Blog > SuiteCommerce B2C Payment Optimization: Converting More Customers with Embedded Payments

SuiteCommerce B2C Payment Optimization: Converting More Customers with Embedded Payments

In the world of online shopping, first impressions matter, but the last step—checkout—often makes or breaks a sale. For B2C businesses, payments aren’t just a technical detail. They’re the bridge between browsing and buying. If the process feels clunky, slow, or insecure, customers walk away. If it’s smooth and seamless, they’re far more likely to complete their purchase and come back again.

That’s where SuiteCommerce comes in. By combining a unified storefront with the power of NetSuite software, SuiteCommerce gives merchants the tools to control their catalog, pricing, and overall payment experience. And when paired with embedded payments and the right extensions, businesses can unlock the full range of SuiteCommerce B2C eCommerce advantages, turning payments into a driver of conversions instead of a stumbling block.

Unique Challenges of B2C Payments

Consumer payments are deceptively complex. Cart abandonment remains one of the biggest obstacles in B2C eCommerce. Studies consistently show that customers abandon carts when checkout requires too many steps, lacks their preferred payment method, or doesn’t feel secure.

Modern buyers expect variety. Some want to pay with credit or debit cards, others prefer wallets like Apple Pay or Google Pay, and a growing segment expects Buy Now, Pay Later (BNPL) options. Many B2C shoppers are also on mobile devices, where every extra click feels magnified. If your payment system isn’t optimized for small screens, you risk losing buyers who would otherwise complete the purchase.

Security is another sticking point. Customers need trust signals, like PCI compliance and fraud protection, but they also want a frictionless experience. The challenge for businesses is striking the right balance—delivering both confidence and convenience.

Why SuiteCommerce for B2C Transactions

NetSuite SuiteCommerce addresses many of these challenges by integrating your storefront with the broader ERP environment. Instead of juggling disconnected tools, merchants get a single system that ties inventory, pricing, customer data, and orders together. This NetSuite integration ensures consistency across the business and creates a better experience for both staff and customers.

For B2C transactions, the biggest advantage of SuiteCommerce NetSuite is the ability to embed payments directly into the site. Embedded payments keep customers on your page rather than redirecting them elsewhere. The result is faster checkouts, reduced cart abandonment, and a shopping experience that feels modern and trustworthy. These are among the most important SuiteCommerce B2C eCommerce advantages for retailers looking to grow.

Key Capabilities for Optimized B2C Payments

Optimizing B2C payments in SuiteCommerce means more than just accepting credit cards. Essential features include:

- Payment variety: Support for cards, digital wallets, BNPL, PayPal, and even gift cards.

- Saved payment methods: Tokenization and vaulted profiles for one-click checkout.

- Mobile-first design: Checkout flows that adapt perfectly to smartphones and tablets.

- Security: PCI compliance, including tokenization and fraud monitoring built in.

- Real-time sync: Payments flow directly into NetSuite software for accurate, immediate reconciliation.

Together, these capabilities make payments a strategic part of the customer journey rather than a backend detail.

Embedded Payments and Conversion Impact

Embedded payments differ from traditional redirects by keeping customers on your site from start to finish. This small change makes a big impact. Without redirects, checkout feels smoother, faster, and more trustworthy. Customers are less likely to hesitate and more likely to hit “confirm.”

For B2C merchants, this means lower cart abandonment and higher conversion rates. Embedded payments also encourage impulse buys since customers face fewer barriers when making a purchase decision. In a highly competitive online environment, even a small increase in conversion can mean a significant boost in revenue.

Extensions and Integrations

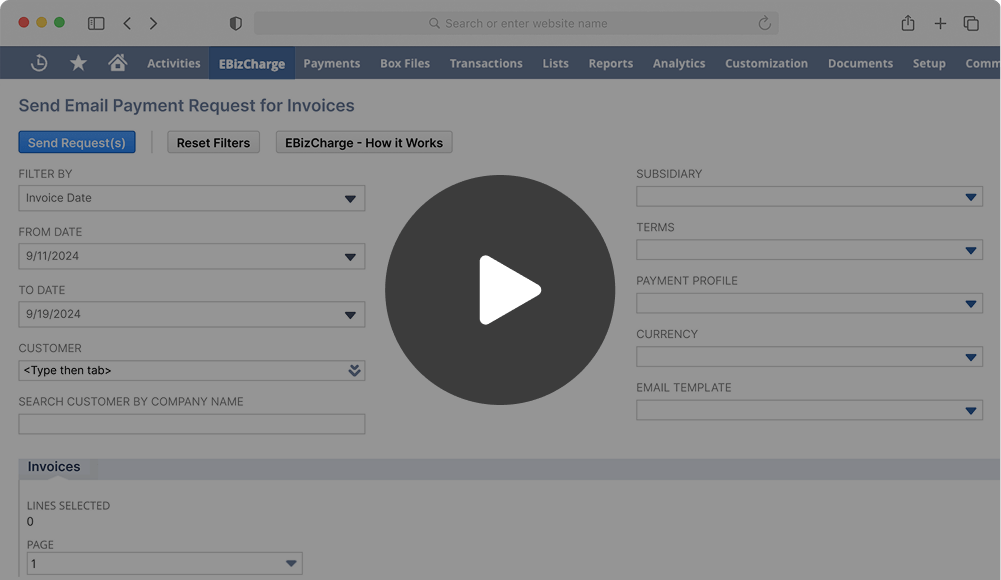

SuitePayments, the built-in option, provides a baseline for handling transactions. It works for basic needs but often lacks the advanced tools B2C merchants require. That’s where extensions and a third-party payment processor can make all the difference.

With the right payment processor, merchants can unlock advanced fraud tools, broader payment method coverage, and customer-friendly features like recurring billing or digital wallets. Just as importantly, these tools stay aligned with NetSuite integration, ensuring that all payments are posted automatically into the ERP system without manual entry. For growing businesses, that alignment is crucial—it saves time, reduces errors, and keeps finance teams confident in their numbers.

Benefits of Streamlined B2C Payments

When payments are optimized, the benefits ripple across the organization:

- Higher conversions: Faster, simpler checkouts mean fewer abandoned carts.

- Satisfied customers: Offering preferred payment options and smooth mobile experiences builds loyalty.

- Reduced risk: Stronger fraud detection and PCI compliance protect both sides of the transaction.

- Actionable insights: Automatic reconciliation in NetSuite provides better reporting for marketing, sales, and finance.

These improvements show why payments should be seen as a strategic lever, not just an operational step.

Best Practices for Implementing B2C Payment Optimization

Optimizing payments is as much about preparation as it is about technology. Start by mapping your checkout flow and removing unnecessary steps. Test across multiple devices and browsers to ensure a consistent experience.

Offer multiple payment options, but be strategic. Tailor them to your audience—what works for one demographic may not matter for another. Pilot embedded payments with a smaller segment of your customer base before a full rollout. Finally, monitor performance through analytics and refine continuously. Payments aren’t a “set it and forget it” feature—they need ongoing attention.

Turning SuiteCommerce Payments into a Conversion Advantage

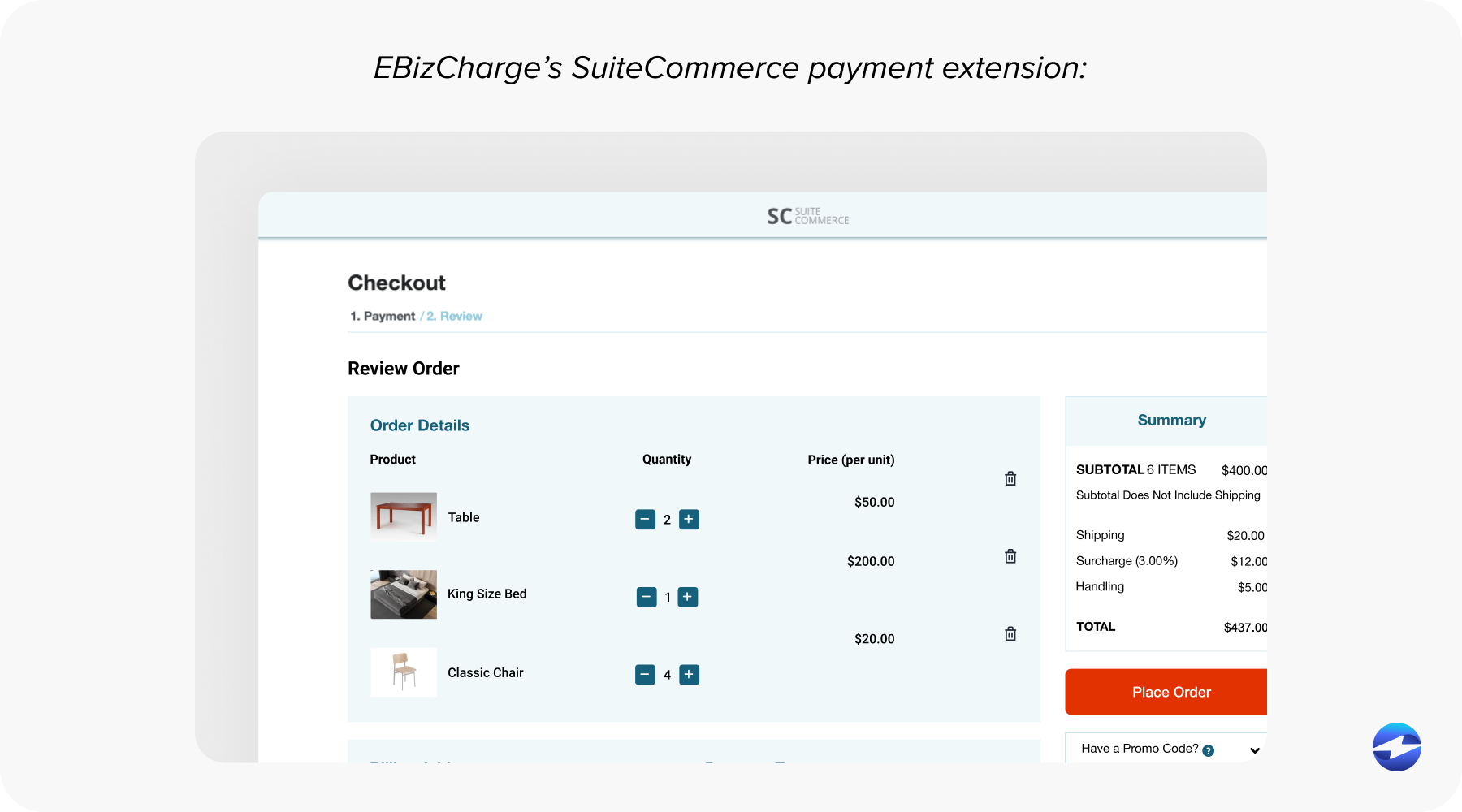

EBizCharge is one of the standout options for businesses looking to optimize payments within SuiteCommerce. Its direct NetSuite integration means payments are posted automatically to the right records, reducing manual work for finance teams. Real-time reconciliation provides accurate data, while saved payment methods and mobile-optimized flows deliver a better customer experience.

On top of that, EBizCharge includes PCI compliance, tokenization, and fraud monitoring, ensuring security without adding friction. Customer portals make it easy for shoppers to pay invoices or manage their payment details, while the platform’s scalability supports growth without slowing operations.

When you combine NetSuite SuiteCommerce with a reliable payment processing solution like EBizCharge, you get more than just a functional checkout—you create a payment experience designed to convert. For merchants focused on capturing every possible sale, that combination turns payments into a true driver of business success.