Blog > Epicor Payment Exchange: Features, Limitations, and Alternatives

Epicor Payment Exchange: Features, Limitations, and Alternatives

Payments are a critical part of any business operation, and how they’re managed inside your ERP system can make a huge difference in efficiency and accuracy. For companies running on Epicor ERP, Epicor Payment Exchange (EPX) was created as a built-in way to process payments directly within the system. On the surface, it offers convenience and native compatibility. But like any tool, it has strengths, limitations, and competitors worth considering.

This guide takes a closer look at EPX: what it does, where it fits best, and why alternatives such as EBizCharge might be a better match for businesses that need more from their payment processing solution. Along the way, we’ll also highlight what to think about before committing to any Epicor integration.

What is Epicor Payment Exchange (EPX)?

At its core, Epicor Payment Exchange is Epicor’s own payment processor, designed to connect directly with Epicor ERP software. Businesses use it to accept credit cards, ACH transfers, and other basic payment types. Because it ties into the Epicor system, payments can be recorded automatically, cutting down on manual entry and reducing errors.

The idea is simple: keep payments inside the ERP environment rather than pushing them through external platforms. For organizations that already rely heavily on Epicor software, that tight link can feel seamless.

EPX was built to meet the demand from businesses that wanted everything in one place. By embedding payments within the Epicor ERP system, companies avoid juggling multiple providers or doing complicated imports and exports just to balance their books.

Key Features of Epicor Payment Exchange

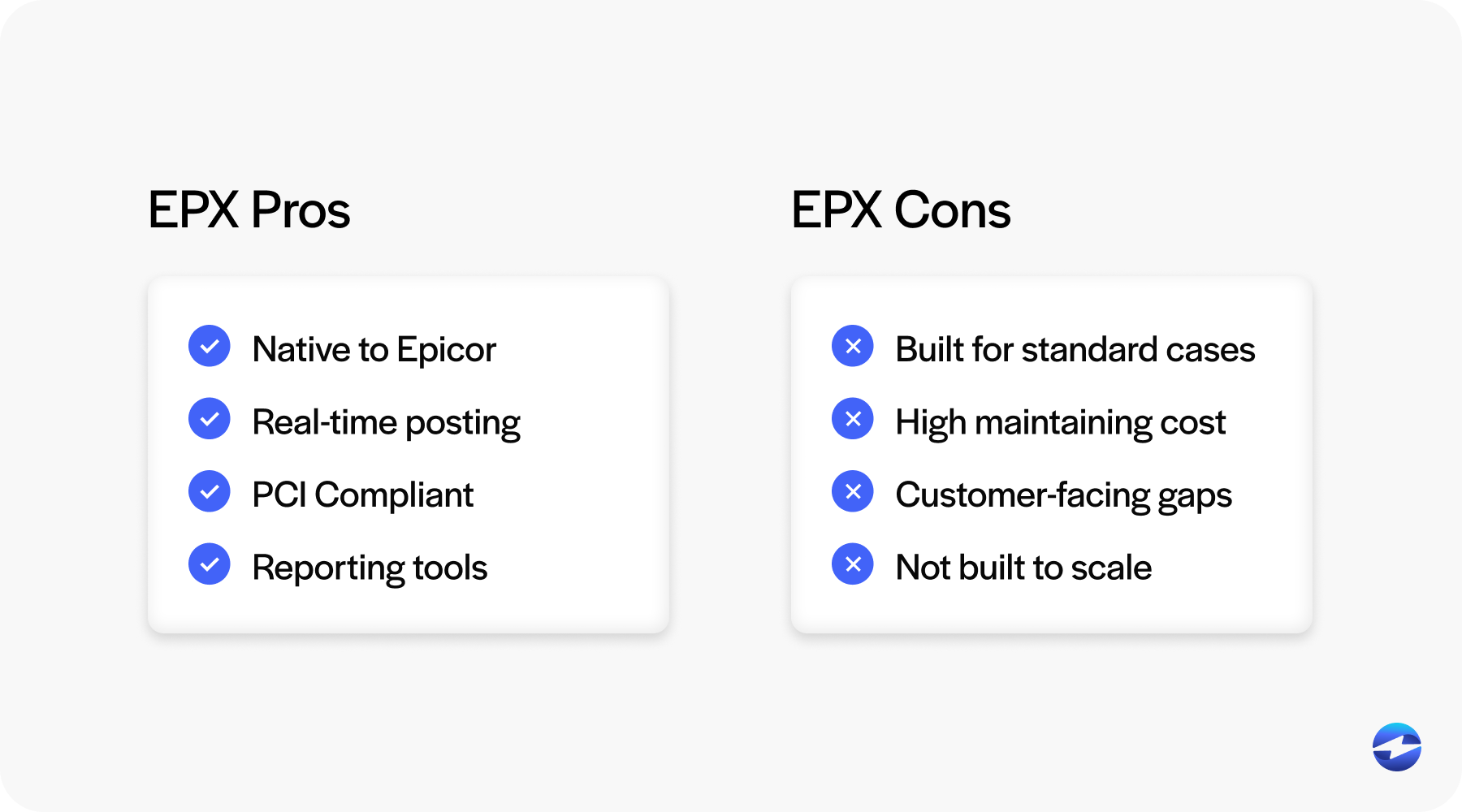

EPX comes with a few standout features that make it appealing to many users:

- Native Epicor integration. Because EPX was built for the Epicor ERP system, it fits directly into existing workflows with minimal setup.

- Real-time posting. Transactions processed through EPX can be logged instantly in the financial modules of Epicor ERP, making reconciliation smoother.

- Security and compliance. EPX includes PCI compliance measures and encryption to help protect sensitive payment data.

- Reporting tools. Businesses can track payments, settlements, and reconciliation inside their ERP.

Another subtle benefit is how much EPX reduces the learning curve. Staff who already know the Epicor ERP software environment don’t have to learn a new third-party interface. Everything happens within the screens they already use. For smaller teams or those without dedicated IT support, that ease of use can be a real advantage.

Limitations of Epicor Payment Exchange

While EPX has its place, it’s not without drawbacks. Some of the more common issues businesses encounter include:

- Flexibility limits. EPX is built for standard use cases. Companies with unique workflows or specialized billing models may find it restrictive.

- Cost concerns. Depending on transaction volume and fee structures, EPX may not be the most affordable payment processing solution compared to competitors.

- Customer-facing gaps. EPX doesn’t offer much in terms of payment portals, self-service options, or advanced analytics that many modern businesses now expect.

- Scaling challenges. As companies grow and their transaction needs expand, EPX sometimes struggles to keep up. Larger organizations may outgrow it faster than expected.

Another limitation worth noting is support. While Epicor provides assistance, some businesses feel that specialized third-party payment processors offer more personalized customer service and quicker response times. When payments are on the line, even small delays in support can create big frustrations.

When EPX Works Best

EPX tends to be a good fit when simplicity is the top priority. It works especially well for companies already deep into Epicor ERP that want the quickest way to add payment without much extra setup. Organizations with relatively straightforward payment requirements also benefit, since EPX handles the basics reliably. It also appeals to teams that prioritize internal efficiency and don’t need more advanced customer-facing features.

For these businesses, EPX does what it promises: keeps payment activity within the Epicor system and reduces the need for extra moving parts. It’s a “plug-and-play” option for those who don’t want to think too much about payments beyond getting them posted and reconciled.

However, once your company starts to need more flexibility, better insights, or stronger customer experiences, EPX starts to show its limits. That’s usually when businesses begin to evaluate other tools that connect with Epicor ERP software but go further.

Alternatives to Epicor Payment Exchange

Many businesses turn to third-party payment processors as an alternative to EPX. These options bring in added functionality and sometimes better pricing while still maintaining strong Epicor integration. A common example is EBizCharge, which connects directly into the Epicor ERP system while adding features EPX doesn’t provide.

Some of the advantages of using a third-party include:

- Lower transaction costs in some cases.

- Customer portals where clients can pay invoices online 24/7.

- Advanced reporting and analytics tools for finance teams.

- More scalability for businesses processing higher volumes of transactions.

Third-party providers also tend to innovate more quickly. While EPX offers a steady, consistent toolset, companies like EBizCharge evolve their platforms to keep up with changing technology and customer expectations. This pace of innovation can be an advantage for businesses that want to stay ahead.

Choosing the Right Payment Integration for Epicor

Deciding which payment path to take inside Epicor ERP software comes down to weighing your needs against what each solution offers. Important factors include:

- Cost: How do transaction fees and monthly costs compare between EPX and third-party providers?

- Features: Do you need customer-facing tools, advanced analytics, or just the basics?

- Scalability: Can the solution grow with your business, or will you outgrow it in a few years?

- Support: Does the payment processor offer strong customer service and technical support?

Beyond these basics, consider your company’s strategic goals. If customer experience is becoming a bigger focus, you may want to prioritize providers with portals and self-service tools. If cost reduction is critical, compare the fee structures closely. If scalability is your concern, ensure the solution can comfortably handle tomorrow’s transaction volume, not just today’s.

Piloting an integration before rolling it out broadly is another smart move. Testing ensures the tool works smoothly with the rest of your Epicor ERP system and gives your team confidence before you decide to implement the integration.

EBizCharge: A Strong EPX Alternative

EBizCharge stands out as a particularly strong alternative to EPX. It brings its own Epicor integration, offering all the reliability of Epicor’s native tools while adding features that modern businesses expect—like customer portals, real-time reporting, and stronger scalability. For companies using Epicor ERP software, EBizCharge provides a way to keep payments tightly tied to your ERP while also cutting costs and giving customers a smoother experience.

What sets EBizCharge apart is its ability to modernize payment workflows without disrupting the familiar Epicor software environment. Teams get automation, security, and scalability, while customers get convenience and choice. It’s a balance that many businesses find more sustainable than relying solely on EPX.

Ultimately, EPX works best for businesses that want simplicity and native compatibility. But if you’re looking for a more flexible payment processing solution that grows with your needs, exploring third-party payment processors like EBizCharge is a smart move. Choosing the right tool isn’t just about payments—it’s about building a stronger, more efficient financial backbone for your Epicor ERP system.