Blog > Oracle Fusion Payment Automation: Streamlining Financial Processes with Embedded Payments

Oracle Fusion Payment Automation: Streamlining Financial Processes with Embedded Payments

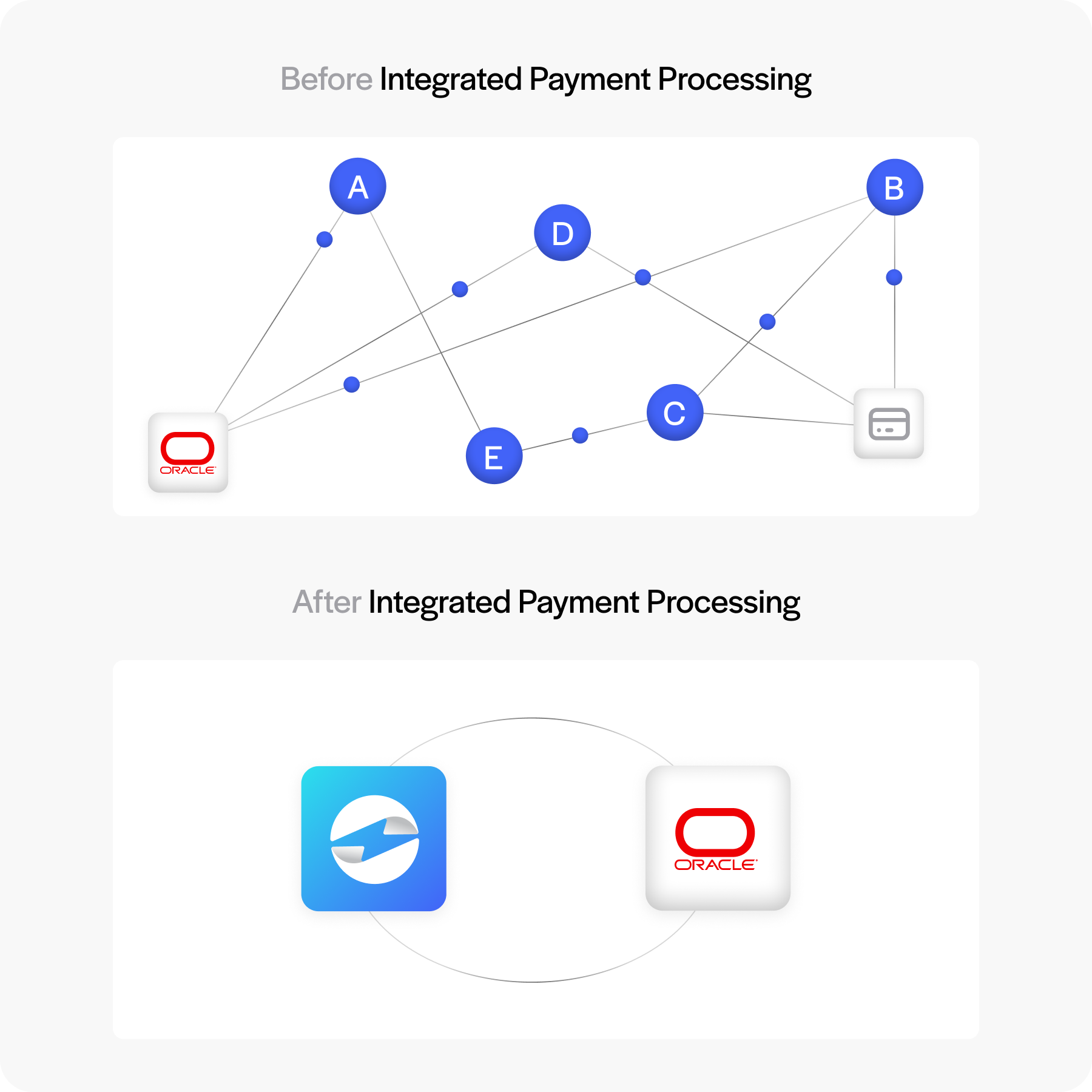

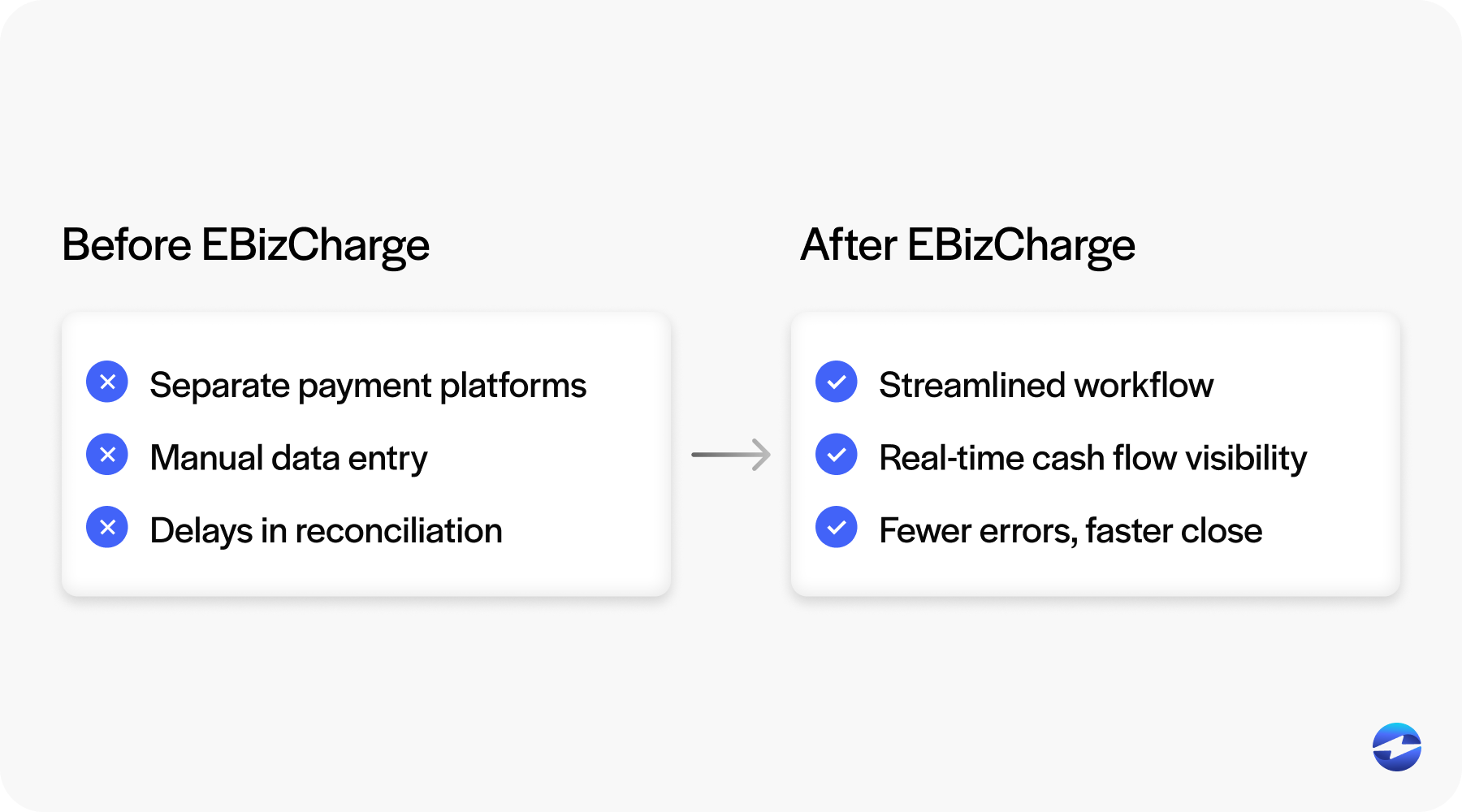

For many businesses, the way payments are handled makes a bigger difference than most realize. Even if your financial team uses a strong system like Oracle Fusion ERP, manual payment operations can slow down operations, introduce errors, and frustrate both staff and customers. In today’s fast-paced environment, finance teams need more than just efficiency—they need reliability and accuracy.

That’s why Oracle Fusion automation is such an important step. By embedding payments directly into your ERP workflows, you can eliminate repetitive tasks, reduce reconciliation headaches, and create a system that works seamlessly from invoice to ledger. The result isn’t just about saving time. It’s about building a foundation for better cash flow, stronger compliance, and more satisfied customers and vendors. This article explores how automation works in Oracle Fusion, which modules benefit most, and how the right payment processing solution can transform your financial operations.

What is Oracle Fusion ERP?

At its core, Oracle Fusion ERP is a cloud-based enterprise resource planning platform designed for flexibility and scale. Businesses of all sizes use it to connect essential areas like finance, HR, supply chain, and procurement. From manufacturing and wholesale to retail and beyond, you eliminate system silos and gain one integrated platform where each process flows naturally into the next.

The system is built on Oracle Fusion modules—each responsible for a different business function. These modules are designed to work together, so a purchase order in procurement can update accounts payable, which then posts to the general ledger. This interconnected design makes Oracle Fusion software a strong foundation for automating payments. When automation is added, those already tight connections become even more powerful, turning your ERP into a true end-to-end financial ecosystem.

In practice, this means that every department sees the same data at the same time. Finance doesn’t have to chase down information from procurement, and HR can tie reimbursements directly to ledger entries. This single source of truth is one of the biggest advantages of using a modern ERP software platform like Oracle Fusion.

The Case for Payment Automation

Many finance teams still manage payments manually. That means entering data by hand, reconciling line by line, and dealing with delays when records don’t match. These old ways create silos, slow down reporting, and increase compliance risks. Manual work also wastes staff time, leaving less room for analysis and strategic projects.

With Oracle Fusion automation, payments are captured and posted in real time. No more waiting for manual updates or worrying about mismatched invoices. Errors are reduced, reconciliation is smoother, and financial reporting becomes more accurate. When paired with Oracle Fusion billing, businesses gain consistent, reliable payment cycles that give finance teams peace of mind and customers a better experience.

Automation also supports compliance. When transactions are logged instantly and securely, audit trails are clearer, and regulatory requirements are easier to meet. For companies working in heavily regulated industries, this assurance is invaluable.

Core Oracle Fusion Modules That Benefit from Embedded Payments

Not every part of Oracle Fusion ERP handles payments directly, but several modules benefit greatly from automation:

- Accounts Receivable (AR): Automated collections mean faster reconciliation and lower days sales outstanding (DSO). Payments through Oracle Fusion credit card processing or ACH flow straight into AR without delays. Customers get immediate confirmation, and finance teams spend less time chasing down late payments.

- Accounts Payable (AP): Vendor payments can be scheduled and approved automatically, ensuring vendors are paid on time while reducing administrative effort. This strengthens supplier relationships and may even lead to better contract terms.

- General Ledger (GL): Real-time updates create instant visibility, making financial reports more accurate and audit-ready. When payments flow seamlessly into the general ledger, finance teams can trust that the numbers they see reflect reality.

- Procurement: Vendor transactions tie seamlessly into purchasing workflows, reducing manual follow-ups and improving supplier relationships. This is especially valuable for companies with complex supply chains.

- Expenses/HR: Employee reimbursements are posted quickly and accurately, improving staff satisfaction. Timely reimbursements help retain talent and show employees that their time and expenses are valued.

Each of these Oracle Fusion modules plays a key role in keeping the financial process smooth. Embedding automation strengthens those roles, cutting delays and errors while giving finance teams more control.

Technologies That Power Payment Automation in Oracle Fusion

Payment automation in Oracle Fusion ERP doesn’t happen on its own. It relies on a mix of technologies working together. Payment gateways and APIs connect external payment networks directly with your ERP system. Middleware acts as a translator, ensuring Oracle Fusion software communicates properly with your payment processor.

Security is another crucial piece. Sensitive financial data must be protected, and that means PCI compliance, tokenization, and encryption are essential. When companies use Oracle Fusion credit card processing, these protections reduce the risks tied to cardholder data. Because Fusion is cloud-native, businesses also gain scalability, uptime, and global reach—critical advantages for any company handling a high volume of payments.

Another benefit of these technologies is flexibility. Companies can expand into new markets, add new payment methods, or scale up transaction volumes without reworking their entire ERP system. In this way, Oracle Fusion automation doesn’t just improve today’s workflows—it future-proofs your financial operations.

Best Practices for Oracle Fusion Payment Automation

Automating payments isn’t about flipping a switch. It takes preparation and planning. Here are some steps that make a difference:

- Audit your system and data: Clean data is critical before adding automation. Inconsistent records can cause errors once automation is applied.

- Bring teams together: Involve IT, finance, and compliance early in the process. Cross-functional input ensures smoother integration.

- Test before rollout: Sample transactions highlight issues before they spread. Testing reduces risk and builds confidence in the system.

- Train staff thoroughly: Adoption is smoother when teams understand both the “how” and the “why.” Training also reduces resistance to change.

- Monitor and refine: As your business grows, adjust your workflows so automation continues to deliver value. Continuous improvement ensures your system remains aligned with evolving needs.

These practices may sound simple, but they help ensure that Oracle Fusion automation delivers on its promise of smoother, faster payment workflows. Skipping these steps can lead to setbacks that undermine the benefits of automation.

How Third-Party Payment Processors Add Value

While Oracle Fusion ERP offers strong native features, many businesses discover that they need more flexibility. This is where a third-party payment processor can add real value.

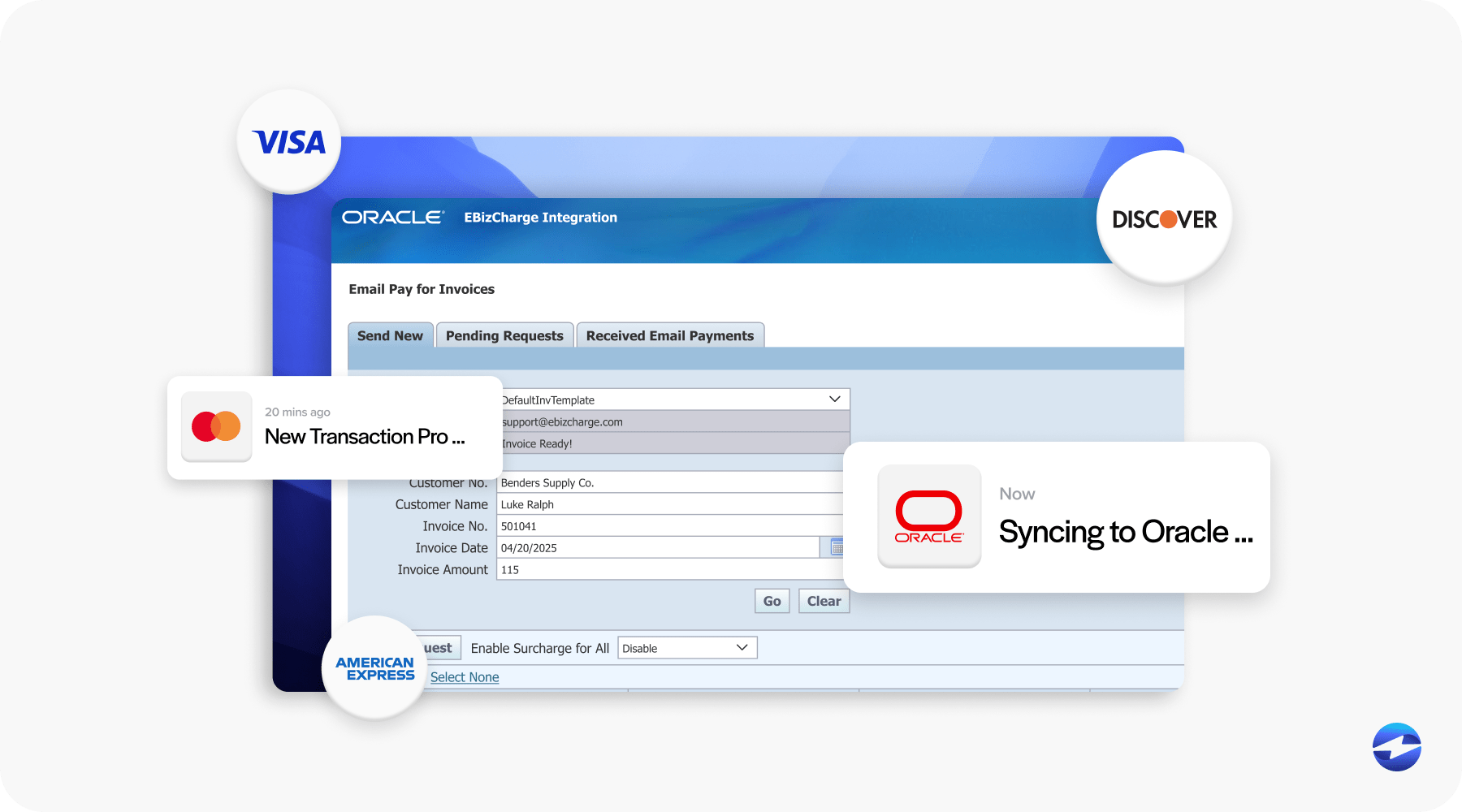

Solutions like EBizCharge integrate directly with Oracle Fusion modules, providing tools that go beyond the basics. These include customer-facing payment portals, advanced reporting, and lower transaction fees. With a third-party payment processor, businesses gain scalability to handle more transactions as they grow, plus the ability to customize payment workflows in ways Oracle’s native tools can’t always support.

Third-party tools also help bridge gaps when companies need features not natively available in Oracle Fusion software. For example, businesses may need multi-currency support, advanced fraud detection, or detailed analytics dashboards. Adding these features through a payment processing solution enhances the ERP environment without requiring costly custom development.

Transforming Finance with Oracle Fusion Payment Automation

This is where everything comes together. EBizCharge is consistently rated as one of the top payment processing solutions available for businesses using Oracle Fusion ERP. Its seamless integration ensures that automation is more than just a feature —it becomes the standard for how finance teams manage payments. Instead of chasing down data or rekeying transactions, finance teams see payments posted instantly across AR, AP, and the general ledger.

One of EBizCharge’s strengths is how naturally it fits into existing Oracle Fusion modules. The integration doesn’t require heavy customization, and it enhances workflows with customer portals, advanced reporting, and built-in PCI-compliant security. This combination reduces manual work, improves compliance, and speeds up reconciliation. Customers and vendors also benefit from faster, more reliable transactions that improve their overall experience.

The long-term advantages are clear: better cash flow, more accurate reporting, and finance teams free to focus on strategy instead of repetitive tasks. Vendor and customer relationships also strengthen when payments flow smoothly and transparently. By selecting a top-rated tool like EBizCharge, businesses ensure that Oracle Fusion automation is efficient, secure, and scalable.

Pairing Oracle Fusion ERP with EBizCharge creates a financial system that sets companies up for growth. It’s not just a technical upgrade—it’s a smart decision that helps finance teams gain confidence, improves customer convenience, and positions the business to stay competitive well into the future.