Blog > SuiteCommerce Payment Integrations: Complete Guide to Third-Party Payment Solutions

SuiteCommerce Payment Integrations: Complete Guide to Third-Party Payment Solutions

For many businesses running on SuiteCommerce, payments are more than just the final step in a transaction—they’re the glue holding together the customer experience and the back office. If your payment workflows aren’t seamless, customers notice, finance teams get bogged down, and reporting becomes a nightmare. That’s why many merchants explore SuiteCommerce integrations with third-party tools to streamline the process.

This guide will break down why payment integrations matter, what technical components like API connections and webhooks really do, and how the right payment processing solution can keep everything in sync. The goal is simple: help you, as a SuiteCommerce or NetSuite user, understand the landscape of payment integrations so you can make smarter choices for your business.

Why Payment Integrations Matter in SuiteCommerce

On its own, NetSuite SuiteCommerce offers native tools for processing transactions. These tools work for straightforward needs but can fall short when complexity grows. Maybe you’re selling globally, handling recurring payments, or managing both online and offline channels. In these cases, SuiteCommerce’s out-of-the-box setup isn’t enough.

This is where SuiteCommerce integrations come into play. By adding connections to external payment platforms, merchants can extend functionality, improve the checkout experience, and cut down on manual processes in the back office. Strong payment integrations lead to faster settlements, fewer errors, and more reliable visibility into cash flow. In practice, this means happier customers and finance teams that spend less time reconciling spreadsheets.

Core Components of Third-Party Payment Integrations

When evaluating any third-party payment processor, it helps to understand the three core components that make integrations work:

- API connections: Application Programming Interfaces (APIs) are the pipelines that allow SuiteCommerce, NetSuite software, and your payment processor to talk to one another. APIs let data like invoices, authorizations, and settlements flow smoothly between systems.

- Webhook management: Webhooks provide real-time alerts when something happens, like a payment being captured or a refund being issued. Instead of pulling data manually, webhooks push updates instantly.

- Data synchronization: Ensures that payment and customer records remain consistent across SuiteCommerce, NetSuite ERP, and your processor. Without reliable synchronization, reconciliation turns into guesswork.

Together, these three components create the foundation for reliable, automated payment processing.

Key Features of SuiteCommerce Payment Integrations

The best integrations don’t just connect systems—they add capabilities that make a real difference in day-to-day operations. Look for features like:

- Support for multiple payment methods: cards, ACH, PayPal, wallets, BNPL, and more.

- PCI compliance, including tokenization and fraud detection tools for security.

- Saved profiles and one-click checkout for repeat buyers.

- Real-time reconciliation in NetSuite software through accurate data synchronization.

- Automation for refunds, partial payments, and invoice matching.

These features transform a simple integration into a full payment processing solution that supports business growth.

Native Option: SuitePayments

SuitePayments is the native payment tool built into SuiteCommerce NetSuite. It’s simple, aligned with the system, and covers basic needs. For smaller businesses, that might be enough.

But SuitePayments has its limits. It doesn’t always offer advanced API flexibility, comprehensive webhook coverage, or deep reporting features. For merchants expanding internationally or handling complex workflows, SuitePayments can feel restrictive. That’s why many turn to third-party payment processor integrations to fill those gaps.

Advantages of Third-Party Payment Solutions

Partnering with a third-party payment processor can open up a range of benefits that go beyond what’s built in. These integrations bring flexibility and efficiency to the table in ways merchants quickly notice in their daily operations.

- Expanded payment options: Accept global and regional payment methods, making it easier to serve a wider customer base.

- Stronger NetSuite integration: Sync automatically with accounts receivable, the general ledger, and billing so the back office always has accurate data.

- Customizable API connections: Tailor integrations to match unique business processes rather than forcing workarounds.

- Webhook automation: Get instant updates for payments, refunds, and chargebacks without waiting for manual checks.

- Clearer reporting: Synchronized data improves visibility for both operations and finance, helping teams make better decisions.

In short, adding a third-party integration helps transform SuiteCommerce from a capable storefront into a connected commerce system that grows with your business.

Choosing the Right Payment Integration

With so many providers out there, narrowing down the right fit can feel overwhelming. The first step is to think about what payment types your business actually needs to support—whether that’s credit cards, ACH, wallets, or Buy Now, Pay Later options. From there, look at how flexible the API connections are and what kinds of endpoints they expose, since that flexibility will affect how well the integration fits into your existing workflows.

You’ll also want to pay attention to webhook reliability and how many events are covered, because those real-time notifications reduce manual checks. Just as important is the accuracy and speed of data synchronization, which determines how confident your finance teams can be when they look at reports. Security and compliance should be non-negotiable, and of course, costs matter too, from processing rates to the ability to scale affordably.

Ultimately, align these factors with your business model. A growing B2C merchant might put wallets and BNPL at the top of the list, while a B2B company may be more focused on ACH and invoice portals. The best payment processing solution is the one that meets today’s needs while leaving room for tomorrow’s growth.

Best Practices for Implementing Third-Party Integrations

Implementation is often where even well-planned projects stumble. Integrations touch multiple teams, and without preparation, details slip through the cracks. A thoughtful rollout helps avoid those headaches and ensures the new system really supports your business.

To avoid pitfalls:

- Map your current workflows before integrating.

- Test API connections and webhook triggers in a sandbox.

- Validate data synchronization rules so records don’t drift.

- Train your team to monitor logs and handle alerts.

- Keep an eye on webhook failures or API timeouts with proactive alerts.

These practices help ensure your integration isn’t just functional—it’s dependable. More importantly, it sets the foundation for smoother day-to-day work, fewer reconciliation errors, and a payment flow that grows confidently with your business.

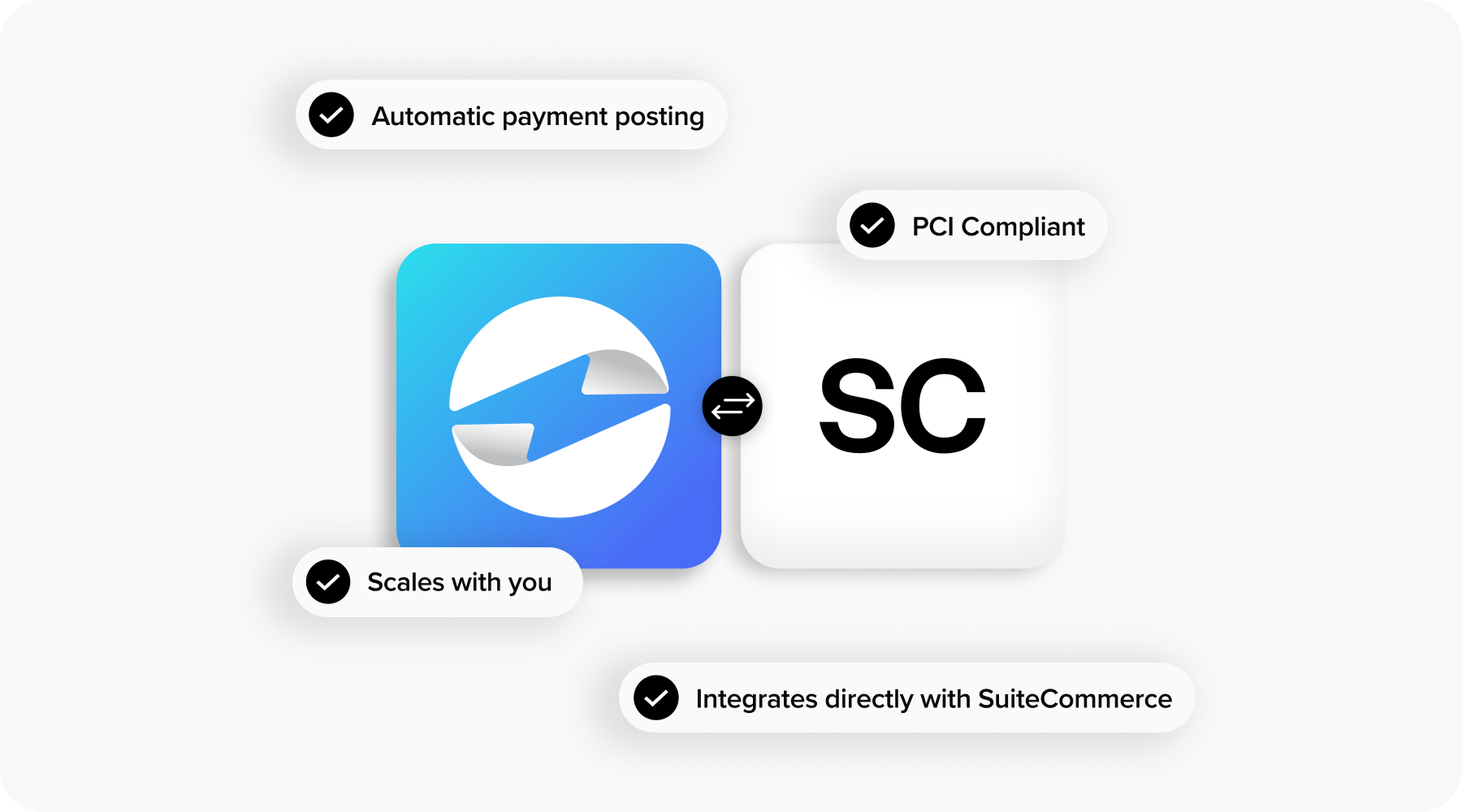

Case for EBizCharge as a SuiteCommerce Payment Integration

One strong example of a third-party integration is EBizCharge. It provides deep SuiteCommerce integration with accounts receivable and the general ledger, ensuring financial data stays accurate without extra manual work. Its API connections give businesses room to customize integrations so payment workflows can match specific needs, while webhook management delivers real-time alerts whenever transactions refunds, or chargebacks occur. Additionally, strong data synchronization keeps reconciliation clean and reliable. EBizCharge also offers customer portals, advanced security, and scalability, making it a practical choice for merchants focused on growth. By plugging into SuiteCommerce NetSuite, EBizCharge helps reduce manual work, speed reconciliation, and expand customer payment options—all without sacrificing security.

Building Confidence and Growth Through SuiteCommerce Intergrations

Payments aren’t just about moving money from point A to point B. For SuiteCommerce merchants, payments are about ensuring data flows accurately, customers feel confident, and finance teams have reliable numbers. That’s why API connections, webhook management, and data synchronization matter.

With the right SuiteCommerce integrations and a capable third-party payment processor, merchants can turn payments into a competitive advantage. Combined with the power of NetSuite software, SuiteCommerce becomes not just a storefront, but a smarter, more efficient commerce engine.

Summary

- Why Payment Integrations Matter in SuiteCommerce

- Core Components of Third-Party Payment Integrations

- Key Features of SuiteCommerce Payment Integrations

- Native Option: SuitePayments

- Advantages of Third-Party Payment Solutions

- Choosing the Right Payment Integration

- Best Practices for Implementing Third-Party Integrations

- Case for EBizCharge as a SuiteCommerce Payment Integration

- Building Confidence and Growth Through SuiteCommerce Intergrations