Blog > A Complete Guide to Acumatica Credit Card Processing

A Complete Guide to Acumatica Credit Card Processing

With increasing reliance on online transactions, understanding how to streamline payment solutions has never been more essential.

Thankfully, leading integrated enterprise resource planning (ERP) systems like Acumatica cater to diverse business needs by integrating robust credit card processing tools into its platform.

Whether you’re exploring how to set up credit card processing or want to understand various security measures, this article will serve as your guide to leverage Acumatica to transform credit card transactions.

What is Acumatica?

Acumatica is a cloud-based ERP software designed to help businesses manage their core financial processes efficiently.

When integrated with a powerful payment processing solution, Acumatica provides a comprehensive suite of tools for accounting, finance, customer relationship management (CRM), inventory management, and project management.

Acumatica’s open application programming interface (API) framework enables seamless integrations with third-party applications so businesses can extend their functionalities as needed.

Syncing reliable payment integrations with the Acumatica Cloud ERP allows companies to process and manage customer payments efficiently.

Why should businesses process credit cards in Acumatica?

Merchants can process credit cards and Automated Clearing House (ACH) payments or eChecks directly inside Acumatica to accelerate and improve their invoicing operations and overall finances.

With the right payment provider, businesses can leverage customizable modules that adapt to specific industry needs to promote more payment flexibility. This includes manufacturing, retail, distribution, and professional services.

With strong automation capabilities, Acumatica integrations help businesses improve efficiency, reduce manual workloads, and enhance decision-making through real-time analytics and reporting. Its cloud-based nature allows users to access the system from anywhere, ensuring real-time data visibility and collaboration across teams.

Acumatica payment integrations can empower merchants to optimize their customer payments, improve financial management, and drive more business growth.

In addition to these benefits, integrating a reliable Acumatica payment solution into your system will give your business access to multiple payment methods.

4 ways to process credit cards in Acumatica

A top-rated Acumatica payment processor can equip merchants with numerous payment collection tools and features to quickly and easily collect payments on customer invoices.

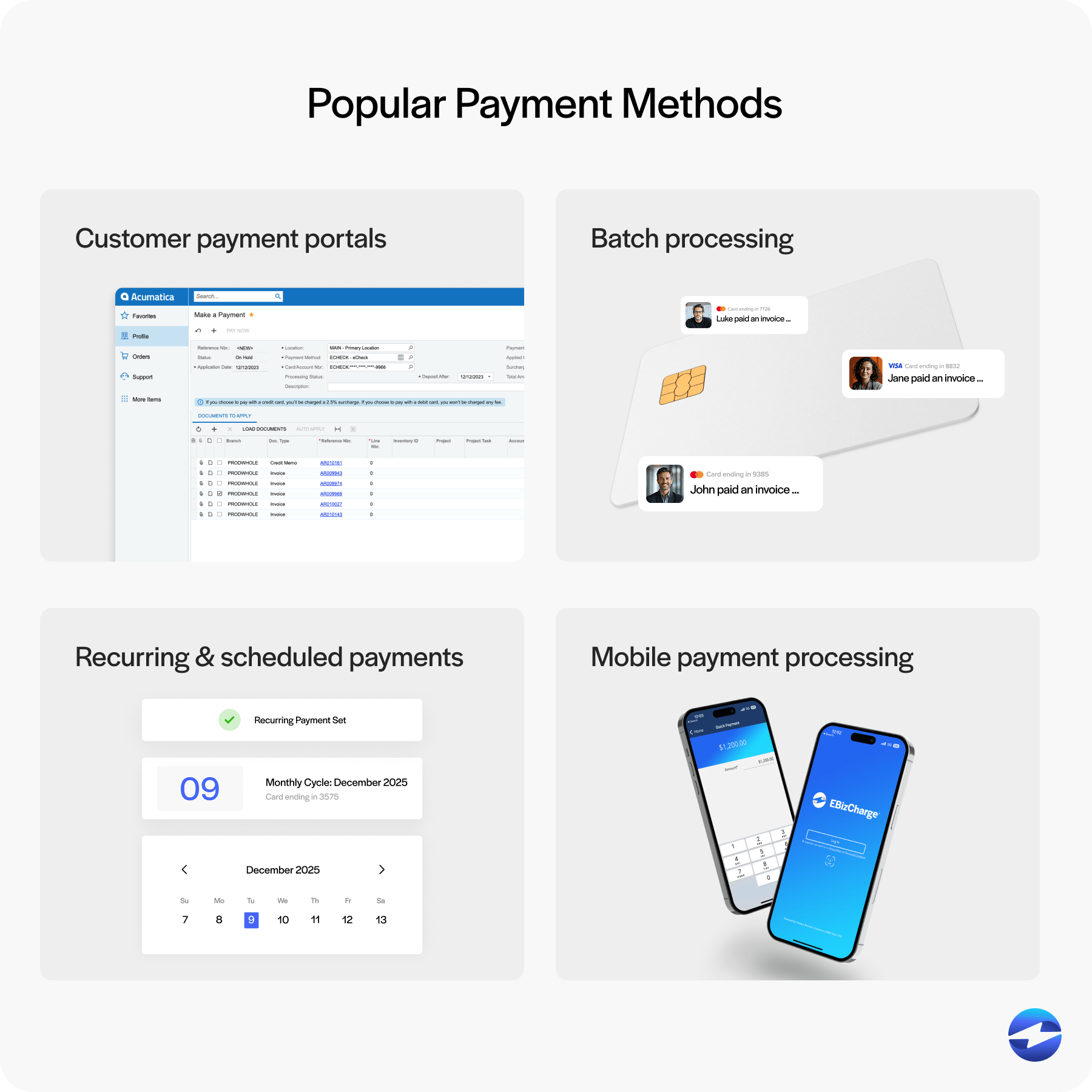

Four popular payment methods include:

Customer payment portals: Acumatica payment integrations allow businesses to set up self-service payment portals where customers can securely pay invoices online. This option enhances customer convenience by enabling them to make payments anytime, from any location. The portal automatically syncs payments with Acumatica, ensuring up-to-date financial records and reducing administrative workload.

Batch processing: Batch processing enables businesses to process multiple credit card transactions at once. This is particularly beneficial for companies handling high transaction volumes, as it improves efficiency and reduces processing time.

Recurring and scheduled payments: For businesses that handle subscription-based billing or installment payments, Acumatica payment solutions can support recurring and scheduled credit card transactions. This feature automates payment collection, reducing the risk of late payments and improving cash flow consistency. Automated billing schedules can enhance customer retention and simplify financial management.

Mobile payment processing: Acumatica-integrated payment solutions support mobile payments, allowing merchants to accept credit card and ACH/eCheck payments from smartphones and tablets. This functionality is particularly useful for sales teams, field service providers, and businesses operating outside traditional office settings to provide flexible payment options to complete transactions on the go.

These payment methods enable companies to choose the most effective solution based on their operational needs to enhance financial efficiency and customer satisfaction.

Automated payments can also be paired with Acumatica payment integrations to streamline payment processing further.

Automating payments in Acumatica

Automating payments in Acumatica is vital for businesses to improve financial processes and reduce manual errors.

With automation, companies save time and money while enhancing payment accuracy, prompt transactions, cash flow, and operational efficiency. Automation also helps maintain good relationships with customers and vendors.

Three ways to automate payments in Acumatica include recurring billing schedules and autopay options.

Recurring payments are an efficient way to improve credit card processing in Acumatica as they remove the need to manually process each transaction. Businesses can set up recurring payments to occur at specific times, helping to ensure timely collections, reduce administrative work, and minimize payment delays. This streamlined approach promotes fewer late fees, and fosters trust with partners and clients.

Autopay ensures that invoices are automatically paid when due to reduce overdue payments. This can provide more convenience for customers by giving them peace of mind, knowing they don’t have to worry about missing payments. Autopay also helps merchants maintain a steady cash flow and reduces the time spent on collections.

Using Acumatica Scheduler allows businesses to set up recurring payments, schedule batch processing, and automate invoicing, eliminating the need for manual entry and reducing the risk of errors. This automation ensures that payments are processed consistently, improving cash flow management and minimizing delays.

Additionally, the Acumatica scheduler integrates with payment gateways to process transactions at predefined intervals, allowing businesses to optimize their financial operations without constant oversight.

In addition to automation, reporting and reconciliation are important features in Acumatica credit card processing.

Reporting and reconciliation in Acumatica

Understanding reporting and reconciliation in Acumatica is crucial since it helps businesses maintain financial record accuracy and reliability.

Accurate reporting enables merchants to make more informed decisions, while reconciliation boosts efficiency and reduces errors. Here’s how these tools can yield these benefits in Acumatica for your business:

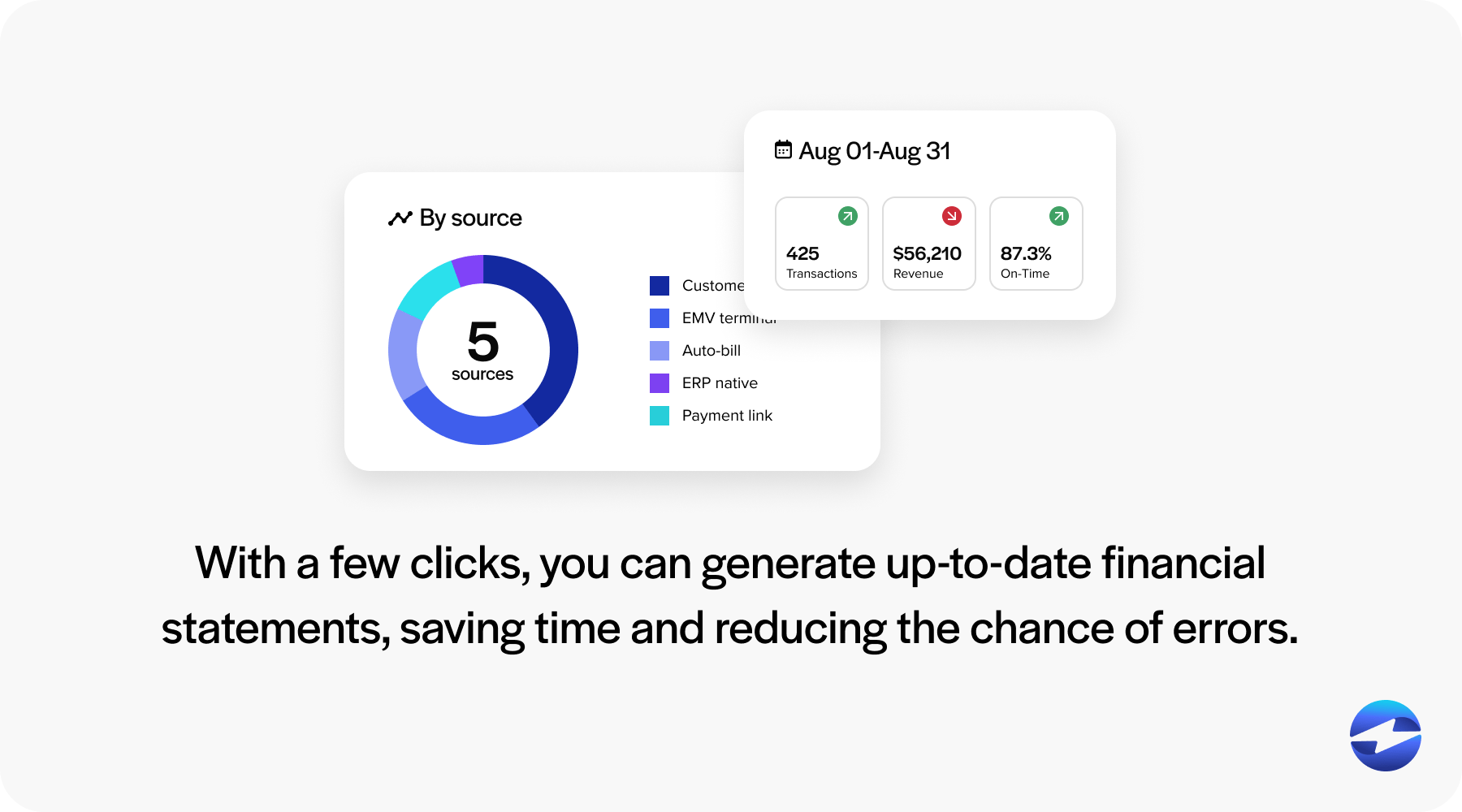

- Financial reports: Financial reports can be simplified in Acumatica by working with a payment processor that provides the tools to automatically capture payments and sync these transactions directly to your accounts. This integration streamlines your financial processes. With a few clicks, you can generate up-to-date financial statements, saving time and reducing the chance of errors.

- Reconciliation: Acumatica payment processing can enhance reconciliation by enabling merchants to match their company’s records with the records of financial institutions to ensure all payments are accurately accounted for. This practice is essential for effective financial management and maintaining a smooth flow of business processes. It also allows businesses to pinpoint and resolve discrepancies to avoid potential issues quickly.

Another crucial component of integrating credit card and ACH/eCheck payments into Acumatica is its compliance with industry security standards.

Payment security and compliance in Acumatica

Security and compliance are vital for any payment software, especially regarding processing credit cards and ACH/eChecks in Acumatica. Merchants must handle sensitive payment data to process their customers’ transactions, making it essential to protect this information.

Acumatica payment providers should comply with legal and regulatory requirements like Payment Card Industry Data Security Standards (PCI-DSS), which safeguard payment data by implementing various security protocols.

Acumatica-integrated payment solutions can meet various legal and regulatory requirements and keep your data safe using the latest security measures. These measures can also enhance customer satisfaction, operational efficiency, and trust.

Four security features to look for when working with a payment processor in Acumatica include:

- Tokenization is a key security measure that replaces credit card details with unique symbols known as “tokens.” This process makes it much harder for hackers to access sensitive information. Tokenization is crucial in securing electronic payment methods, reducing data breaches, and ensuring a seamless payment integration with your financial processes in Acumatica.

- The address verification system (AVS) is a security tool that verifies the billing address provided by the customer with the address on file with the credit card company. If there is a mismatch, the transaction may be flagged or declined. AVS helps identify fraudulent transactions to ensure only valid transactions are processed.

- 3D Secure authentication requires an additional verification step during a credit card transaction. Customers receive a unique code that they must enter to complete the purchase. This method helps verify your customer’s identity, reducing fraud and enhancing payment security.

- Advanced fraud detection tools monitor and analyze payment transactions for suspicious activities. By catching unusual patterns, these tools help prevent fraud before it can threaten the business or affect financial statements.

Now that you know what credit card and ACH/eCheck payment processing in Acumatica entails, it’s time to set it up.

Setting up Acumatica payment processing

Understanding how to set up a payment gateway in your Acumatica system is essential for modern businesses.

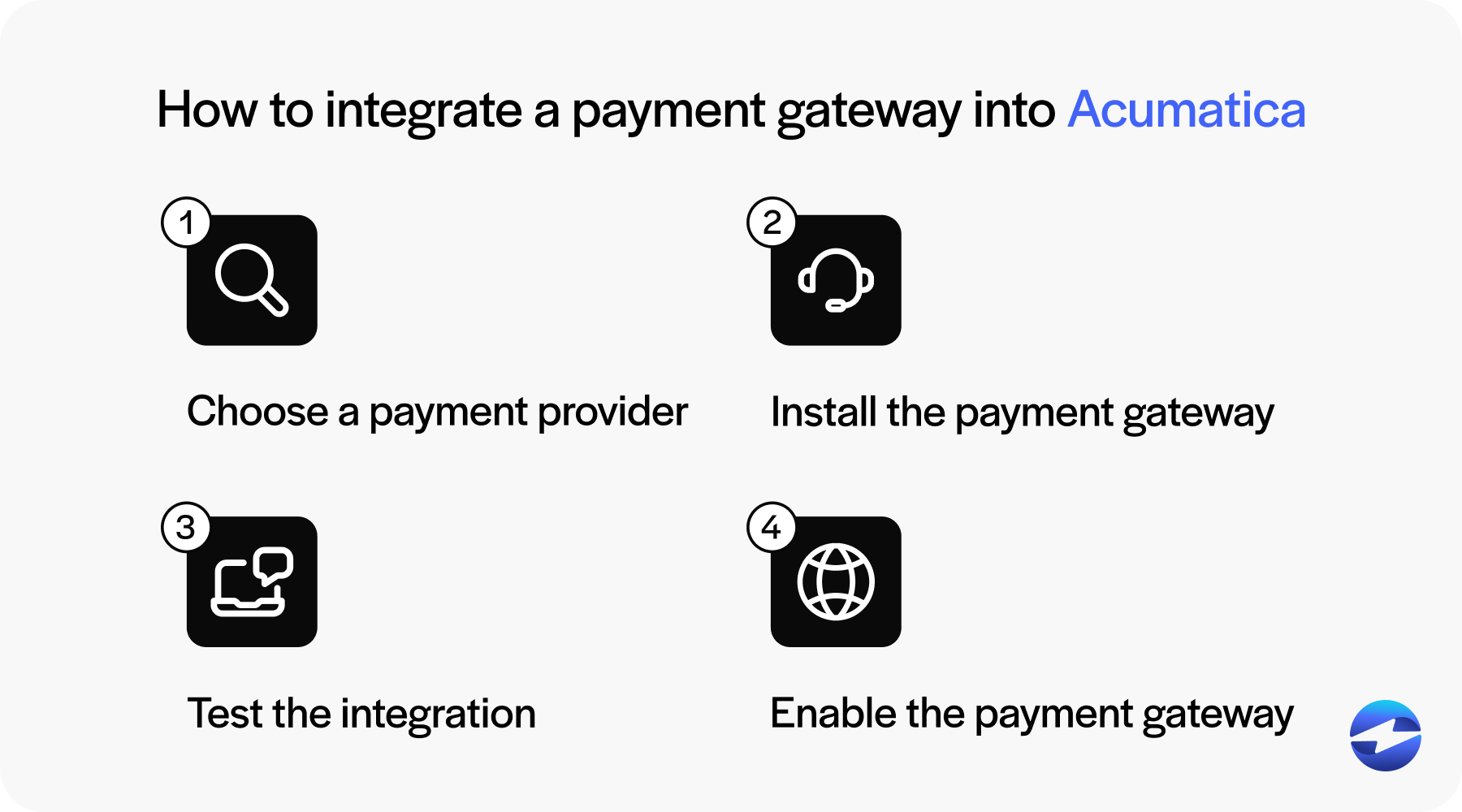

Here are four steps your company can follow to sync a payment gateway into Acumatica:

- Choose a payment gateway provider: Choosing the right payment gateway provider sets the foundation for your Acumatica payment processing system, so look for a provider that fits your business needs. When deciding, merchants should evaluate transaction fees and overall costs, PCI compliance, compatibility, supported payment methods and features, the installation process, and whether the provider has a dedicated, reliable customer service team to resolve any issues quickly.

- Install the payment gateway: Once you’ve selected a provider, the next step is to install your Acumatica payment gateway. Payment processors require businesses to set up a merchant account before the installation, which acts as an intermediary between your company and the payment processor to ensure funds from customer transactions are accurately deposited into your bank account. Once you’ve linked your merchant account and configured application programming interface (API) credentials, the provider typically handles the rest of the installation process. A smooth installation will pave the way for efficient payment workflows, reducing the chance of future technical errors.

- Test the integration: Testing your payment integration in Acumatica before using it is imperative to confirm it’s operating correctly. Merchants can conduct test transactions to verify payment processing functionality and evaluate the system’s performance. You can then make necessary adjustments to resolve any gaps or discrepancies that may lead to payment delays or poor customer experience.

- Enable the payment gateway: The final step is to enable the Acumatica payment gateway for public use. Once everything checks out in testing, you can launch your integrated solution in Acumatica. At this stage, you’re ready to accept customer payments.

With a reliable and efficient payment processing system, merchants can focus on long-term growth and improving their overall financial management.

Trusted providers like EBizCharge can achieve this with its powerful Acumatica-certified payment integration that provides a robust suite of payment collection tools and features to transform your invoicing process.

EBizCharge: An Acumatica-certified payment integration

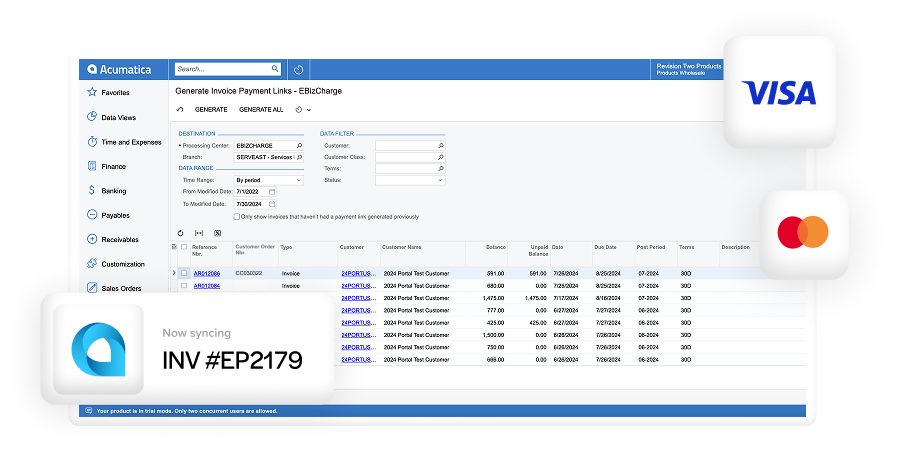

Acumatica credit card processing by EBizCharge provides an effortless integration for merchants to securely process and manage credit card and ACH/eCheck payments inside Acumatica without the need for external platforms or redundant workflows.

With built-in payment automation, EBizCharge eliminates manual data entry, reduces human error, and improves overall financial efficiency for its users.

EBizCharge is a trusted PCI-compliant payment processing software with robust security measures in Acumatica, such as tokenization, encryption, off-site data storage, fraud prevention modules, and more.

The EBizCharge for Acumatica payment integration includes real-time reporting, automated reconciliation, and customizable payment workflows to give businesses better control over their financial processes.

EBizCharge also enables merchants to accept multiple payment methods and provides flexible payment options to enhance the user experience and maintain customer loyalty with secure click-to-pay invoice and email payment links, an online customer payment portal, mobile and auto payment options, and many other tools.

With its effortless payment integration into Acumatica, EBizCharge optimizes payment collections, accelerates cash flow, delivers high-quality performance, and minimizes administrative burdens, allowing merchants to prioritize long-term growth initiatives and customer satisfaction.