Blog > 5 Reasons Why Collecting Payments with a PDF Form Isn’t PCI Compliant

5 Reasons Why Collecting Payments with a PDF Form Isn’t PCI Compliant

When it comes to processing payments, adhering to the Payment Card Industry (PCI) Standards is crucial to ensuring cardholder data is safe and secure. This article will explore five reasons why using PDF forms for payment collection doesn’t meet PCI DSS requirements, highlighting the risks and security gaps inherent in this method.

By understanding these pitfalls, businesses can take proactive steps to adopt more secure payment processing solutions.

What is PCI compliance?

PCI compliance refers to the adherence to the Payment Card Industry Data Security Standards (PCI DSS), a set of security standards designed to ensure that all entities that accept, process, store, or transmit credit card data maintain a secure environment.

PCI standards were established by major credit card companies such as Visa, Mastercard, American Express, Discover, and JCB, forming the Payment Card Industry Security Standards Council (PCI SSC).

Compliance with PCI standards is mandatory for any business that handles credit card transactions. It involves meeting various security requirements, including maintaining a secure network, protecting cardholder data, implementing strong access control measures, regularly monitoring and testing networks, and maintaining an information security policy.

5 reasons PDF forms aren’t PCI-compliant

PDF forms are popular for their ease of use and the ability to capture information efficiently. However, when collecting payment card details, PDF forms present significant compliance issues with PCI Standards.

Here are five reasons why PDF forms fall short of the stringent requirements for secure credit card transactions.

1. Lack of encryption

1. Lack of encryption

Encryption is essential for protecting sensitive cardholder data during transmission over public networks.

Standard PDF forms don’t typically offer end-to-end encryption for data in transit or at rest, making the sensitive information vulnerable to interception or unauthorized access by cybercriminals. PCI compliance requires encryption for any transmission of cardholder data across open, public networks using strong cryptography, which regular PDF forms don’t support.

2. Insecure storage

2. Insecure storage

Storing payment card data requires secure systems to prevent breaches. When a completed PDF form is saved, the cardholder data is often stored without adequate security controls.

This poses a risk as non-compliant storage solutions may not have the necessary protections against unauthorized physical access or cyberattacks, putting payment information at risk. Under PCI standards, businesses must protect stored cardholder data and limit access to the physical and digital data storage locations, a feature typically unavailable in standard PDF form tools.

3. Difficulty in tracking and monitoring

3. Difficulty in tracking and monitoring

To maintain PCI compliance, businesses must implement robust monitoring and tracking mechanisms for payment processing and access to cardholder data. This oversight is often challenging with PDF forms, as they don’t rapidly provide a mechanism for real-time monitoring or logging access and changes to payment data.

Without the ability to track who accesses the data, when, and what changes are made, ensuring the ongoing compliance and safety of sensitive information as required by PCI standards is nearly impossible.

4. Weak security access protocols

4. Weak security access protocols

Strong access control measures are critical PCI compliance components that ensure only authorized individuals access cardholder data.

PDF forms generally can’t enforce role-based access control or multi-factor authentication (MFA), which are fundamental to PCI compliance. Therefore, PDF forms don’t guarantee that only authenticated personnel access sensitive data, compromising the security of credit card information.

5. Absence of data masking

5. Absence of data masking

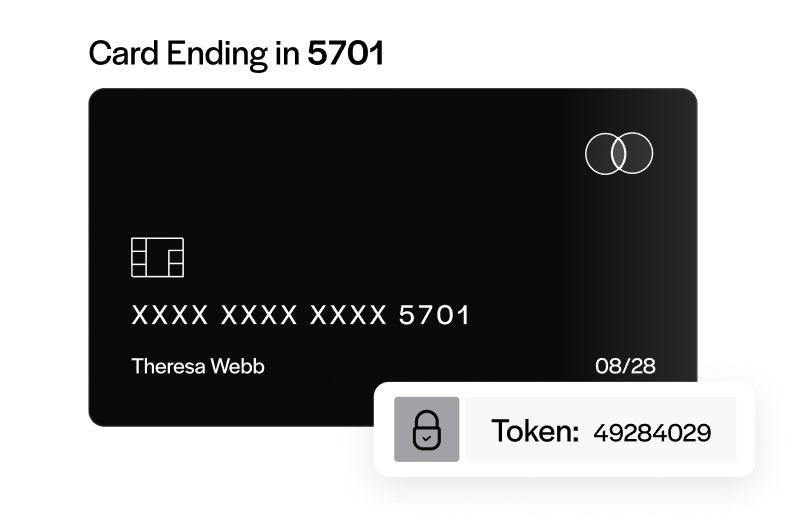

When displaying payment transaction details, it’s vital to obscure certain pieces of information to protect against potential misuse.

PCI standards mandate that businesses mask card numbers when displayed and require no more than the last four digits of the card number to be visible post-authorization. Standard PDF forms don’t mask data automatically, making them a non-compliant option for collecting or displaying payment card information since full access to cardholder data could inadvertently be granted.

While PDF forms may be convenient for various document-related tasks, they inherently lack the necessary features to comply with PCI requirements for payment data collection and handling.

Businesses must employ payment processing solutions specifically designed to adhere to the strict security standards and protocols the PCI Council sets to ensure the security of credit card payment transactions.

The importance of being PCI compliant

PCI compliance is crucial for merchants as it ensures the secure handling of credit card transactions and protects against data breaches. PCI standards set by the PCI Security Standards Council guard access to cardholder data, shielding merchants and customers from fraud.

Non-compliance not only risks financial penalties from credit card companies like Visa, MasterCard, and American Express but also endangers the merchant’s reputation.

To avoid non-compliance, businesses can look to third-party, PCI-compliant payment processors like EBizCharge to provide streamlined payment collections within PCI guidelines.

Ensuring ongoing PCI compliance with EBizCharge

EBizCharge is recognized as a top-rated, PCI-compliant payment processing solution that’s established its credibility by implementing strong access control measures, ensuring a secure network for all payment transactions, and providing robust security controls over the storage and transmission of sensitive cardholder data.

EBizCharge integrates seamlessly with business software to facilitate credit card, debit card, and other payment processing operations while maintaining strict security requirements.

To ensure ongoing compliance, EBizCharge offers a secure system that’s regularly updated to align with the ever-evolving security standards dictated by the payments industry. It also restricts physical access to cardholder data, mitigating the risk of any unauthorized access.

EBizCharge stands out as an award-winning PCI-compliant payment processor that efficiently handles sensitive payment data and gives merchants and their customers peace of mind during payments.