Blog > 4 Steps to Maximize AR Efficiency with an SAP Business One Payment Gateway

4 Steps to Maximize AR Efficiency with an SAP Business One Payment Gateway

Accounts receivable (AR) often sits at the helm of a company’s financial health. When AR is efficient, cash flow is steady, and teams can spend less time chasing invoices and more time on meaningful work. But for many businesses, AR management becomes a headache—manual invoicing, late customer payments, and reconciliation issues that slow everything down.

That’s where an SAP Business One payment gateway comes in. By integrating payments directly into your enterprise resource planning (ERP) system, you can eliminate the friction that comes with disconnected systems. Instead of juggling spreadsheets and manual entries, the SAP payment process becomes more streamlined, automated, and reliable. In this article, we’ll look at four steps you can take to maximize AR efficiency with SAP payments, and we’ll also discuss why solutions like EBizCharge are such a strong fit.

Step One: Streamline Invoice Creation and Delivery

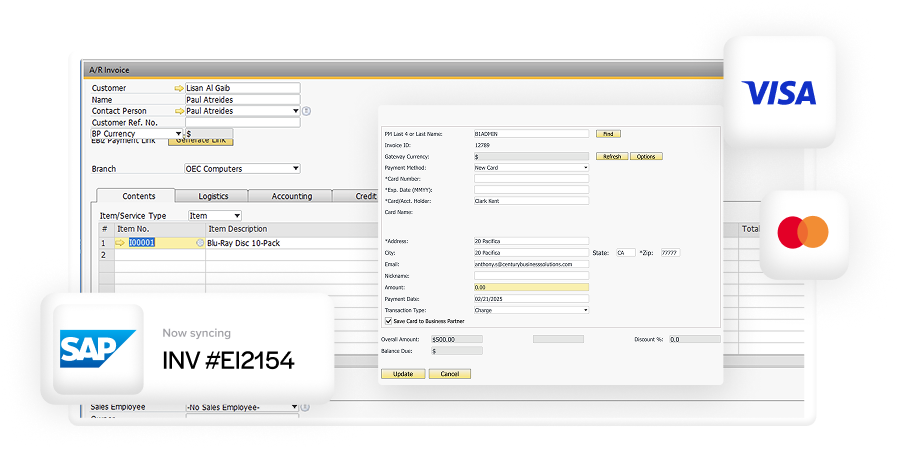

Invoices are the starting point for the entire SAP payment processing workflow. If they’re slow to create or inaccurate, everything else that follows gets delayed. Fortunately, SAP Business One makes invoice creation much easier by pulling data directly from orders and customer records. This reduces the chances of human error and ensures every invoice has the correct information.

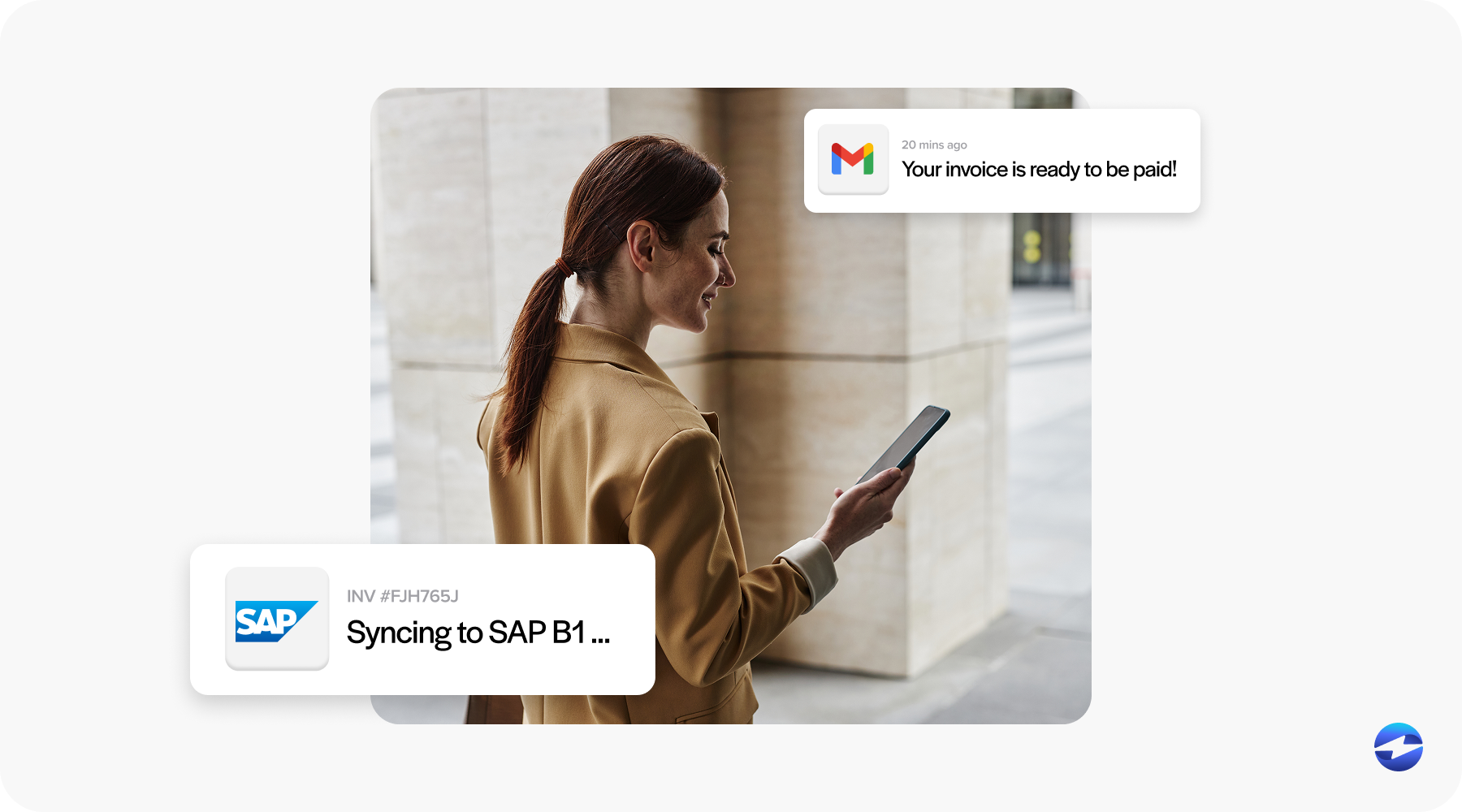

Delivery is just as important as creation. Instead of printing and mailing invoices, you can automate email delivery or share them through a customer portal. This way, invoices land in your customer’s inbox instantly. A faster delivery method shortens the time between billing and payment, which means your team spends less time waiting and more time keeping the SAP payment process moving forward.

In short, starting with accurate, timely invoices lays the foundation for everything that comes after. When invoices are handled properly within SAP Business One, they pave the way for smoother collections and better cash flow.

Step Two: Offer Flexible Payment Options

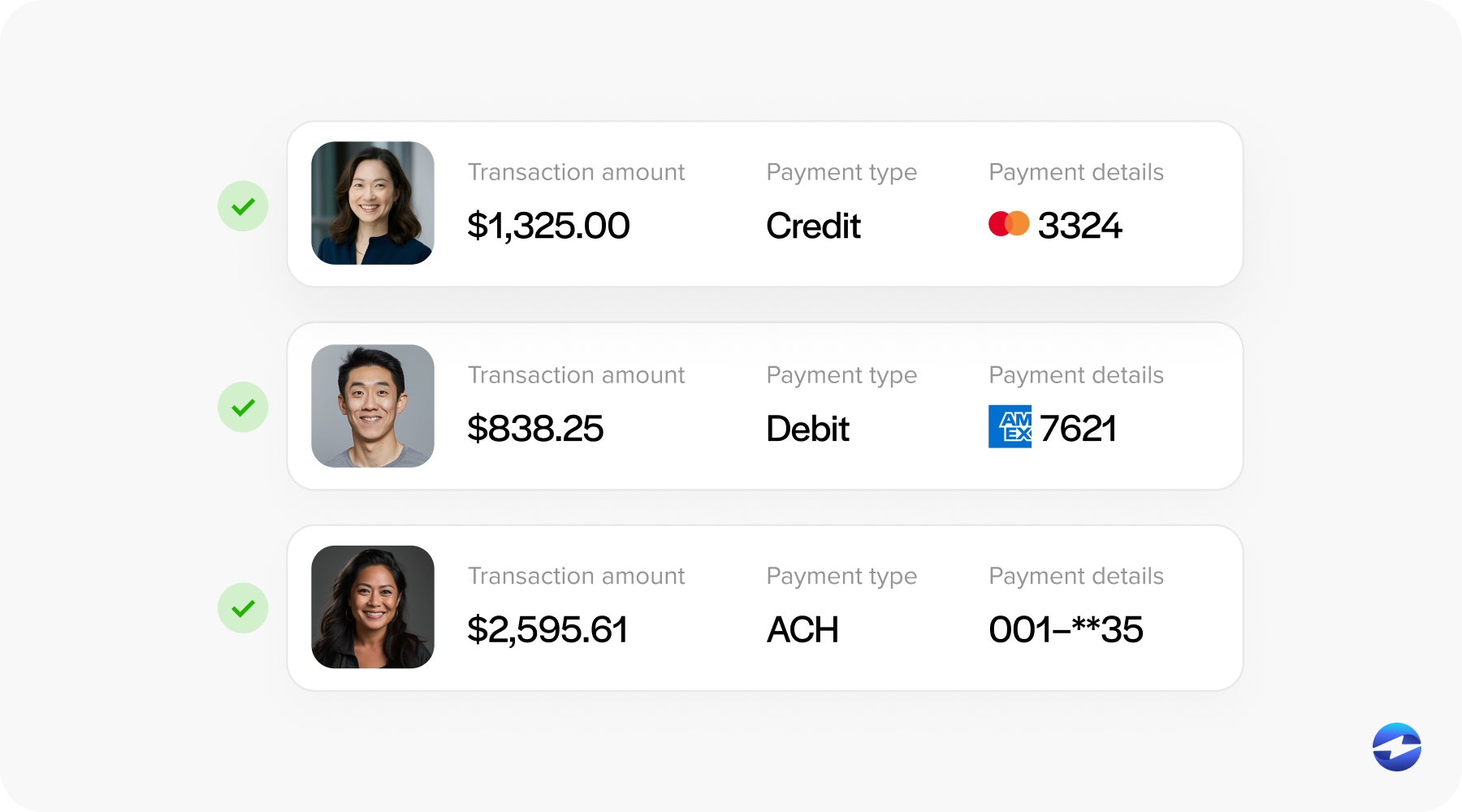

Customers are more likely to pay on time when they can use the payment method they prefer. Limiting them to checks or manual bank transfers only slows down the process. That’s why supporting multiple SAP payment methods—like credit cards, ACH, and even digital wallets—can make a big difference.

Through an SAP Business One payment gateway, these options are available right inside your ERP. This means customers can pay directly from their invoice with a click, whether they choose a credit card or another method. For companies handling recurring billing or subscriptions, SAP Business One credit card processing ensures those payments happen automatically without the need to chase down reminders.

Offering flexibility isn’t just about convenience. It builds goodwill with your customers and shows that you value their time. The easier it is to make SAP payments, the more likely you are to receive them on time.

Step Three: Automate Payment Posting and Reconciliation

One of the most time-consuming parts of AR is reconciliation. Without automation, your team spends hours entering payments manually, double-checking for errors, and matching them against outstanding invoices. An SAP payment gateway changes this by posting payments directly into AR and the general ledger the moment they’re processed.

This level of automation does two things. First, it reduces errors since payments no longer require manual input. Second, it gives you real-time visibility into your cash flow. Instead of waiting for end-of-month reconciliations, you know exactly where your receivables stand at any given time.

By using a payment processing solution that ties directly into SAP Business One, you’re not just saving time—you’re also creating a cleaner, more transparent financial picture. And that kind of visibility is invaluable for making better business decisions.

Step Four: Gain Better Visibility with Reporting and Analytics

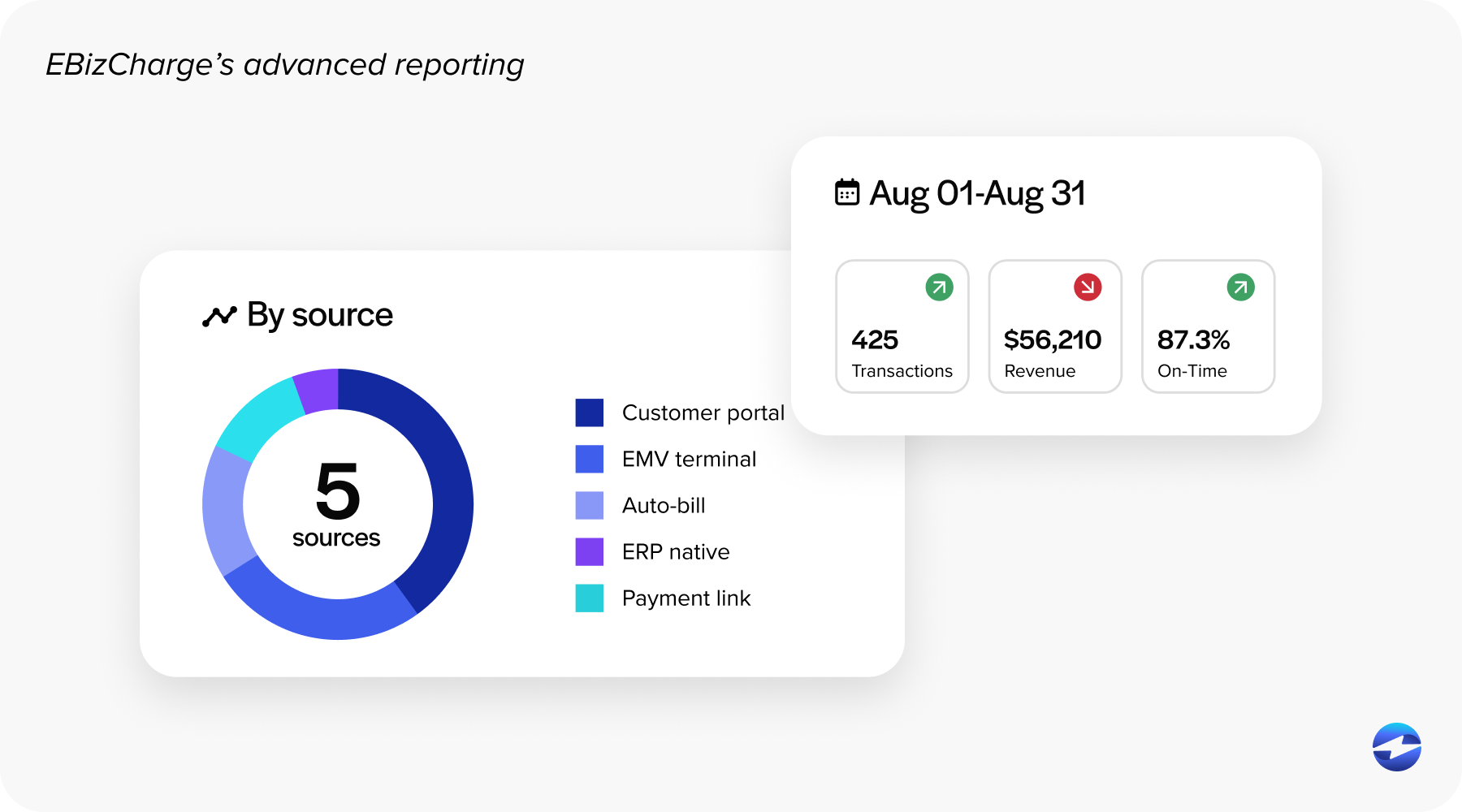

Efficient AR isn’t just about processing payments quickly. It’s also about understanding what the data is telling you. With an integrated SAP payment solution, you can access detailed reports that track customer payment habits, highlight overdue invoices, and reveal bottlenecks in your collection process.

For example, you may notice that customers in one region tend to pay later than others, or that a specific payment method in SAP consistently leads to delays. These insights allow you to adjust strategies—whether it’s offering incentives for faster payment, tightening credit terms, or simply reaching out to customers sooner.

The benefit of these tools is not just in spotting problems but also in planning for the future. With accurate analytics tied directly to the SAP payment process, you can forecast cash flow with more confidence and make strategic decisions that support growth.

Why EBizCharge is a Strong Fit for SAP Business One

SAP provides the structure, but sometimes you need an extra layer of functionality to get the most out of it. That’s where a third-party payment processor like EBizCharge comes in. It integrates directly with SAP Business One, adding features that simplify AR and make collections faster.

For example, EBizCharge offers secure online payment portals that let customers pay invoices anytime, anywhere. This not only speeds up payments but also reduces the back-and-forth for your team. Lower transaction fees compared to many traditional processors are another benefit, helping to cut costs while maintaining efficiency.

EBizCharge also strengthens SAP Business One credit card processing by offering advanced security features and PCI-compliant tools. On top of that, its reporting features provide more granular insights into customer behavior and payment trends, enhancing the visibility you already have in SAP.

By choosing a third-party payment processor like EBizCharge, you’re not replacing what SAP already does—you’re enhancing it. The result is a more seamless workflow, lower costs, and a better experience for both your team and your customers.

Maximizing AR with SAP Business One

Maximizing AR efficiency isn’t about reinventing the wheel—it’s about using the tools you already have in smarter ways. By streamlining invoices, offering flexible payment options, automating reconciliations, and leveraging analytics, you set your business up for faster collections and healthier cash flow.

An SAP Business One payment gateway makes each of these steps easier to achieve. And when paired with a solution like EBizCharge, you gain even more benefits—from lower fees to enhanced reporting. Together, these improvements turn AR from a constant challenge into a reliable process.

For businesses serious about growth, the time to optimize AR is now. Evaluate your current SAP payment processing setup, consider the SAP payment solutions available, and take steps to build a system that works for you—not against you.