Blog > NetSuite Payment Processing: Native Integration vs. API Solutions

NetSuite Payment Processing: Native Integration vs. API Solutions

Payment processing tends to sit quietly in the background—until it doesn’t. When payments fail to sync, invoices don’t update, or reporting starts to feel unreliable, the way your payments connect to NetSuite suddenly becomes very visible.

If you’re reading this, chances are you’re responsible for keeping things running smoothly inside NetSuite ERP. Maybe you’re on the finance or AR side, or maybe you’re the one IT calls when something breaks. Either way, choosing the right approach to NetSuite payment processing matters more than most people expect.

Today, NetSuite users generally face two paths: relying on native payment integrations inside NetSuite software, or connecting external platforms through APIs—often with tools like Stripe to NetSuite, PayStand NetSuite, or Recurly NetSuite. Each option solves real problems, but each comes with trade-offs that are easy to overlook early on.

This article breaks those options down in practical terms, without marketing spin. The goal is to help you understand what you’re really signing up for, so you can choose a payment solution that fits how your business actually operates.

Understanding Payment Processing in NetSuite

At its core, NetSuite payment processing is about how money moves from your customer to your bank—and how accurately that movement is reflected in your system.

Payments typically start at an invoice, sales order, or customer portal. From there, a payment gateway captures the transaction and passes it to a payment processor for authorization and settlement. Finally, that payment data needs to land back in NetSuite software, so invoices close, balances update, and reports stay accurate.

What sounds simple can quickly become complicated. Finance teams care about clean cash application and reporting. AR teams care about speed and accuracy. IT teams care about reliability and maintainability. A payment processing solution has to balance all of those priorities at once.

What Is Native Payment Processing in NetSuite?

Native payment processing refers to payment tools that live directly inside NetSuite ERP. These integrations are designed to work within NetSuite’s existing workflows, screens, and records.

With native tools, users typically enter or accept payments directly in NetSuite software. Transactions post immediately, and reporting stays centralized. For many teams, this feels clean and familiar.

Native payment processing often works best for straightforward use cases—standard invoicing, limited payment methods, and moderate transaction volume.

Benefits of Native NetSuite Integrations

Native integrations offer simplicity. Payments, customers, and invoices all live in one place.

Because everything happens inside NetSuite ERP, reporting is consistent and easier to trust. There’s less dependency on external systems, and setup tends to be faster.

For teams with limited IT resources, native tools can be appealing because there’s less to maintain over time.

Limitations of Native NetSuite Integrations

That simplicity can also be restrictive.

Native options may not support every payment method your customers expect. Customization is often limited, especially for complex billing models.

As transaction volume grows, some teams find that native tools struggle to keep up with advanced needs like subscriptions, usage-based billing, or detailed customer payment experiences.

What Are API-Based Payment Solutions?

API-based payment solutions connect external platforms to NetSuite using application programming interfaces (APIs). An API is a set of rules that allows different systems to exchange data automatically, enabling payment platforms to send customer, invoice, and transaction information back and forth with NetSuite without users entering that data manually.

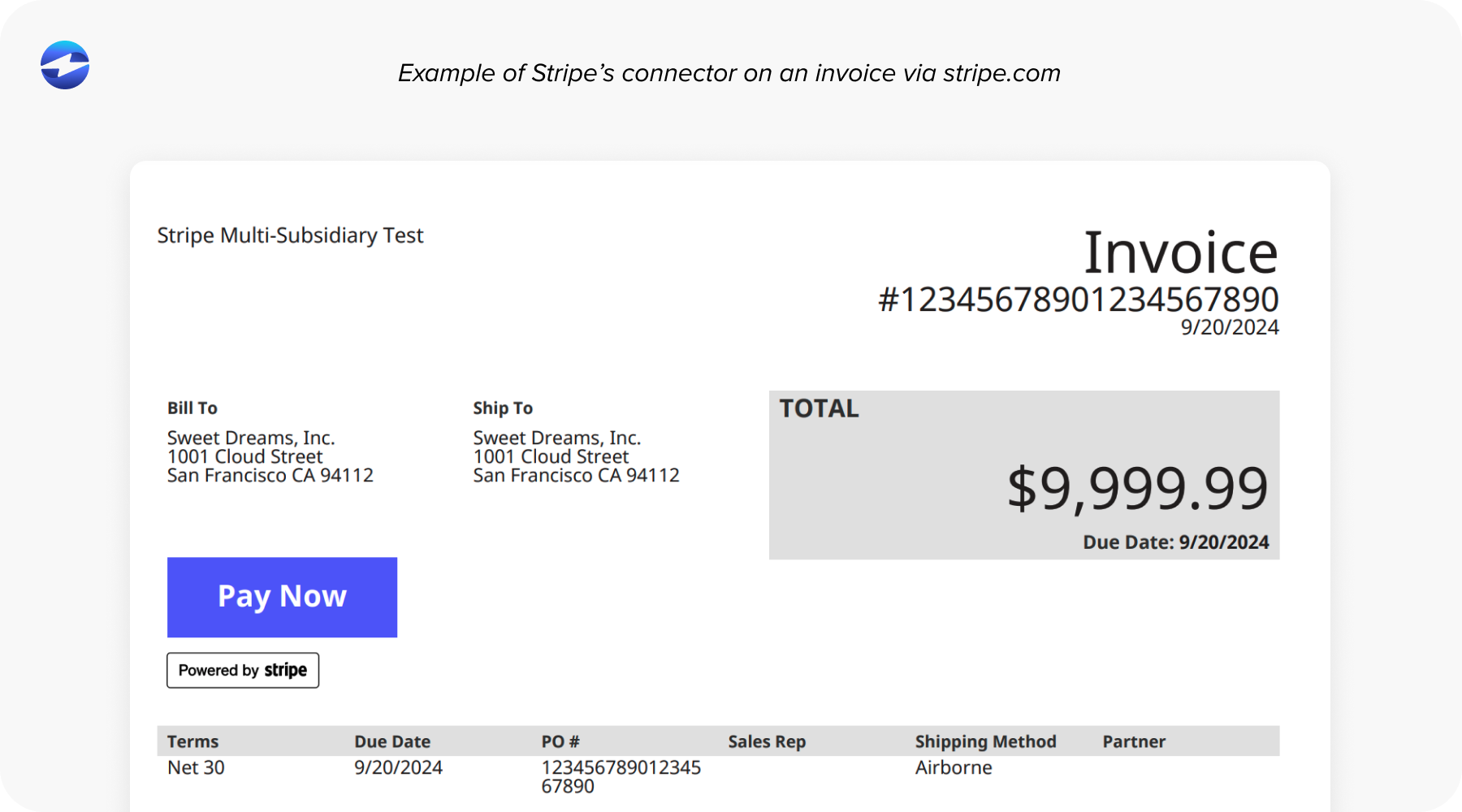

This approach is common with tools like Stripe to NetSuite, PayStand NetSuite, and Recurly NetSuite. In these setups, payments are often initiated outside NetSuite software and then synced back in.

API-based integrations offer flexibility. They allow businesses to layer powerful payment functionality on top of NetSuite ERP—but that power comes with added complexity.

How API-Based Payment Processing Works with NetSuite

With an API-based approach, payment data flows between systems.

A customer submits a payment through an external payment gateway. The payment processor handles authorization and settlement. Then, APIs push customer, invoice, and payment data into NetSuite software.

This often requires middleware, scripts, or custom mappings to ensure everything lines up correctly. When it works, the system can be very powerful. When it doesn’t, troubleshooting can involve multiple vendors and teams.

Benefits of API-Based Solutions

API-based solutions shine when flexibility matters.

They often support advanced use cases like subscriptions, recurring billing, and complex pricing models. Payment method options tend to be broader, and innovation happens quickly as third-party platforms evolve.

For businesses built around SaaS or recurring revenue, tools like Recurly NetSuite can be a strong fit.

Challenges and Trade-Offs of API Solutions

More flexibility means more responsibility.

API integrations require ongoing maintenance. Someone needs to own updates, handle failures, and monitor data syncs.

When issues arise, it’s not always clear where the problem lives—NetSuite ERP, the payment processor, the payment gateway, or the integration layer in between.

Native Integration vs. API Solutions: A Practical Comparison

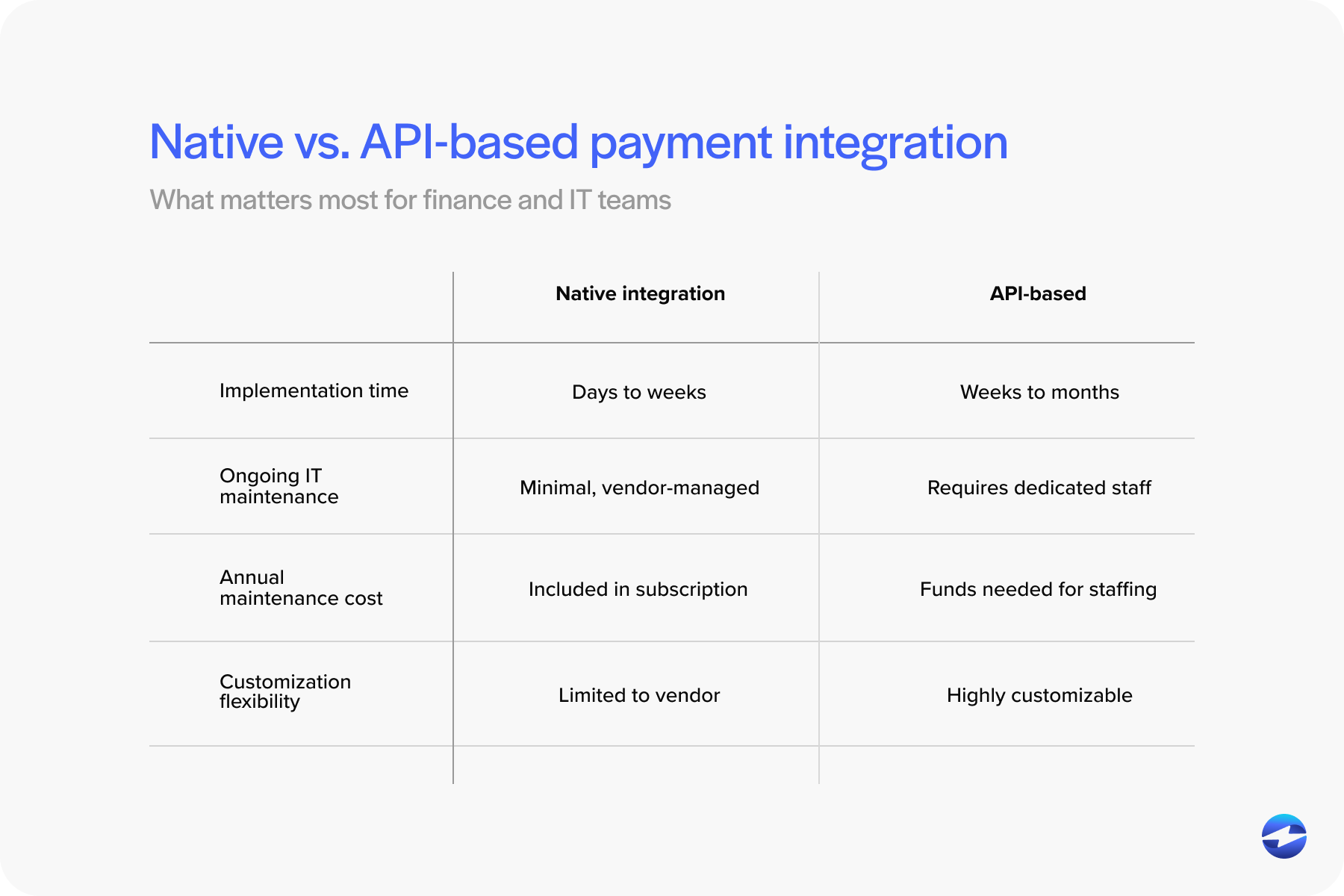

Native integrations are easier to set up and manage but offer less flexibility. API-based payment solutions provide customization and scale but introduce technical overhead.

The right choice depends on whether your team values simplicity or extensibility—and how much complexity you’re prepared to manage long term.

When Native NetSuite Payment Processing Makes Sense

Native NetSuite payment processing is often a good fit for businesses with straightforward billing, lower transaction volume, and limited internal IT support.

If most payments are one-time transactions and reporting needs are simple, native tools can get the job done without unnecessary friction.

When API-Based Payment Solutions Are the Better Fit

API-based approaches make sense when billing models are complex or payment volume is high.

If your business relies on subscriptions, usage-based pricing, or highly customized payment flows, tools like Stripe to NetSuite or PayStand NetSuite may offer the flexibility you need.

The key is recognizing the operational cost that comes with that flexibility.

Key Questions to Ask Before Choosing a Payment Approach

Before committing to any payment solution, it’s worth asking a few honest questions.

- How complex are your billing workflows today—and how might they change?

- Who will own the integration when something breaks?

- How critical is real-time accuracy for AR and reporting?

Clear answers upfront can prevent painful surprises later.

Best Practices for Evaluating NetSuite Payment Processing Options

Evaluating NetSuite payment processing options works best when it’s treated as a cross-functional decision rather than a purely technical one. Finance, AR, and IT all interact with payments differently, so involving those teams early helps surface real requirements before a solution is selected.

It’s also important to map the full payment lifecycle end to end – from invoice creation and customer payment through authorization, settlement, cash application, and reconciliation. This exercise often reveals hidden dependencies, manual steps, or failure points that aren’t obvious when looking at integrations in isolation.

Finally, look beyond upfront pricing or implementation speed. A payment solution should be evaluated on long-term maintenance, scalability, reporting accuracy, and operational risk. What feels simple today can become costly if it requires constant troubleshooting or limits how your business grows tomorrow.

Why EBizCharge Is a Great Fit for NetSuite Users

For many teams, the real need sits somewhere between native simplicity and API-heavy customization.

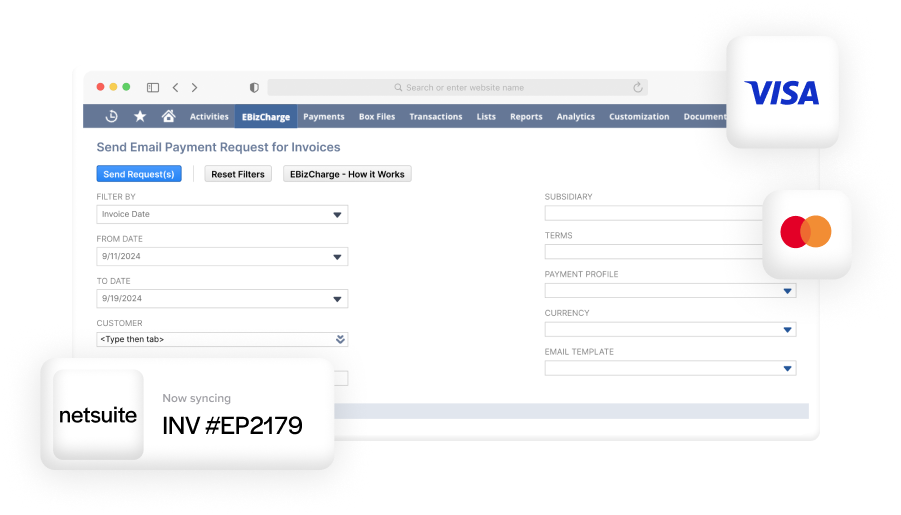

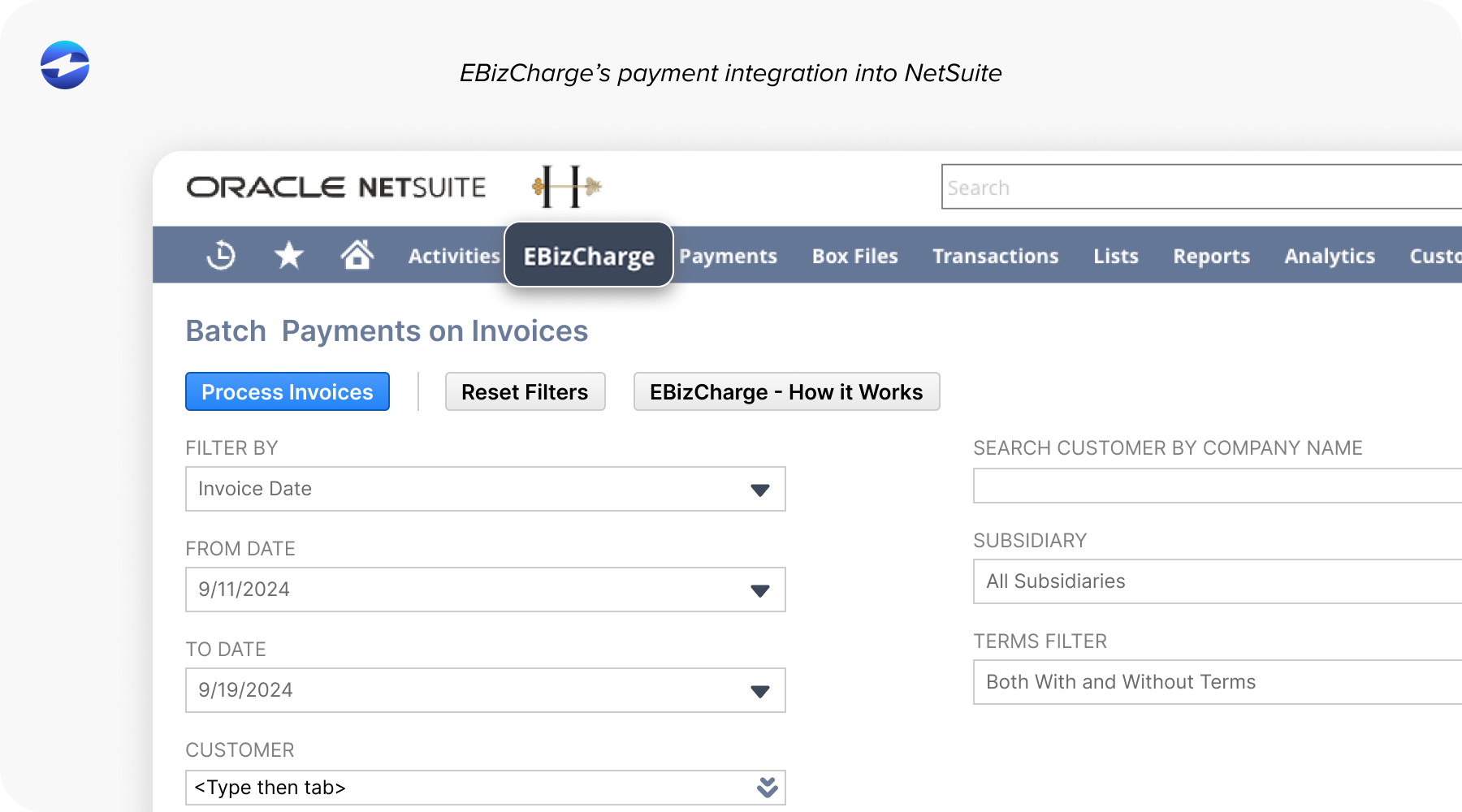

EBizCharge is built specifically for NetSuite ERP, offering a payment processing solution that works directly inside NetSuite software while still supporting modern payment needs.

Payments run through a secure payment gateway and trusted payment processor, then apply automatically to invoices in NetSuite. There’s no middleware to manage and no custom scripts to maintain.

Tools like automated cash application, customer payment portals, and real-time synchronization help reduce manual work and keep reporting accurate.

For NetSuite users who want flexibility without added complexity, EBizCharge delivers a practical middle ground—a payment solution designed to support growth without creating technical debt.