Blog > 5 Best Sage Intacct Payment Processing Solutions

5 Best Sage Intacct Payment Processing Solutions

Choosing the right payment system inside Sage Intacct can make or break how smoothly your finance operations run. When done well, payment integration isn’t just about moving money – it’s about saving time, improving accuracy, and cutting costs. With so many options out there, finding the best Sage Intacct payment processing solution can feel overwhelming. The good news is that Sage Intacct’s open framework and flexible integrations make it easier than ever to find a setup that fits your exact needs.

This guide breaks down the top five Sage Intacct payment solutions for 2025, including pricing insights, integration details, and fee-reduction opportunities. It’s written for professionals who rely on Sage daily – finance leads, IT managers, and operations teams who want tools that work reliably behind the scenes.

1. EBizCharge

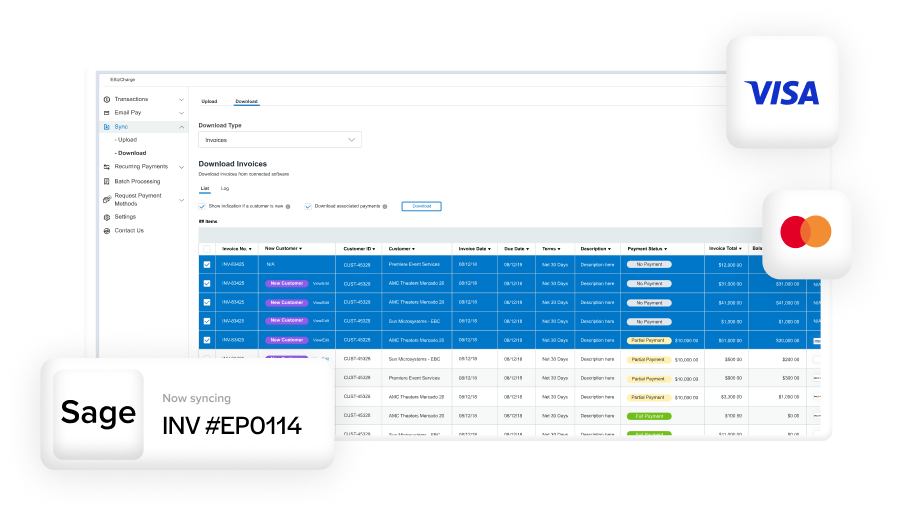

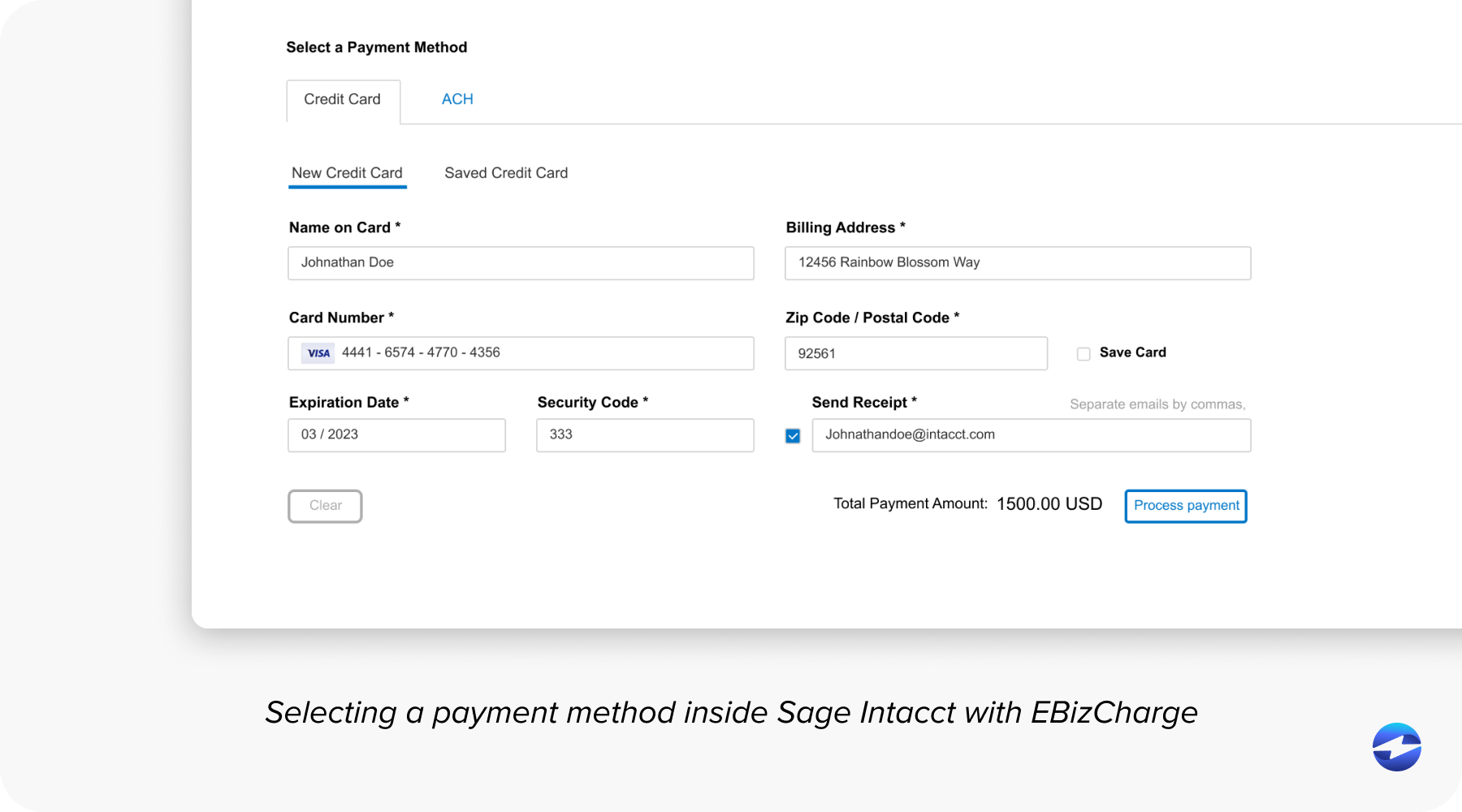

EBizCharge consistently ranks among the best Sage Intacct payment processing solutions thanks to its native integration and strong balance of automation and security. It was built specifically for Sage, which means transactions post directly to invoices and accounts in real time. There’s no double entry or manual reconciliation, and every payment stays linked to the right customer record.

Key features include tokenization, fraud prevention, recurring billing, and customer payment portals. As both a payment processor and integration provider, EBizCharge helps users lower fees through interchange optimization – automatically routing transactions into the least expensive rate category. That alone can make a noticeable difference in total costs.

In terms of Sage Intacct pricing, EBizCharge is known for transparent, predictable rates and minimal add-on fees. It’s ideal for businesses that value strong security, PCI compliance, and integrated reporting – all without needing custom development.

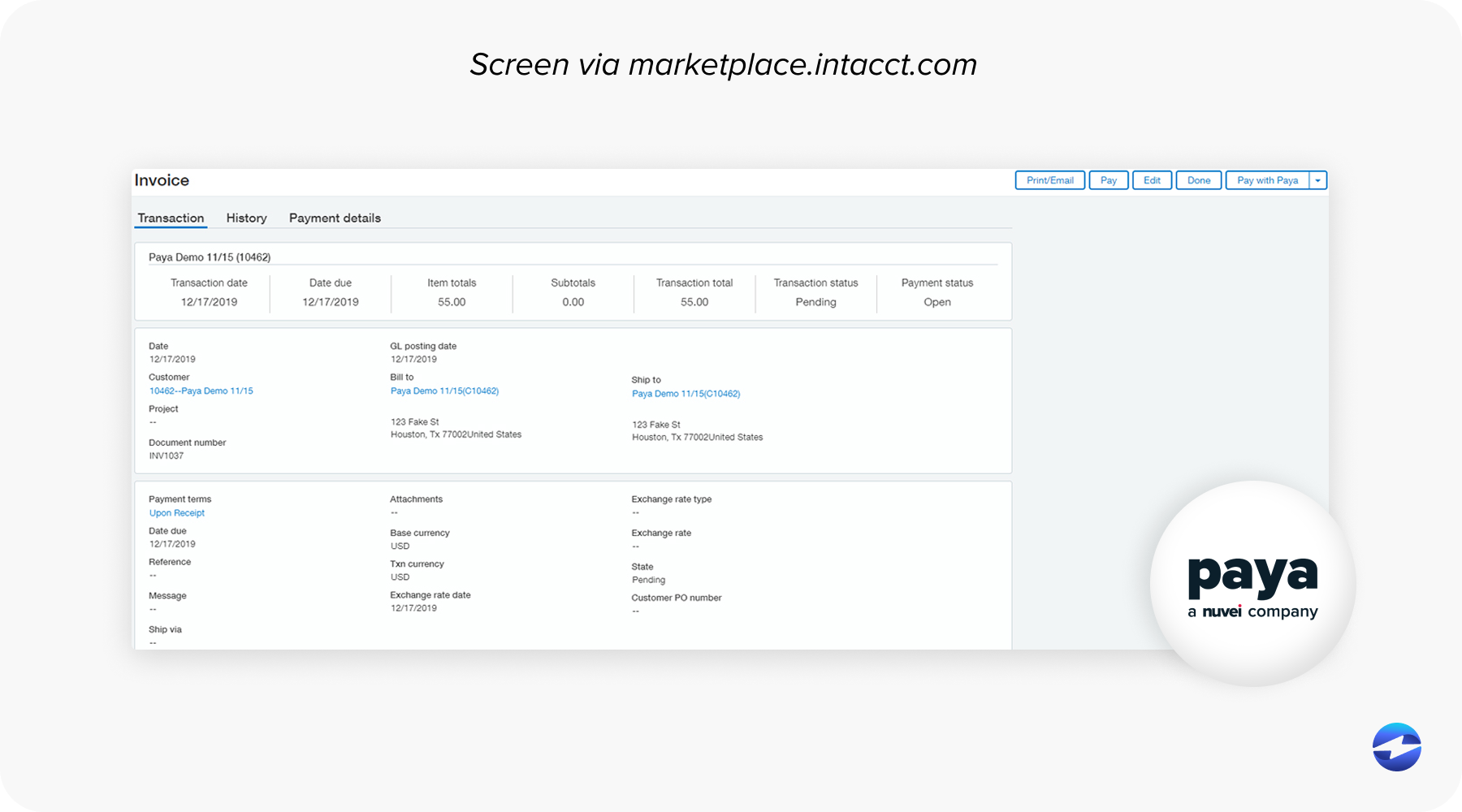

2. Paya

Paya is another reliable option for Sage Intacct payment processing, offering a simple but effective way to accept ACH, credit card, and mobile payments. Its integration provides a smooth invoice-to-cash workflow, helping companies post transactions faster and keep records aligned across systems.

Paya supports multiple payment methods and offers solid fraud prevention features. The system works well for mid-sized businesses that process a high volume of recurring payments but don’t need the deeper automation tools of a fully native system like EBizCharge.

While Sage Intacct pricing varies depending on transaction volume and card mix, Paya remains competitive. It’s a dependable payment processing solution for finance teams that want a balance of functionality and ease of setup.

That said, there are a few tradeoffs to keep in mind. Because Paya isn’t as deeply embedded in Sage Intacct as some native integrations, users may encounter small sync delays or need occasional manual adjustments during high transaction periods. Some companies also note that advanced automation – like automatic reconciliation or custom reporting – requires extra configuration or third-party tools. These aren’t dealbreakers, but they’re worth considering if your team handles complex or high-volume payments.

3. Stripe for Sage Intacct

Stripe is widely recognized as one of the most flexible payment systems in the world – and it integrates with Sage Intacct through third-party connectors. Its biggest strength is its Sage Intacct API compatibility. Developers can use Stripe’s powerful API and webhook capabilities to customize nearly every part of the payment flow, from invoicing to reconciliation.

The tradeoff, however, is that Stripe isn’t a native Sage integration. It often requires technical setup or middleware to connect properly, which can mean higher upfront development costs. Still, for businesses with strong internal IT resources, it offers flexibility.

Stripe’s cost model remains simple, although pricing depends on card type and country. It’s best suited for global companies that need multi-currency support, advanced customization, or recurring billing options at scale. For smaller organizations without developer resources, though, it might not be the easiest fit.

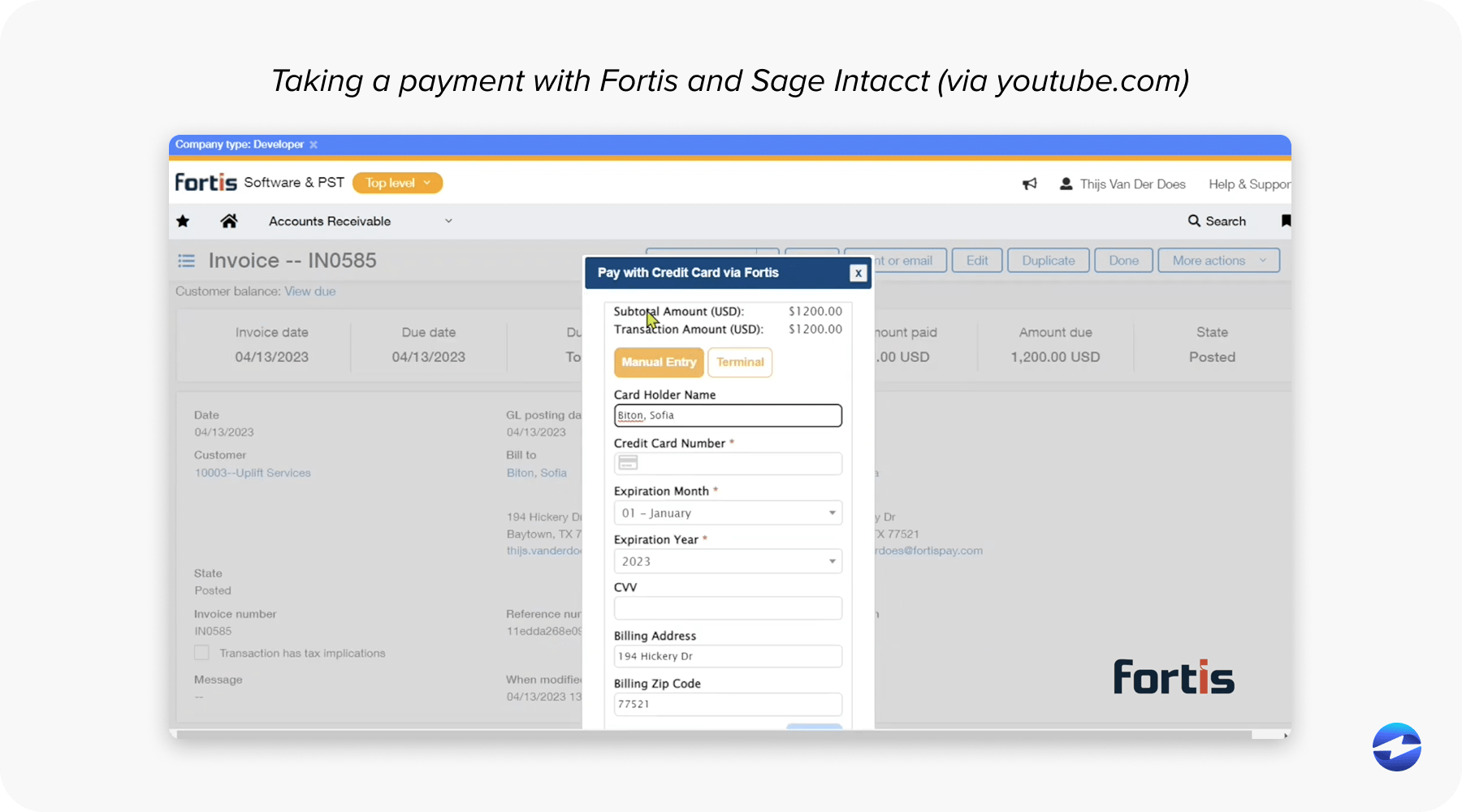

4. FortisPay

FortisPay has gained traction as a strong Sage Intacct payment processing solution, especially for B2B and healthcare organizations. It integrates smoothly with Sage to support recurring billing, payment reminders, and secure tokenization – all focusing on data security and compliance.

FortisPay’s tools make it easy to handle high-volume transactions and recurring payments without manual tracking. It also offers detailed analytics and fraud monitoring, which are particularly valuable for businesses managing sensitive financial data or patient payments.

Pricing for FortisPay depends heavily on transaction volume and contract terms. It’s best for companies that want strong industry-specific support and a dependable payment processor with flexible features and long-term stability.

Still, there are a few tradeoffs to note. FortisPay’s setup and reporting features can require a bit more time to configure compared to more plug-and-play integrations. Some users also mention that while its tools are more robust, customer support response times can vary during high-volume periods.

5. APS Payments (now Repay)

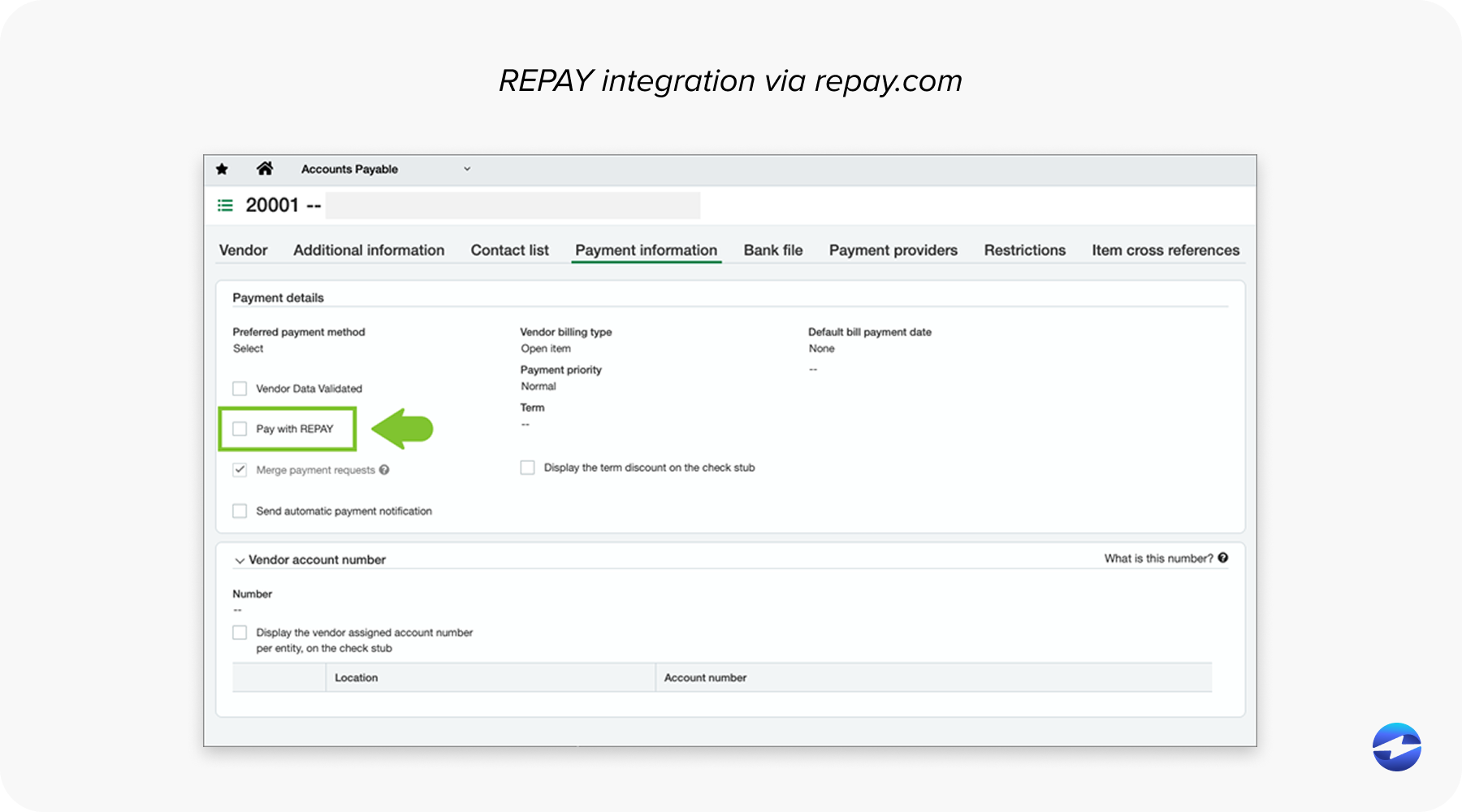

APS Payments – now operating under the Repay brand – is another integration partner for Sage users. Its Sage Intacct integrations focus on automating credit card and ACH transactions while keeping reconciliation as simple as possible.

Repay shines in multi-channel environments. Whether your business takes payments online, over the phone, or through invoices, Repay helps centralize everything into one view. It also supports tokenization and recurring billing, ensuring payments remain secure and compliant.

Cost-wise, Repay’s pricing depends on your transaction size and type, similar to most processors. It’s best for mid-sized organizations with varied payment channels that want an integration that doesn’t require constant oversight.

However, because Repay supports multiple channels and systems, setup can take a bit longer to fine-tune for specific workflows. Some users also state that reporting customizations are less flexible compared to more native Sage Intacct integrations.

Alternatives to Sage Intacct Payment Processing

While Sage Intacct offers a robust ecosystem for payment processing, it’s not the only option. Many businesses explore alternatives like NetSuite, QuickBooks Enterprise, or Xero – all of which have their own strengths.

NetSuite is a comprehensive ERP with strong automation tools, but its integrations can be more expensive to build and maintain. QuickBooks is easier to start with, but it often lacks the scalability mid-sized and enterprise businesses need. Xero is cost-effective but geared toward smaller teams with simpler financial structures.

Ultimately, Sage Intacct stands out for its open Sage Intacct API, flexible integration options, and active network of Sage Intacct integration partners. While there’s always an alternative to Sage, few systems offer the same combination of scalability, automation, and customization flexibility.

Understanding Sage Intacct Payment Processing Costs

Every payment processing solution has its own cost structure. In the context of Sage Intacct, expenses usually include gateway fees, per-transaction charges, and sometimes monthly platform costs. However, the bigger differentiator is how efficiently your system handles transactions.

Integrated Sage Intacct payment processing reduces hidden costs like manual reconciliation time or duplicate data entry. Processors that support interchange optimization – like EBizCharge – can further lower costs by automatically qualifying transactions for the best possible rate category.

It’s important to compare not only flat processing fees but also the long-term value of automation. When evaluating Sage Intacct pricing, remember that a slightly higher per-transaction rate can still lead to savings if it eliminates hours of manual work or minimizes errors that delay collections.

Sage Intacct Integration Partners

The real strength of Sage Intacct lies in its network of certified Sage Intacct integration partners. These partners build and maintain solutions that are pre-verified to work within the Sage ecosystem, minimizing setup time and technical risk.

Using a certified partner from the Sage Intacct marketplace ensures that your data syncs securely and that updates won’t break your workflow. EBizCharge, for instance, is a trusted partner that offers both payment processing and reporting tools directly inside Sage. Other partners like Paya and Repay provide flexible options depending on your industry and volume.

Whether you choose a turnkey app or a custom API-based setup, working with verified partners means fewer surprises and faster go-live times. They understand the nuances of Sage Intacct integrations and can help tailor payment workflows to your organization’s structure.

Reducing Payment Processing Fees in Sage Intacct

Reducing processing fees doesn’t always mean renegotiating rates. Often, it’s about optimizing how transactions are routed and how data flows between systems. Within Sage Intacct, the best way to reduce costs is by leveraging direct integrations with processors that support interchange optimization and automated reconciliation.

For example, EBizCharge helps businesses lower fees by sending transactions through the lowest-cost interchange categories whenever possible. Automation also minimizes the manual work tied to reconciliation and batch processing, both of which add operational costs over time.

Working with the right Sage Intacct integration partners allows companies to track fees more transparently and identify where savings can be made. Over time, even small improvements in processing efficiency can add up to significant annual savings.

Why EBizCharge Is a Good Fit for Sage Intacct Integration

When it comes to connecting payments within Sage Intacct, EBizCharge stands out as the most complete and seamless option. Unlike other systems that rely on middleware or complex connectors, EBizCharge was built to work natively inside Sage Intacct. Payments post instantly to invoices, accounts, and opportunities – no extra reconciliation steps or duplicate entries. That kind of real-time accuracy gives finance teams confidence in their data and keeps books aligned across the board.

EBizCharge also helps businesses save money over time. Its built-in interchange optimization automatically routes transactions through the lowest available processing rates, cutting unnecessary fees before they happen. Combined with advanced security features like tokenization and fraud prevention, it delivers both safety and savings in one package.

EBizCharge is also known for its ease of use. Implementation is quick through certified Sage Intacct integration partners, and the support team behind EBizCharge knows the Intacct ecosystem inside and out. Companies don’t need to hire developers or spend weeks testing custom code – the integration is designed to work out of the box while still leaving room for customization.

For organizations already running Sage Intacct, EBizCharge offers more than just another payment processor. It’s a long-term payment processing solution that aligns perfectly with Intacct’s financial workflows, turning complex payment handling into something efficient, accurate, and scalable for the years ahead.