Blog > Oracle Fusion Manufacturing: Embedded Payment Solutions for B2B Transactions

Oracle Fusion Manufacturing: Embedded Payment Solutions for B2B Transactions

In modern manufacturing, speed and accuracy aren’t optional—they’re what keep operations running smoothly. Many companies already use Oracle Fusion ERP to tie together their core processes, but payments are often left out of that streamlined flow. When that happens, manual work creeps in, slowing production cycles and introducing errors into financial data. Both suppliers and customers feel the frustration.

Embedded payment solutions fix this by bringing payments directly into Oracle Fusion Manufacturing, so money moves through the system as seamlessly as materials do. This article will explore how this works, why it’s especially valuable for B2B transactions, and why having the right payment processor in place makes all the difference.

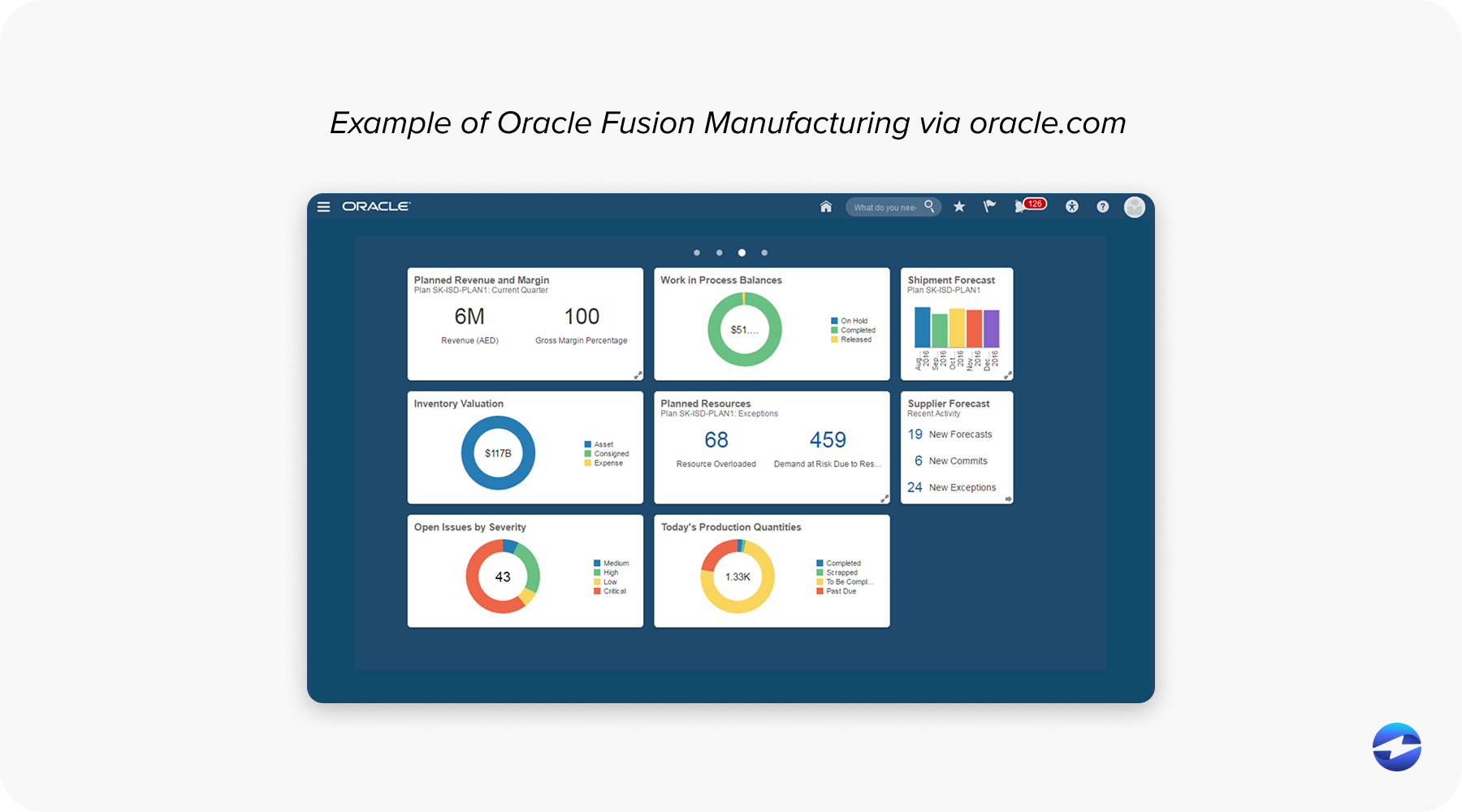

Understanding Oracle Fusion Manufacturing

Oracle Fusion Manufacturing is one of the many powerful Oracle Fusion modules designed to help businesses run smarter. Within the Oracle Fusion software, this module handles production scheduling, order management, supply chain coordination, and inventory oversight. For manufacturers, it’s where operations meet planning, ensuring that goods are produced on time and resources are used efficiently.

But manufacturing doesn’t happen in a vacuum. Every purchase order, vendor invoice, or shipment has a financial side. Without payment integration, teams often juggle multiple systems, rekey data, and reconcile transactions manually. Embedding payments into the Oracle Fusion ERP framework ensures that finance moves hand-in-hand with production, creating one reliable source of truth across the entire ERP software environment.

The Need for Embedded Payment Solutions in Manufacturing

Traditional B2B payments often involve paper checks, phone-based transactions, or disconnected portals. These outdated methods take time, cost money, and create a lot of frustration. For finance teams, reconciling records across separate systems becomes a weekly grind. For vendors and suppliers, delays in payment strain relationships and limit trust.

Embedded payment solutions solve these problems by streamlining payment workflows within the system—or in this case, the Oracle Fusion software. They bring transactions into the same environment where production, orders, and invoices already live. This shift means fewer bottlenecks, more reliable financial data, and a payment cycle that matches the pace of modern manufacturing.

Benefits of Embedded Payments for B2B Transactions

Adding embedded payment solutions to Oracle Fusion Manufacturing brings measurable benefits:

- Faster payment cycles and healthier cash flow: Payments are posted automatically, reducing delays.

- Automated reconciliation: Transactions match invoices and ledgers instantly, saving staff hours of manual work.

- Stronger vendor and supplier relationships: On-time, transparent payments foster trust and better terms.

- Improved compliance and security: Built-in protections keep sensitive payment data safe while meeting industry standards.

Together, these benefits give manufacturers an edge. Cash moves quicker, staff spend less time fixing errors, and business partners feel more confident about doing business with you.

How Embedded Payment Solutions Work with Oracle Fusion Manufacturing

The real power of embedded payments comes from their tight integration with Oracle Fusion modules. For example, a purchase order in procurement can trigger a vendor invoice, which then flows directly into accounts payable. With an integrated payment processing solution, the vendor is paid automatically, and the update posts in real time to the general ledger. Similarly, customer payments captured in accounts receivable flow instantly into Oracle Fusion billing, cutting down on reconciliation time.

Instead of disjointed systems, you get one ecosystem where money moves as seamlessly as materials.

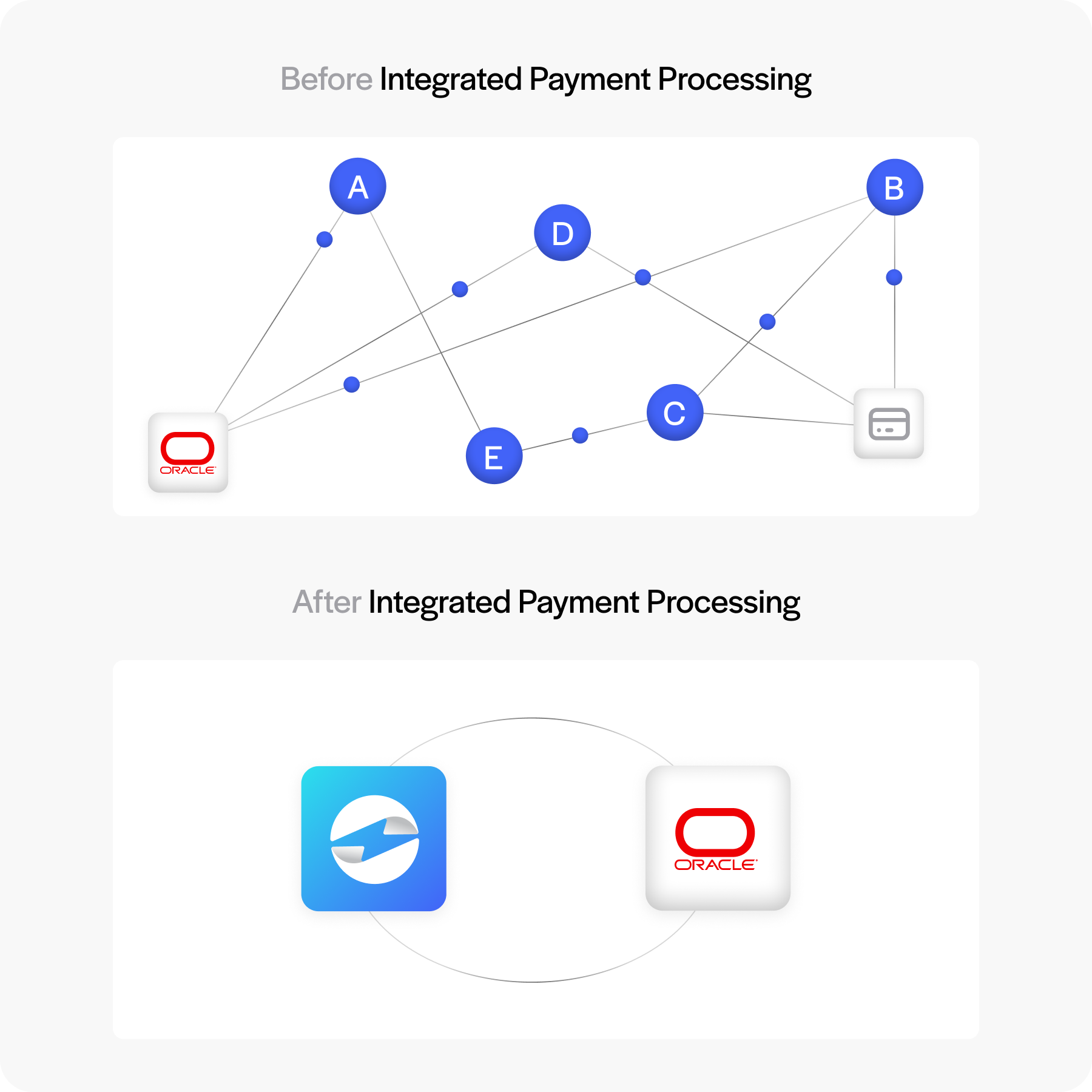

Third-Party Payment Processors and Oracle Fusion

Oracle Fusion ERP comes with strong, native payment tools, but many businesses eventually find they need more options. That’s where a third-party payment processor steps in. These integrations can add features like detailed reporting, online payment portals for customers, and sometimes lower transaction costs than standard tools. Just as important, they can handle growth more smoothly, so payment operations don’t become a bottleneck when volumes rise.

The key is choosing a partner that offers a payment processing solution built to work directly with Oracle Fusion software. The right integration should fit your workflows without heavy customization and support how your business actually operates. For many manufacturers, a third-party option isn’t just nice to have—it’s a practical step to keep up with modern B2B payment expectations.

Best Practices for Implementing Embedded Payment Solutions

Rolling out embedded payments is more than a technical project—it’s an operational shift. Here are some practical steps:

- Assess workflows: Identify where payments slow you down and where automation can have the biggest impact.

- Clean up data: Inconsistent records can cause problems once payments start posting automatically.

- Train teams: Finance and operations staff should understand not just how to use the tools, but why they matter.

- Test thoroughly: Run sample transactions end-to-end before rolling out to customers and vendors.

These steps ensure that your Oracle Fusion payment processor integration delivers value from day one.

Why EBizCharge is a Strong Choice for Oracle Fusion

Among the many third-party payment processors available, EBizCharge stands out as a top-rated option for businesses running Oracle Fusion ERP. Its seamless integration connects directly with accounts receivable, accounts payable, and the general ledger, eliminating duplicate entry and posting payments instantly. That means your team spends less time on manual work and more time on strategic tasks.

But EBizCharge isn’t just about integration. It also provides secure online customer portals, advanced reporting dashboards, and PCI-compliant security tools that protect sensitive payment data. For manufacturers, these features improve vendor trust, speed up collections, and simplify compliance.

Most importantly, EBizCharge scales with your business. Whether you’re processing hundreds or thousands of transactions daily, it adapts without sacrificing performance. This combination of seamless integration, powerful tools, and long-term reliability makes EBizCharge one of the strongest payment processing solutions for businesses looking to modernize financial operations in Oracle Fusion Manufacturing.

Building a Smarter Future with Oracle Fusion and Embedded Payments

Oracle Fusion automation and embedded payments aren’t just nice add-ons—they’re practical tools that make financial operations smoother and more dependable. For manufacturers managing complex B2B transactions, embedding payments into the Oracle Fusion ERP ecosystem helps reduce inefficiencies, build stronger relationships, and keep reporting accurate. When paired with the right partner, like EBizCharge, these advantages become even more impactful. By integrating a trusted payment processor directly with Oracle Fusion billing and other modules, companies can reduce manual work, improve accuracy, and position themselves to grow confidently while meeting the demands of modern B2B commerce.