Blog > A Complete Guide to Securely Process Credit Cards in Sage 100

A Complete Guide to Securely Process Credit Cards in Sage 100

As data breaches evolve and advance, a robust payment processing system that protects sensitive financial information is essential. For companies using Sage 100, understanding how to process credit cards securely is not just an option – it’s a necessity.

Thankfully, this article will serve as a complete guide to help you securely process payments inside Sage 100, covering everything from integrating payment gateways into this system to ensuring compliance with security standards.

What is Sage 100?

Sage 100 is an enterprise resource planning (ERP) software that enables small and mid-sized businesses to effectively manage various business operations.

The Sage 100 system provides comprehensive tools for accounting, financial management, inventory control, manufacturing, and distribution. It also offers robust functionality to help businesses streamline operations, improve efficiency, and maintain compliance with industry regulations.

Sage 100 is highly customizable, supporting various industry-specific needs, and integrates with third-party applications to extend its functionality.

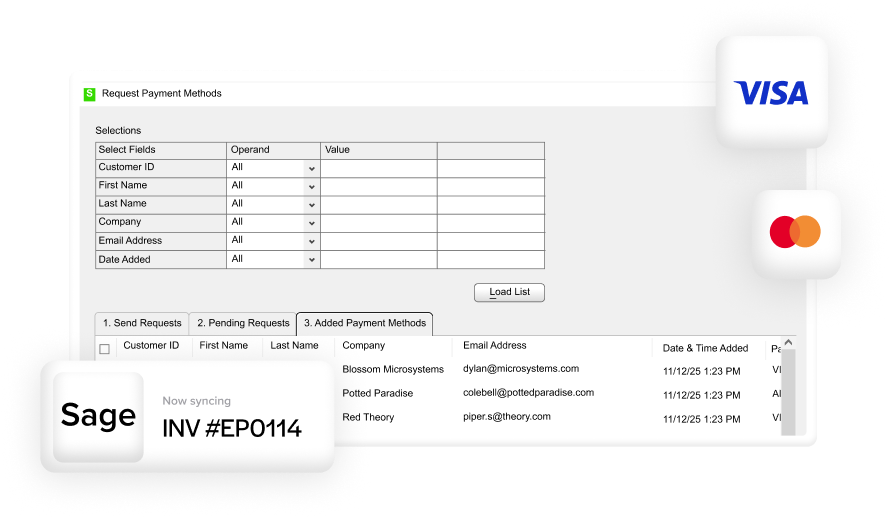

Integrating a payment gateway into Sage 100

When integrated with a trusted payment gateway, merchants can leverage their Sage 100 system to streamline their finance, accounting, inventory, and sales operations. These gateways act as a bridge between your business and financial institutions to process customer transactions quickly and securely.

A reliable Sage 100 integration will be user-friendly and effortlessly compatible to provide merchants with robust functionality and features to securely process payments while managing business finances. This gateway integration should also provide detailed reporting tools for better decision-making and growth initiatives.

To ensure the best payment processing experience in Sage 100, finding a comprehensive payment gateway solution with seamless payment processing capabilities and valuable collection tools and features to transform your invoicing process is key.

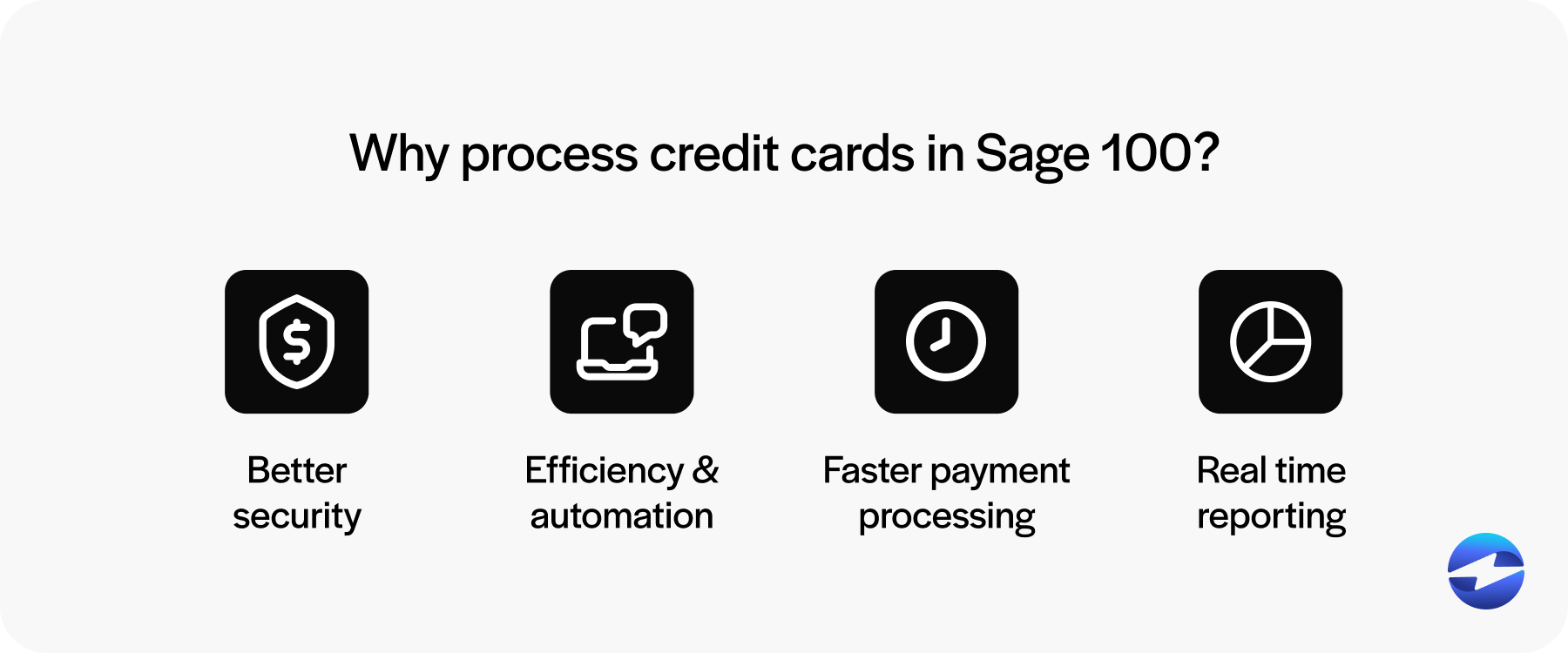

Why businesses should process credit cards in Sage 100

Sage 100 credit card processing offers multiple benefits that can enhance your invoicing process and the customer payment experience.

Some top reasons to process credit cards in Sage 100 include better payment security, efficiency and automation, faster payment processing, and real-time reporting and insights.

Payment security

A reliable Sage 100 payment processing solution will protect customer payment information by implementing robust security protocols and ensuring full compliance with Payment Card Industry Data Security Standards (PCI-DSS).

PCI-compliant Sage 100 payment software providers must maintain strict security standards and enforce various measures, such as advanced encryption and tokenization, to safeguard sensitive payment data.

A secure payment processing provider for Sage 100 will also give merchants access to fraud detection and prevention tools, 3D Secure, chargeback management, and more.

By protectin g payments in Sage 100, your company can reduce the risk of data breaches and fraud, ensuring a secure experience for all parties involved.

Improved efficiency and automation

Manual payment processing can be time-consuming and prone to errors, leading to inefficiencies in billing and collections.

Thankfully, processing credit cards with an efficient Sage 100 payment solution automates key payment workflows, including invoice generation, payment collection, and data entry, reducing the need for manual intervention.

Additionally, Sage 100 integrations provide automated reconciliation, ensuring that transactions are accurately matched to invoices and recorded in accounts receivable (AR) without manual effort.

This automation helps businesses save time, improve accuracy, and free up employees to focus on higher-value tasks, like customer service and business growth.

Faster payment processing

Delays in payment collection can negatively impact cash flow and overall business operations.

With Sage 100, businesses can accept credit card payments instantly, either at the time of sale, upon invoicing, or through customer self-service portals. This ensures faster fund transfers and reduces the time spent waiting for payments, improving liquidity and financial stability.

Real-time reporting and insights

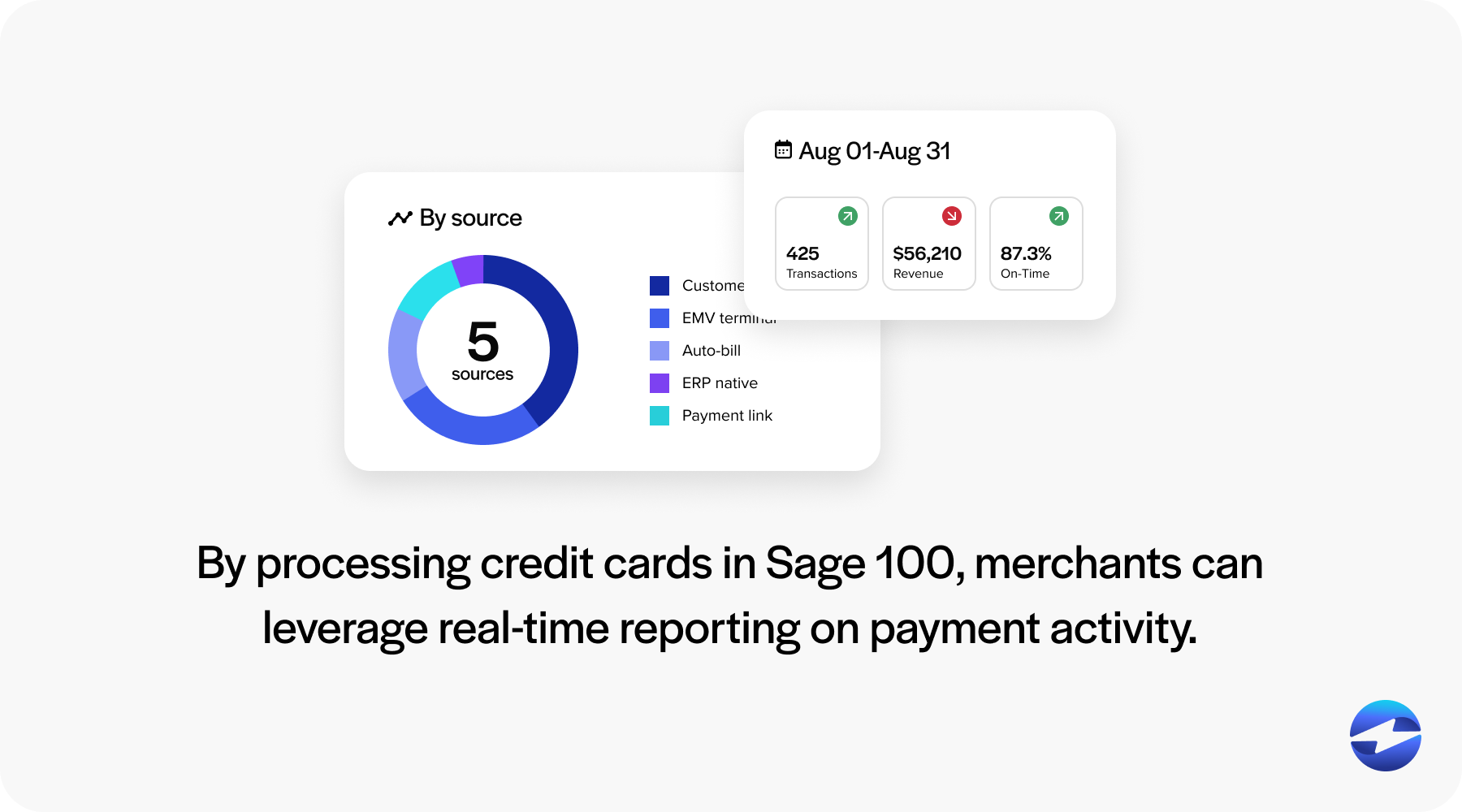

Having access to up-to-date financial data is essential for making informed business decisions.

By processing credit cards in Sage 100, merchants can leverage real-time reporting on payment activity, including transaction statuses, outstanding invoices, and cash flow trends. With detailed insights directly within the system, you can better monitor payment performance, identify trends, and optimize financial strategies to ensure steady growth.

It’s important to remember that, as with any form of payment processing, security is paramount. So, it’s crucial to monitor and address any security issues that may arise.

4 security challenges of credit card processing

With the increasingly digital payment landscape, security threats continue to evolve to target sensitive information such as payments.

Merchants must address any security challenges associated with credit card processing to protect customer data and prevent fraud.

Here are four common security concerns of credit card processing to be aware of:

- Data breaches: Data breaches typically consist of hackers that target payment systems to steal cardholder data, leading to financial losses and reputational damage.

- Fraudulent transactions: Fraudulent transactions occur when cybercriminals use stolen credit card details for unauthorized purchases, resulting in chargebacks and disputes.

- Chargeback fraud: Chargeback fraud (also known as friendly fraud) occurs when a customer disputes a legitimate charge, leading to business financial losses.

- Poor PCI compliance: Poor PCI compliance that fails to meet industry security standards can put businesses at risk due to increased vulnerabilities and potential penalties.

To mitigate these risks and secure financial data, pairing your Sage 100 with a secure payment gateway provider with robust security features is key.

Ensuring secure payments with Sage credit card processing

In addition to the security Sage 100 provides, trustworthy integrated payment processors can provide a suite of tools and features to secure transactions.

Here are five ways you can ensure secure payments with Sage credit card processing:

- Maintain full PCI compliance: PCI Standards require merchants to follow strict security protocols, such as encrypting payment data, limiting access to sensitive information, and regularly monitoring for vulnerabilities. By adhering to these standards, businesses can reduce data breach risks and maintain regulatory compliance.

- Tokenization and encryption: Tokenization replaces credit card details with unique tokens with no exploitable value, preventing hackers from accessing sensitive data. Encryption secures payment data by converting it to unreadable code during transmission, ensuring that data remains protected even if interpreted.

- Fraud prevention measures: Sage credit card processing supports various fraud protection tools, such as Address Verification System (AVS), VCC verification, and transaction monitoring. These measures help detect suspicious activity, prevent unauthorized transactions, and reduce chargeback risks.

- Role-based access and user authentication: A Sage 100 integration enhances security by enabling role-based access controls for payment data, ensuring only authorized users can process transactions or view sensitive information. It allows businesses to enforce user permissions within the system, reducing the risk of internal security threats. Additionally, the integration can support multi-factor authentication (MFA), requiring additional verification before granting access, further strengthening security and preventing unauthorized entry.

- Secure integration with payment processors: A trusted payment processor provides additional security features, such as fraud detection, tokenization, and end-to-end encryption (E2EE). A seamless Sage 100 integration ensures that transactions are processed securely while maintaining efficiency and compliance.

By implementing these security measures, merchants using a Sage 100 integration can protect customer payment data, prevent fraud, and ensure smooth, secure transactions.

4 best practices for secure Sage 100 credit card processing

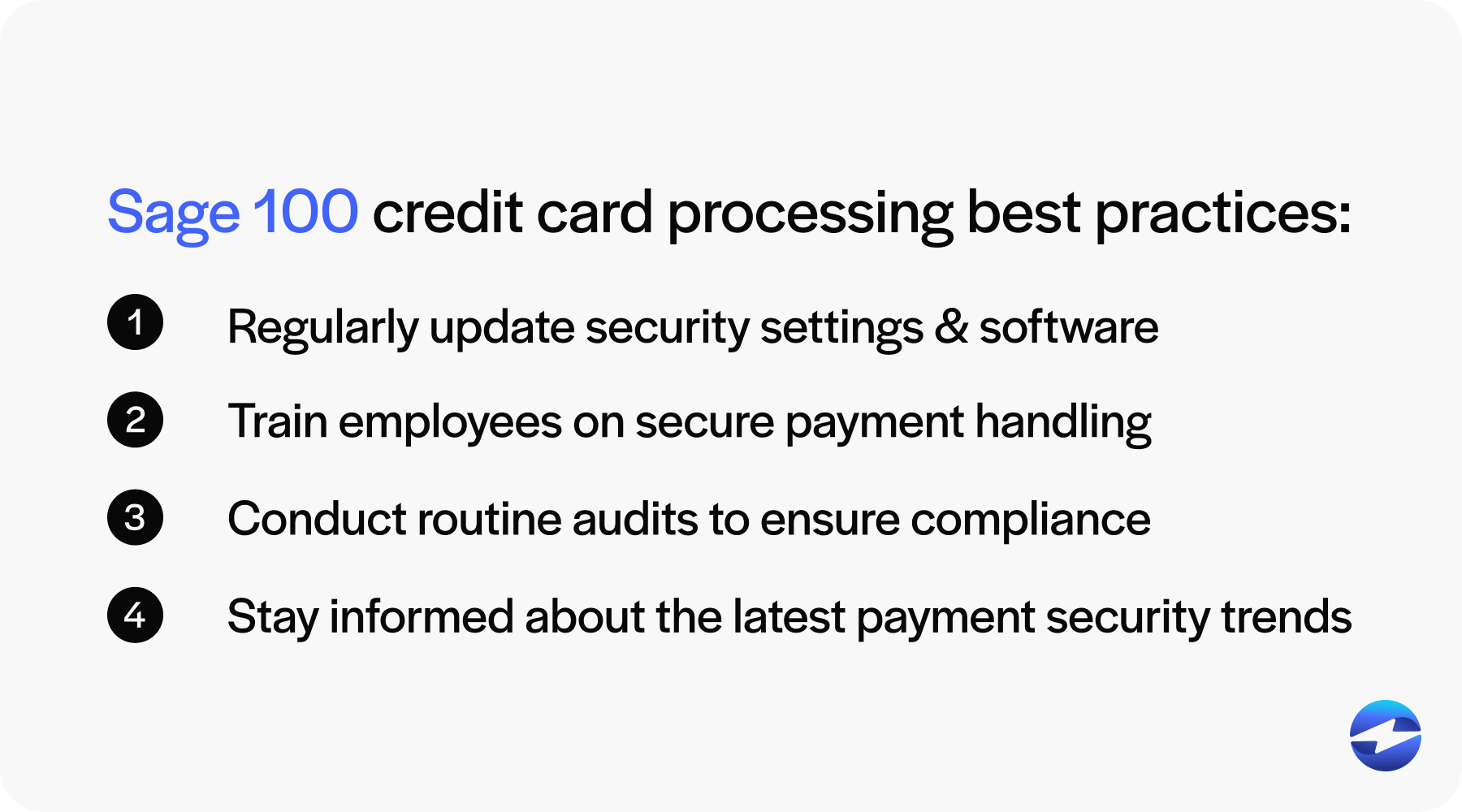

Since processing credit cards securely is crucial for any business using Sage 100, implementing best practices can help protect customer data, maintain compliance with regulations, ensure smooth transactions, and build customer trust.

Here are four best practices to enforce secure credit card processing in Sage 100:

- Regularly update security settings and software: Regular updates can pinpoint security flaws and prevent unauthorized access. By updating regularly, businesses can stay ahead of cybercriminals and safeguard sensitive credit card information.

- Train employees on secure payment handling: Employees play a significant role in handling payments securely. Training staff on how to manage credit card data can prevent costly mistakes. Employees should know the importance of keeping data private and recognizing suspicious activities. A well-informed team can protect your business and customer data more effectively.

- Conduct routine audits to ensure compliance with security protocols: Audits help identify weaknesses in your payment processing system and ensure all operations are up to standard. By regularly reviewing procedures, merchants can proactively address and mitigate potential issues early to protect against data breaches and maintain compliance with industry regulations.

- Stay informed about the latest payment security trends: Staying informed about new and evolving payment security trends will allow your business to enhance its security measures. This includes subscribing to industry news and attending relevant workshops. Understanding new threats and technologies can help you adapt and continue protecting credit card information effectively.

Alongside these best practices, working with trusted payment gateway providers like EBizCharge will promote more seamless payment operations for Sage 100 users.

EBizCharge: A trusted Sage 100 payment integration

EBizCharge’s Sage 100 integration simplifies credit card processing, making transactions straightforward and secure.

By integrating directly with Sage 100, EBizCharge enhances and accelerates payment processing operations for merchants to collect payments faster while reducing manual entry and minimizing human errors.

EBizCharge is a PCI-compliant payment software that enhances security by utilizing advanced features such as tokenization, encryption, off-site data storage, fraud prevention modules, and more to protect sensitive cardholder data and ensure all transactions are secure and compliant with industry standards.

With a user-friendly interface, EBizCharge is a top-rated payment solution that simplifies the overall payment experience, making it an ideal solution for businesses looking to optimize their payment processing in Sage 100.