Blog > Oracle Fusion General Ledger Payment Integration: Real-Time Financial Reporting

Oracle Fusion General Ledger Payment Integration: Real-Time Financial Reporting

Financial reporting is the backbone of smart business decisions. When reports are accurate and up to date, leaders can move with confidence. But when numbers lag behind reality, it can cause delays, missed opportunities, and unnecessary risks. Many companies running on Oracle Fusion ERP face this issue—payments and the Oracle Fusion general ledger don’t always align in real time.

That gap is where frustration builds. Finance teams spend hours reconciling records, closing books drags on, and decision-makers don’t get the full picture until it’s too late. The good news is that payment integration with the general ledger can close these gaps. By embedding payments directly into Oracle Fusion modules, businesses create a smoother, more reliable flow of financial data. The result? Real-time financial visibility that strengthens both strategy and daily operations.

Understanding Oracle Fusion General Ledger

The Oracle Fusion general ledger sits at the center of financial management. Within Oracle Fusion software, it’s the place where every transaction eventually lands, whether it begins in Accounts Payable, Accounts Receivable, Procurement, or Sales. Because it collects information from all these Oracle Fusion modules, the general ledger is essential for accurate reporting and compliance.

Think of it as the master book of record. If the ledger isn’t current, your company’s financial story is out of sync. That’s why the general ledger is one of the most important components of enterprise resource planning. It doesn’t just hold numbers; it provides the insight leaders need to measure performance, spot risks, and plan for growth. For businesses already relying on Oracle Fusion ERP, ensuring payments are fully integrated into the general ledger is a logical next step.

Why Payment Integration Matters

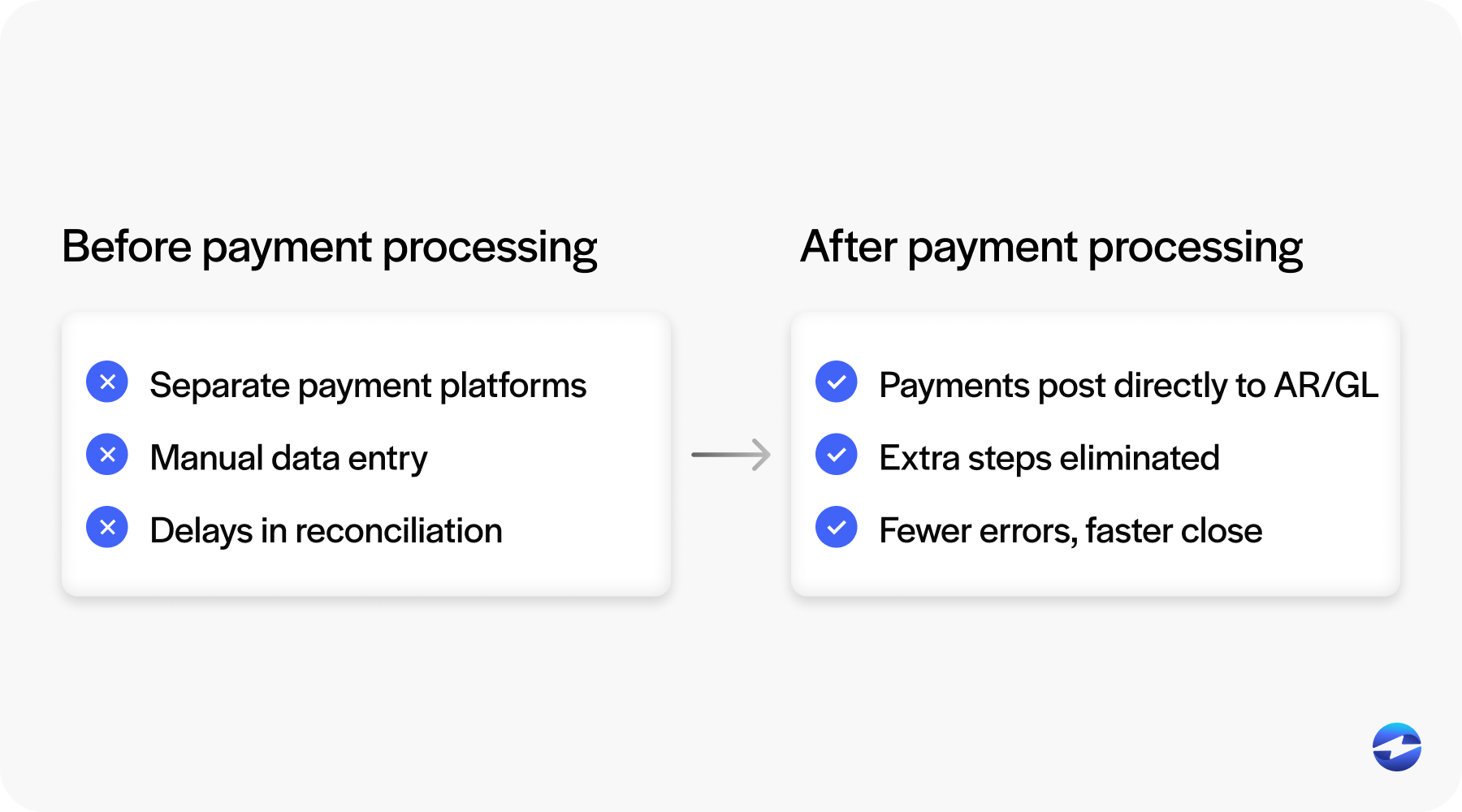

Without integration, payments often live on the edges of the system. They’re processed separately, recorded manually, or reconciled days later. These delays create reporting that looks backward instead of in real time. Finance teams spend more time fixing errors than analyzing trends. And in fast-moving industries, that kind of lag can put you behind competitors.

Manual payment posting also increases the risk of mistakes. A single typo can throw off the entire general ledger, forcing teams to dig through spreadsheets to find the issue. By connecting payments directly to Oracle Fusion billing and the GL, businesses eliminate those extra steps. Integrated payments close the gap between transactions and reporting, giving finance leaders the confidence that the numbers they see are accurate.

Key Benefits of Real-Time GL Payment Integration

Integrating payments with the Oracle Fusion general ledger delivers a range of benefits that ripple across the organization:

- Faster reporting cycles: With payments posting automatically, reports are always current.

- Reduced reconciliation effort: Automation cuts down on hours of manual matching.

- Greater accuracy in financial data: Errors are minimized because data flows directly into the system.

- Enhanced audit readiness and compliance: Integrated systems provide cleaner audit trails.

- Improved decision-making: Leaders get real-time insight to guide strategy, budgets, and investments.

For finance teams, these benefits mean less stress and more time to focus on high-value tasks. For executives, it means having information that truly reflects the state of the business.

How Oracle Fusion GL Payment Integration Works

So, how does it actually work? Imagine a customer payment is made. Instead of sitting in an external system or waiting for someone to manually enter it, it flows directly from the payment processor into Oracle Fusion billing and the general ledger. The transaction updates Accounts Receivable in real time, the GL reflects the change instantly, and reports are accurate within moments.

Automation drives this process. By eliminating manual steps, payments move quickly and securely across the Oracle Fusion ERP environment. Compliance also plays a big role. Secure integrations ensure that data is encrypted, tokenized, and handled in line with PCI requirements. The result is speed without sacrificing accuracy or safety.

The Role of Third-Party Payment Processors

While Oracle provides strong tools out of the box, many businesses turn to a third-party payment processor to enhance their workflows. These providers extend what Oracle Fusion software can do by offering features like advanced reporting, lower transaction costs, and customer portals where payments can be made online. For growing companies, scalability is another benefit—a robust payment processing solution can handle higher volumes without bogging down the system.

Choosing the right partner matters. The best fit is a payment processor designed to integrate seamlessly with the general ledger. That way, payments aren’t bolted on as an afterthought; they’re part of the natural flow of the ERP software. For finance teams, this means fewer disruptions. For leadership, it means financial data you can trust.

Why EBizCharge is a Strong Fit

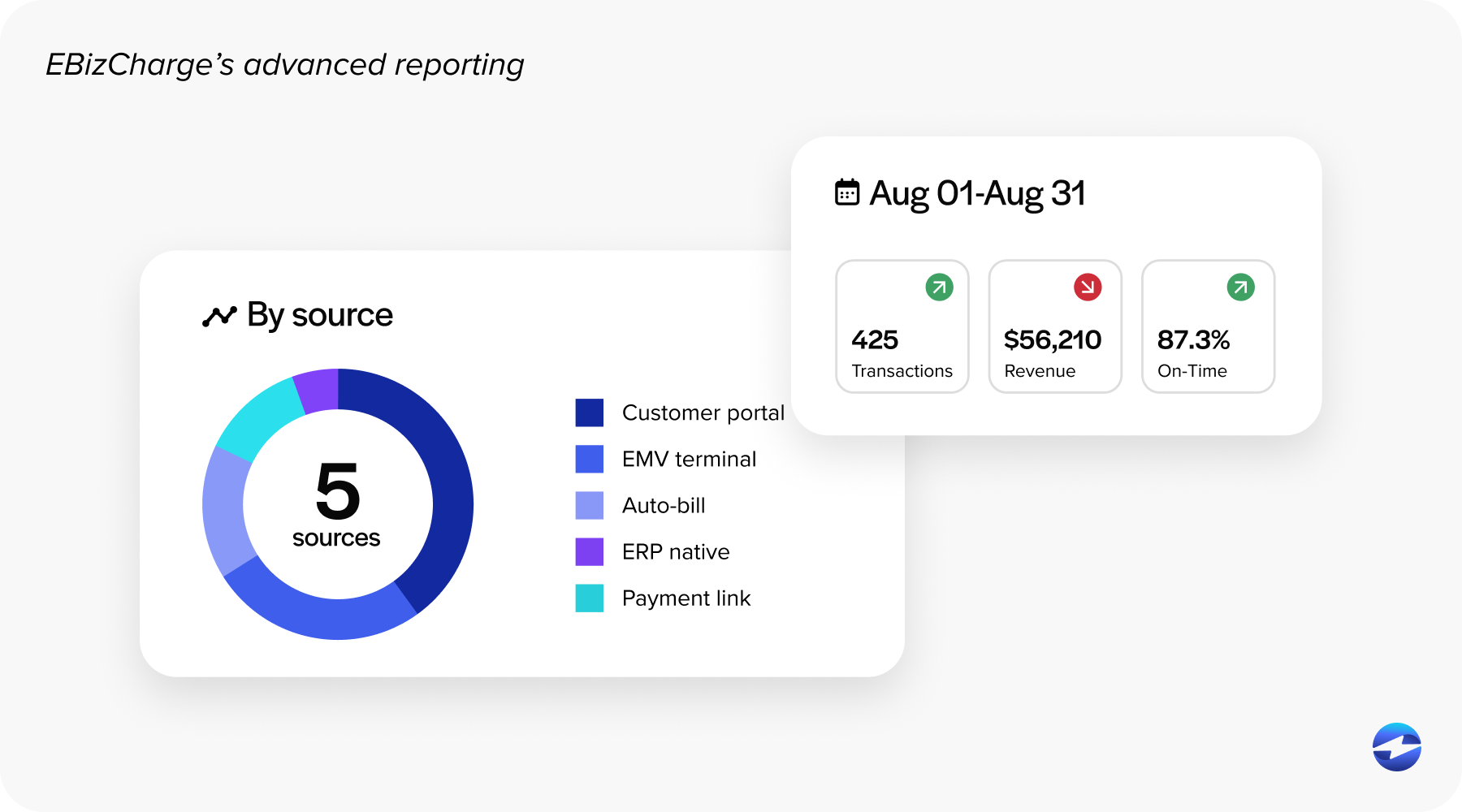

One solution that consistently stands out is EBizCharge. Unlike generic processors, it’s built to integrate directly with the Oracle Fusion general ledger and other key Oracle Fusion modules. Payments are posted automatically into Accounts Receivable and the general ledger, cutting out duplicate entry and reducing errors. Reconciliation becomes a background process instead of a weekly headache.

EBizCharge also offers advanced features that fill gaps in Oracle Fusion ERP. PCI-compliant security ensures sensitive data is protected. Customer portals make it easier to collect payments on time. Reporting tools give finance teams deeper visibility into trends and cash flow. And because it scales, EBizCharge supports businesses whether they’re handling hundreds or thousands of payments each day.

For companies looking to modernize, pairing Oracle Fusion software with a trusted third-party payment processor like EBizCharge creates a payment system that is accurate, efficient, and ready for growth.

Best Practices for Successful GL Payment Integration

Integrating payments into the general ledger is a project worth planning carefully. Here are some best practices that make a difference:

- Clean up data: Before integration, ensure customer and vendor records are consistent.

- Test before rollout: Run sample transactions to confirm payments flow correctly into AR and the GL.

- Train your team: Finance and IT staff should understand both the mechanics and the purpose of integration.

- Monitor performance: Use reporting tools to track results and make adjustments as needed.

These steps may sound basic, but they set the foundation for a reliable integration that delivers real value.

Building Confidence with Real-Time Reporting

At the end of the day, the goal is simple: accurate, real-time financial reporting that helps businesses grow. Integrating payments directly into the Oracle Fusion general ledger makes that possible. It reduces errors, shortens close cycles, and frees finance teams from repetitive manual work.

When combined with a powerful payment processing solution like EBizCharge, Oracle Fusion ERP becomes even stronger. Businesses not only gain speed and accuracy but also unlock tools that improve customer experience and vendor trust. For organizations still wrestling with manual payment posting, now is the time to modernize. By embedding payments into the Oracle Fusion software you already rely on, you’ll create a system that’s accurate today and ready for tomorrow.