Blog > Salesforce CPQ Billing – Streamlining Quote-to-Cash with Native Payments

Salesforce CPQ Billing – Streamlining Quote-to-Cash with Native Payments

Every business knows the thrill of closing a deal, but the real challenge begins after the contract is signed. That’s when the quote turns into revenue, invoices are generated, and payments need to flow into the bank. Too often, this handoff between sales and finance is where things break down – manual re-entry, mismatched data, or delayed cash collection. That’s where Salesforce CPQ billing comes in. By combining the power of Configure, Price, Quote (CPQ) with native billing and payments, businesses can simplify their quote-to-cash process and reduce friction for both teams and customers.

This article examines how Salesforce CPQ billing works, why native payments matter, and how features like subscription billing, Salesforce invoicing, and advanced automation make it a game-changer.

Understanding Salesforce CPQ Billing

To understand CPQ Billing, start with CPQ itself. Salesforce CPQ automates how businesses configure products, apply pricing rules, and generate quotes. It’s built to reduce errors, speed up approvals, and give sales teams a consistent playbook. But quoting alone isn’t enough. That’s where CPQ Billing extends the workflow, ensuring the same information flows directly into orders, invoices, and payments.

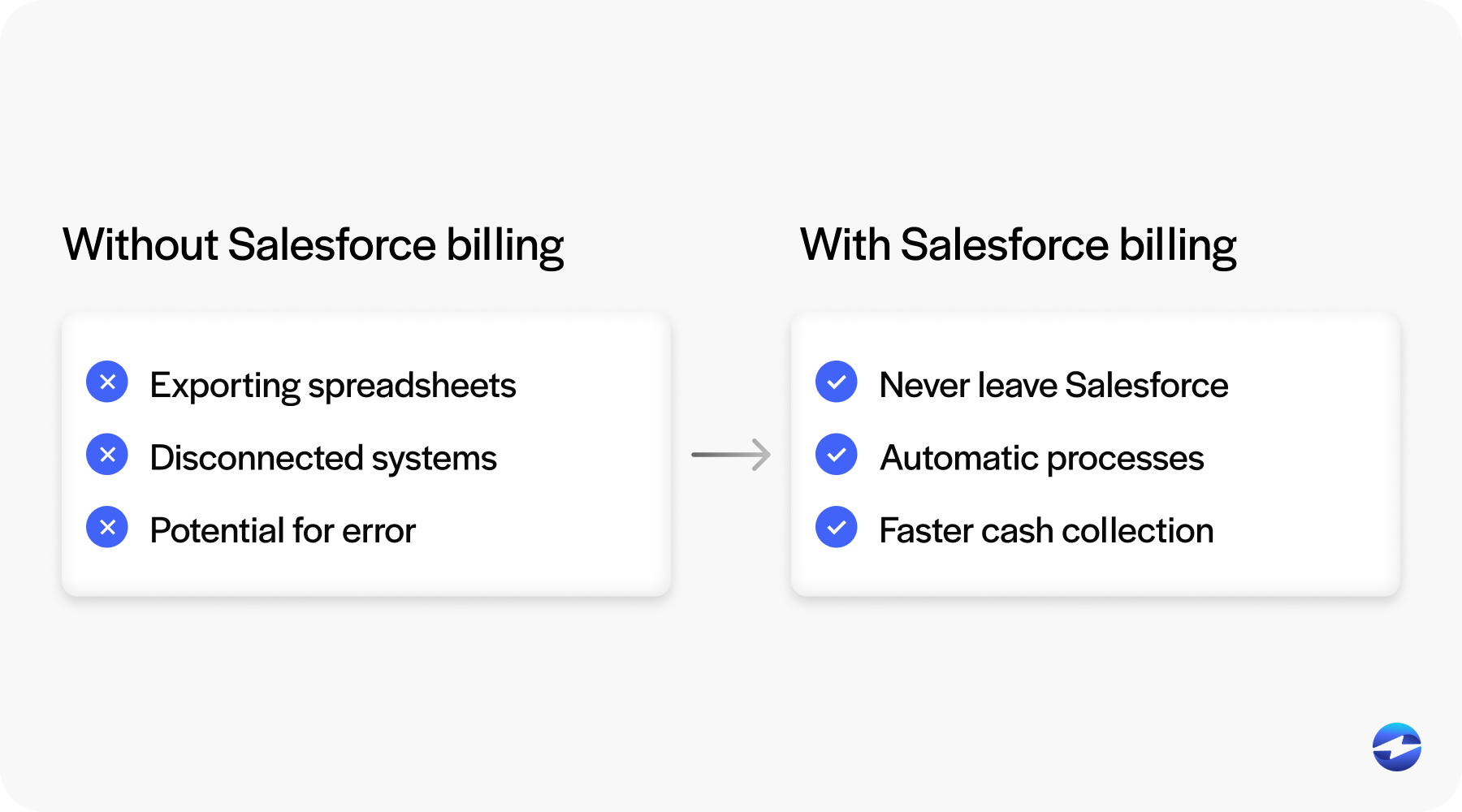

By keeping this all inside the Salesforce billing platform, you remove the silos that often plague revenue operations. No more exporting spreadsheets or re-entering line items into an external system. Instead, every quote detail – from discounts to custom terms – carries through to invoicing and payment collection. That continuity creates fewer disputes, cleaner audits, and faster cash collection.

CPQ Workflow Optimization

Workflow optimization is one of the biggest benefits of Salesforce CPQ billing. CPQ handles complex configuration and pricing, while billing turns those quotes into invoices without missing a beat. Because both live on the same platform, data doesn’t get lost between handoffs.

Imagine a subscription order created in CPQ. Instead of finance trying to recreate the terms manually, the billing engine automatically generates schedules, invoices, and payment records. Everything is in sync. For leadership, this translates into real-time visibility and revenue. For finance, it means fewer reconciliations. For sales, it creates confidence that the deal they closed will be billed correctly.

The Quote-to-Cash Connection

“Quote-to-cash” is more than a buzzword—it’s the lifeline of your revenue cycle. It covers every step from a signed quote to recognized revenue in the books.

With Salesforce CPQ billing, the process is seamless:

- Quote

- Order

- Invoice

- Cash

Each stage passes data cleanly to the next.

This continuity matters because every handoff is a risk. Break the chain, and you get billing errors, delayed invoices, and missed revenue. Keep it intact, and you get predictability, fewer disputes, and stronger cash flow. Businesses that invest in quote-to-cash efficiency often see shorter sales cycles, reduced days sales outstanding (DSO), and happier customers who don’t have to question their invoices.

Handling Complex Billing Scenarios

Not all billing is straightforward. Subscription models, usage-based charges, and hybrid contracts add layers of complexity. Salesforce billing is designed to handle these variations without endless customization.

For subscription billing, CPQ Billing can automate recurring charges, proration for mid-cycle changes, and renewals. For usage-based billing, it can process data like API calls, seats, or consumption units, rolling them up into invoices. Hybrid billing – combining one-time fees, recurring subscriptions, and usage charges – also fits neatly into the model. Even complex adjustments, credits, or refunds can be managed without disrupting the larger workflow.

These features allow companies to scale without patching together multiple billing systems. Instead of creating exceptions for every unique deal, CPQ Billing provides flexible structures that adapt as business models evolve.

Invoicing with CPQ Billing

Salesforce invoicing is a natural extension of CPQ Billing. Once a deal closes, invoices are generated directly inside Salesforce, pulling data from orders and contracts. Businesses can customize templates with logos, branding, and compliance fields like taxes or regional notes. Multi-currency support ensures that invoices make sense for both local and international customers.

Automation takes things further. Invoice runs can be scheduled – monthly, quarterly, or tied to milestones – so finance teams don’t have to babysit the process. Delivery is just as flexible: email, customer portals, or APIs. For customers, invoices are clear and professional. For businesses, consistency reduces disputes and accelerates payments.

Advanced Features for Growing Businesses

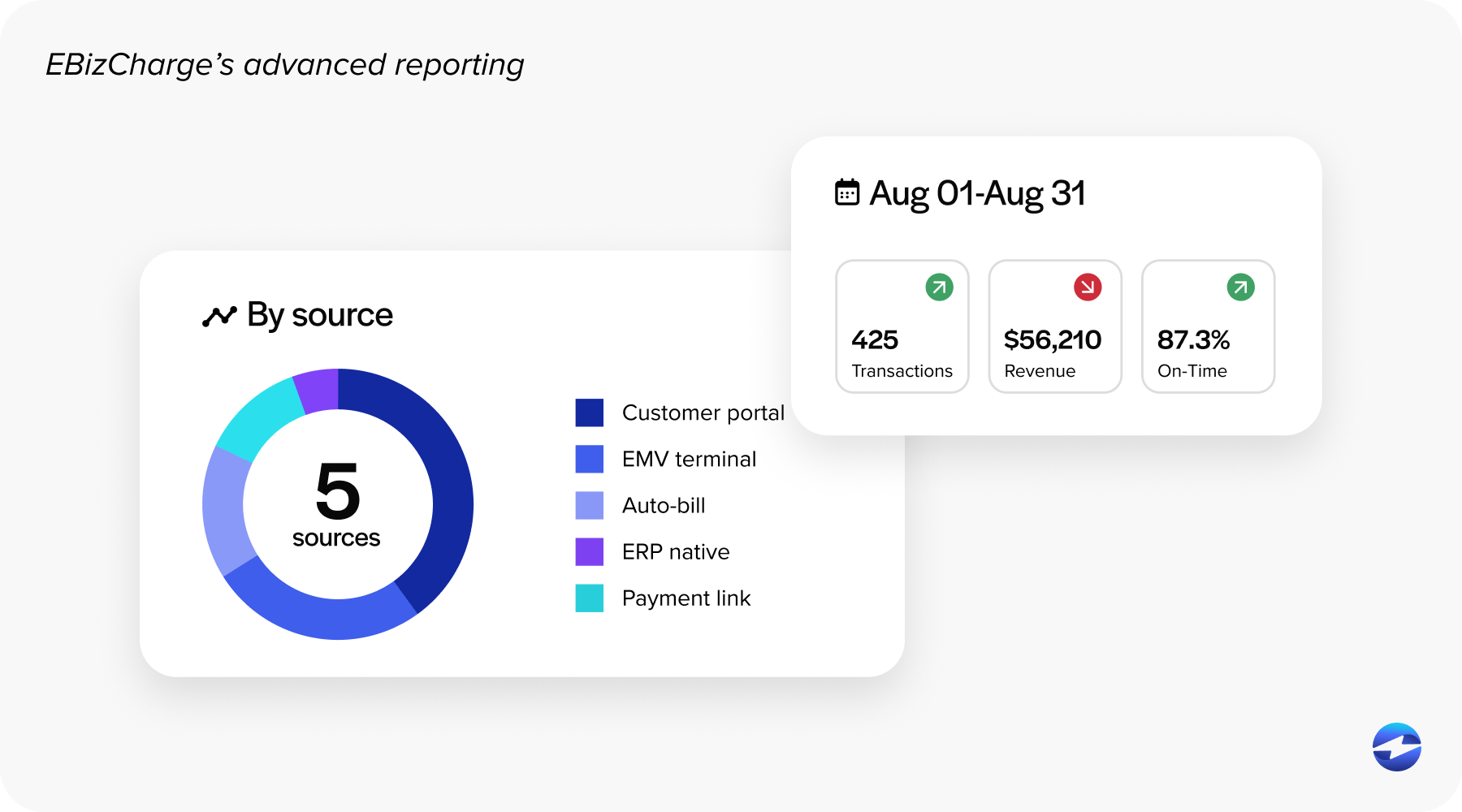

As companies expand, so do billing demands. The Salesforce billing platform includes advanced tools to keep operations on track. Dunning management helps businesses recover failed payments with retry sequences and reminders. Revenue recognition aligns invoices with compliance standards like ASC 606 or IFRS 15. Multi-currency and compliance features make international expansion manageable. Dashboards and analytics keep leadership informed with metrics like DSO, recovery rates, and chargeback outcomes.

Together, these features transform CPQ Billing from a back-office necessity into a strategic asset. Instead of just issuing invoices, it provides insight and control across the entire revenue cycle.

Subscription Billing and Renewals

Recurring revenue models thrive when renewals are handled seamlessly. With CPQ Billing, renewals and upsells can be automated. Quotes flow directly into contracts and schedules, reducing manual intervention. Upsell opportunities can be linked to existing accounts, and renewals automatically trigger new invoices without disrupting service.

This approach makes it easier for sales teams to grow accounts and for finance teams to trust that revenue is being captured accurately. It also improves the customer experience – buyers don’t have to worry about lapses in service or confusing billing cycles.

Native Payments Integration

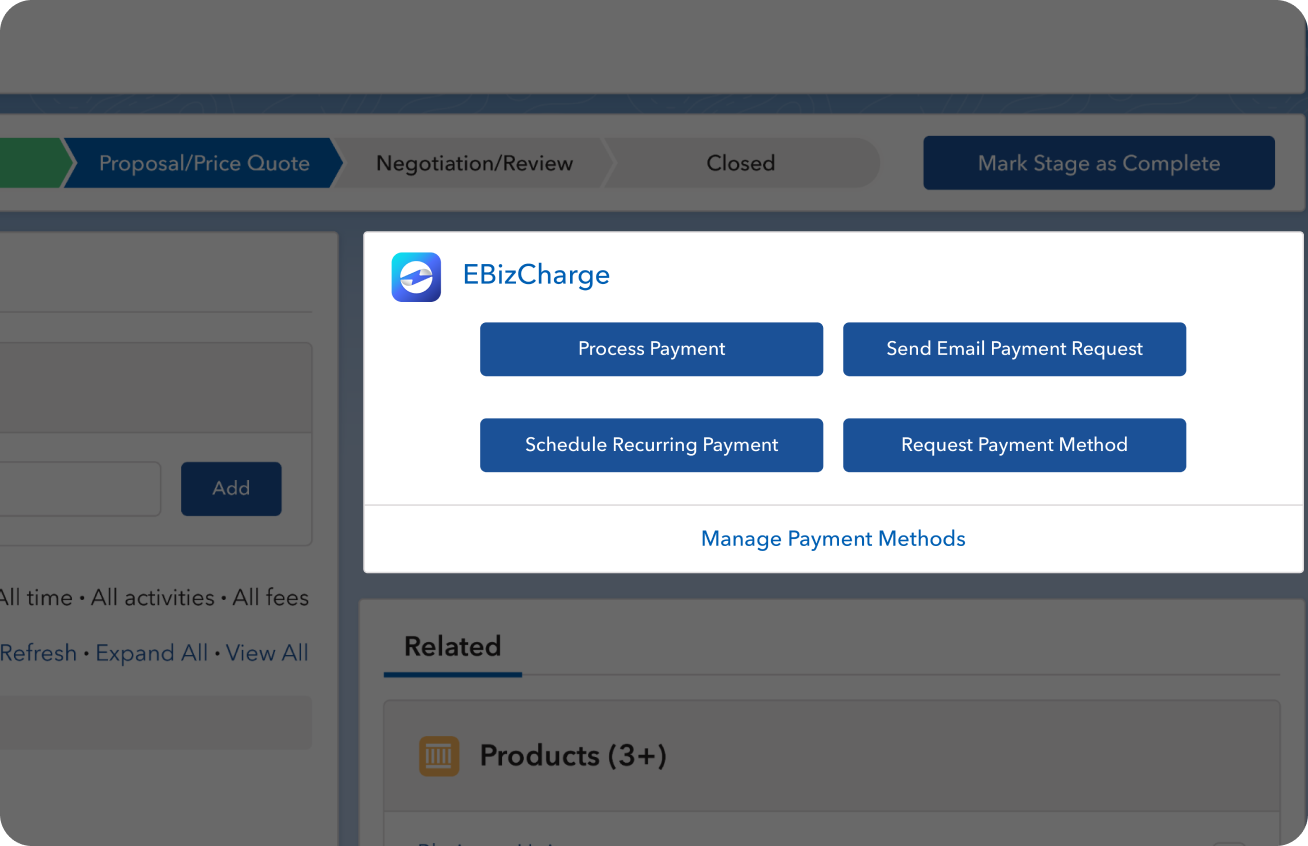

None of this works smoothly without payments. That’s where Salesforce payment gateways and Salesforce CPQ payment integration play a central role. A native payment processing solution ensures that once an invoice is created, the customer can pay using their preferred Salesforce payment option – credit card, ACH, or digital wallet – and the payment posts automatically.

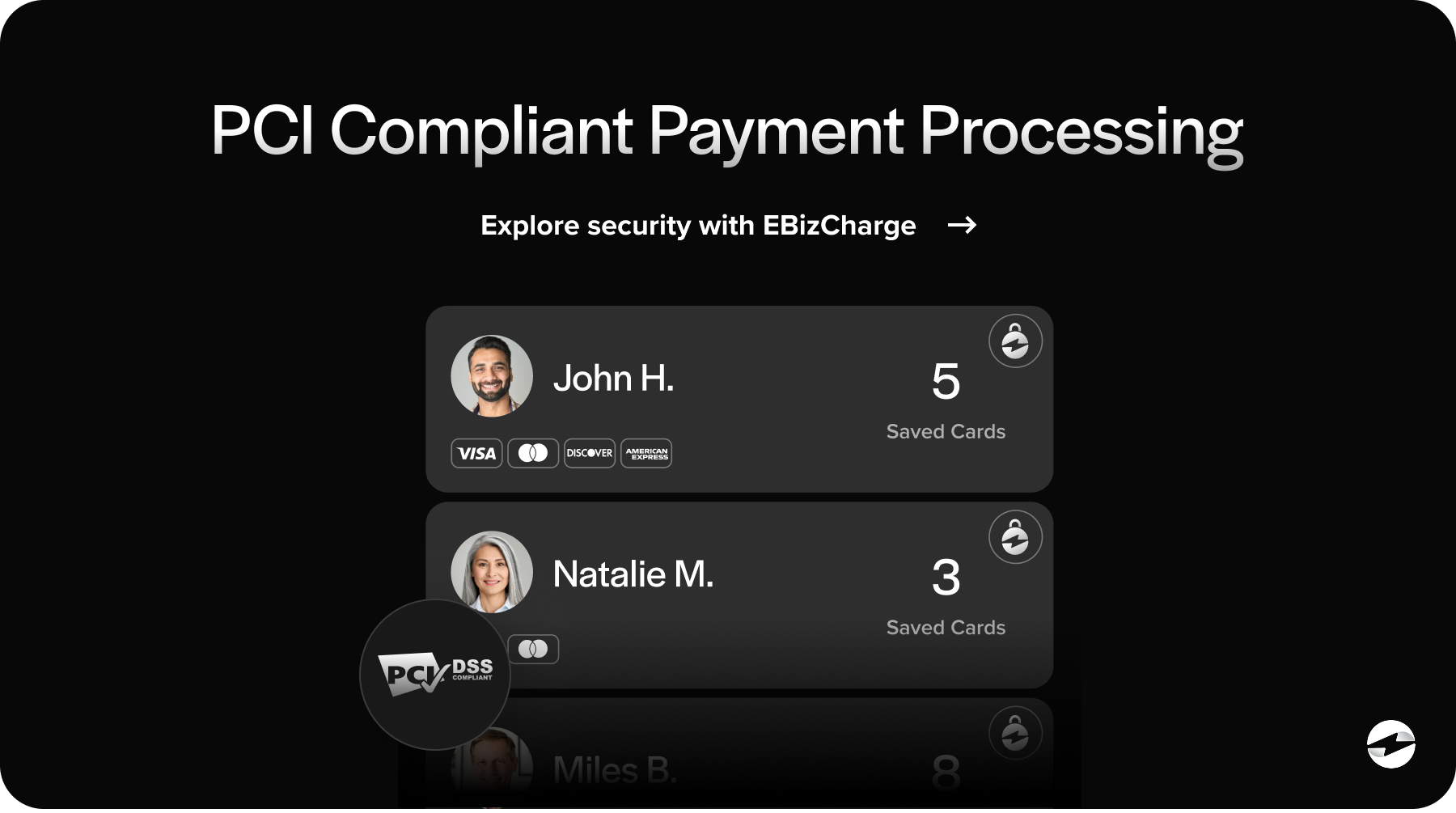

The advantage of native integration is simplicity. Payments are authorized, captured, and reconciled directly in Salesforce. No batch imports, no duplicate records, and fewer reconciliation headaches. A strong payment processor will also bring PCI-compliant features like tokenization and fraud monitoring to protect sensitive data.

By contrast, relying solely on a third-party payment processor often introduces extra steps. Payments may live in another system, requiring sync jobs to update Salesforce. While workable, it usually creates more manual oversight. For many businesses running revenue through Salesforce, native payments are the smarter path.

Best Practices for Implementation

Implementing CPQ Billing isn’t just about technology – it’s about process. Success depends on aligning sales and finance teams early. Clean product and pricing data is critical; if CPQ doesn’t reflect reality, billing won’t either. Testing is equally important. Don’t just test simple invoices – test edge cases like mid-cycle subscription changes or large usage events. Plan for exceptions too. Refunds, chargebacks, and disputes will happen, and your workflows should account for them.

Monitoring doesn’t end at go-live. Use Salesforce dashboards to track key metrics and refine processes over time. This proactive approach keeps operations smooth and ensures the system continues to deliver value as business needs evolve.

Why Consider EBizCharge for Salesforce CPQ Billing

When evaluating native solutions, EBizCharge stands out as a strong option for Salesforce CPQ payment integration. As a native Salesforce payment gateway, it posts payments directly to invoices and accounts in real time. Features like secure tokenization, Level 2/3 data support, and multi-currency handling make it ideal for B2B companies with complex needs. Customer portals extend convenience by letting clients pay invoices online, reducing manual collections.

EBizCharge isn’t just another payment processor – it’s a complete payment processing solution built to work natively within Salesforce. For organizations using CPQ Billing, that means fewer manual steps, stronger compliance, and a smoother revenue cycle.

Turning Quote-to-Cash into a Reliable Growth Engine

The path from quote to cash is filled with potential pitfalls, but with Salesforce CPQ billing, businesses can build a process that feels seamless end-to-end. From Salesforce invoicing and subscription billing to advanced compliance features and native Salesforce CPQ payment integration, the system keeps sales, finance, and customers aligned.

The right tools, especially a native Salesforce payment gateway like EBizCharge, turn billing from a pain point into a growth enabler. By keeping data in one place and automating where it counts, the Salesforce billing platform helps businesses reduce friction, improve cash flow, and build confidence across every team involved in the revenue cycle.

- Understanding Salesforce CPQ Billing

- CPQ Workflow Optimization

- The Quote-to-Cash Connection

- Handling Complex Billing Scenarios

- Invoicing with CPQ Billing

- Advanced Features for Growing Businesses

- Subscription Billing and Renewals

- Native Payments Integration

- Best Practices for Implementation

- Why Consider EBizCharge for Salesforce CPQ Billing

- Turning Quote-to-Cash into a Reliable Growth Engine