Blog > Best Payment Extensions for SuiteCommerce: A Complete Guide to Payment Processing Solutions

Best Payment Extensions for SuiteCommerce: A Complete Guide to Payment Processing Solutions

For SuiteCommerce merchants, managing payments is one of the most critical parts of running an online store. At the same time, it’s often one of the most frustrating. A great checkout experience can boost customer trust and speed up cash flow. A poor one, on the other hand, slows down sales, creates headaches for finance teams, and leaves customers second-guessing whether to come back.

This guide is for SuiteCommerce and NetSuite SuiteCommerce users who want a clear view of their payment processing options. Whether you’re an operations leader, a finance manager, or directly involved with site administration, the goal here is simple: give you real-world guidance on choosing the right extension for your store. With the right tools, you can streamline your payment processes, protect customer data, and make revenue management much smoother.

Why Payment Extensions Matter in SuiteCommerce

Out of the box, SuiteCommerce includes built-in functionality for handling transactions, but many businesses quickly run into its limits. Payment methods may be too narrow, reconciliation might require too much manual work, or reporting doesn’t go deep enough. For businesses trying to grow, those gaps can slow everything down.

That’s where SuiteCommerce extensions come in. By plugging into the platform, these add-ons expand what NetSuite software can do. A good payment processing solution saves your B2B or B2C team time and shortens the path between a completed sale and cash in your account.

Native Option: SuitePayments

NetSuite offers SuitePayments as the native way to process transactions. It covers basic needs and has the advantage of being built directly into the SuiteCommerce NetSuite environment. For smaller merchants, SuitePayments can be enough to get started.

Its main strengths are simplicity and familiar administration. However, many businesses find its limitations push them toward third-party payment processor options. If you need advanced fraud protection, international methods, or deeper reporting, you’ll likely find SuitePayments too narrow.

Benefits of Using Third-Party Payment Extensions

Adding a third-party payment processor to SuiteCommerce brings advantages that go beyond the basics offered by SuitePayments. Businesses often turn to these extensions because they need more flexibility, broader payment method support, or tighter alignment with finance operations in NetSuite.

Key benefits include:

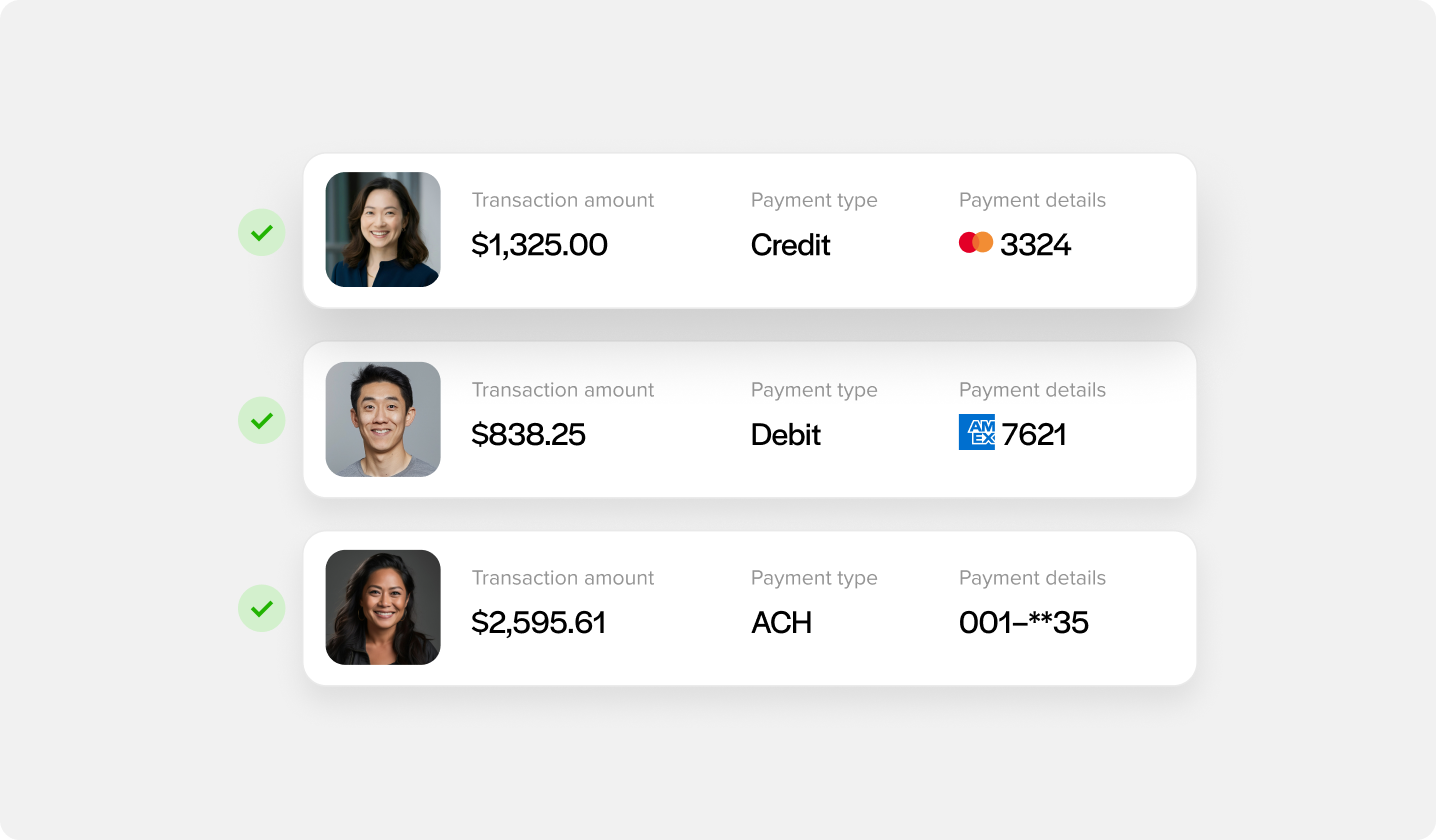

- Expanded payment options: Accept credit cards, ACH, digital wallets, BNPL, and more, giving customers more ways to pay.

- Deeper NetSuite integration: Many extensions connect directly with SuiteCommerce NetSuite records, improving reconciliation and reducing manual entry.

- Stronger security and compliance: PCI compliance, including tokenization and fraud detection tools help protect both the business and the customer.

- Better reporting and visibility: Automated sync into NetSuite software means finance teams can access more accurate, real-time insights.

- Improved customer experience: Saved payment methods, mobile-friendly checkout, and one-click options make transactions smoother.

In short, using a third-party payment processor ensures your SuiteCommerce extensions don’t just process payments—they streamline operations, support compliance, and keep your checkout experience modern and customer-friendly.

Key Evaluation Criteria for Payment Extensions

When comparing SuiteCommerce extensions, keep these factors in mind:

- Supported payment types: Can the payment processor handle credit cards, ACH/eCheck, digital wallets like Apple Pay and Google Pay, and possibly Buy Now, Pay Later options?

- NetSuite integration depth: How seamlessly does the extension connect with SuiteCommerce NetSuite records, invoices, and reconciliation processes?

- Security and compliance: Tokenization, PCI scope reduction, fraud monitoring, and tools like 3-D Secure can reduce risk and give customers peace of mind.

- Reporting and reconciliation: A strong extension should automatically tie transactions back to NetSuite accounting data, so finance teams don’t have to chase down mismatches.

- Customer experience: Speed, mobile optimization, saved payment profiles, and an intuitive checkout flow matter more than ever.

- Cost: Beyond processing rates, consider monthly extension fees, chargeback costs, and potential savings from automation.

These criteria create a balanced lens for choosing a payment processing solution that fits your business, both now and as it scales.

Best Practices for Choosing a SuiteCommerce Payment Extension

Choosing the right payment processing solution isn’t just a technical decision—it impacts finance, operations, and customer service. To get it right:

- Assess your current needs: Look at what’s slowing down your billing or reconciliation today.

- Bring the right people in: Include finance, IT, and operations leaders in the evaluation so all pain points are considered.

- Think about scalability: Choose an extension that will still work when your transaction volumes double.

- Test before committing: Use a sandbox environment to run real-world transactions and catch issues before going live.

Taking the time to evaluate carefully pays off in smoother day-to-day operations later.

Why EBizCharge is a Strong Choice for SuiteCommerce

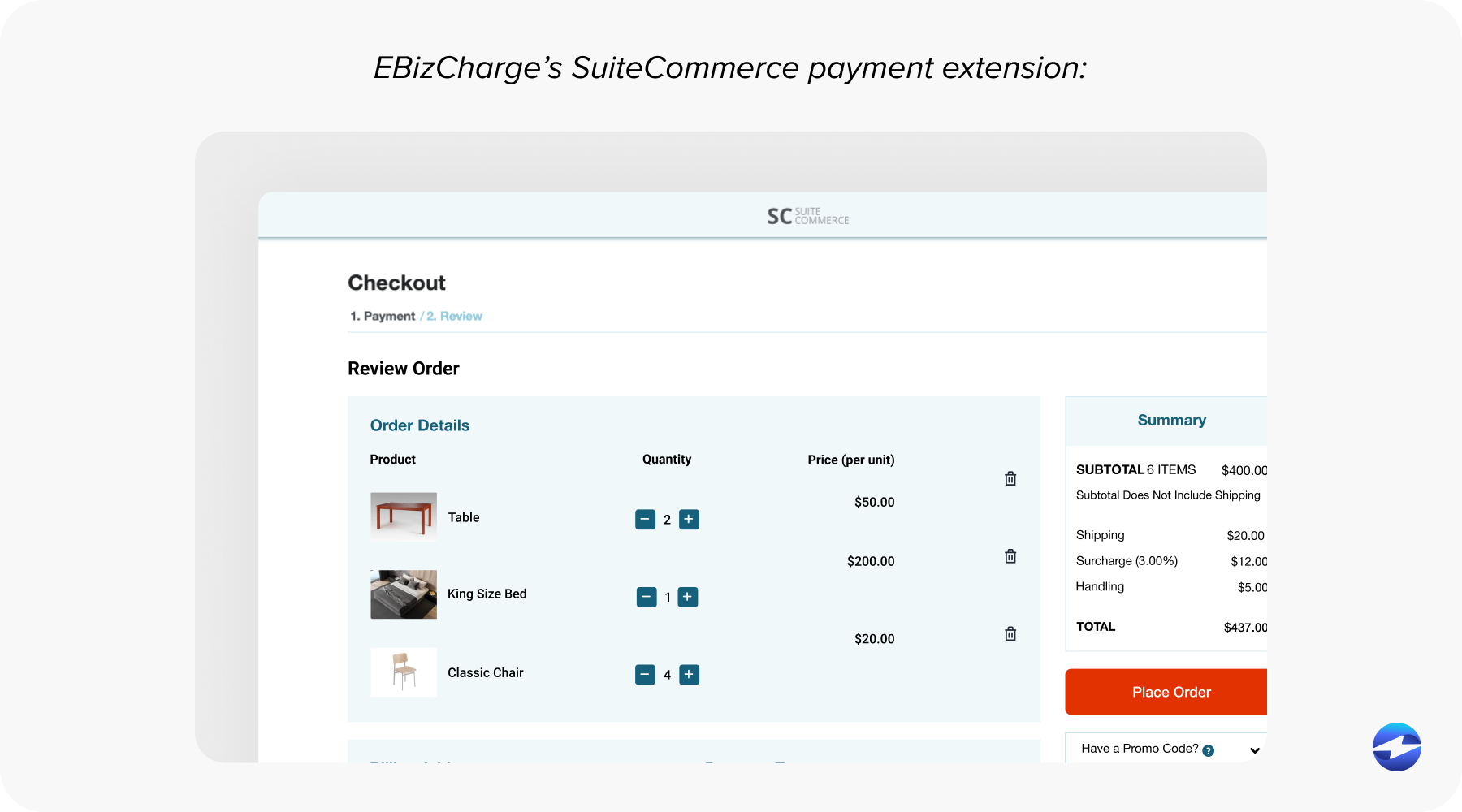

Among third-party payment processor options, EBizCharge has become a popular pick for SuiteCommerce NetSuite users. Its biggest advantage is tight NetSuite integration, meaning payments post directly to the right records without manual work. Finance teams appreciate how this reduces reconciliation time and helps them close the books faster.

EBizCharge also improves the customer experience with self-service payment portals, making it easier for clients to pay invoices online. On the security side, built-in PCI compliance, tokenization, and fraud monitoring help reduce risk while maintaining customer trust. Finally, its scalable design ensures that as your transaction volumes grow, the extension keeps pace without bogging down your workflows.

When you combine Oracle NetSuite software with a payment processing solution like EBizCharge, you get a system that’s efficient, secure, and built to last. For SuiteCommerce extensions, that balance between operations, customer experience, and compliance is exactly what most merchants are looking for.