Blog > Automating Payment Workflows in SAP ECC: From Manual Processes to Embedded Payments

Automating Payment Workflows in SAP ECC: From Manual Processes to Embedded Payments

For many businesses still running on SAP ECC, payment workflows can feel like a constant balancing act. Manual entries, slow reconciliation, and compliance checks create more work than value. Finance teams know the frustration of late nights spent trying to align invoices with payments or resolve mismatches in reports. These inefficiencies don’t just affect your team—they ripple out into delayed cash flow, customer frustration, and uncertainty in financial forecasting.

This guide explores how automation can transform those processes. We’ll look at the realities of manual workflows, the benefits of automating, and how SAP ECC payment integration can help you move from patchwork solutions to truly embedded payments inside your ERP. If you’re looking for ways to simplify life for your finance team while making payments smoother for your customers, this is for you.

Manual Payment Workflows in SAP ECC

Manual payment handling in ECC often means keying data into the system one transaction at a time. Invoices are entered, payments are matched, and reconciliations are double-checked. These steps might work for small volumes, but quickly become overwhelming when your business grows. Errors creep in, and cleaning them up eats even more time.

Finance teams also feel pressure when customers or vendors ask for status updates. Without automation, tracing a payment through the SAP system can take hours. Reports may not match reality until someone manually reconciles accounts, leaving the business flying half-blind. In a world where real-time data is the norm, these manual steps hold companies back.

Benefits of Automating Payment Workflows

Shifting from manual work to SAP ECC automation is more than just a time-saver. Automation reduces errors by taking humans out of repetitive tasks and letting the system handle data entry and reconciliation. Instead of manually matching payments to invoices, the process happens instantly in accounts receivable.

Automation also means faster updates to the general ledger. This keeps financial reporting more accurate and up-to-date, helping make more informed decisions. Built-in audit trails improve compliance, and customers see faster payment confirmations. In practice, that means fewer calls to your support team and more trust in your brand.

For finance professionals, the real benefit is time. With fewer manual processes, teams can shift from firefighting to strategy—whether that’s forecasting cash flow or exploring new business models.

Key Technologies for Payment Automation

So how do you get from manual processes to automated workflows? It starts with the right tools. SAP billing software already offers functionality to manage invoicing and accounts receivable. However, adding a payment processing solution takes it further, connecting the customer-facing transaction directly with your financial modules.

Payment gateways and payment processors play a key role here. By connecting through APIs or middleware, they ensure that data moves seamlessly between systems. Security tools like tokenization and encryption keep sensitive data safe, while PCI compliance frameworks reduce risk for your business.

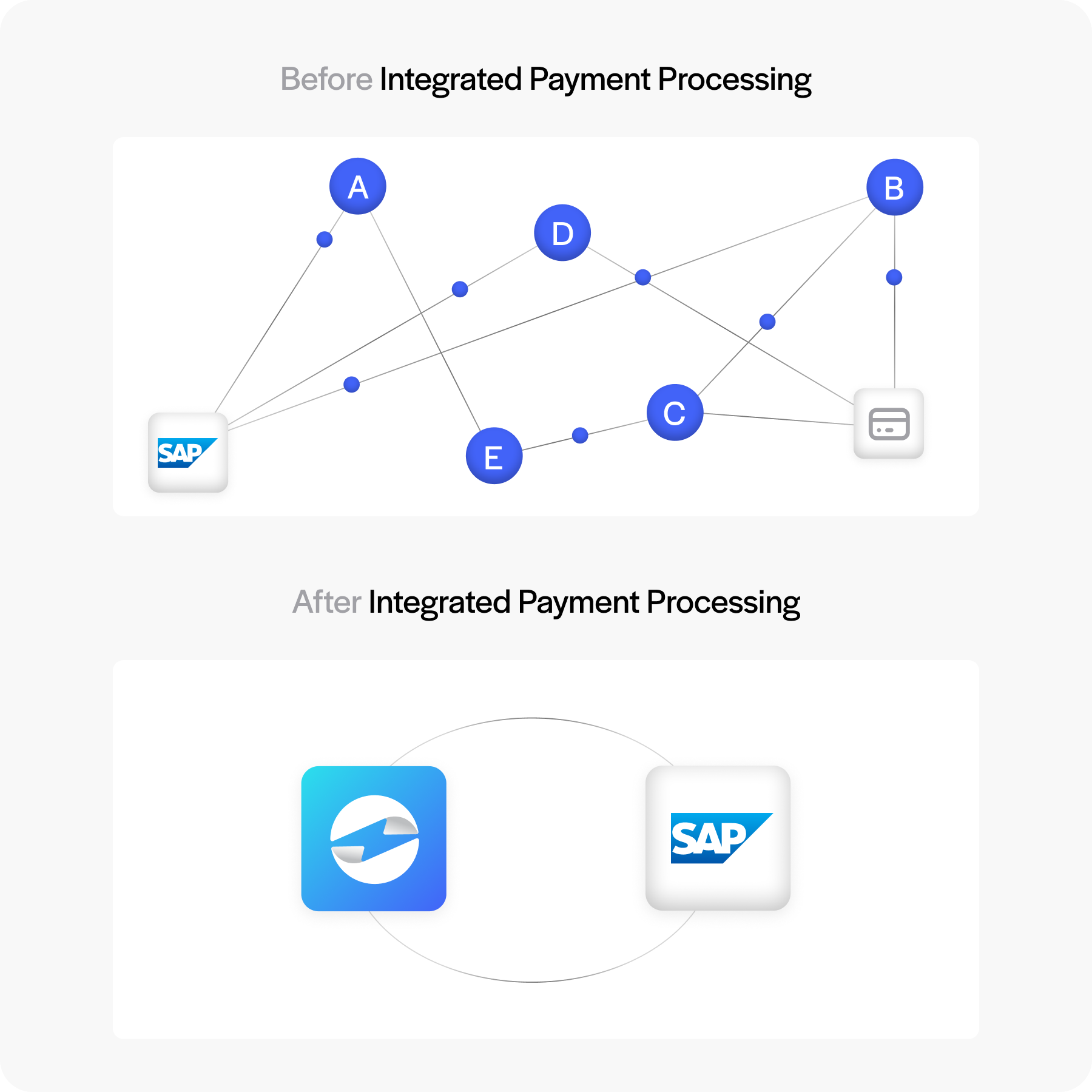

In many cases, a strong SAP ECC integration means you don’t just process payments—you embed them into your ERP so they’re part of the same system you already trust for financial reporting.

Embedded Payments in SAP ECC

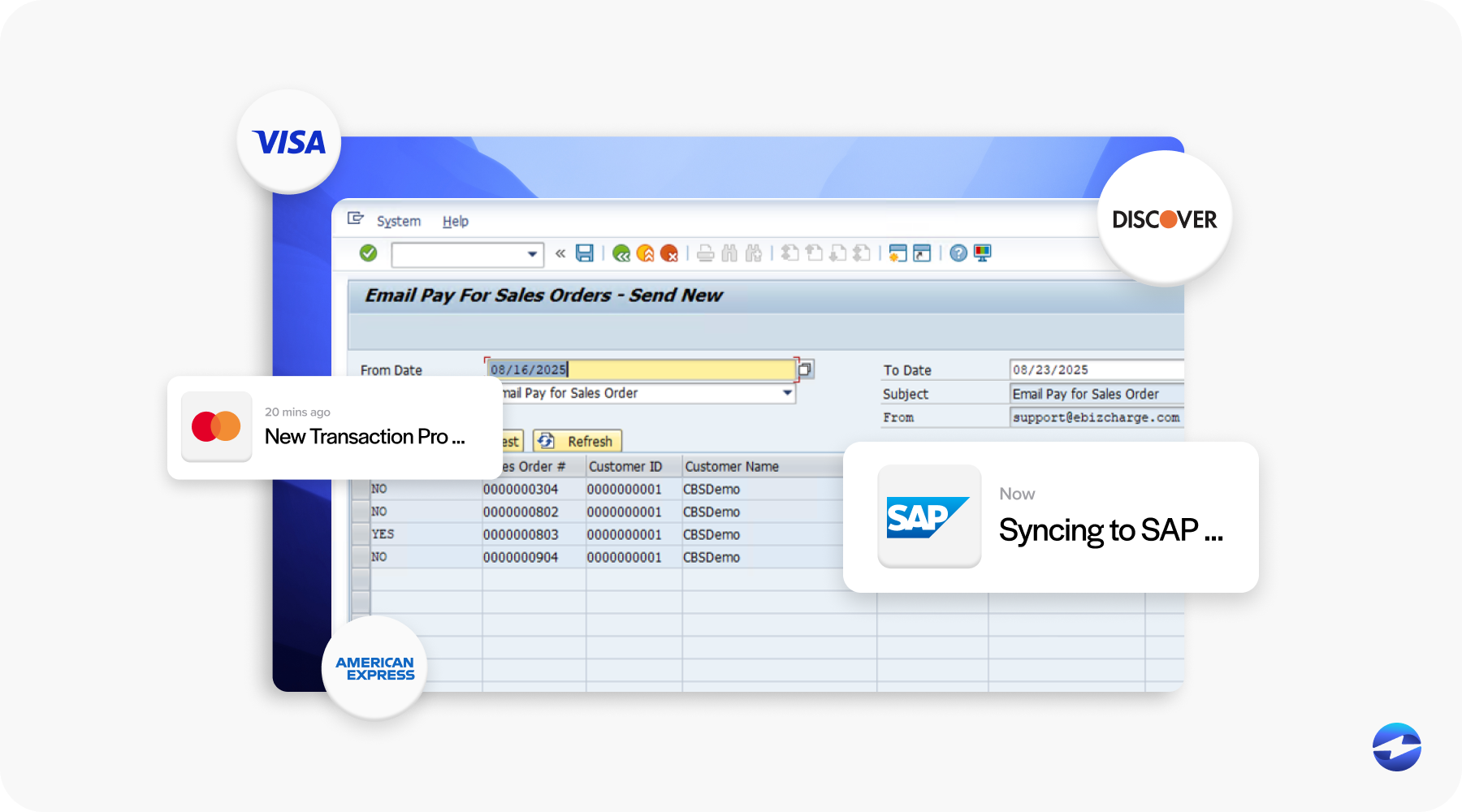

Embedded payments mean handling the entire payment process inside your SAP ERP environment. Instead of pushing transactions through separate platforms, payments are authorized, captured, and posted directly within ECC. For finance teams, this eliminates the back-and-forth of switching between systems.

Embedded payments also improve the customer experience. Self-service portals let customers pay invoices online at their convenience, and recurring billing options help reduce late payments. Because these payments post directly into ECC’s financial modules, the business benefits from faster reconciliation and more reliable data. In short, embedded payments make ECC smarter, faster, and easier to use.

Common Challenges in Automating Payments

Of course, automation doesn’t come without challenges. ECC’s complex architecture can make integration tricky, and not all payment methods are supported natively. Data quality issues—like duplicate records or outdated customer information—can also create hiccups when payments start flowing automatically.

Security is another concern. Handling payment data inside an older ERP system can feel risky if safeguards aren’t in place. That’s why choosing the right integration and payment processing solution matters. Without careful planning, businesses risk trading one set of problems for another.

Best Practices for Transitioning to Automation

To make SAP ECC payment integration successful, preparation and planning go a long way. Here are a few best practices to keep in mind:

- Clean your financial data: Remove duplicates, update records, and make sure everything is consistent before turning on automation.

- Test end-to-end workflows: Run sample transactions to confirm payments post correctly into accounts receivable and the general ledger.

- Train your teams: Both finance and IT staff should understand not just how the system works, but why automation matters.

- Monitor and adjust: Use reporting tools to spot issues early and be ready to tweak processes as your business grows.

Taken together, these best practices create a smoother transition. They don’t just reduce risk —they give your team confidence that the system will keep pace with your needs.

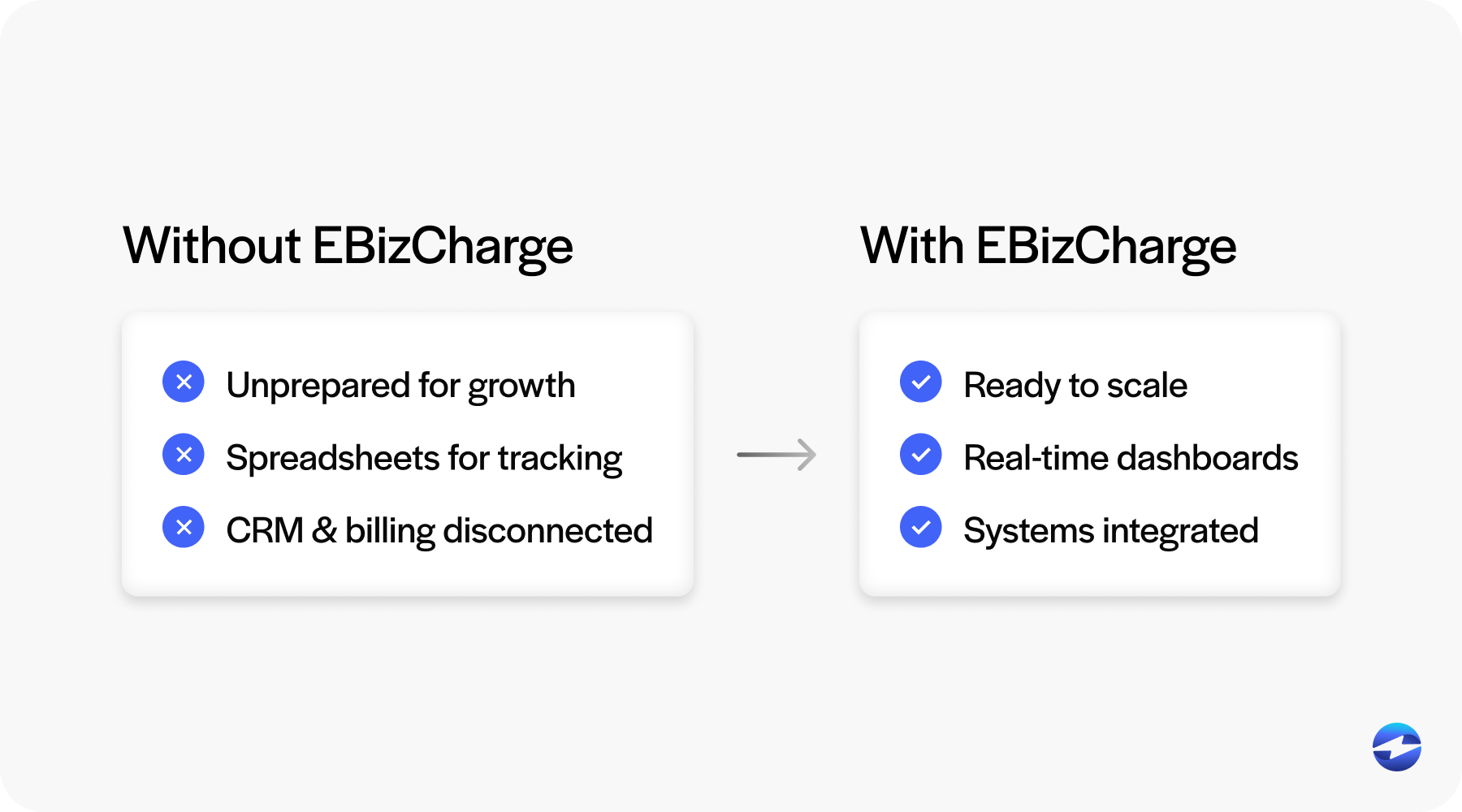

Why Consider Third-Party Payment Processors like EBizCharge

While ECC provides the foundation, most businesses find they need outside help to modernize payments. This is where a third-party payment processor like EBizCharge comes in. EBizCharge connects directly to SAP ECC financial modules, automating posting into accounts receivable and the general ledger. This removes manual entry and keeps your records accurate.

It also brings features ECC doesn’t have out of the box. Customer portals allow for online invoice payments, and advanced reporting tools give finance teams more visibility into trends. Because EBizCharge is a scalable payment solution, it can handle growing volumes without slowing down. For businesses still running on ECC, pairing it with a trusted third-party tool is often the most practical path forward.

From Manual Work to Automated Confidence

Moving from manual processes to automation is a big step, but it’s one worth taking. Automated workflows save time, reduce errors, and improve both compliance and customer satisfaction. Embedded payments take it further, making ECC a hub for accurate, real-time financial data.

The key is thoughtful SAP ECC integration. With the right preparation and the support of a strong payment processor, automation becomes less intimidating and more like an opportunity. Whether you’re just starting with SAP ECC automation or considering new integrations, now is the time to invest. Start small, plan carefully, and lean on proven tools like SAP billing software and trusted third-party payment processing providers to build a smoother, more reliable future for your business.

Summary

- Manual Payment Workflows in SAP ECC

- Benefits of Automating Payment Workflows

- Key Technologies for Payment Automation

- Embedded Payments in SAP ECC

- Common Challenges in Automating Payments

- Best Practices for Transitioning to Automation

- Why Consider Third-Party Payment Processors like EBizCharge

- From Manual Work to Automated Confidence