Blog > Salesforce Payment Security: Protecting Customer Data & Transactions

Salesforce Payment Security: Protecting Customer Data & Transactions

Handling payments in Salesforce isn’t just about moving money—it’s about protecting your customers and your business at the same time. Customers expect their payment information to be secure, while regulators demand strict adherence to compliance frameworks. That’s where Salesforce payment security comes into play. With the right setup, you can process transactions efficiently, stay compliant with standards like PCI DSS, and maintain trust across every interaction.

This guide breaks down the essentials of payment security in Salesforce. It’ll examine the Salesforce security model, explore how Salesforce payment encryption and Salesforce payment tokenization work, and discuss the role of access controls, monitoring, and PCI compliance. It’ll also touch on why the right Salesforce payment gateway and payment processor can make or break your setup, and how native solutions like EBizCharge simplify the picture.

Understanding the Salesforce Security Model

Salesforce operates on a shared responsibility model. In simple terms, Salesforce provides the secure infrastructure, but how you configure and integrate payments is up to your team. The Salesforce billing platform offers a strong backbone for invoicing, subscription billing, and account management. However, businesses must ensure that their Salesforce payment integration respects security rules.

Think of it like building on top of a solid foundation. Salesforce secures the walls and locks the doors, but you still have to decide how to handle keys, who has access, and what happens when someone tries to get in without permission. This is why many companies rely on a trusted payment processing solution to handle sensitive data rather than building custom systems that may introduce risk.

Salesforce Payment Encryption and Tokenization

At the core of Salesforce payment security are encryption and tokenization. Salesforce payment encryption ensures sensitive details, like card numbers or bank accounts, are scrambled during transmission. That way, even if someone intercepts the data, it’s unreadable.

Salesforce payment tokenization, on the other hand, takes sensitive data and replaces it with a secure placeholder—or token. Instead of storing a credit card number in Salesforce, the system stores a token that can’t be reversed into the original number. The token links back to the real data, which is stored securely by the payment processor. For businesses, tokenization is a huge win: it reduces the scope of Salesforce PCI compliance and keeps sensitive cardholder data out of your CRM.

Together, encryption and tokenization form the backbone of safe transactions. They allow companies to process renewals, recurring charges, or refunds without ever exposing raw data. The result is faster processing and lower risk.

Access Controls and Permissions

Technology alone won’t keep data secure. People and processes matter just as much. Inside Salesforce, access to sensitive payment data should be tightly controlled. Profiles, roles, and permission sets let you decide who can view, edit, or process payment information.

For example, customer service reps may need to see whether an invoice has been paid, but shouldn’t see raw card details. Finance managers may need broader access but still benefit from role-based restrictions. Multi-factor authentication (MFA) adds another layer by requiring users to confirm their identity before handling sensitive records.

If you’ve ever had to clean up after a data leak, you know how important this is. Access controls reduce the risk of human error and protect the system against internal misuse. A well-designed Salesforce payment integration always starts with the principle of least privilege—give people the access they need, and no more.

Audit Trails and Monitoring

Security isn’t just about prevention. It’s also about knowing what happened when something goes wrong. Salesforce provides tools for logging and monitoring activity, making it easier to maintain accountability.

Audit trails record who accessed payment data, when, and what actions were taken. Event monitoring can highlight unusual activity, like repeated failed login attempts or changes to sensitive fields. For IT managers and finance teams, these logs are invaluable. They simplify compliance reporting, assist with dispute resolution, and act as an early warning system for fraud.

The most effective setups use automation to flag anomalies in real time. If a payment fails multiple times or a suspicious refund is requested, alerts can be sent to the right people instantly. This reduces manual oversight and ensures issues are addressed before they escalate.

Salesforce PCI Compliance and Responsibilities

Compliance with Payment Card Industry Data Security Standards (PCI DSS) is non-negotiable for anyone handling cardholder data. But here’s the question many teams ask: Is Salesforce PCI-compliant on its own? The answer is no, not entirely. Salesforce provides a secure infrastructure, but compliance depends on how businesses use it.

Salesforce PCI compliance works through a shared responsibility model. Salesforce secures its platform, but your organization is responsible for configurations, integrations, and data handling. That means avoiding practices like storing raw card data in custom fields or relying on insecure connectors.

This is where a PCI-compliant Salesforce payment gateway or payment processor becomes critical. Native, compliant solutions reduce your burden by handling sensitive information securely and keeping it out of Salesforce records. In practice, this makes compliance audits easier and lowers overall risk.

Best Practices for Secure Salesforce Payment Integration

Implementing secure payments in Salesforce requires a mix of technology and discipline. A few best practices stand out:

- Avoid storing raw card data anywhere in Salesforce.

- Use Salesforce payment encryption and Salesforce payment tokenization to protect sensitive details.

- Rely on PCI-compliant payment processing solutions that integrate natively.

- Configure strong authentication and role-based access.

- Test integrations with edge cases, like failed payments or chargebacks, not just the happy path.

- Keep systems updated with the latest security patches.

For IT and finance teams, these steps may feel like extra effort up front, but they pay dividends. A secure system means fewer disputes, smoother audits, and less firefighting when problems arise.

Why EBizCharge is a Good Fit

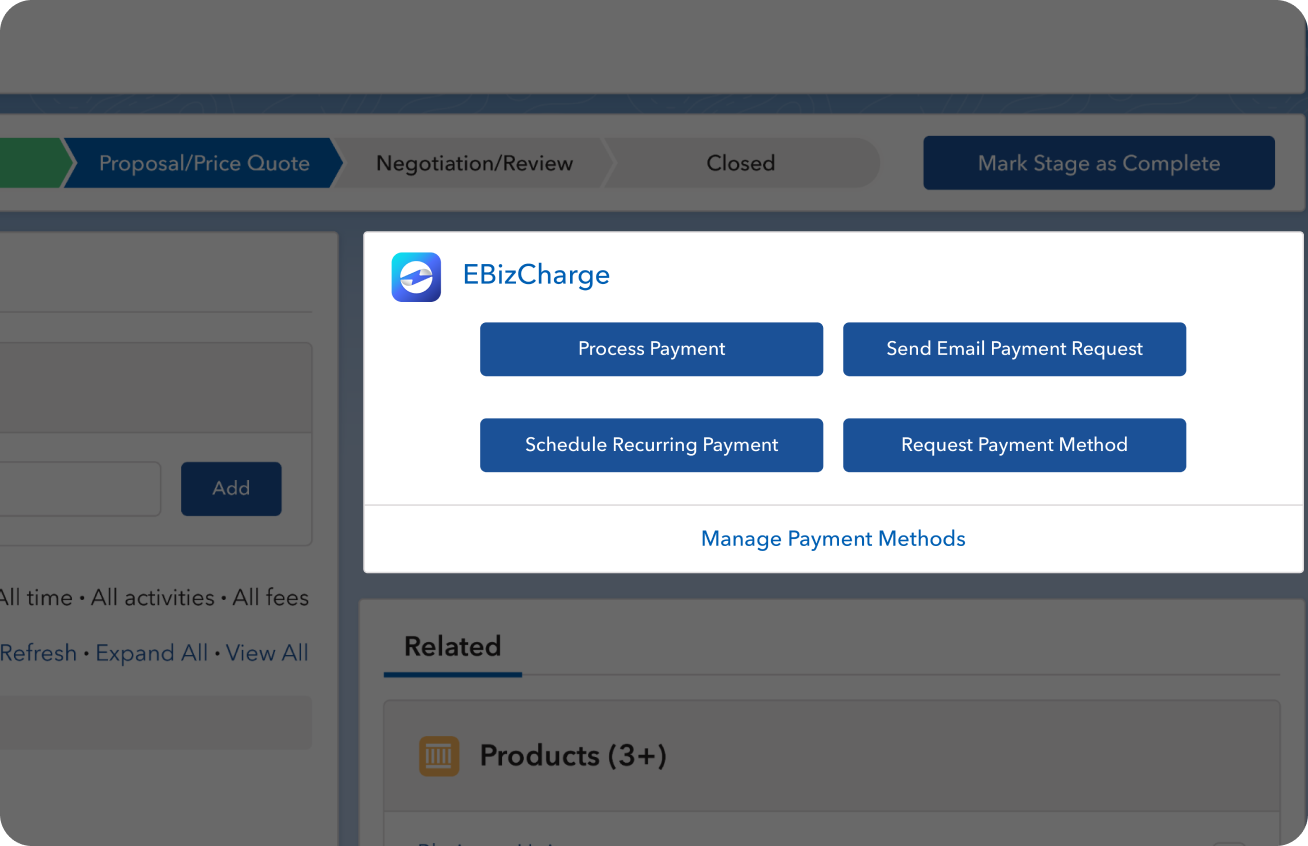

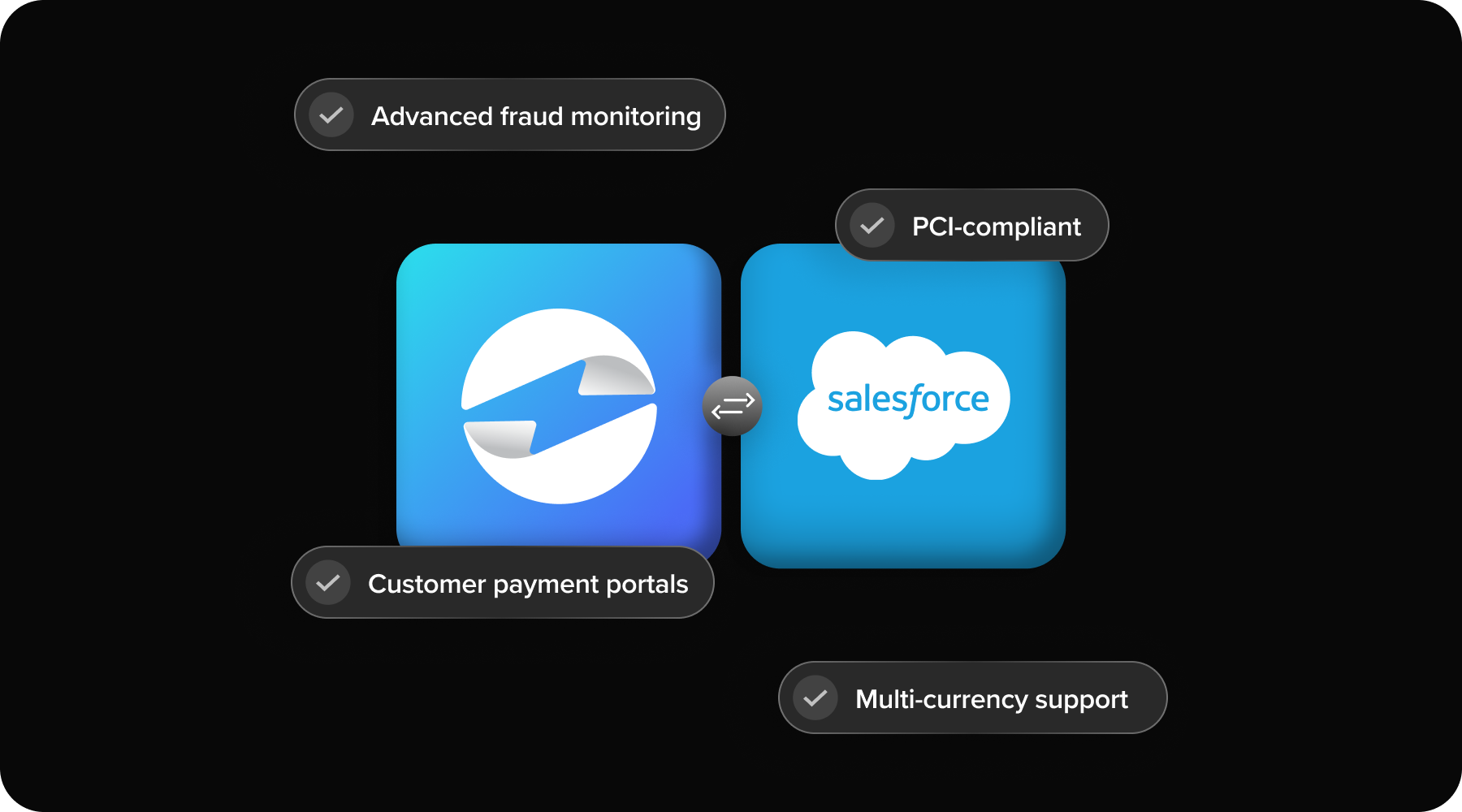

Among available options, EBizCharge is a strong fit for businesses running on Salesforce. It’s fully PCI-compliant, which means it tokenizes and secures sensitive cardholder data automatically. This reduces compliance scope and makes Salesforce PCI compliance much easier to manage.

What sets EBizCharge apart is its native Salesforce integration. Payments are posted directly to invoices and accounts in real time, which cuts down on manual reconciliation and keeps records accurate across the Salesforce billing platform. Multi-currency support makes it ideal for international operations, while fraud monitoring tools add another layer of protection. Customer portals give buyers a secure way to pay online, offering flexibility without sacrificing security.

Taken together, EBizCharge isn’t just another payment processor. It’s a payment processing solution built to simplify Salesforce operations while keeping payment data safe. For IT managers, finance leaders, and eCommerce teams, that combination of compliance and native integration can be a game-changer.

Building Confidence Through Security

At the end of the day, Salesforce payment security is about more than technical details. It’s about trust—trust from customers who hand over their card details, and trust within your business that payments will be processed correctly and securely.

By combining Salesforce payment encryption, Salesforce payment tokenization, role-based access, and thorough monitoring, you create a system that’s both secure and efficient. Pair that with the right Salesforce payment gateway and payment processor, and you have a setup that not only meets compliance requirements but also supports your long-term growth.

For IT managers and finance professionals, the message is clear: invest in security up front, and you’ll spend less time fixing problems later. With tools like EBizCharge and a thoughtful approach to Salesforce payment integration, Salesforce can be the hub of a secure, compliant, and reliable revenue cycle.

- Understanding the Salesforce Security Model

- Salesforce Payment Encryption and Tokenization

- Access Controls and Permissions

- Audit Trails and Monitoring

- Salesforce PCI Compliance and Responsibilities

- Best Practices for Secure Salesforce Payment Integration

- Why EBizCharge is a Good Fit

- Building Confidence Through Security