Blog > Sage 500 Payment Processing: Enterprise-Level Integration

Sage 500 Payment Processing: Enterprise-Level Integration

Large organizations have a lot of moving parts. When it comes to getting paid, a single delay can ripple across payroll, vendors, and long-term planning. That’s why efficient payment handling is more than an administrative detail—it’s central to financial stability. Too often, though, enterprise-scale businesses get stuck with disconnected systems or manual processes that slow everything down.

This is where Sage 500 payment processing can play an important role. Instead of treating billing and payments as two separate workflows, Sage 500 ties them together, giving enterprises a consistent way to manage collections, reconcile accounts, and report on financial health.

This article will walk through how Sage 500 handles payment processing, its core features, how to set it up, and why integrating tools like EBizCharge can make an already strong payment solution even better.

Understanding Sage 500 Payment Processing

Sage 500 is an enterpirse resource planning (ERP) system built for larger organizations that need robust financial management, distribution, and manufacturing functionality. Within this ecosystem, payment processing isn’t a bolt-on—it’s an integrated function that works with your existing modules. This means your accounts receivable (AR), general ledger (GL), and order management all stay aligned without extra steps.

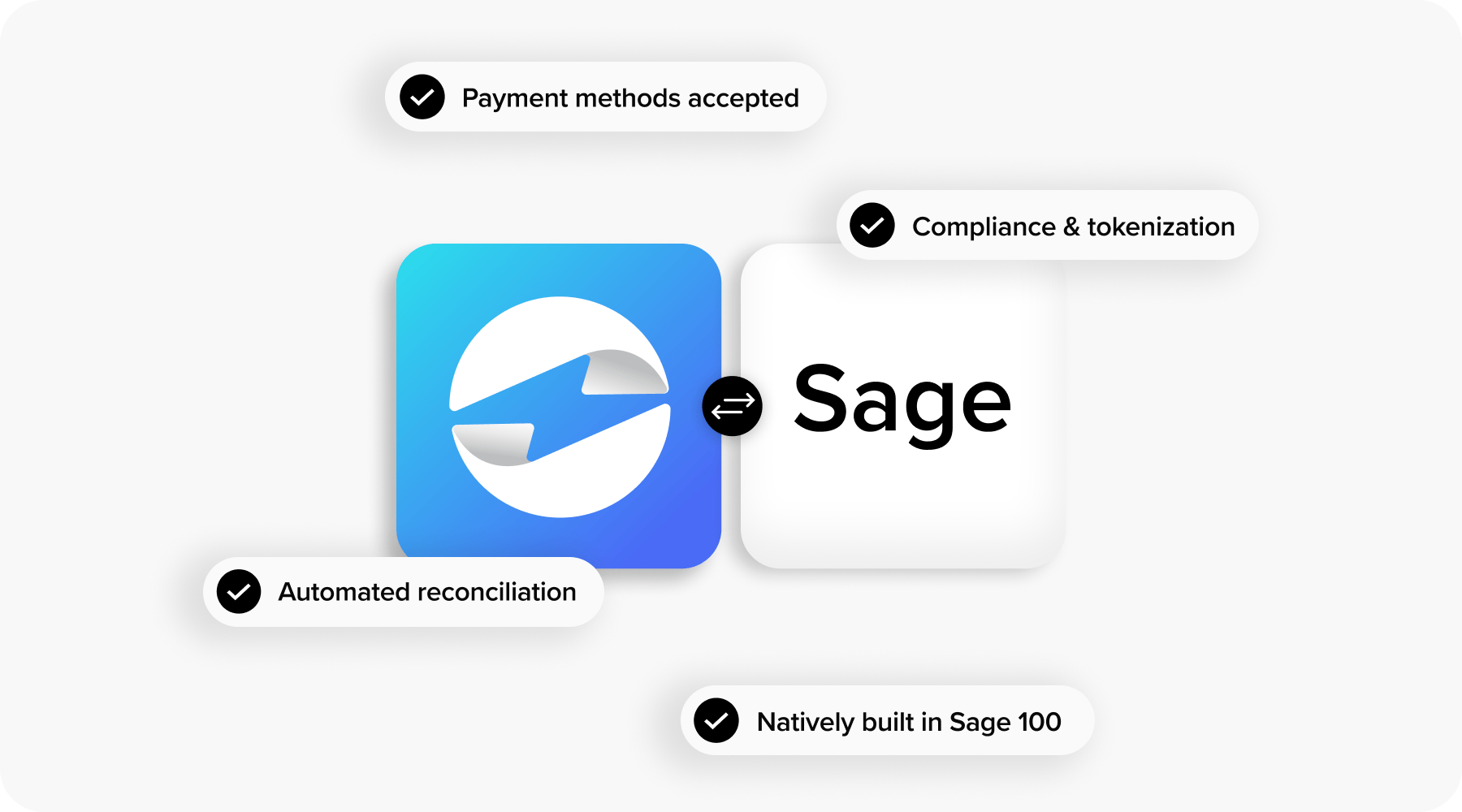

Having Sage 500 payment solutions inside the ERP saves time and reduces errors compared to relying solely on external tools. While third-party systems can work, they often create additional reconciliation steps or require batch imports. By contrast, Sage 500 payment processing ensures data consistency from the moment a customer makes a payment through to financial reporting.

For enterprise users, this integration reduces risk, improves accuracy, and supports scale. You don’t have to worry about whether a third-party integration will break after an update—payments live within the ERP framework you already depend on.

Core Features of Sage 500 Payment Processing

Let’s look at what Sage 500 offers when it comes to core functionality.

Multiple Payment Methods

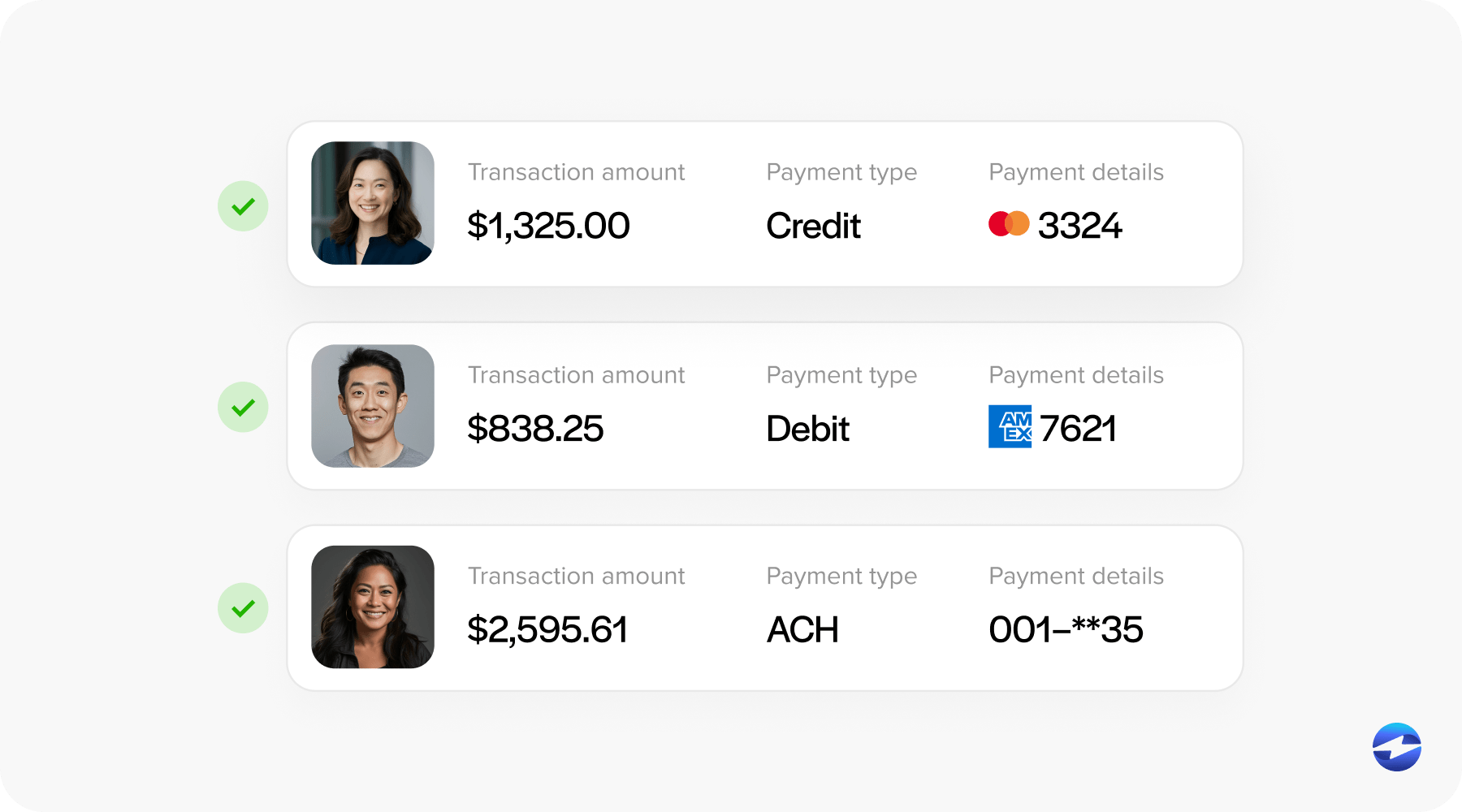

Modern enterprises deal with diverse customers, so flexibility matters. Sage 500 payment solutions support credit cards, ACH transfers, and recurring transactions. That flexibility helps businesses meet customer expectations while standardizing how payments are collected and tracked.

Integration with Sage 500 Modules

Because payments tie directly into Sage 500’s AR, GL, and order management modules, you get real-time updates. When a payment is made, invoices and account balances update automatically. This reduces manual work and ensures that financial reports are accurate at any given moment.

Security and Compliance

Payment security can’t be an afterthought at the enterprise level. Sage 500 supports Payment Card Industry (PCI) compliance, uses encryption, and provides fraud detection tools to help safeguard both the business and its customers. These measures make Sage 500 payment processing a safer payment processing solution than patchwork approaches.

Reporting and Analytics

Enterprises need visibility at both a high and granular level. Sage 500 offers transaction-level detail, reconciliation tools, and audit support. Finance teams can dive into specific payments or view overall trends, making it easier to forecast and plan.

Sage Payment Gateway and EBizCharge Integration

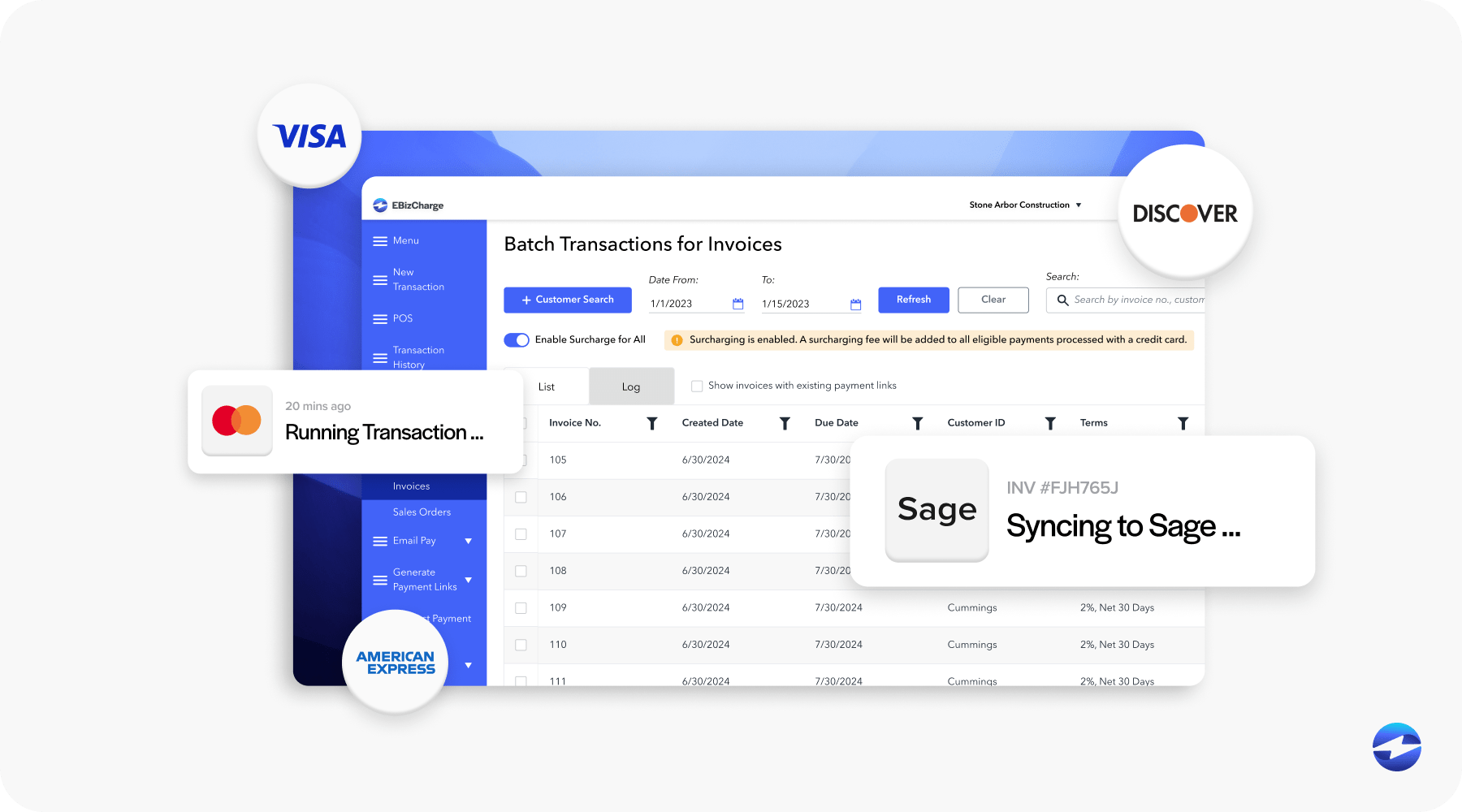

The Sage payment gateway is the built-in connection point that lets Sage 500 process payments efficiently. However, many enterprises enhance this by integrating with EBizCharge. This top-rated payment solution adds benefits like faster funding, lower fees, and a secure customer portal. In practice, this means customers have more ways to pay while finance teams spend less time chasing collections.

Setting Up Payment Processing in Sage 500

Configuration can seem intimidating, but it doesn’t have to be. Setting up Sage 500 payment solutions is straightforward when approached step by step.

Prerequisites

Before anything else, verify that your version of Sage 500 supports payment modules and meets system requirements. Not all builds have the same options, so it’s important to confirm compatibility first.

Enabling Payment Functions

Within Sage 500, activate the payment processing modules. This is where you connect Sage billing software with payment functionality, allowing invoices to carry live payment options.

Connecting to a Payment Processor

Next, connect your Sage ERP to a payment processor. This is where the Sage payment gateway comes in. If you opt for EBizCharge as your processor, integration steps are clearly defined and built to work within Sage 500 without complex third-party integration headaches. This allows you to manage every Sage payment directly within the ERP.

Testing Transactions

Finally, run test transactions. Process a few credit card and ACH payments to confirm they post correctly to AR and GL. Testing ensures your payment solution works as expected before you go live, saving your team time and stress later.

Best Practices for Enterprise-Level Payment Workflows

Once Sage 500 is configured, good practices help keep processes efficient and reliable.

- Automate recurring billing: Take advantage of built-in features for subscriptions or repeat customers.

- Send reminders: Automated payment reminders reduce late payments without adding staff workload.

- Maintain clean data: Accurate customer and invoice records keep reconciliation straightforward.

- Review security regularly: Schedule audits of your Sage billing and payment processes to ensure compliance.

Train staff across departments: Payment workflows touch AR, sales, and sometimes customer service. Everyone should understand how Sage 500 payment processing works so they can help resolve issues quickly.

Benefits of Integrating EBizCharge with Sage 500

While Sage 500 payment processing is strong on its own, integrating with EBizCharge provides measurable advantages.

- Seamless workflow: Payments happen inside Sage 500 without requiring external logins.

- Lower processing costs: Many enterprises find that EBizCharge reduces transaction fees compared to traditional processors.

- Customer convenience: A secure payment portal improves customer satisfaction and encourages faster payment.

- Enhanced reporting: With detailed data stored directly in Sage 500, reconciliation and month-end close become less stressful.

In short, pairing Sage 500 with EBizCharge creates a more efficient and cost-effective payment processing solution that supports enterprise needs.

Driving Efficiency and Accuracy with Sage 500 Payments

Enterprises can’t afford inefficiency in how they get paid. Sage 500 payment processing brings billing, payments, and reporting under one roof, reducing errors and cutting down on manual work. When paired with EBizCharge, it transforms into a more powerful Sage 500 payment solution—one that lowers costs, improves accuracy, and enhances the customer experience.

If you’re already running Sage 500, adopting these tools and best practices means fewer delays, fewer errors, and more predictable cash flow. For finance leaders managing at scale, this combination is a reliable payment solution that balances security, flexibility, and convenience without relying on fragile third-party integration paths.