Blog > SAP Payment Portal: Implementation and Customer Experience Optimization

SAP Payment Portal: Implementation and Customer Experience Optimization

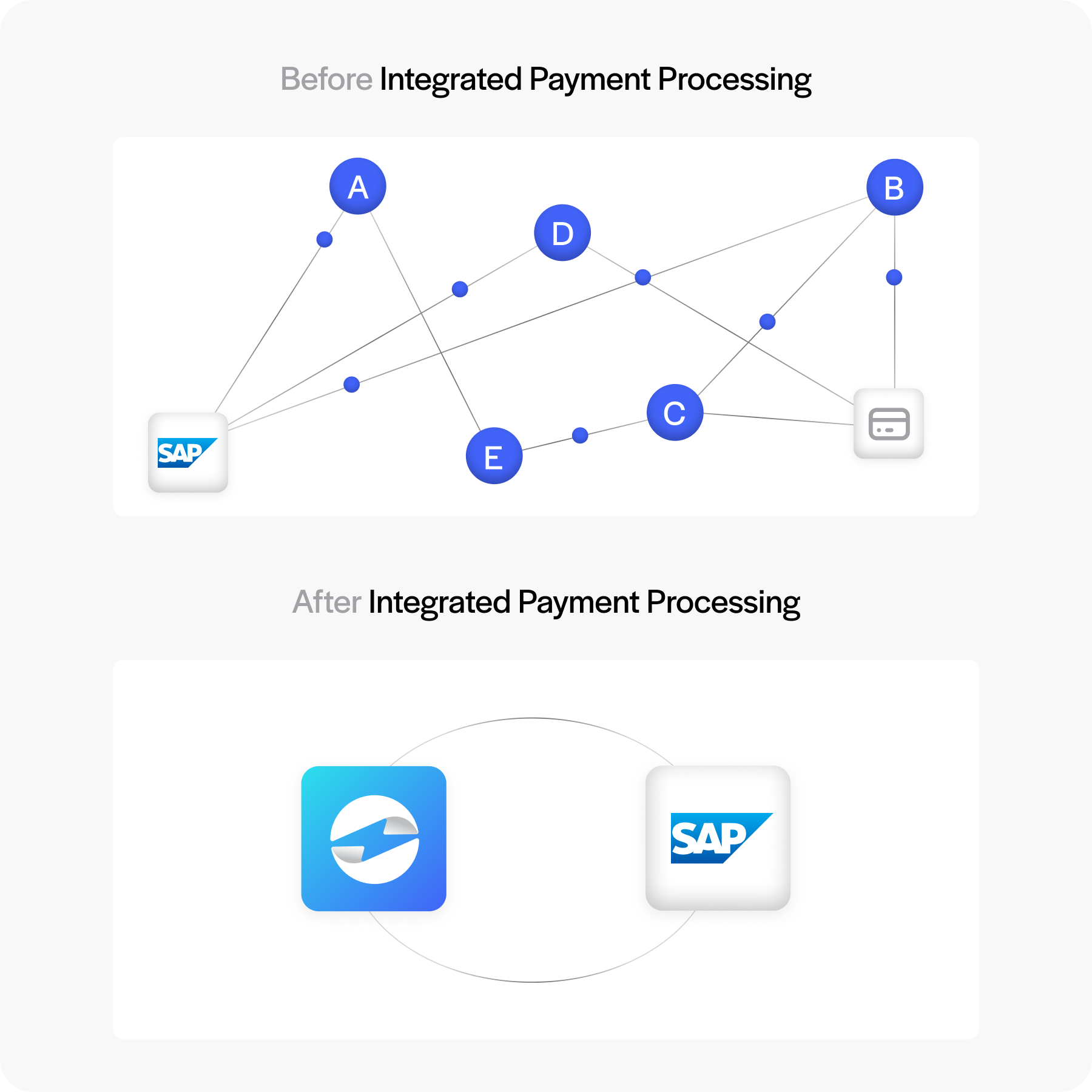

For many businesses, getting paid on time is a constant challenge. Traditional payment processes—like mailing checks, taking card details over the phone, or manually entering payments into systems—are slow and prone to mistakes. They frustrate customers, drain staff time, and delay cash flow. If you’ve ever felt stuck chasing invoices or reconciling payments at the end of a long week, you’re not alone.

This is where the SAP payment portal comes in. By offering customers a self-service way to pay online, companies can modernize their workflows while making life easier for clients. A portal ties directly into SAP billing and financial modules, giving businesses a secure, connected way to handle transactions.

This guide will explore how an SAP payment portal works, how to implement one, and the best ways to optimize the customer experience.

Why Businesses Need an SAP Payment Portal

Delayed collections create stress for finance teams and disrupt cash flow. High accounts receivable (AR) workloads also mean staff spend more time on repetitive tasks like sending reminders or keying in payments, instead of focusing on strategy. Without a digital solution, customers are stuck with limited SAP payment methods, often leaving them with little flexibility.

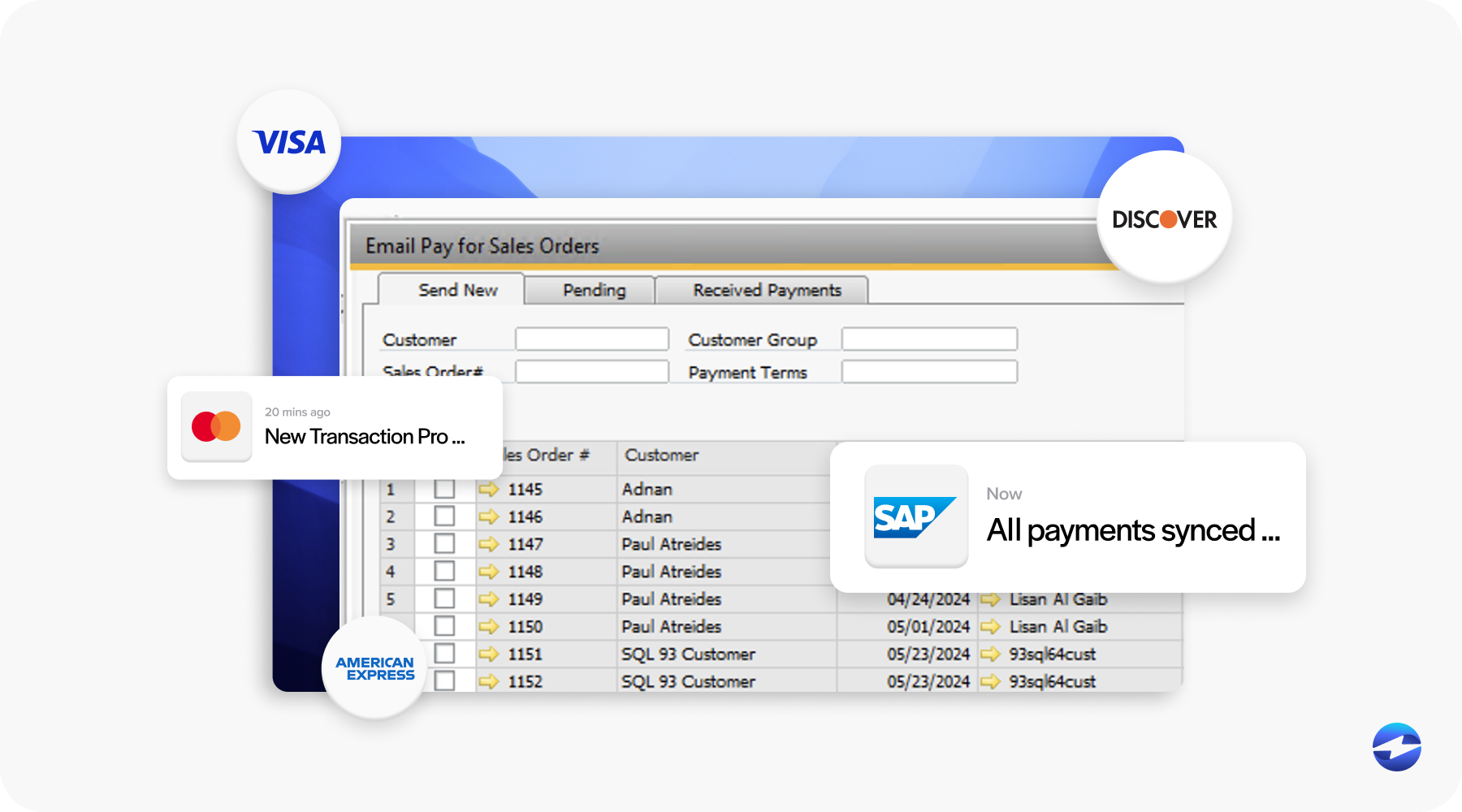

A modern payment portal fixes these issues by providing customers with an accessible, 24/7 option to view invoices and make payments. Instead of waiting for office hours or mailing checks, customers can pay online whenever it’s convenient for them. For the business, this translates into faster collections, reduced AR overhead, and a more professional customer experience.

How SAP Payment Portals Work

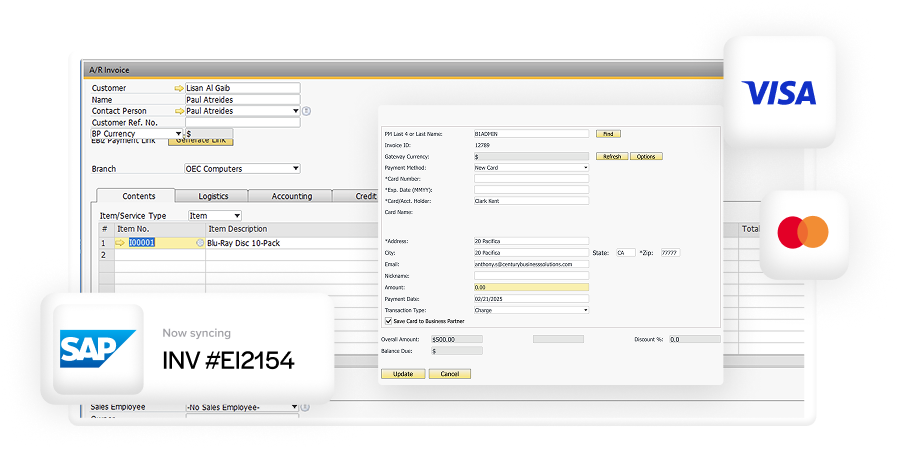

An SAP payment portal is essentially a digital bridge between your ERP and your customers. Customers log in, view outstanding invoices, and submit payments securely. Those payments are then processed through a payment processor and automatically posted back into SAP. This means invoices, accounts receivable, and general ledger updates happen in real time without manual entry.

Portals usually include features like invoice history, downloadable receipts, and customer dashboards. For AR teams, this eliminates countless follow-up calls and emails. For customers, it’s a simple, straightforward way to pay that reduces friction and delays.

Building Blocks of an Effective SAP Payment Portal

A good portal isn’t just a place to pay—it’s designed with both security and usability in mind.

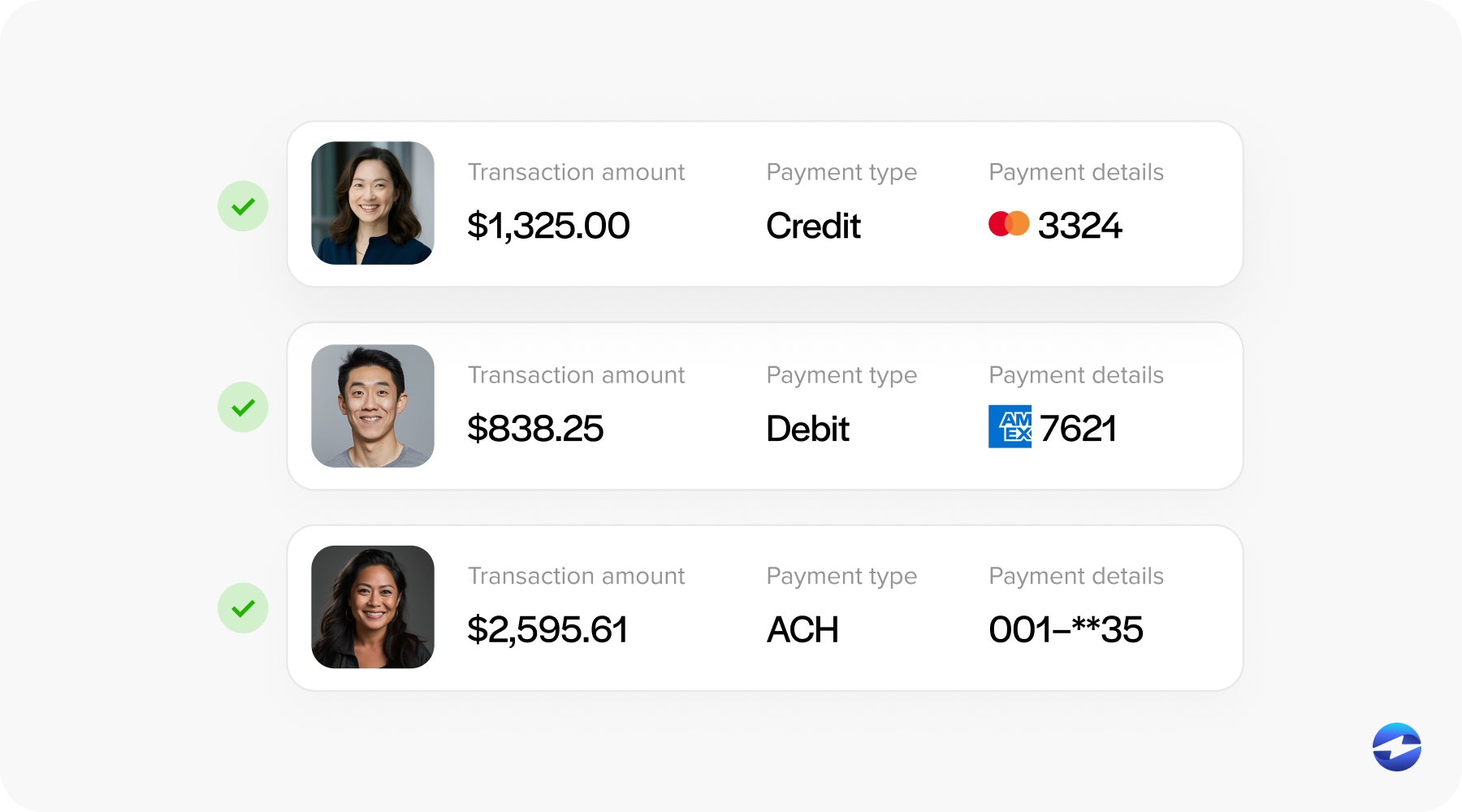

- Payment flexibility: Customers expect choices. The portal should support credit cards, ACH, digital wallets, and even cross-border payments. This makes it easy for clients to use their preferred SAP payment methods.

- Security by design: PCI-compliant tools like tokenization and fraud detection are essential for any SAP payment processing setup. Customers need to feel confident that their data is safe.

- Integration with SAP billing: Payments should post directly into accounts receivable and the general ledger, making SAP billing software more accurate and reducing reconciliation work.

- Accessibility: A mobile-friendly, intuitive design ensures customers can make payments from any device without confusion or delays.

Together, these features make a portal both functional and customer-friendly.

Steps to Implement an SAP Payment Portal

Getting a portal up and running doesn’t happen overnight, but breaking it into steps makes the process manageable.

- Prepare your environment: Ensure you have the correct SAP modules, licenses, and IT infrastructure to support a portal.

- Design and configure: Customize branding, set up customer login access, and link your portal with existing SAP billing workflows.

- Choose a payment processor: Decide whether to use SAP’s native tools or work with a third-party payment processor. Evaluate options based on cost, scalability, customer support, and security. The right payment processing solution should grow with your business.

- Pilot and launch: Always test with sample transactions. Check that payments flow into accounts receivable and the general ledger correctly and gather customer feedback. Some companies prefer a phased rollout, while others go live simultaneously—it depends on your risk tolerance and team readiness.

By following these steps, businesses can ensure their SAP payment gateway integration runs smoothly from day one.

Enhancing the Customer Experience

A portal isn’t just about technology—it’s about creating a positive payment experience. Customers should find the process fast, intuitive, and transparent.

- Keep it simple. The interface should be easy to navigate without training.

- Offer confirmations. Immediate receipts give customers peace of mind.

- Use reminders. Email or text alerts help reduce late payments.

- Support multiple channels. Provide options for customer service—chat, phone, or email—so users can get help if needed.

- Review feedback regularly. Ask customers about their experience and adjust accordingly.

When done right, a payment portal becomes more than a tool—it strengthens relationships and builds trust.

EBizCharge as an SAP Payment Portal Solution

While SAP’s built-in features provide a foundation, many businesses choose to enhance their system with a third-party payment processor like EBizCharge. This solution integrates directly with SAP, eliminating duplicate data entry and ensuring payments post instantly to accounts receivable and the general ledger.

EBizCharge also offers secure, customer-friendly portals where clients can pay invoices online anytime. Lower processing costs are another benefit, along with advanced reporting tools that give finance teams more visibility into payment trends. For companies using SAP billing software, EBizCharge makes collections faster, easier, and more cost-effective.

As a scalable payment processing solution, EBizCharge grows with your business. Whether you’re managing a few dozen transactions a month or thousands daily, it provides the stability and flexibility you need.

Optimizing SAP Payment Portal

The way your customers pay says a lot about your business. Clunky, outdated systems send the wrong message. A streamlined SAP payment portal not only accelerates collections but also improves the customer experience from start to finish.

By preparing properly, choosing the right payment processor, and focusing on usability, businesses can unlock the full value of SAP payment processing. Adding a solution like EBizCharge makes the system even stronger, combining SAP’s power with user-friendly tools designed for today’s needs.

For finance teams tired of chasing payments, now is the time to act. Modernize your SAP payment process, improve cash flow, and give customers the seamless experience they’ve come to expect.