Blog > 9 Ways to Automate Payment Collections for Your Business

9 Ways to Automate Payment Collections for Your Business

Accounts receivable (AR) refers to the outstanding payments owed to a company by its customers for goods and services delivered or provided on credit terms.

Managing AR involves invoicing customers, tracking payments, following up on overdue accounts, and reconciling discrepancies to ensure timely and accurate payment collections. Tools like AR automation can streamline these operations.

This article will explore the benefits of collections automation, including how it can improve cash flow and overall efficiency for businesses.

Why businesses should consider automating payment collections

Automated collections services have emerged as a game-changer in accounts receivable, providing numerous benefits.

When businesses automate payment collection processes, they can significantly enhance their cash flow and overall financial health.

Automation software also minimizes the risk of late or overdue payments, reduces human error, speeds up the time it takes to receive payments, and can improve customer satisfaction.

Without collections automation, AR processes can be time-consuming and inefficient.

What are the downsides of manual AR processes?

Manual AR processes can create a multitude of problems that could otherwise be solved through automation.

Here are eight downsides of manual AR operations:

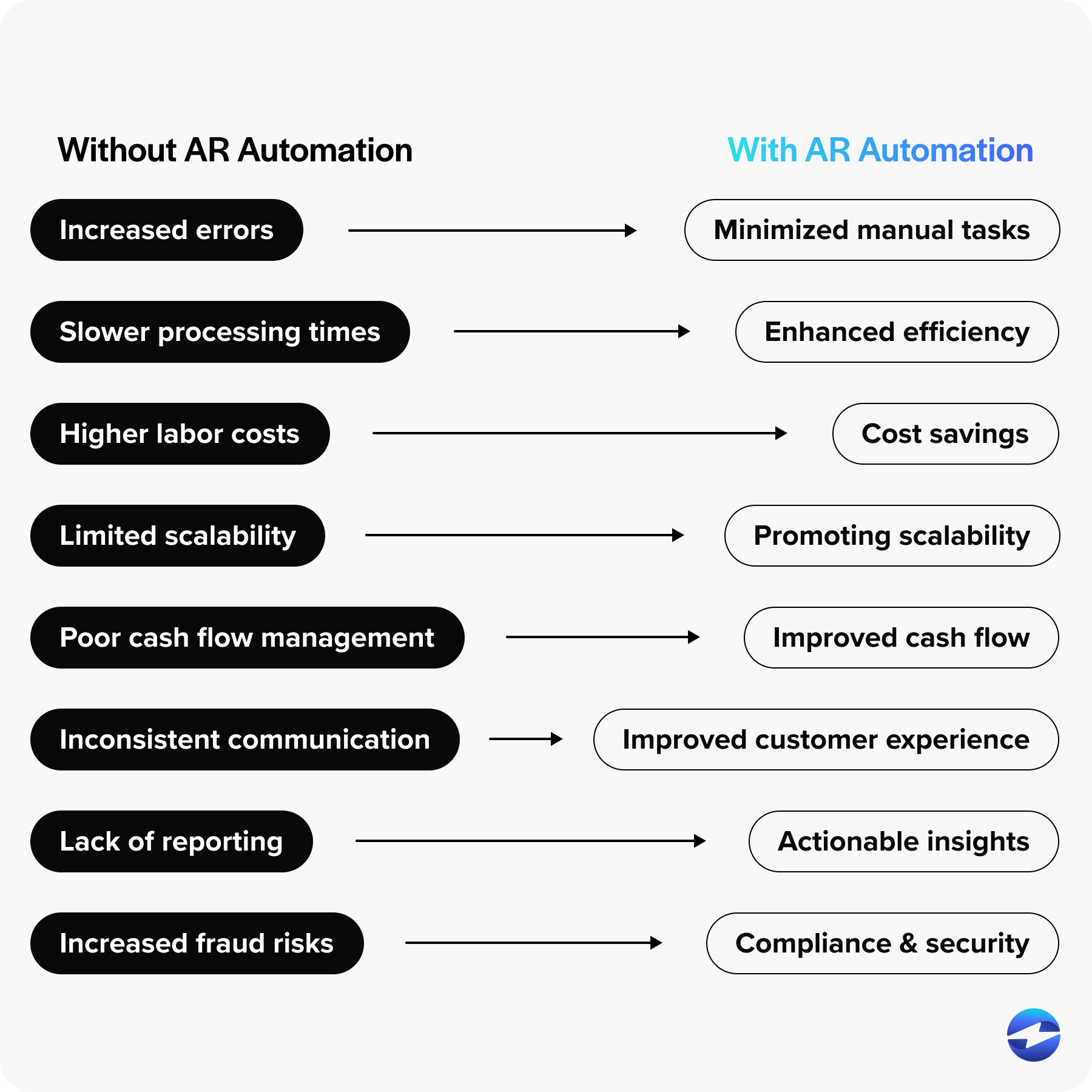

- Increased errors: Manual collection processes are prone to more errors primarily due to human involvement. When tasks such as invoicing, recording, and reconciling payments are done by hand, the likelihood of making mistakes multiplies.

- Slower processing times: Manual payment collection processes rely on paper-based documentation, such as printed invoices and checks, which require physical handling, mailing, sorting, and manual input into systems. This approach can lead to delays in the processing workflow and slower turnaround times.

- Higher labor costs: Manual collection processes require significant manpower to perform tasks such as data entry, invoice generation, payment processing, and collections management. These tasks require employees to dedicate substantial time and effort to accurately and efficiently complete them.

- Limited scalability: When a business grows, transaction volumes typically increase. Manual systems typically don’t adapt well to growth changes. The same number of finance team members who managed accounts for a smaller client base may become overwhelmed with this increased workload, potentially leading to delays in payment processing and reduced customer satisfaction.

- Poor cash flow management: Manual payment tracking can lead to outstanding invoices slipping through the cracks, resulting in an excess of overdue payments. Without real-time tracking, it’s difficult for the finance team to predict cash flow and manage working capital effectively. Manual methods also require considerable administrative effort, further delaying payment collection processes.

- Inconsistent communication: Different team members may have their own methods and schedules for contacting clients, resulting in inconsistent messaging and follow-ups. Furthermore, relying on individuals to send out reminders or notices for overdue payments can lead to communication delays or oversights, especially during peak periods or staff turnover. This inconsistency can be confusing for customers and potentially harmful to customer satisfaction.

- Lack of visibility and reporting: Manual AR processes can significantly hinder visibility and reporting within a business’s financial operations. When accounting teams rely on manual entries and physical paperwork, tracking the real-time status of outstanding invoices and payments becomes challenging and can lead to a lack of up-to-date financial insights.

- Increased fraud risks: Relying on manual data entry and verification opens the door to mistakes, which fraudsters can exploit to manipulate invoices, documents, or payment records. Additionally, manual processes often lack robust controls, making it easier for fraudsters to bypass checks and balances. Without proper distribution of duties and approval mechanisms, unauthorized transactions can slip through undetected.

Manual efforts are becoming less prevalent, as most businesses opt for the ease of automation to solve the problems listed above and more.

What are the benefits of AR automation?

The benefits of automating your receivables extend far beyond greater efficiency, as they can transform your company’s entire payment collection process and profitability.

Here are eight AR automation benefits:

- Minimizing manual tasks: By integrating automation solutions, businesses can streamline repetitive tasks associated with AR. This includes sending invoices, tracking payments, and issuing payment reminders. Automation also reduces the workload on finance teams, allowing them to shift their focus from administrative tasks to strategic initiatives to encourage more business growth.

- Improving cash flow: Cash flow is essential, so automating AR processes ensures a more predictable and steadier income stream. With faster invoice delivery, quicker payment processing, and timely reminders, payment delays become infrequent, stabilizing the business’s financial position. This reduces the average days sales outstanding (DSO), providing businesses with improved liquidity to cover operational expenses and investments.

- Enhancing efficiency: Efficiency is at the heart of AR automation. By replacing manual data entry and paper-based processes with automated systems, businesses achieve faster processing times and reduced account settlement cycles. Invoices get settled quicker, so accounting teams can accurately manage a higher volume of transactions for more efficient operations.

- Improving the customer experience: Automated payment systems can enhance customer satisfaction by providing customers with more convenient payment methods through online payment portals, easy access to their account information, and swift resolution of payment issues. Such frictionless interactions can vastly improve customer relationships and encourage prompt payments.

- Actionable insights: Automation tools come equipped with robust reporting features that provide real-time insights into the financial status of receivables. Business owners and finance teams can use this data to make informed decisions, such as identifying trends in payment behavior and developing targeted strategies to address outstanding payments or to enhance the payment collection process.

- Cost savings: Shifting to an automated system can lead to substantial cost savings. Reduction in paper usage, postage, and printing costs are immediate and visible benefits. Indirectly, automation reduces the need for additional staffing to manage accounts receivable and lowers the costs associated with time spent on manual entry and chasing down payments.

- Promoting scalability: As business operations grow, so does the volume of transactions that must be managed. Automation allows for better scalability of AR processes, as the software can handle an increasing workload without the need for proportionate increases in staff or resources. This supports sustainable business growth without sacrificing quality or control over finances.

- Compliance and security: Automation solutions come designed with compliance and security at their core, adhering to payment standards like the Payment Card Industry Data Security Standard (PCI DSS). They help ensure adherence to financial regulations and standards by maintaining transparent, accurate records and audit trails.

By adopting AR automation, businesses can expect a comprehensive suite of benefits that drive performance, efficiency, and profitability, mitigating the risks and limitations of conventional manual systems.

Now that you know the advantages of automation, it’s essential to understand how it can affect each aspect of accounts receivable processes.

Where does automation fit into AR processes?

With the many benefits of automated collections processes, your business can improve and automate multiple areas, such as invoicing, payment processing, cash application, and more.

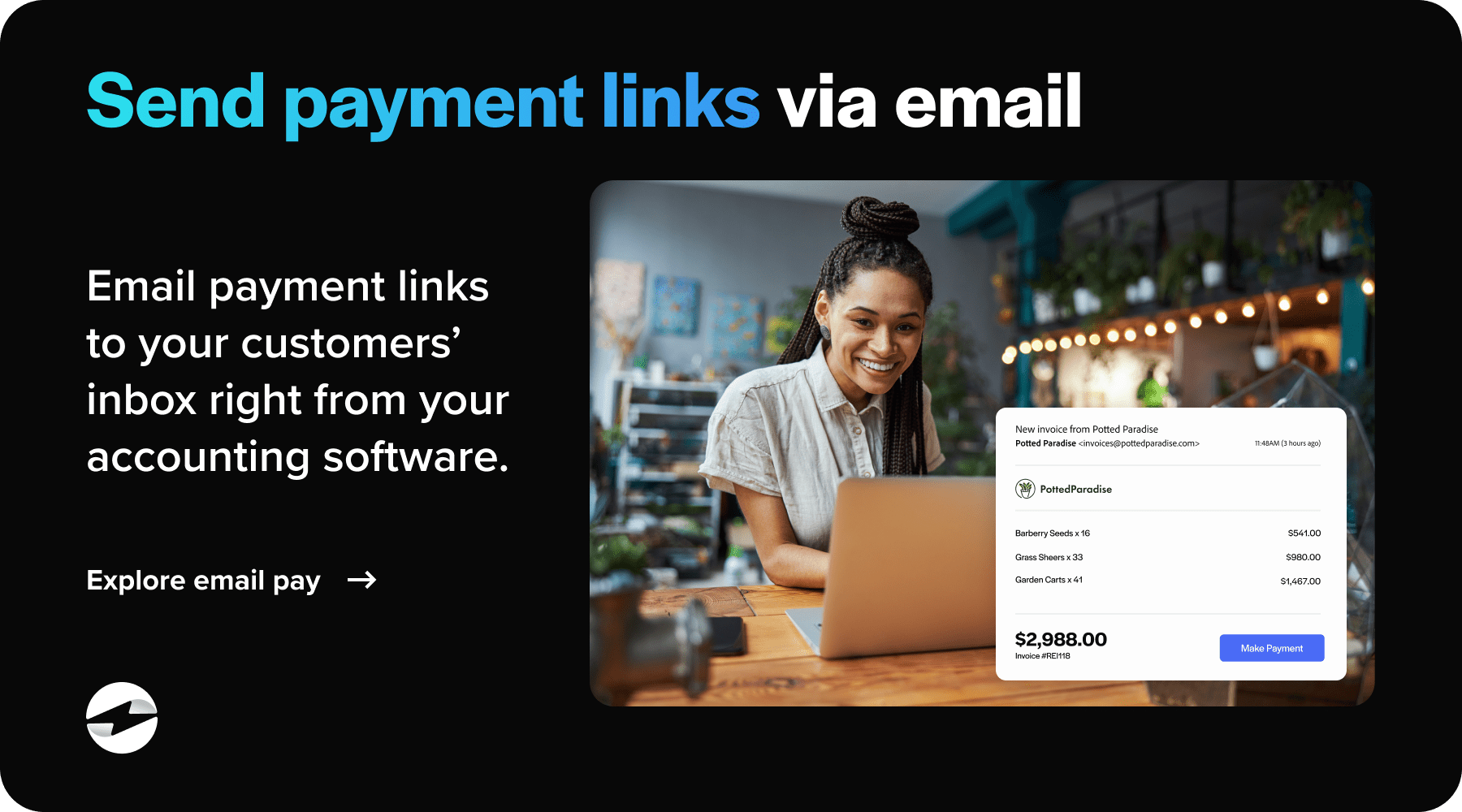

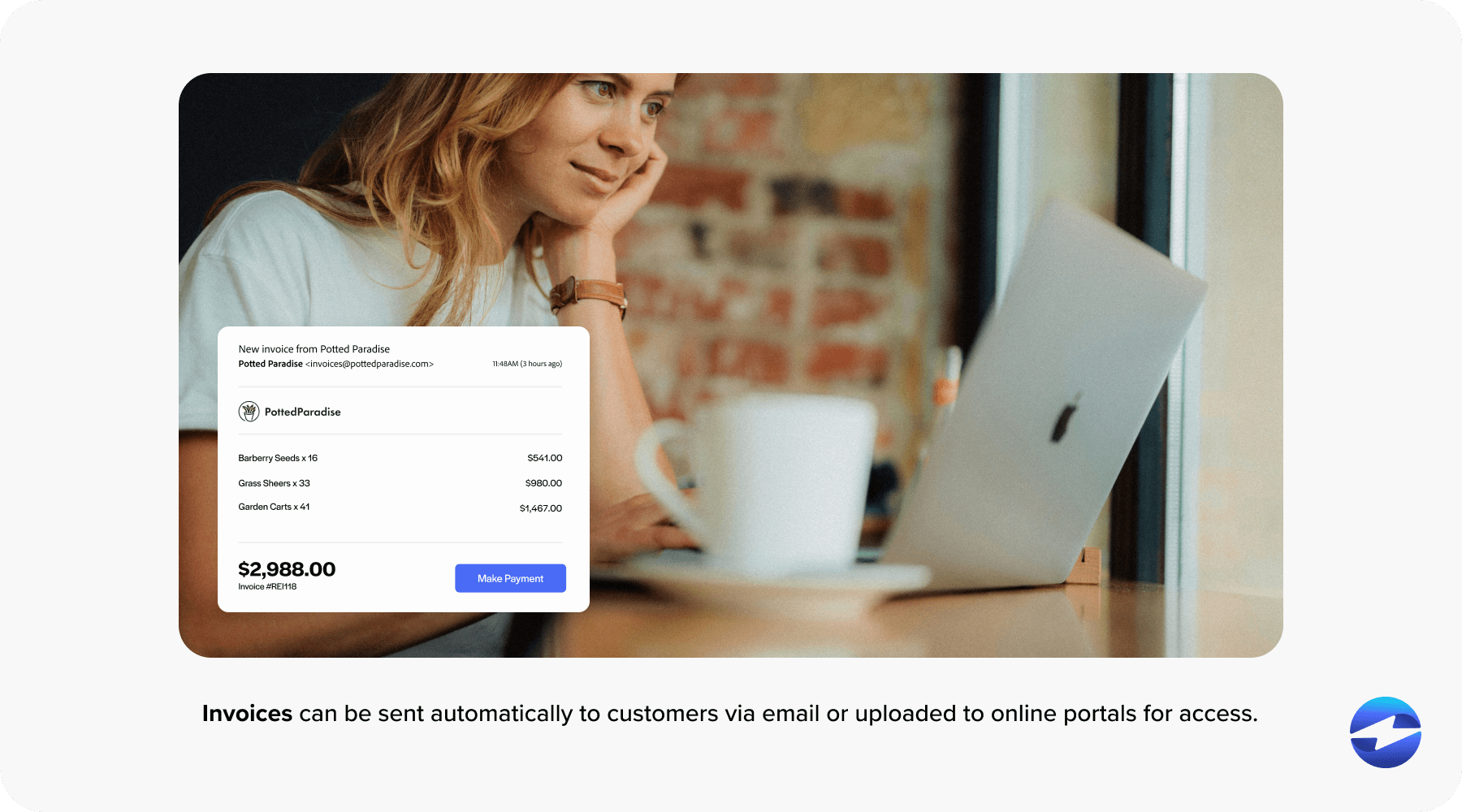

- Invoicing can be automated by implementing software solutions that automatically generate invoices based on predefined templates and rules. Once integrated, invoices can be sent automatically to customers via email or uploaded to online portals for access.

- Payment processing can be automated by integrating payment gateways with accounting or AR automation platforms, allowing customers to make electronic payments securely using various methods such as credit and debit cards or bank transfers.

- Collections management can be automated by implementing software solutions that streamline communication and tracking of outstanding invoices. These systems can also track communication history, record customer responses, and escalate overdue accounts automatically.

- Cash application can be automated by leveraging software solutions that streamline the reconciliation of incoming payments with outstanding invoices. Automated cash application systems utilize algorithms and data-matching techniques to match customer payments with the corresponding invoices in the accounting system.

- Dispute management can be automated by implementing software solutions that streamline the resolution process for billing discrepancies or disputes. Automated dispute management systems allow customers to submit disputes online through a self-service portal, where they can provide details and evidence related to the issue. These systems automatically route disputes to the appropriate department or personnel for review and resolution based on predefined rules and workflows. You can also integrate customer communication channels to automate notifications and updates to customers regarding the status of their disputes.

- Reporting and analytics can be automated by implementing software solutions that gather, analyze, and automatically present key performance metrics and insights. These automated reporting systems pull data from various sources such as accounting software, AR automation platforms, and ERP systems, and generate predefined reports based on customizable parameters and key performance indicators (KPIs).

- Integration with ERP systems can be automated by leveraging software solutions that facilitate seamless data exchange and synchronization between the AR automation platform and the ERP system. Automated integration processes establish predefined connections and data mappings between the two systems, allowing for the automatic transmission of relevant data, invoice details, payment transactions, and accounting entries.

- Customer self-service can be automated by implementing online portals or software solutions that empower customers to manage their accounts independently. Automated customer self-service platforms allow customers to access their account information, view invoices, make payments, and submit inquiries or disputes online without the need for human intervention.

Now that you know where AR automation can be implemented, you can learn how to apply it to these operations in your infrastructure.

9 ways to automate AR processes

Automating AR processes involves using collections automation software to streamline and reduce the manual effort associated with collecting payments from customers.

Here’s how your business can apply automation into its AR processes:

- Integrate with an ERP system

- Adopt electronic invoicing processes

- Implement customer payment portals

- Automate collections procedures

- Digitize dispute management

- Automate cash application with AI and machine learning

- Automate your records

- Leverage reporting and analytics

- Establish continuous monitoring and maintenance protocols

1. Integrate with an ERP system

To automate collections, businesses should integrate their Enterprise Resource Planning (ERP) system with various payment gateways. This allows finance teams to accept customer payments from multiple sales channels directly.

ERP integration involves setting up a seamless data transfer bridge between your payment acceptance platforms and the ERP software, thereby ensuring real-time visibility of all financial transactions.

2. Adopt electronic invoicing processes

Transitioning from traditional paper-based invoicing to a digitized process is a vital step toward AR automation. Compared to their physical counterparts, digital invoices dramatically expedite dispatch and processing times.

Electronic invoicing involves the generation, delivery, and management of invoices in digital format, typically via email or electronic portal. These digital invoices can be customized with company branding and payment terms before being sent directly to customers via email or uploaded to secure online portals for access.

3. Implement customer payment portals

Introducing a customer-facing payment portal simplifies the payment experience for your customers and expedites the receivable process. Such portals allow customers to view outstanding invoices, process payment via credit cards or eChecks, and manage their accounts online.

The payment portal is integrated with your AR system, automating the update of customer accounts post-transaction, thereby reducing the administrative burden on your receivable team.

4. Automate collections procedures

Automating collections procedures involves implementing collections automation software that sends payment reminders to customers with outstanding invoices. Utilizing tailored communications strategies for different segments and overdue periods ensures that reminders are assertive yet professional.

The software can also prioritize customer accounts based on risk and payment behavior, enabling a more strategic and effective collections process.

5. Digitize dispute management

Bringing dispute management online facilitates a more transparent resolution process.

By incorporating an online dispute management system, both customers and the receivable team can track, record, and resolve disputes efficiently. This approach significantly shortens the duration of days sales outstanding (DSO) and encourages collaboration and communication between all involved parties.

6. Automate cash application with AI and machine learning

To streamline the cash application process, accounting software can match incoming payments with the correct invoices, reducing manual involvement.

Modern automation tools use Artificial Intelligence (AI) and machine learning to improve the accuracy of the cash application over time. This sophisticated software can handle complex applications involving partial payments, discounts, or multiple invoice payments, supporting optimal accounts receivable management.

7. Automate your records

After successful payment processing, it’s essential to ensure all transactions are recorded accurately in your financial system. Automation tools can synchronize and post all payment data to your ERP in real time.

This integration prevents discrepancies between receivables and other financial records, maintaining an up-to-date and precise financial overview.

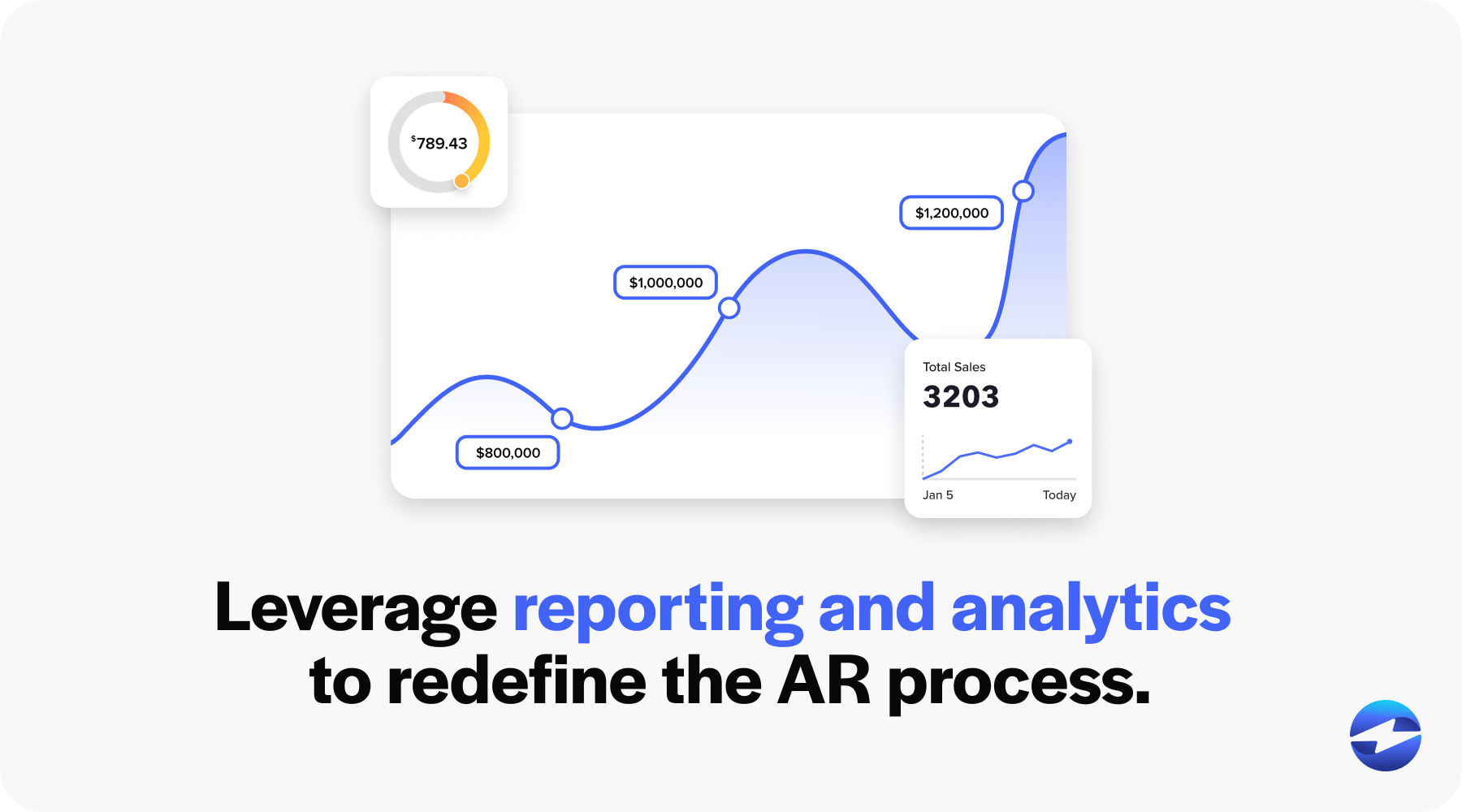

8. Leverage reporting and analytics

Leveraging reporting and analytics can refine the AR process. Applying sophisticated reporting and analytics tools to the receivables data helps identify trends, forecast cash flow, and pinpoint areas requiring attention.

Finance teams can use these insights to make informed decisions about credit policies, customer payment terms, and how to optimize the overall receivable cycle.

9. Establish continuous monitoring and maintenance protocols

Ensure the sustainability and effectiveness of your automated collections processes by establishing continuous monitoring and maintenance protocols.

Regularly assess the performance of your automation initiatives, identify any issues or areas for optimization, and implement necessary adjustments or enhancements.

By proactively monitoring and maintaining your automated AR processes, you can ensure they continue to meet the evolving needs of your business and deliver maximum efficiency and effectiveness over time.

Embracing automated collections services

Transitioning to automated collections offers many advantages for businesses, particularly relating to AR operations by eliminating manual tasks, improving cash flow, enhancing efficiency, and the user experience.

Automation ensures compliance with regulations, enhances security measures, and provides valuable insights through actionable analytics. Embracing automation in AR processes is not just a trend but a necessity for businesses aiming to stay competitive and thrive in today’s dynamic marketplace.