Blog > A Guide to Implementing P2P Payments in Your Business

A Guide to Implementing P2P Payments in Your Business

From the simplicity of splitting a meal cost to scrambling for a wallet-less solution at a flea market, peer-to-peer (P2P) payments offer a modern alternative to traditional cash and check systems. This financial exchange model, wherein individuals can send and receive money through a digital platform without the intermediation of conventional financial institutions, has garnered significant popularity.

Understanding the mechanics of P2P payments is crucial for businesses looking to stay ahead in the increasingly cashless marketplace.

What are P2P payments?

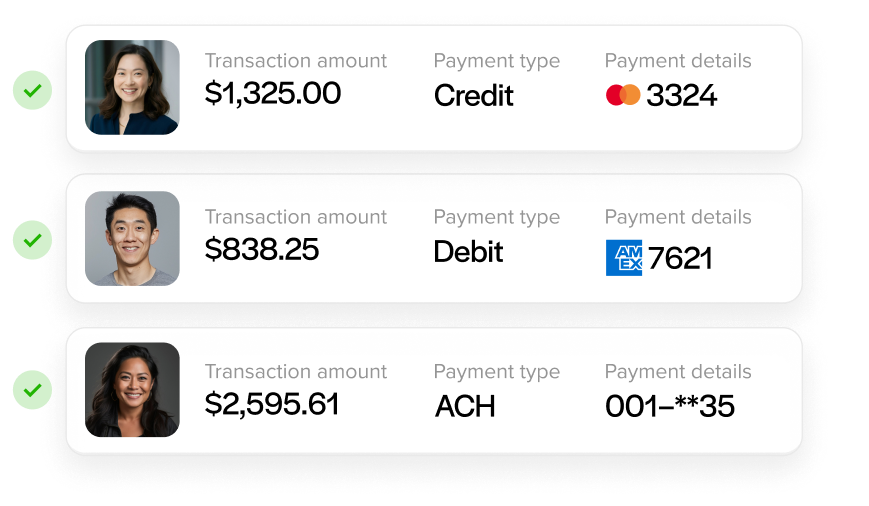

Peer-to-peer or P2P payments are digital transactions that allow individuals to send and receive money directly to and from others without the need for intermediary financial institutions. This process typically involves using a P2P payment app or platform on a mobile device or computer to manage the transfer of funds.

Users can link their bank accounts or input debit or credit card details into the P2P app, enabling them to send money to friends, family, or businesses quickly. These apps often require two-factor authentication (2FA) for added security, protecting users from sending money to the wrong person.

P2P payment services have revolutionized financial transactions with their convenience. They offer instant transfers and reduce the need to carry cash.

While traditional bank transfers can take several business days, depending on the service used, P2P transactions can occur almost instantaneously, depending on the service used.

How do P2P payments work?

The core of P2P systems lies in their ability to directly connect users’ bank accounts, digital wallets, or card details with the intended recipient’s account through a secure platform.

P2P payment systems encrypt sensitive data, maintaining privacy and reducing the risk of fraud. They’re designed to operate seamlessly on various devices, mainly mobile apps, which have become integral to the P2P transfer experience.

It’s worth noting that while many P2P transactions are completed within moments, the actual time for transferred funds to be accessible can depend on the P2P platform’s policies and the financial institutions connected to the transaction.

The seamless nature of P2P payments lies in their design to fit effortlessly into the digital lifestyle, making financial interactions hassle-free.

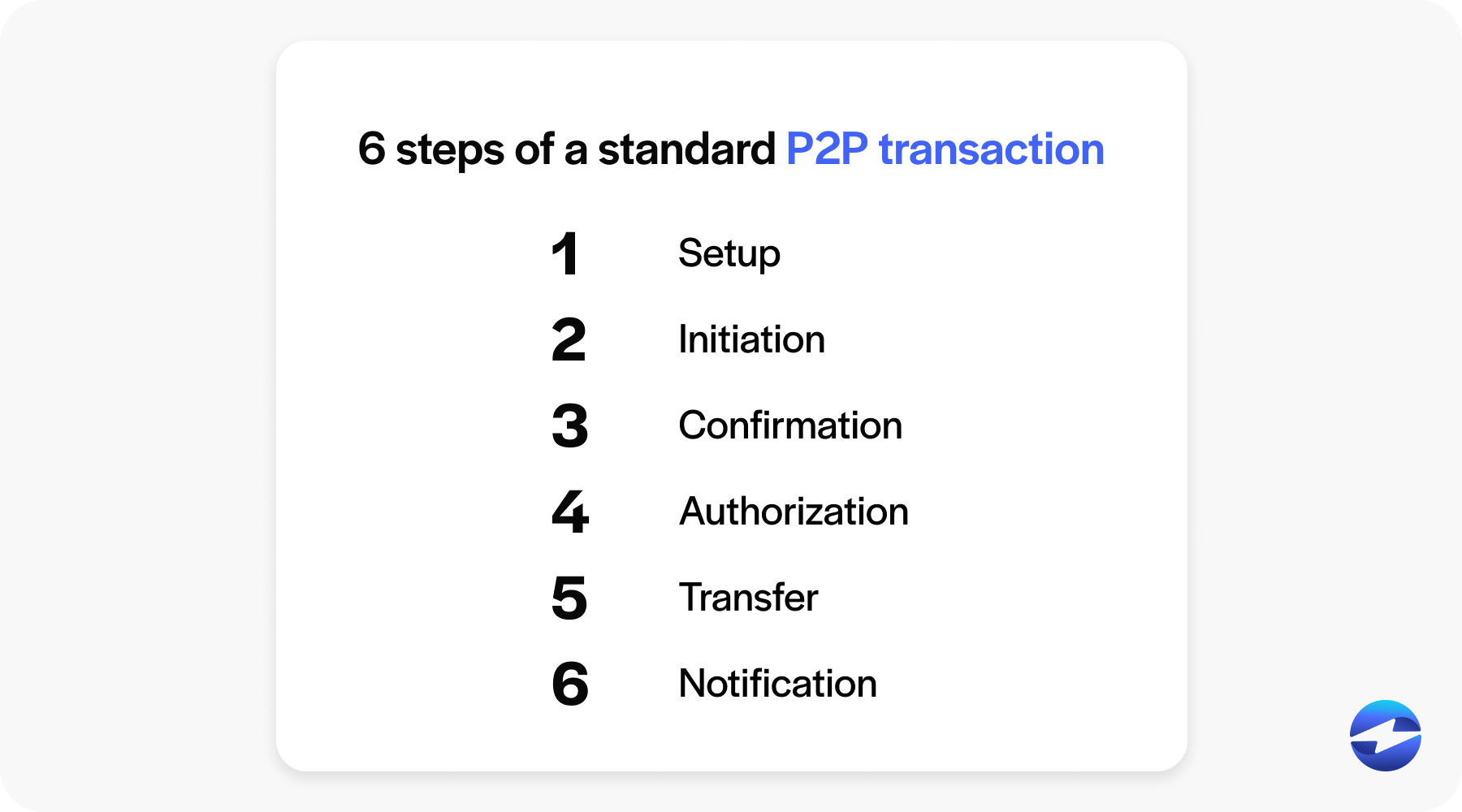

6 steps of a standard P2P transaction

When it comes to executing a P2P transaction, the steps are relatively straightforward:

- Setup: Before initiating any transactions, the sender and receiver must set up accounts on a chosen P2P payment app. This involves downloading the app, linking bank accounts or entering card information, and verifying identity as required.

- Initiation: The sender starts the process by entering the recipient’s email address, phone number, or unique identifier provided by the P2P service. This ensures the money reaches the correct person.

- Confirmation: The sending party inputs the amount of money they wish to transfer. P2P services often display confirmation screens to review and verify the correct amount and recipient before continuing.

- Authorization: Depending on the P2P platform and amount, additional security steps, such as 2FA, may be triggered to authorize the transaction.

- Transfer: Upon confirmation and authorization, the sender submits the transaction. The P2P payment app processes the payment, moving funds from the sender’s account to the recipient’s account within the P2P system.

- Notification: Both parties receive a notification when the transaction is complete. The recipient may need to take additional steps to transfer the funds from the P2P payment app to their bank account if they wish.

Transaction fees may apply throughout these steps, and users should be mindful of any potential costs.

Each P2P payment service has specific protocols, but the general process remains consistent across different P2P payment systems.

P2P payment security and safety

P2P payment platforms prioritize the security and safety of financial transactions between users. Ensuring that money transfers are secure is a top concern for P2P services, given the rise in digital payments and the sensitivity of banking data.

To maintain user trust, P2P payment apps employ several security features. These can include encryption, monitoring systems to detect suspicious activity, and user education on best practices to safeguard their accounts.

Encryption and fraud prevention measures

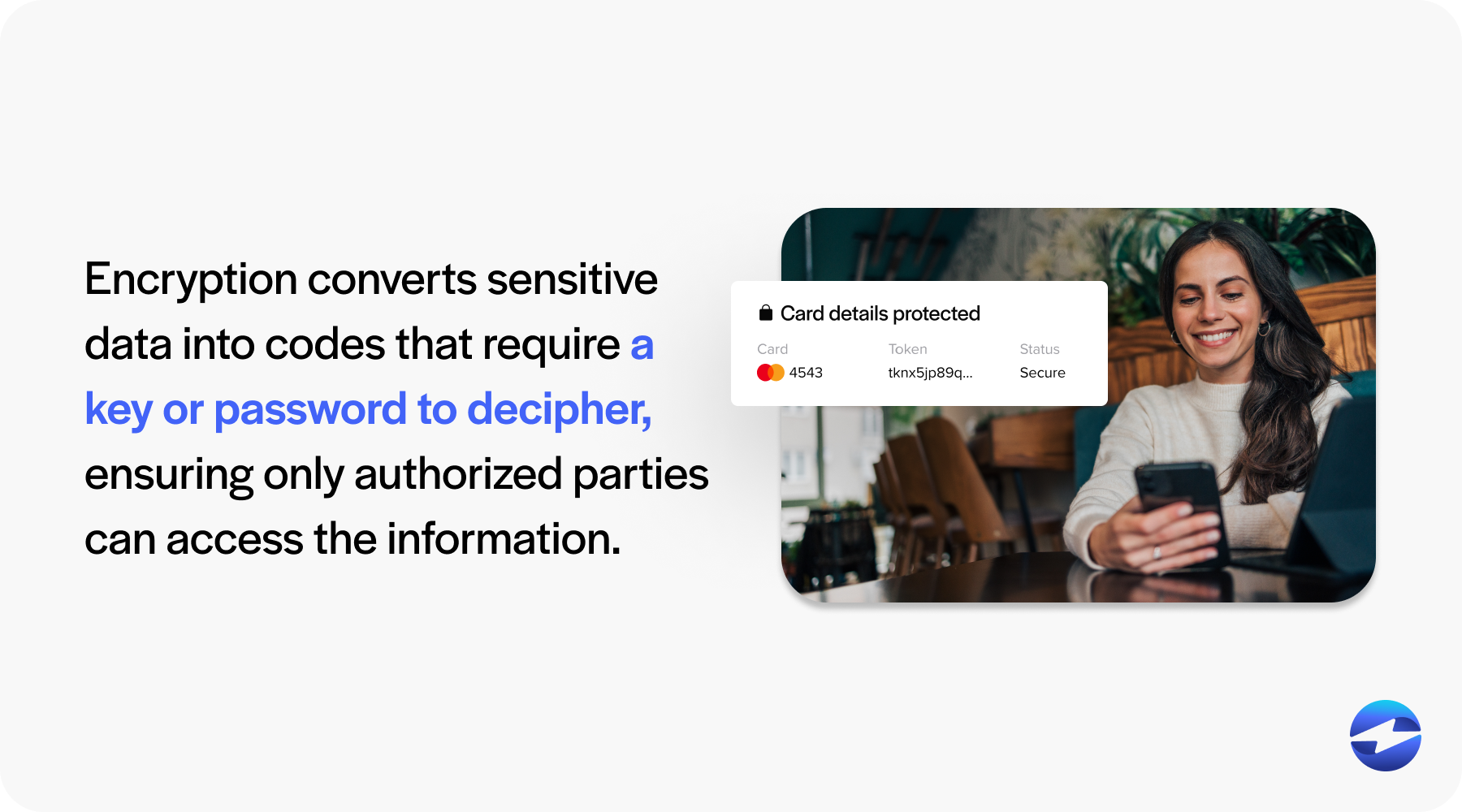

Encryption and fraud prevention measures are critical to maintaining the security of financial transactions, especially in the digital age.

Encryption converts sensitive data into codes that require a key or password to decipher, ensuring only authorized parties can access the information. This is particularly essential for P2P payment platforms where bank account and credit card details are involved.

Fraud prevention measures are equally significant since they contain various techniques and tools to detect and prevent unauthorized or fraudulent activity. Common examples are 2FA, real-time monitoring, and secure sockets layer (SSL) certificates.

In addition to passwords, 2FA requires secondary security information or parameters, which can consist of codes sent to mobile devices. Next, real-time monitoring tracks transaction patterns to detect and halt suspicious activity. Lastly, SSL certificates create a secure link between websites and visitors’ browsers, ensuring all transferred data remains private.

Digital payments rely heavily on these protective measures to safeguard peer payments. Users are advised to ensure their P2P payment apps employ robust encryption and fraud prevention strategies to prevent funds from being sent to the wrong person or falling into the hands of fraudsters during financial transactions.

Regulatory standards and compliance

Regulatory standards and compliance are critical components in maintaining the integrity and security of P2P payment systems. Peer-to-peer platforms are expected to adhere to various financial regulations to protect users from fraud and ensure the safety of their transactions.

Financial institutions and P2P applications must follow anti-money laundering (AML) laws and know your customer (KYC) regulations. These are in place to prevent illegal activities such as terrorism financing and money laundering.

Moreover, P2P platforms must also comply with the Payment Card Industry Data Security Standards (PCI DSS) when processing debit card and credit card transactions. Compliance is mandatory to ensure cardholder data security, prevent fraud, and build user trust. Adhering to PCI DSS helps protect sensitive information by implementing stringent security measures, such as encryption and regular monitoring. This compliance safeguards customers and reduces the risk of data breaches, enhancing the platform’s reputation and reliability in handling financial transactions.

To remain compliant, companies offering P2P services must regularly monitor transactions, report suspicious activities to the authorities promptly, and ensure users’ data protection and privacy. Compliance establishes trust with users and avoids legal repercussions and hefty fines from regulatory bodies.

Now that you know the robust security most P2P payment providers apply, you can evaluate popular providers to see if one fits your business.

Major P2P payment providers

P2P payment platforms have revolutionized how money is exchanged, providing a digital bridge for financial transactions between individuals.

With its rise in popularity, several payment providers, such as PayPal, Venmo, and Zelle, have established themselves in the P2P payment space.

- PayPal: A well-known P2P service with a global reach, offering both personal and business transaction capabilities.

- Venmo: Owned by PayPal, Venmo is known for its social feed feature and quick transfers among friends.

- Zelle: Integrated with many bank apps, Zelle offers instant transfers between bank accounts at participating financial institutions.

These providers offer P2P services, from quick and easy mobile app transfers to more comprehensive digital wallet services. They’ve become central to personal finance and business transactions, with options for debit and credit card connections and security features like 2FA, encryption, and tokenization.

Pros and cons of P2P payments for businesses

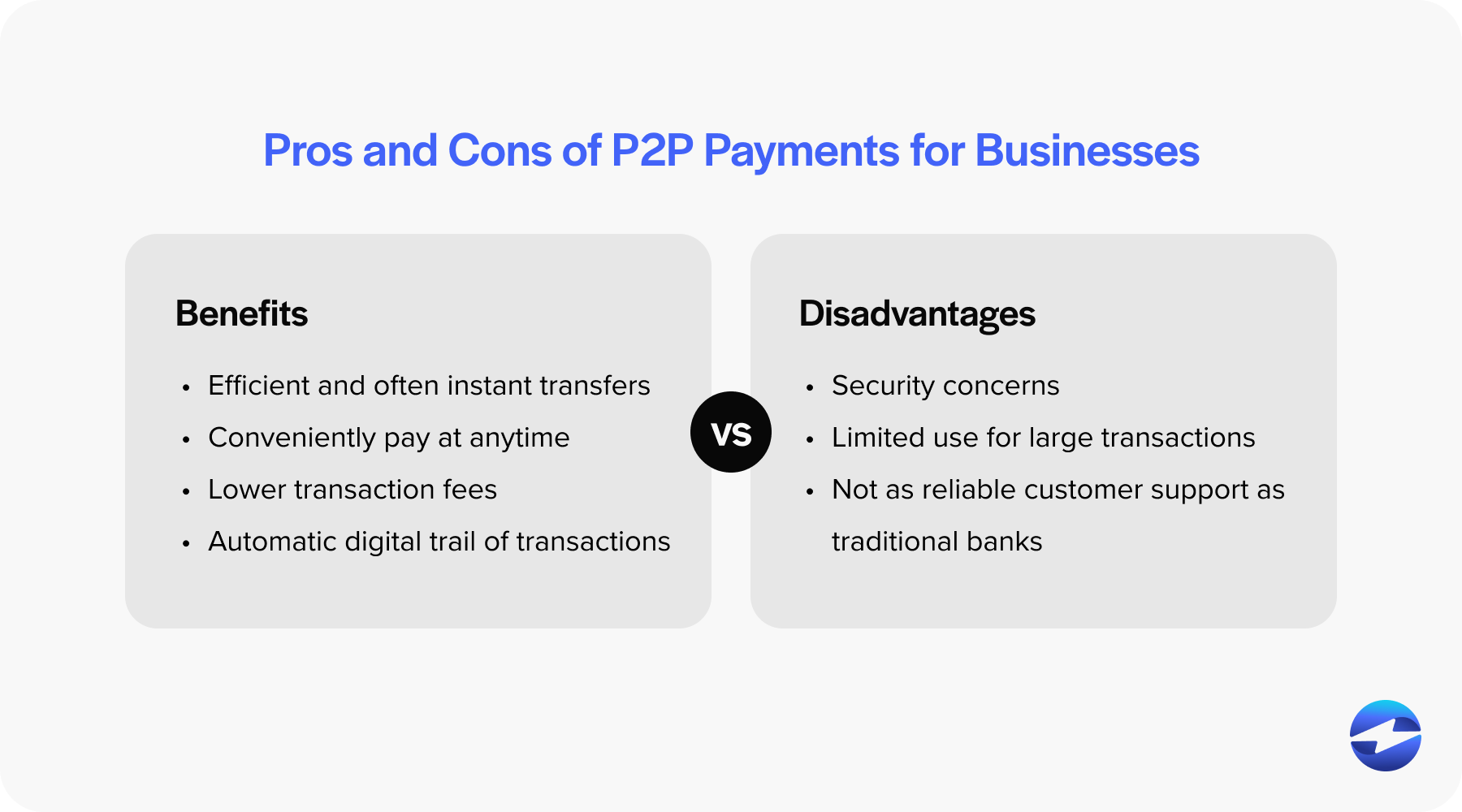

P2P payments offer many perks for businesses wanting to streamline transactions, but like any newer payment method, these platforms have some drawbacks.

Benefits of P2P payments:

- Efficiency: P2P payment platforms offer instant transfers, speeding up financial transactions compared to the several business days it can take for bank transfers.

- Convenience: Digital wallets and mobile apps allow payments to be made anytime, which is excellent for businesses that operate outside standard hours.

- Low cost: Numerous P2P services have lower transaction fees than traditional bank transfers or credit card payments.

- Digital record keeping: P2P platforms automatically create a digital trail of transactions, simplifying the accounting process.

Disadvantages of P2P payments:

- Security concerns: While P2P systems often enforce security measures, the risk of sending money to the wrong person or falling prey to fraud is present.

- Limited use for large transactions: There may be limits on the amount that can be sent in a single P2P transaction, which isn’t ideal for businesses needing to move large sums.

- Customer support: Users may find it challenging to resolve issues since P2P applications may not offer reliable customer support like traditional banks.

- Adoption: The adoption of digital wallets is on the rise, but it is worth noting that in a recent internal survey of 243 Payment Decision-Makers, only 5% used digital wallets as their preferred method of payment, showing people prefer traditional methods.

While P2P payments present a mix of accessibility and ease for merchants, they may not be ideal for robust payment security and scalability.

Incorporating P2P payments into your business structure

Implementing P2P payments in businesses can provide convenient and swift financial transactions that can easily integrate with existing systems since they facilitate digital payments directly between individuals without the need for traditional financial institutions as intermediaries.

To utilize P2P payment services, a business must first select a preferred P2P application that aligns with its transaction needs. This involves researching various providers to understand their features, fees, security measures, and compatibility with the business’s existing systems.

Once a suitable application is chosen, a business needs to set up an account and configure it for commercial use, which may include verifying its identity, linking bank accounts, and enabling security settings. It’s also crucial to train staff on how to use the application and to communicate the new payment option to customers through signage, digital communications, and at the point of sale.

Additionally, businesses should regularly review and update their chosen P2P service to ensure it continuously meets their evolving needs and complies with any new regulations or security standards.

Companies can link their bank accounts or debit cards to P2P platforms to streamline transfers. Most payments are processed within a few business days, though some P2P services offer immediate transactions.

Optimizing payments with P2P services

Utilizing P2P services can streamline payment processes, eliminating the need for cash, debit card, or credit card handling. Businesses can easily integrate P2P payment apps into their operations to facilitate peer payments, contactless payments, and even international payments.

Nevertheless, transaction fees, the policies of various financial institutions, and P2P platform security measures should be considered.

By harnessing the power of P2P payment systems, businesses can cater to the growing demand for quick and hassle-free digital wallets and funds transfers, thereby enhancing the user experience and operational efficiency.