Blog > Complete Oracle Fusion Cloud Payment Automation: From Quote to Cash

Complete Oracle Fusion Cloud Payment Automation: From Quote to Cash

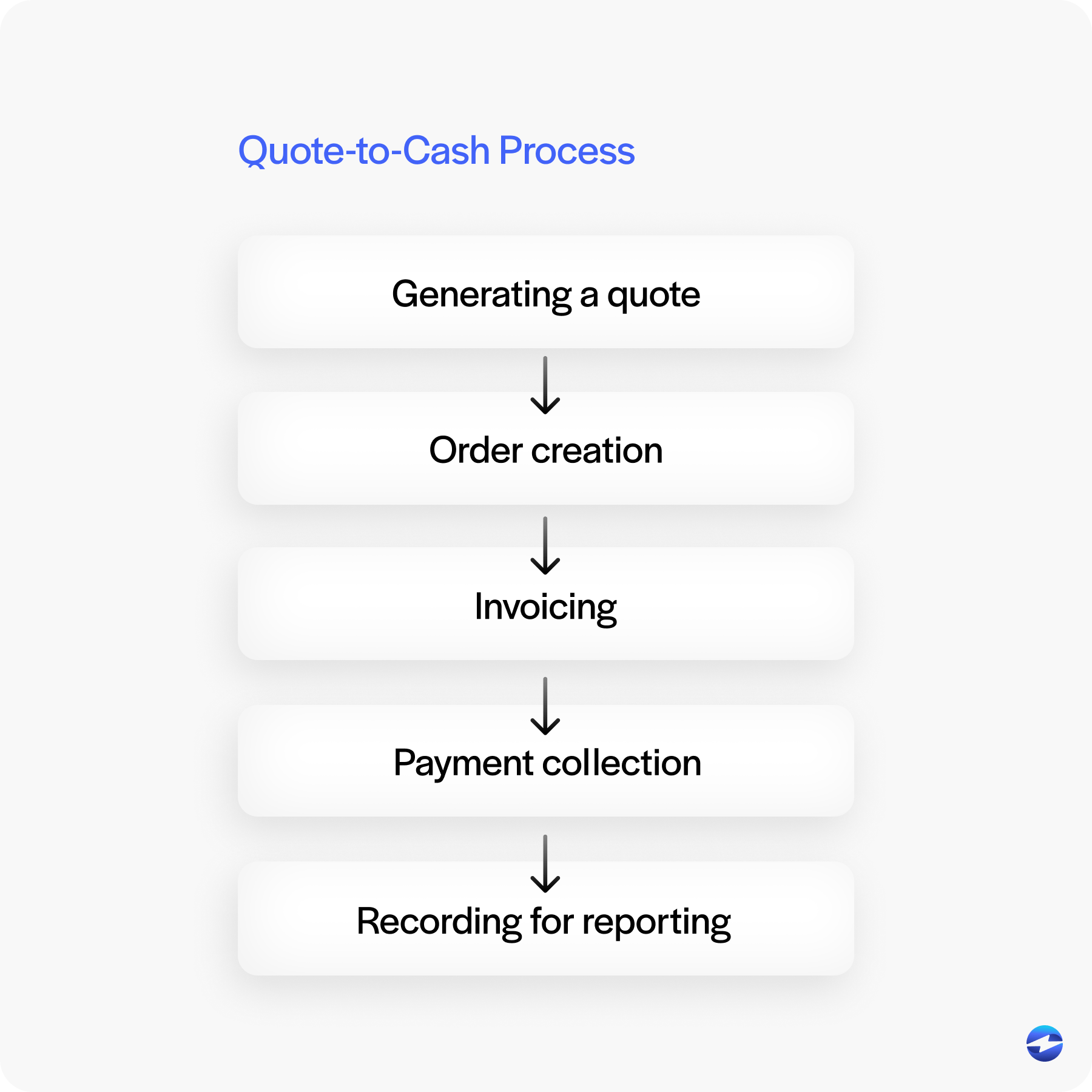

The quote-to-cash process is the backbone of every business. It’s the journey from creating a quote for a customer to collecting payment and recording it in your system. When it works smoothly, companies see faster revenue cycles, stronger cash flow, and happier customers. However, when payment workflows are disconnected or manual, even the best sales process can grind to a halt. Teams get stuck entering data by hand, reconciliation drags on, and financial reports are often out of sync with reality.

That’s why Oracle Fusion Cloud ERP automation is so valuable. By embedding payments directly into your workflows, you can eliminate unnecessary steps, reduce errors, and give your teams real-time financial visibility. This article will walk through how automation changes the quote-to-cash cycle in Oracle Fusion, the benefits it brings, and why choosing the right payment processing solution makes all the difference.

Understanding Oracle Fusion Cloud and the Quote-to-Cash Process

At its core, Oracle Fusion Cloud ERP is a modern ERP software platform designed to connect every part of your business. It offers a wide set of Oracle Fusion modules, covering everything from Sales and Procurement to Accounts Receivable and the General Ledger. These modules work together, ensuring that when one team updates information, the rest of the business sees it in real time.

The quote-to-cash process sits at the center of this system. It starts with generating a quote, then moves to order creation, invoicing, payment collection, and finally, recording everything for reporting. Each stage involves multiple Oracle Fusion modules, and when those steps are automated, the process becomes much faster and far less error-prone.

Why Automating Payments in Oracle Fusion Cloud Matters

Many companies still rely on manual payment workflows. This often means finance teams are stuck keying in data line by line, chasing missing records, and spending hours reconciling accounts. These outdated methods create delays, put pressure on cash flow, and increase the risk of mistakes.

With Oracle Fusion Cloud ERP automation, payments flow directly into Oracle Fusion billing and Accounts Receivable without anyone needing to retype or manually upload data. That means invoices are matched to payments instantly, and the General Ledger reflects real-time updates. Finance teams spend less time fixing errors and more time analyzing results. Customers also benefit because they can pay quickly and see immediate confirmation, which builds trust and improves their experience.

Key Benefits of Oracle Fusion Cloud Payment Automation

When payments are automated, the improvements ripple across the entire organization. Some of the benefits include:

- Real-time visibility: Leaders always have access to accurate, up-to-date reports.

- Faster cycles: The quote-to-cash process moves more quickly, freeing up working capital.

- Reduced reconciliation work: Fewer manual steps mean less time spent on closing the books.

- Improved compliance: Automated workflows create clear audit trails and reduce risks.

- Stronger relationships: Customers and vendors enjoy smoother, more reliable payment experiences.

These aren’t small improvements. They can transform how finance teams operate day to day and how leadership plans for growth.

How Oracle Fusion Cloud Payment Automation Works

Here’s how it looks in practice: A customer order is approved in Sales. The system generates an invoice through Oracle Fusion billing, and when the customer pays, the payment processor sends that data straight into Accounts Receivable. The General Ledger updates instantly, and management reports reflect the new numbers without delay.

The backbone of this is automation. Instead of relying on people to re-enter or reconcile data, the system does it automatically. PCI-compliant safeguards like encryption and tokenization ensure sensitive data is secure, so companies don’t have to sacrifice safety for speed. The combination of accuracy, efficiency, and compliance is what makes automation such a game-changer in Oracle Fusion software.

Challenges Businesses Face Without Automation

Without automation, businesses encounter the same frustrating issues over and over again. Manual entry wastes time and invites errors. Financial reports lag behind because payments aren’t recorded in real time. Scaling becomes difficult because each new transaction adds to the workload. And with compliance requirements growing stricter, gaps in payment processes can expose businesses to unnecessary risks.

In short, manual payment workflows hold companies back, slowing growth and making financial operations more fragile than needed.

The Role of Third-Party Payment Processors

While Oracle Fusion offers strong native capabilities, many businesses need more flexibility than what’s provided out of the box. That’s where a third-party payment processing solution comes in. These providers extend Oracle’s native tools, offering features like customer payment portals, advanced reporting, and lower transaction costs. They also scale better, ensuring that as payment volumes grow, systems can handle the load without creating bottlenecks.

The key is choosing a payment processor that integrates directly with Oracle Fusion modules. Seamless integration means payments aren’t bolted on as an afterthought—they’re embedded into the natural flow of the ERP. That integration makes daily operations smoother and gives leadership confidence in the accuracy of the data they’re reviewing.

Why EBizCharge is a Strong Fit

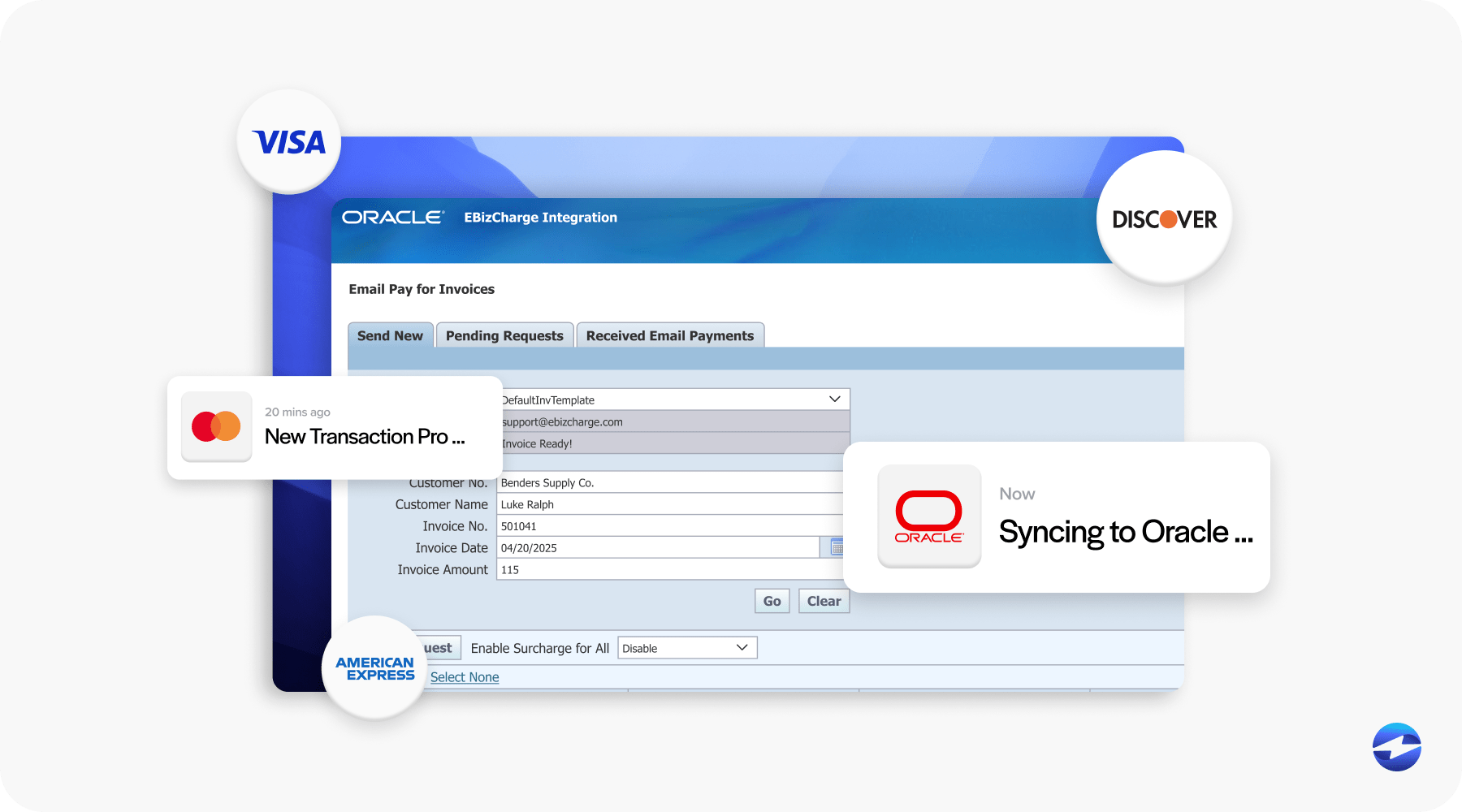

Among the many options out there, EBizCharge has proven to be a standout. It connects directly to key Oracle Fusion modules like Accounts Receivable and the General Ledger, ensuring payments are posted instantly and automatically. That removes the need for duplicate entry and reduces the risk of errors.

But EBizCharge offers more than just posting payments. Its built-in PCI-compliant security protects sensitive data. Customer portals make it easier to collect payments on time. Advanced reporting tools give finance teams insights into cash flow and trends that Oracle’s native reporting can’t always provide. And because it scales, businesses don’t need to worry about outgrowing the system—it adapts as volumes increase.

In other words, EBizCharge isn’t just another third-party payment processor. It’s a long-term partner that helps companies modernize their Oracle Fusion ERP environment while improving efficiency, compliance, and customer satisfaction.

Best Practices for Implementing Oracle Fusion Cloud Payment Automation

Rolling out payment automation requires preparation and planning. Here are some best practices that make the process smoother:

- Assess your workflows: Identify bottlenecks and pain points before integration.

- Clean up your data: Ensure customer and vendor records are accurate and consistent.

- Test with sample transactions: Confirm that payments flow properly into AR and the GL.

- Train your teams: Help finance, sales, and IT staff understand both the mechanics and the purpose.

- Monitor performance: Use reporting tools to track success and make adjustments as needed.

These steps build a strong foundation for success. They ensure automation doesn’t just get installed—it delivers lasting value.

Transforming the Quote-To-Cash Process with Oracle Fusion Cloud Payment Automation

Oracle Fusion Cloud ERP automation has the power to transform the quote-to-cash process. By embedding payments directly into the flow of Oracle Fusion software, businesses eliminate unnecessary manual work, reduce errors, and gain real-time financial insight. The benefits extend beyond finance teams, improving relationships with customers and vendors while strengthening compliance and cash flow.

For companies ready to modernize, pairing Oracle Fusion ERP with a trusted third-party payment processing solution like EBizCharge is a smart move. The combination of seamless integration, scalability, and advanced features creates a system that works today and grows with your business tomorrow. It’s not just about automation—it’s about building financial operations that support long-term success.

Summary

- Understanding Oracle Fusion Cloud and the Quote-to-Cash Process

- Why Automating Payments in Oracle Fusion Cloud Matters

- Key Benefits of Oracle Fusion Cloud Payment Automation

- How Oracle Fusion Cloud Payment Automation Works

- Challenges Businesses Face Without Automation

- The Role of Third-Party Payment Processors

- Why EBizCharge is a Strong Fit

- Best Practices for Implementing Oracle Fusion Cloud Payment Automation

- Transforming the Quote-To-Cash Process with Oracle Fusion Cloud Payment Automation