Blog > Hidden Sage 100 Payment Features You’re Probably Not Using

Hidden Sage 100 Payment Features You’re Probably Not Using

What if Sage 100 could handle more than you think? Most users never unlock the full payment features already built into their ERP.

If you’ve been using Sage 100 for a while, you’ve probably settled into familiar routines for handling payments. You create invoices, take payments however you can, and do your best to keep things organized. If that process still includes manual entry, jumping between systems, or constantly updating records after the fact, there might be a better way. Many Sage 100 users fall into this rhythm. It works, and changing anything can feel like a hassle. Over time, the small inefficiencies will add up. When you’re the one doing the work, the difference between “it works” and “it works well” can really matter.

EBizCharge offers a way to simplify your payment workflow without making you change how you use Sage 100. It installs directly into the system, so your team can use the same screens they already know. The difference is, you’ll suddenly be able to process payments, update records, and reconcile faster, all inside of Sage.

This guide walks through seven features built into the EBizCharge integration that many Sage 100 users aren’t using to their full potential.

- Take Payments Without Leaving Sage 100

- Saved Customer Payment Cards for Future Use

- Hosted Checkout Pages (“Pay Now” Buttons on Your Site)

- Self-Service Invoice Payments via Email and Customer Portal

- Mobile Payment Processing On-the-Go

- Custom Reporting and Analytics for Payments

- Advanced Security Measures & Unlimited Support

If you’re a controller, AR lead, bookkeeper, or Sage admin, these tools can help you speed up collections, reduce errors, and eliminate a lot of the repetitive busy work that slows teams down. The best part? You don’t have to overhaul your process. Just make better use of the tools already built into your ERP.

Full feature comparison overview

| Feature | EBizCharge | Nuvei | Repay | VersaPay | BlueSnap | Authorize.net |

|---|---|---|---|---|---|---|

| Native Sage 100 Integration | ✅ Deep, out-of-the-box | ✅ Built-in | ✅ Built-in | ❌ Requires APIs | ❌ Custom setup | ❌ No native integration |

| Embedded Payment Entry (SO, Invoice, Cash Receipts) | ✅ Full in-Sage entry | ✅ | ✅ | ❌ | ❌ | ❌ |

| Automatic AR & GL Posting | ✅ Real-time sync | ✅ | ✅ | ⚠️ Delayed/manual | ⚠️ Requires setup | ❌ |

| Saved Cards (Tokenized) | ✅ In-Sage w/ request link | ✅ | ✅ | ⚠️ Only in portal | ❌ Not in Sage | ⚠️ External only |

| Hosted “Pay Now” Links | ✅ No-code, branded | ✅ | ✅ | ⚠️ Complex setup | ⚠️ Requires dev | ⚠️ Not native |

| Customer Payment Portal | ✅ Integrated & branded | ✅ | ✅ | ✅ External | ✅ External | ❌ |

| Mobile Payments (Field App) | ✅ Sage-connected mobile app | ⚠️ Via 3rd party | ⚠️ Via 3rd party | ❌ | ❌ | ❌ |

| Custom Reporting in Sage 100 | ✅ Built-in w/ filters | ⚠️ External portal | ⚠️ External portal | ❌ Dashboard only | ❌ | ❌ |

| PCI-Compliant Security | ✅ Tokenized, off-site vault | ✅ | ✅ | ✅ | ✅ | ✅ |

| In-House Support (Sage-specific) | ✅ Full install + training | ⚠️ Often through resellers | ⚠️ Partner-dependent | ❌ Generic support | ❌ Generic support | ❌ No Sage help |

| Chargeback Management Help | ✅ Included & proactive | ⚠️ Limited | ⚠️ Limited | ❌ | ❌ | ❌ |

1. Take Payments Without Leaving Sage 100

What it does

EBizCharge plugs directly into Sage 100’s core modules, allowing you to accept payments within Sales Order Entry, Invoice Data Entry, and Cash Receipts screens. In other words, you can process customer credit card or ACH payments at the same moment you’re entering an order or posting an invoice, entirely inside Sage 100.

Why it matters

Everything gets easier when payments can be accepted and applied directly inside Sage 100. There’s no need to rekey information into a separate terminal, and no reason to update your records manually after the fact. Each time a payment is processed through EBizCharge, Sage 100 automatically handles the rest. The payment is applied to the right invoice. Accounts Receivable and the General Ledger stay in sync. Your team doesn’t have to lift a finger to make it happen.

That kind of automation removes the risk of human error and eliminates duplicate data entry. It also means your financial records stay up to date in real time, without waiting for someone to clean them up at the end of the day. That’s a big win for anyone managing cash flow, reconciliation, or trying to close the books on time.

How it improves Sage 100 usage

With everything happening inside one system, your team no longer has to bounce between Sage and outside tools just to process a payment. The entire order-to-cash process can be completed without leaving the familiar screens of Sage 100. That alone can reduce friction across departments, helping sales, accounting, and finance all stay on the same page.

It also helps keep operations consistent. There’s less room for miscommunication or delays, and payments are tied to the right invoices from the start. This level of integration makes Sage 100 feel more complete. You’re not stitching together different systems. You’re using Sage the way it was meant to work, with payments built in.

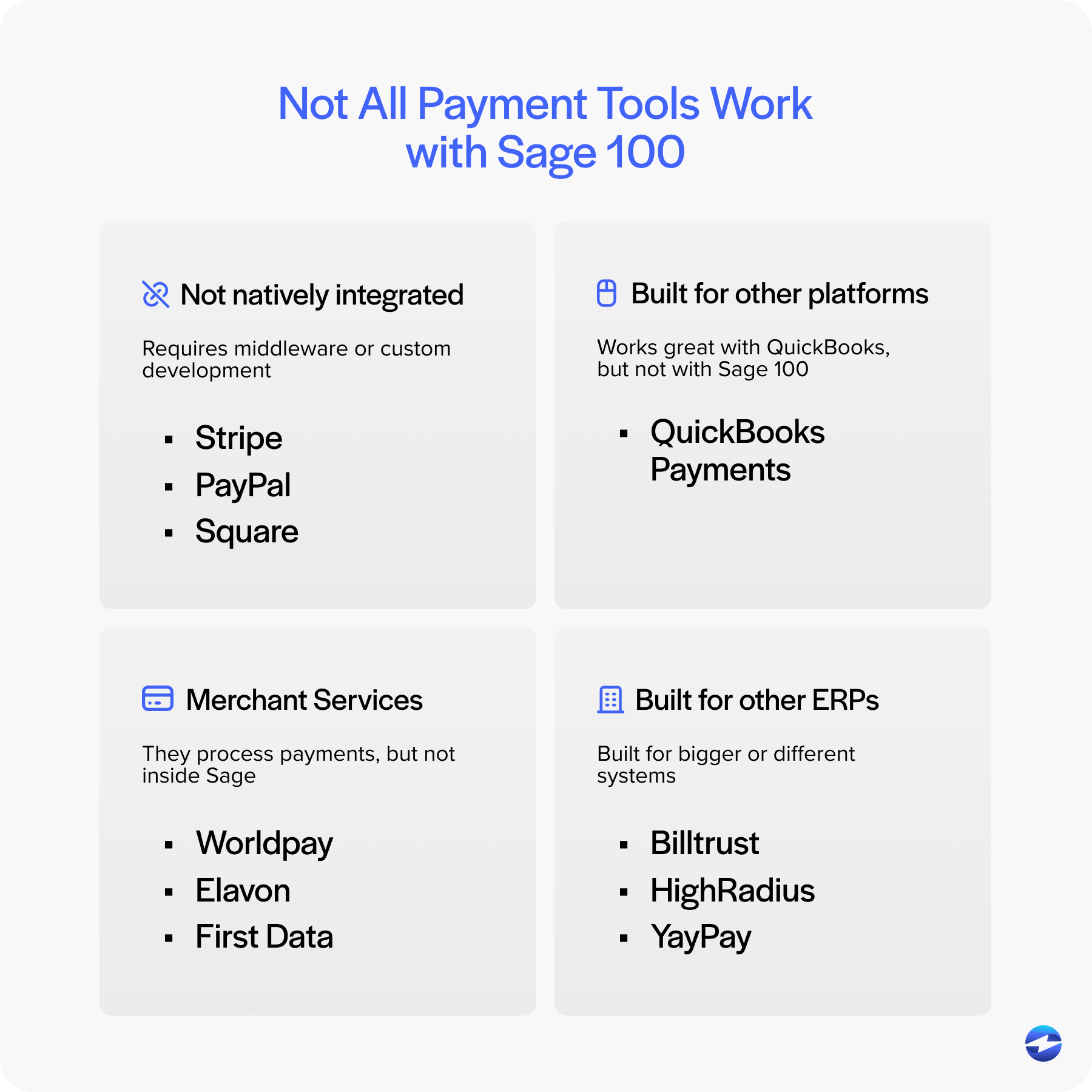

Where others fall short

Some payment tools claim to support Sage 100, but require middleware or custom setups to get basic functionality. VersaPay, BlueSnap, and Authorize.net don’t have a direct connection to Sage 100. Instead, they rely on external portals, file imports, or third-party connectors. That adds extra steps and increases the risk of something falling through the cracks.

Nuvei (formerly Paya) and Repay (formerly APS) do offer better integration with Sage 100, and they cover the core payment screens. Even so, features and workflows can vary between providers. EBizCharge stands out by offering a deeper, more user-friendly connection that doesn’t feel bolted on. Everything happens inside Sage 100 seamlessly and reliably.

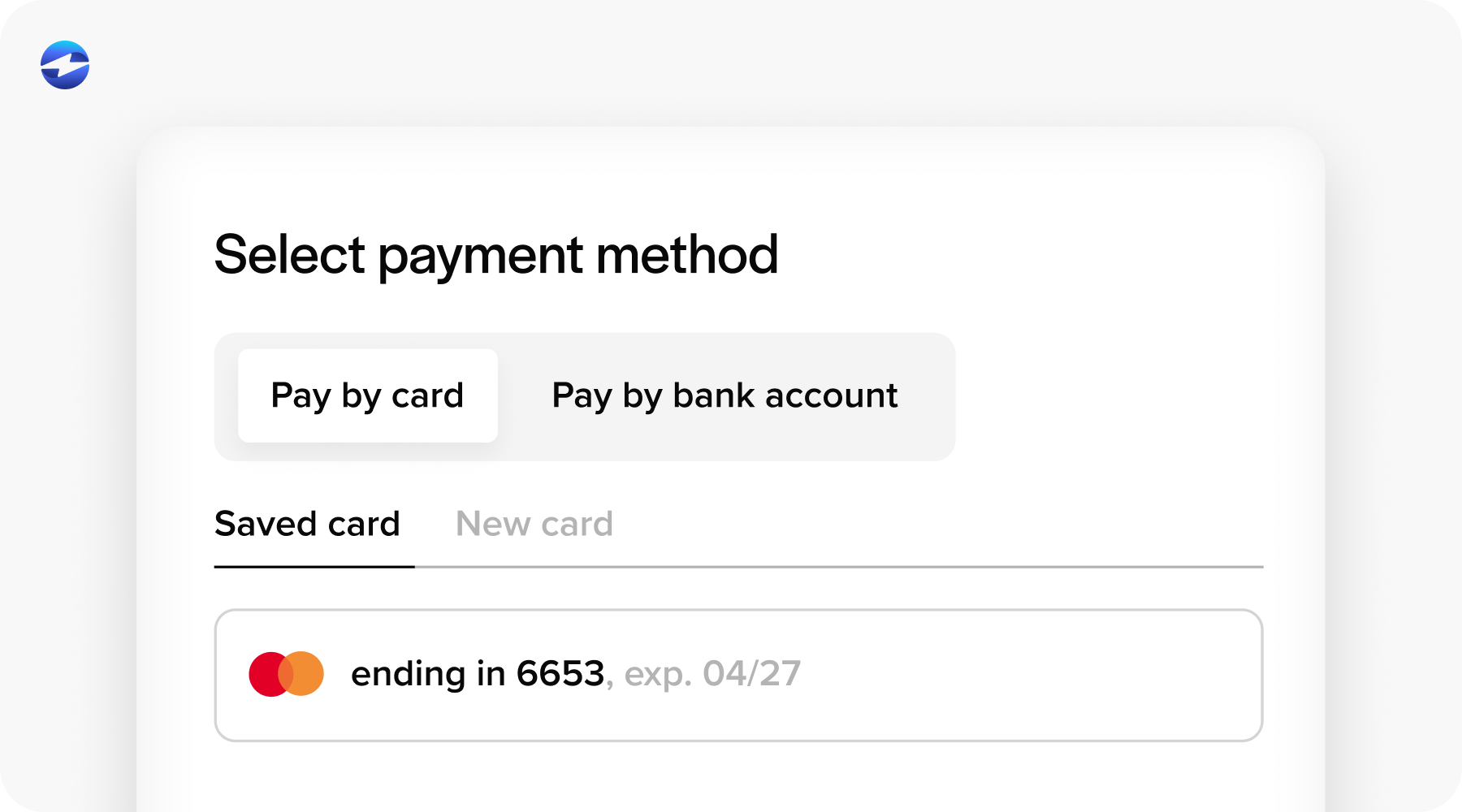

2. Saved Customer Payment Cards for Future Use

What it does

Securely store customers’ credit card or ACH details for convenient reuse on future orders from within Sage 100.

Why it matters

Customers who order from you regularly don’t want to keep reading off their card number every time and your team doesn’t want to keep typing it in either. Saving payment methods makes life easier on both sides. It speeds up repeat transactions, reduces the chance of keying errors, and helps you get paid faster without making customers jump through hoops.

This feature is also a step up for your internal process. When payment info is stored securely, your team doesn’t have to rely on spreadsheets, sticky notes, or unsecured systems just to manage follow-up payments. You keep things running smoothly, without sacrificing security.

How it improves Sage 100 usage

EBizCharge makes this especially simple by keeping everything inside Sage 100. Once a payment method is saved, your team can select it from a dropdown on the payment screen. Behind the scenes, the card or bank account is tokenized and stored safely in EBizCharge’s secure vault. It’s not saved in Sage 100 or your internal servers, which keeps you out of PCI trouble.

There’s even a way to request payment details directly from a customer using a secure link, so you never have to handle their info manually.

Where others fall short

Nuvei and Repay support saved payment methods in Sage 100, but they don’t make it quite as easy to collect them. EBizCharge’s “Request Payment Method” link lets you gather payment info securely without ever touching the data yourself.

Authorize.net does support vaulting, but not inside Sage 100. You’d need a third-party integration to make it work, and it won’t be nearly as smooth.

Other options like VersaPay and BlueSnap store customer data outside of Sage 100 entirely. That means users have to leave the ERP to manage payment methods, which slows down your team and introduces more moving parts than most businesses want to deal with.

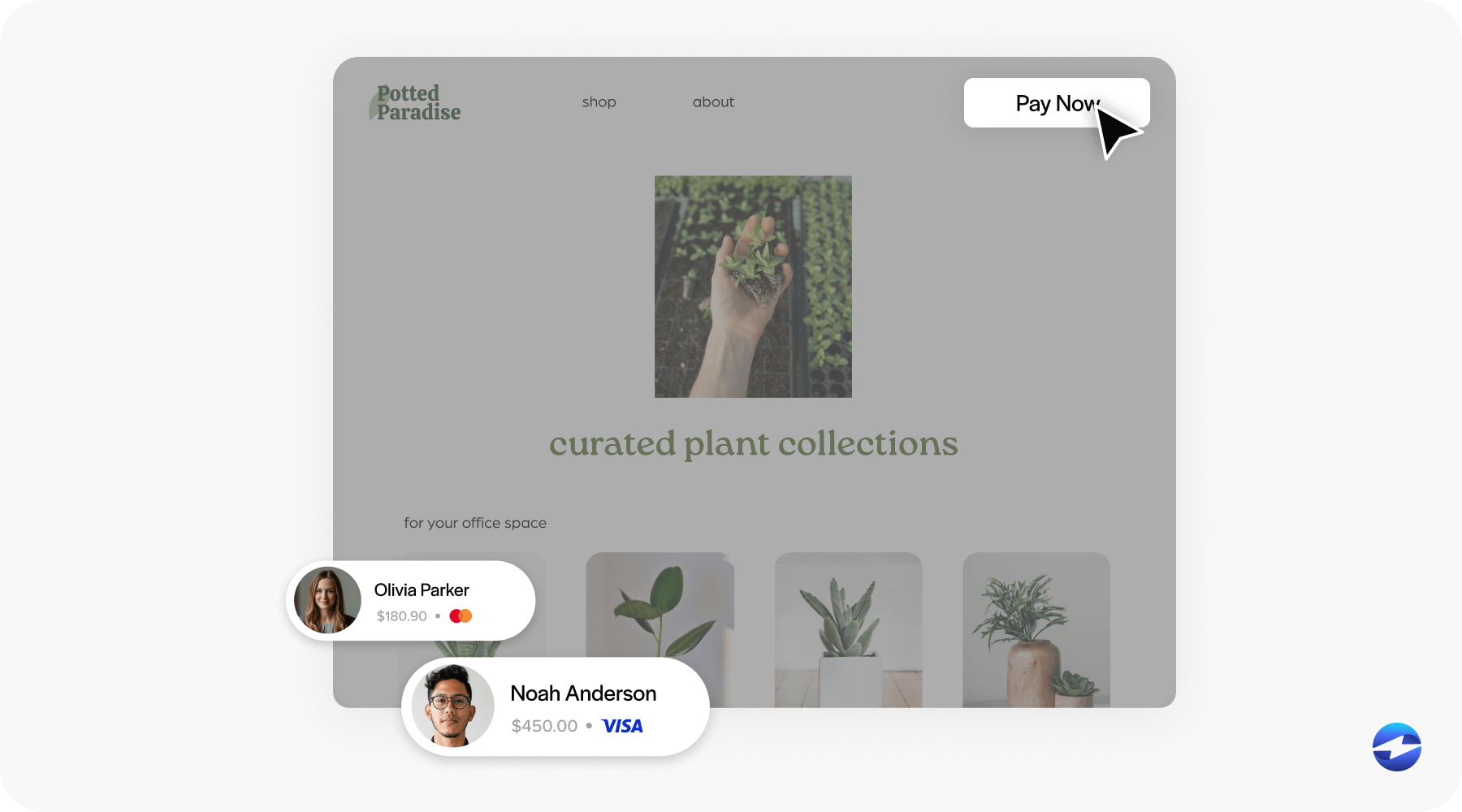

3. Hosted Checkout Pages (“Pay Now” Buttons on Your Site)

What it does:

Add “Pay Now” buttons to your emails or website that link to a secure, EBizCharge-hosted checkout form.

Why it matters

Most Sage 100 users are used to collecting payments the traditional way. That usually means printing invoices, sending emails, waiting on checks, or asking customers to call in their card details. It works, but it’s slow and requires a lot of back-and-forth.

Hosted payment pages change the game. With just a few clicks, your customers can pay invoices online at their convenience. There’s no need to build a custom website or invest in an eCommerce platform. You simply generate a secure link and share it.

For many businesses, this opens up an entirely new payment channel without involving IT or asking customers to jump through hoops. It removes friction from the payment process and encourages faster turnaround.

How it improves Sage 100 usage

The real power of hosted checkout pages is in how well they connect to your existing workflow. Any time a customer makes a payment through one of these links, EBizCharge automatically applies it to the correct invoice in Sage 100. The accounting updates happen instantly behind the scenes. These payments feel just like any other payment processed in Sage 100 because they are. There’s no manual reconciliation. No need to copy payment details from an email or file. Everything posts to your Accounts Receivable and General Ledger automatically, which keeps your records clean and saves your team time.

Where others fall short

Nuvei and Repay both offer similar payment link features, and they both integrate with Sage 100. EBizCharge stands out for ease of setup and branding flexibility.

EBizCharge makes it easy to get started. You can customize the look of the page to match your brand and send out a payment link in seconds. It works whether you’re taking one-time payments or building a self-service payment option into your existing workflow.

Other providers, like VersaPay and BlueSnap, also offer hosted payment pages. The issue is that those platforms don’t operate inside Sage 100. Their systems are separate, which means your team has to jump between tools or rely on file imports to post payments correctly. That slows things down and introduces more room for error.

4. Self-Service Invoice Payments via Email and Customer Portal

What it does

Send one-click payment links via email (Email Pay) or let customers log into a branded portal to view and pay open invoices.

Why It Matters

Chasing payments can slow everything down. You send an invoice, wait for the check, follow up with a call, or maybe send another reminder. It’s not a great use of time.

Self-service tools help you skip all of that. Your customers get the freedom to pay on their terms, whether right after receiving an invoice, over the weekend, or at the end of their day. It’s simple, convenient, and it gets the job done faster.

This kind of flexibility usually leads to quicker payments and less time spent following up. That’s good for your cash flow and even better for your sanity.

How it improves Sage 100 usage

The best part is that all of it happens without your team lifting a finger. When a customer pays through a secure email link or logs into your branded portal, Sage 100 updates automatically. The payment is applied to the right invoice, AR gets updated, and you don’t need to manually touch anything.

Where others fall short

VersaPay’s customer portal is good and built with many features. The challenge is that it lives outside Sage 100. It doesn’t sync payments in real time, and your team may still need to do some cleanup afterward.

Authorize.net and BlueSnap don’t offer self-service portals at all. That means no way for customers to pay invoices online without calling or emailing you first.

Nuvei and Repay both have solid portal options that tie into Sage 100 and work well. Even so, EBizCharge tends to offer a cleaner, more intuitive flow. The email links and portal pages are easy to use, easy to brand, and fully connected to your existing Sage 100 workflow. It keeps everything in one place and running smoothly.

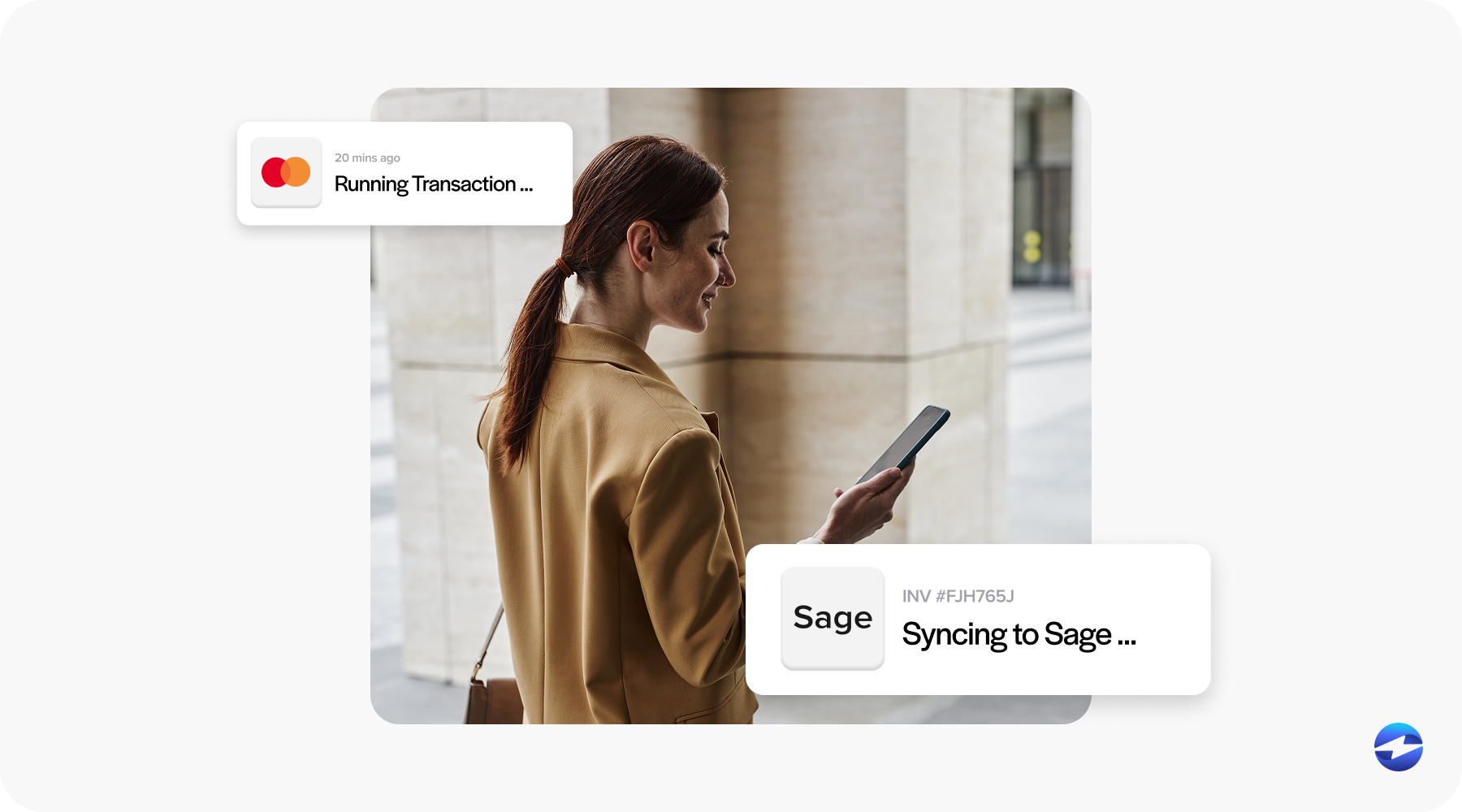

5. Mobile Payment Processing On-the-Go

What it does

Your team can accept payments through a mobile device and sync those payments directly back into Sage 100 instantly.

Why It Matters

Sometimes your team needs to take a payment on the spot. Maybe it’s a field tech wrapping up a service call. Maybe it’s a sales rep finalizing an order at a customer site. Either way, it helps to get paid right then and there, without calling the office or sending a payment form later.

Mobile payment access gives your team the flexibility to close out the job in one go. Customers appreciate it, and you avoid the delays that can come with chasing payments after the fact.

How It Improves Sage 100 Usage

When your team accepts a mobile payment using EBizCharge, that payment shows up in Sage 100 automatically. It gets posted to the right customer account, tied to the right invoice, and pushed into AR without any follow-up work.

You stay on top of your records without having to reconcile anything manually, and you get to keep your books accurate in real time no matter where the transaction happens.

Where others fall short

EBizCharge is one of the only payment tools built for Sage 100 that includes a native mobile app. It’s ready to go and already connected to your Sage environment.

Nuvei and Repay may offer mobile options, but usually through third-party tools that come with added cost and setup. Other providers like VersaPay and BlueSnap don’t offer a mobile solution that ties into Sage 100 at all.

If your team needs mobility and simplicity, EBizCharge gives you both.

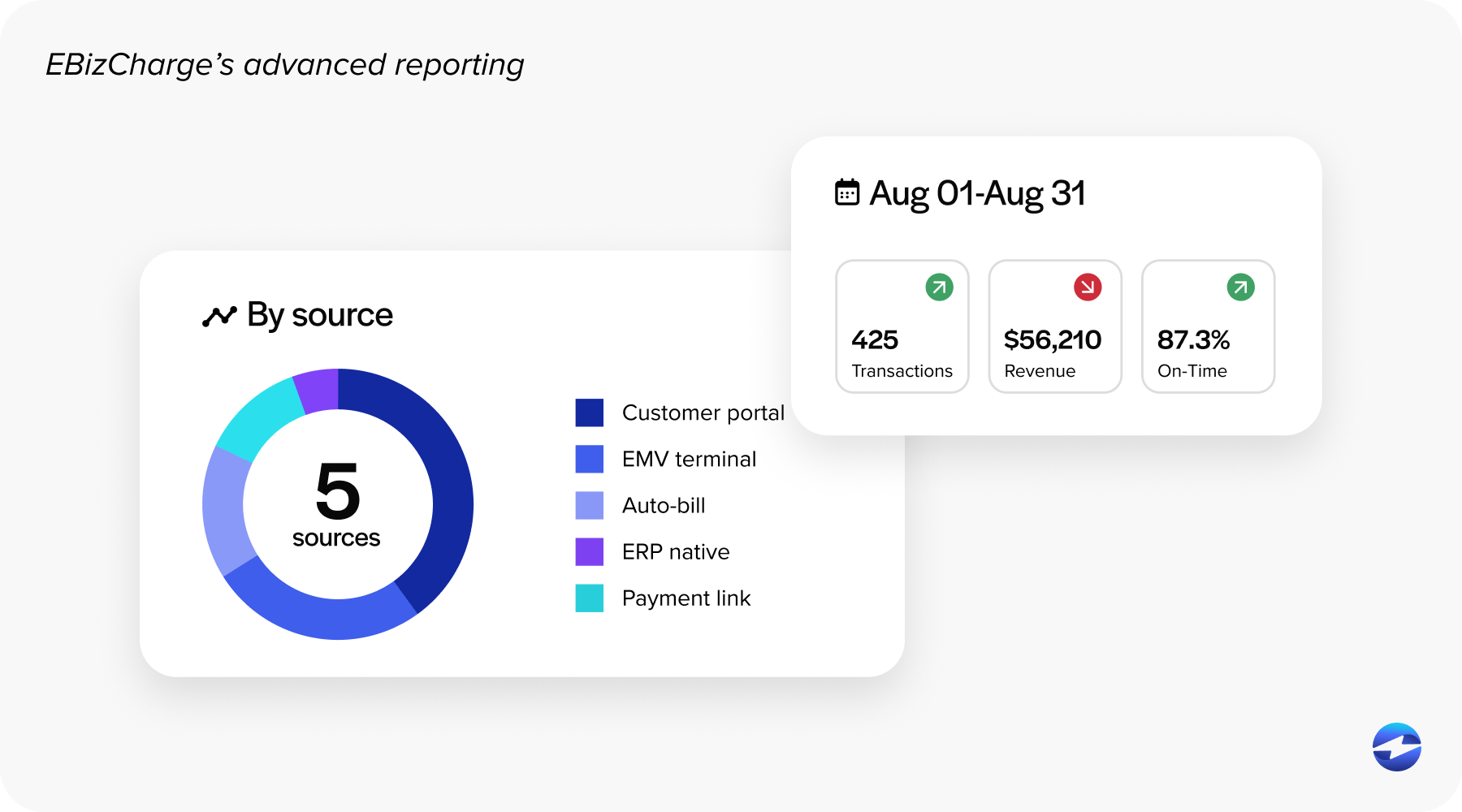

6. Custom Reporting and Analytics for Payments

What it does

Run detailed reports with 50+ filters right inside Sage 100. No exporting, no spreadsheets, no guesswork.

Why It Matters

The more you understand your payment activity, the easier it is to stay ahead of cash flow issues, whether tracking overdue invoices, spotting payment trends, or just trying to get a clear picture of what’s been collected. Visibility matters.

With EBizCharge, that visibility isn’t buried in a separate system or report you have to request. It’s right there in your Sage 100 environment, exactly where you’re already working. You don’t need to guess. You can see the numbers for yourself, in real time.

How It Improves Sage 100 Usage

All of your payment data is already inside Sage 100. EBizCharge helps you actually use it. You don’t have to open a second portal, log in somewhere else, or export a spreadsheet just to understand who’s paid and who hasn’t. Instead, you can run custom reports directly in Sage — filter by customer, date, payment type, or aging status — and get the information you need in seconds. It’s simpler, more accurate, and a lot faster.

Where others fall short

Most alternatives make you jump through a few extra hoops to get the same insights.

Platforms like VersaPay, BlueSnap, and Authorize.net provide dashboards, but they live outside of Sage 100. You’ll need to pull reports from another system, then match them back to what’s in your ERP.

Repay and Nuvei offer reporting, but often through separate merchant portals, which means your team still has to manage data in more than one place.

EBizCharge cuts through all that by putting reporting tools right inside Sage 100. Everything’s connected, so you can focus on what the numbers are telling you, not how to track them down.

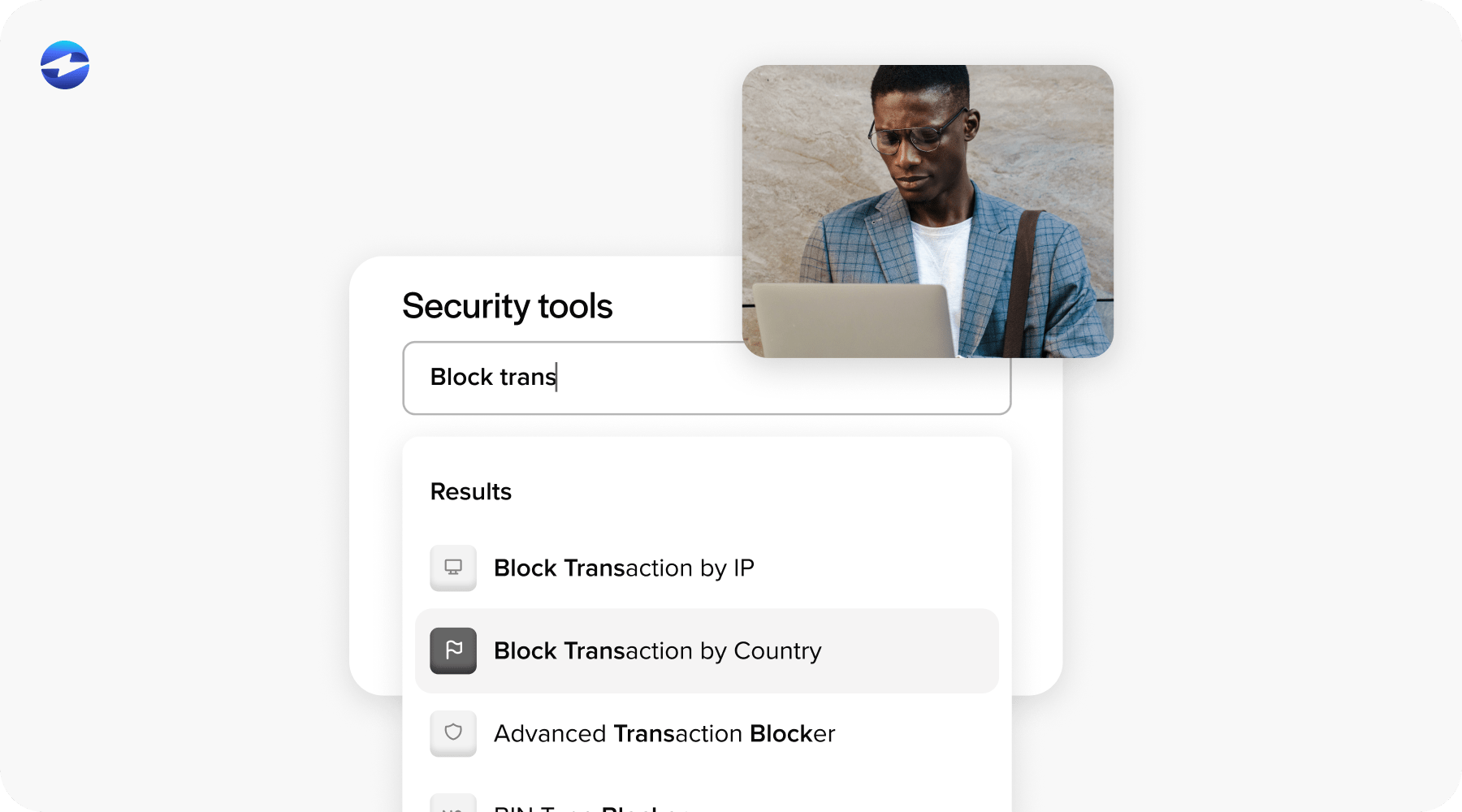

7. Advanced Security Measures & Unlimited Support

What it does

Enterprise-grade security with tokenization, encryption, PCI compliance, and unlimited in-house support from Sage 100 experts.

Why it matters

Security and support might not be the flashiest parts of a payment solution, but they’re what keep everything running smoothly in the background. You’re not just protecting your customers’ data. You’re also protecting your team from unnecessary risk, headaches, and delays.

When you use EBizCharge, sensitive payment information never lives inside Sage 100. Everything is tokenized and stored offsite in a secure, PCI-compliant vault. That’s peace of mind built into every transaction.

There’s also real value in knowing who to call when something breaks. You’re not chasing down different teams for Sage issues and gateway problems. One support line gets you help with both.

How it improves Sage 100 usage

With strong security in place, your team can confidently use features like saved cards, email pay, and hosted checkouts without wondering if it’s safe or compliant. Everything is designed to work inside Sage 100, without exposing your system to sensitive card data.

If a question comes up, there’s a real team ready to walk you through it. No call transfers. No finger-pointing. Just someone who knows Sage 100 and payment processing, ready to help. That makes it easier to try new features, train new staff, or troubleshoot unexpected issues without slowing down your day.

Where others fall short

To be clear, most providers check the PCI compliance box. The difference is in how the rest of the experience works.

EBizCharge handles setup, support, chargebacks, and training in-house. You get one point of contact, and a team knows both Sage 100 plus your individual payment setup.

Nuvei and Repay offer solid security and support too, but they often work through resellers. That can mean waiting longer for answers or getting bounced between providers.

Platforms like Authorize.net or BlueSnap do have support teams, though they’re more general-purpose. If your issue involves Sage 100 specifically, you might be on your own to figure it out or have to hire outside help.

EBizCharge keeps it simple. The security is baked in, and the support is ready when you need it.

Smarter payments, smoother Sage 100

Most Sage 100 users don’t need more software. They just need the tools inside Sage to do more of the work for them. That’s what these features are designed to do. They reduce friction, save time, and make everyday processes easier for your team. Whether it’s accepting payments without leaving Sage, offering self-service options to customers, or cutting down on reconciliation work, these tools quietly remove the pain points that slow things down.

With EBizCharge, these improvements don’t require a system overhaul or complicated setup. Everything runs right inside Sage 100, the way your team already works. You get cleaner records, faster payments, and less back-and-forth between departments. When you line up EBizCharge next to other payment integrations, the differences start to show. Fewer systems to manage. Fewer steps to train on. More control over your cash flow, with less effort to keep things running smoothly.

If you’re looking to get more from Sage 100 without adding more to your plate, then contacting EBizCharge may be the first step.