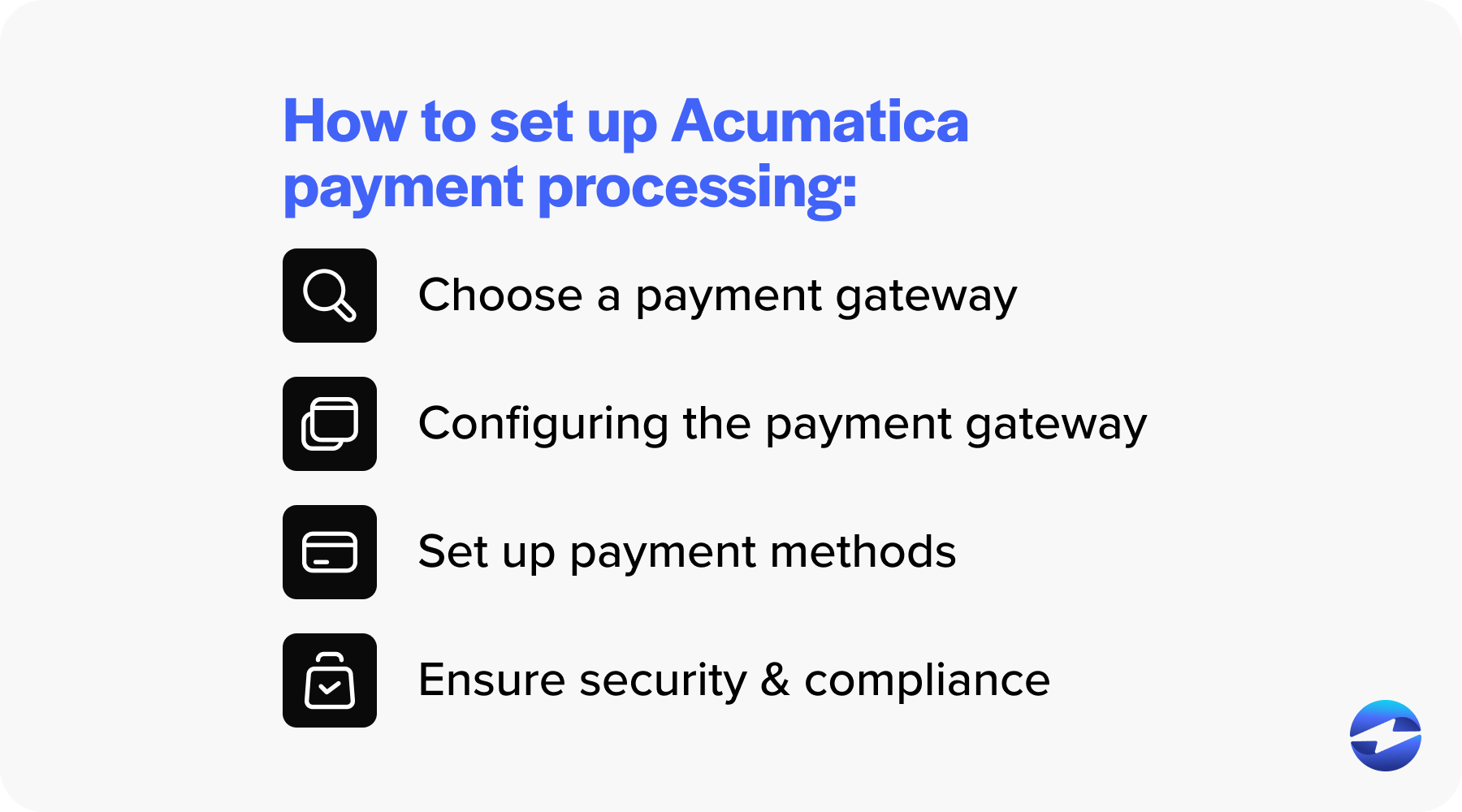

Setting up credit card processing in Acumatica

Acumatica payment processing is a straightforward experience that combines the convenience of digital transactions with the robust functionality of the ERP system.

- Choose a payment gateway. Selecting the best payment gateway for your business is pivotal when implementing Acumatica payment processing. A payment gateway acts as an intermediary between Acumatica and your financial institution, securely handling credit card transactions. When choosing a payment gateway, consider factors such as transaction fees, security features, supported payment methods, and integration capability with Acumatica when choosing a provider. Look for gateways with a proven track record of serving industry customers and a comprehensive arsenal of tools and features. Prioritize those that provide seamless integration with Acumatica to facilitate simple, hands-on processes and customizable reporting options.

- Configuring the payment gateway. Once you’ve locked in your payment gateway, the next step is to configure it within Acumatica. This process typically involves entering the payment gateway’s credentials into Acumatica and defining the types of credit card transactions your business will manage.

- Setting up payment methods. To start processing Acumatica payments, you’ll need to set up the payment methods you’ll accept from customers. In the Acumatica dashboard, navigate to the Payment Methods under receivables. Here, you can create new methods or edit existing ones. Configure the necessary details, such as the payment method type, processing center, cash account, and applicable payment methods. Make sure to test the payment method thoroughly to ensure everything works as expected, providing a smooth transaction process for your customers.

- Security and compliance. Security and compliance are non-negotiable when dealing with credit card processing. Ensure the selected payment gateway complies with the Payment Card Industry Data Security Standards (PCI DSS) to protect your customers’ payment information. Acumatica offers various security features, such as role-based access, which you should leverage to restrict who can process or view credit card information. Regular audits and updates are crucial to maintaining a secure payment environment, as well as educating your team about the best practices for handling sensitive data.

By adhering to the guidelines above, organizations can benefit from Acumatica’s integrated credit card processing capabilities, create a more efficient AR process, and maintain their clients’ and partners’ security and trust.

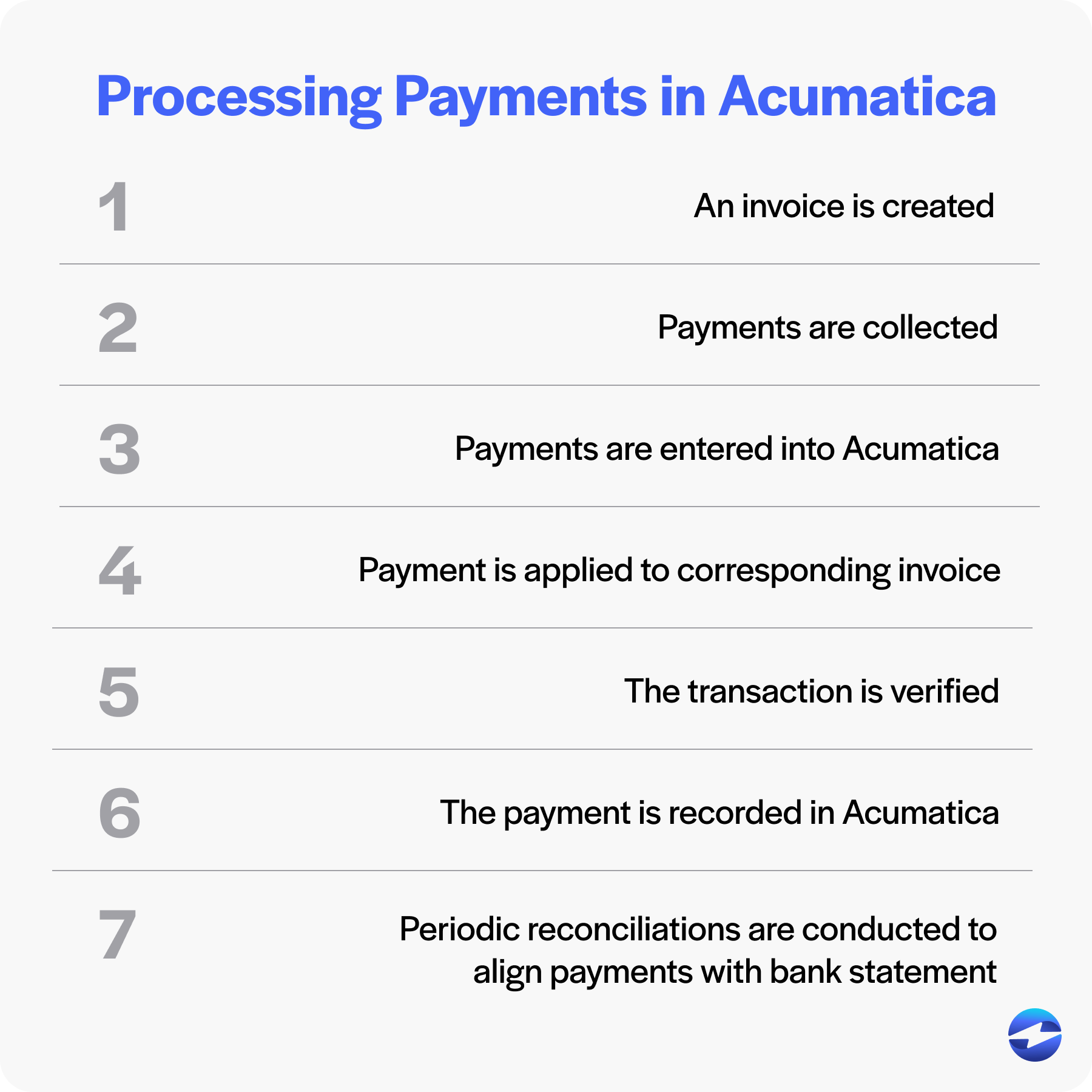

Processing payments in Acumatica

Once you’ve set up payment processing in Acumatica, it’s time to start accepting payments.

Processing payments in Acumatica can vary depending on business needs and specific workflows but typically involves several key steps.

- Invoices are created detailing the products or services provided to customers.

- Payments are collected using various methods, such as credit cards or Automated Clearing House (ACH) transfers.

- The payment details are then entered into Acumatica, including the amount and payment method used.

- The payment is applied to the corresponding invoice to clear the outstanding balance.

- The transaction is verified to ensure accuracy and completeness.

- Once verified, the payment is recorded in Acumatica, and financial records are updated accordingly.

- Periodic reconciliations are conducted to align recorded payments with bank statements, ensuring financial accuracy and integrity.

This comprehensive process ensures that Acumatica payments are efficiently managed and accurately recorded within the system. Moreover, processing credit cards within Acumatica offers additional benefits that further streamline financial operations and enhance overall business efficiency.

What are the benefits of processing credit cards in Acumatica?

With the right payment solution, Acumatica presents a multitude of benefits, including enhanced efficiency across financial operations, improved cash flow management, an improved customer payment experience, comprehensive insight through reporting, and robust security measures to protect against fraud.

Increased efficiency

Processing credit card payments within Acumatica can transform inefficient, manual tasks into a coherent, streamlined process. By consolidating payments into a single system, businesses reduce the need for multiple software applications, thereby decreasing the potential for errors and the time spent on cross-referencing data. Combined with a powerful payment processor, Acumatica’s automated processes, such as batch processing and real-time transaction processing, save valuable time, allowing staff to focus on higher-value tasks. This translates into a quicker reconciliation process and faster closing of financial periods.

Improved cash flow

Acumatica can speed up receivables collections by facilitating instant digital transactions. This immediacy ensures funds are available more quickly, enhancing the organization’s working capital. The system’s efficiency mitigates late and missed payments, contributing to a steady and predictable cash flow. This is critical for meeting operational needs and planning for future investments, enabling better cash flow forecasting and management.

Enhanced customer experience

In today’s digital age, customers expect convenient and secure payment options. Acumatica, combined with the right payment processor, supports a variety of credit cards and provides a smooth transaction experience. By integrating credit card processing into their ERP, businesses can offer customers streamlined, self-service payment portals, thus encouraging prompt payments and improving the overall satisfaction of their client base. Additionally, the quick processing of transactions means customers see their payments reflected in their account balances sooner, reinforcing transparency and trust.

Comprehensive reporting and analytics

Businesses can benefit from Acumatica’s reporting features that offer detailed insights into payment transactions. These customizable reports allow for better financial planning and analysis, maximize visibility into the payment process, and help identify any areas for improvement. Acumatica’s support network, often backed by partners and domain experts with industry experience, ensures that businesses can resolve any issues quickly and make the most of their payment processing system.

Security and fraud prevention

Security is paramount in payment processing, and Acumatica provides robust tools and standards to protect sensitive data. Adhering to PCI DSS and employing advanced security measures like encryption and role-based access helps mitigate the risk of fraud and ensure compliance. Regular system updates and employee education on security best practices contribute to maintaining a secure payment processing environment. Thus, organizations can confidently manage transactions, knowing they are safeguarding their customers’ data and their business’s reputation. For comprehensive security and analytics, assess your chosen payment provider to ensure they adhere to these security and fraud prevention standards.

Now that you know the benefits of processing payments in Acumatica, you should also familiarize yourself with some best practices for implementing it.

Best practices for processing credit cards in Acumatica

Implementing payment processing best practices in Acumatica ensures that credit card transactions are handled efficiently, securely, and in compliance with industry standards. Here are some best practices for implementing credit card processing in Acumatica:

- Regular system updates

- Employee training

- Monitoring and reconciliation

1. Regular system updates: Keeping your Acumatica system up to date is a cornerstone of maintaining a robust credit card processing framework. Regular updates often include enhanced features, which provide access to the latest functionalities that improve payment processing efficiency. Additionally, these updates incorporate security patches, immediately addressing new vulnerabilities, and compliance adjustments to ensure your system plays a pivotal role in protecting against fraud, ensuring that transaction handling is as robust as possible, and maintaining seamless integration with evolving payment technologies and standards.

2. Employee training: Properly trained employees are the linchpin of a reliable payment processing system. Training empowers employees to utilize the system effectively, ensuring that all features of Acumatica’s payment processing are being maximized for efficiency. Moreover, it helps mitigate errors by reducing the potential for costly human errors during payment entry and processing. Additionally, training enables employees to recognize fraud, enhancing their ability to identify suspicious activities, which can prevent fraudulent transactions. A well-trained team will understand the workflow of integrated payments and be able to assist customers with payment-related inquiries promptly, thereby enhancing customer service.

3. Monitoring and reconciliation: Routine monitoring and reconciliation are crucial for maintaining the integrity of your payment processing. This involves transaction verification, checking that each transaction has been correctly processed and posted and/or reconciled, ensuring that payments received match sales records and are accounted for within the financial statements. Additionally, anomaly detection plays a key role in identifying unusual patterns that might indicate errors or potential fraud. By regularly reconciling and monitoring credit card processing activities, you preserve the accuracy of your financial data and foster trust with customers, who can be assured their payments are processed correctly.

Adopting these practices will help increase your business’s operational efficiency, safeguard against fraud, and maintain compliance with relevant payment processing standards. Additionally, a trusted and top-rated payment solution like EBizCharge will promote a smoother transaction experience.

Promoting seamless transactions with EBizCharge

EBizCharge offers a seamless integration for Acumatica, significantly enhancing the overall payment processing experience. By embedding directly into Acumatica’s interface, EBizCharge streamlines credit card transactions, reducing the need for manual data entry and minimizing errors. It also supports a wide range of payment methods and ensures secure processing with advanced encryption and tokenization technologies. Users benefit from real-time transaction reporting and automated reconciliation, which improves efficiency and financial accuracy.

This payment integration simplifies the payment process and provides a robust, secure, and user-friendly solution for managing payments within Acumatica.