Blog > How QuickBooks Handles Credit Card Surcharges (and Why EBizCharge is a Great Alternative)

How QuickBooks Handles Credit Card Surcharges (and Why EBizCharge is a Great Alternative)

QuickBooks is a reliable tool for day-to-day accounting and invoicing, but if you’ve ever tried to pass credit card fees onto your customers, you know it can be a little tricky. For B2B businesses dealing with large transactions and thin margins, those fees add up quickly. That’s where a payment processing integration like EBizCharge comes in. It works alongside QuickBooks to simplify the surcharge process, make things compliant, and save you money without changing how you already do business.

What Are Credit Card Surcharges?

A credit card surcharge is a small fee around 2-3% that a business can add when a customer chooses to pay with a credit card. The goal is to cover the processing fees that come with accepting those payments. On a $1,000 invoice, a 3% surcharge adds $30. It’s not meant to be a profit center it’s just a way to help businesses break even. Card networks typically cap it at 4%, and you can’t apply it to debit or cash payments.

Credit cards are one of the most popular forms of payment among customers, due to the rewards or extra benefits they offer. But for you, those same perks come at a price. On a $50,000 order, a 3% fee means you’re out $1,500. That’s not pocket change. Thankfully, surcharging gives B2B sellers a way to accept cards without eating the cost. Especially for midsized companies dealing in high-value transactions, it can be the difference between a healthy margin and a painful one.

It’s not as simple as flipping a switch or toggling a feature to “on”. Surcharging is legal in most states, but not all. As of 2025, states like Connecticut, Maine, and Massachusetts still ban it. Even where it’s allowed, card networks like Visa and MasterCard require you to register and clearly disclose the fee.

Handled properly, surcharging can be a smart, compliant way to manage processing costs. Done sloppily, it can land you in trouble. For B2B businesses, it’s all about balancing flexibility for customers while protecting your bottom line.

How QuickBooks Handles Credit Card Surcharges (Desktop and Online)

If you’re a B2B business using QuickBooks (Desktop or Online) you’ve probably wondered: Can I just add a credit card surcharge to my invoices? The short answer is: not easily.

QuickBooks doesn’t have a built-in feature to automatically add a credit card fee when someone chooses to pay with a card. There’s no toggle, no automation, no way to say, “add 3% if this is a credit card payment.” Even QuickBooks’ own processor, QuickBooks Payments, doesn’t support it. If you want to charge a fee, it’s up to you.

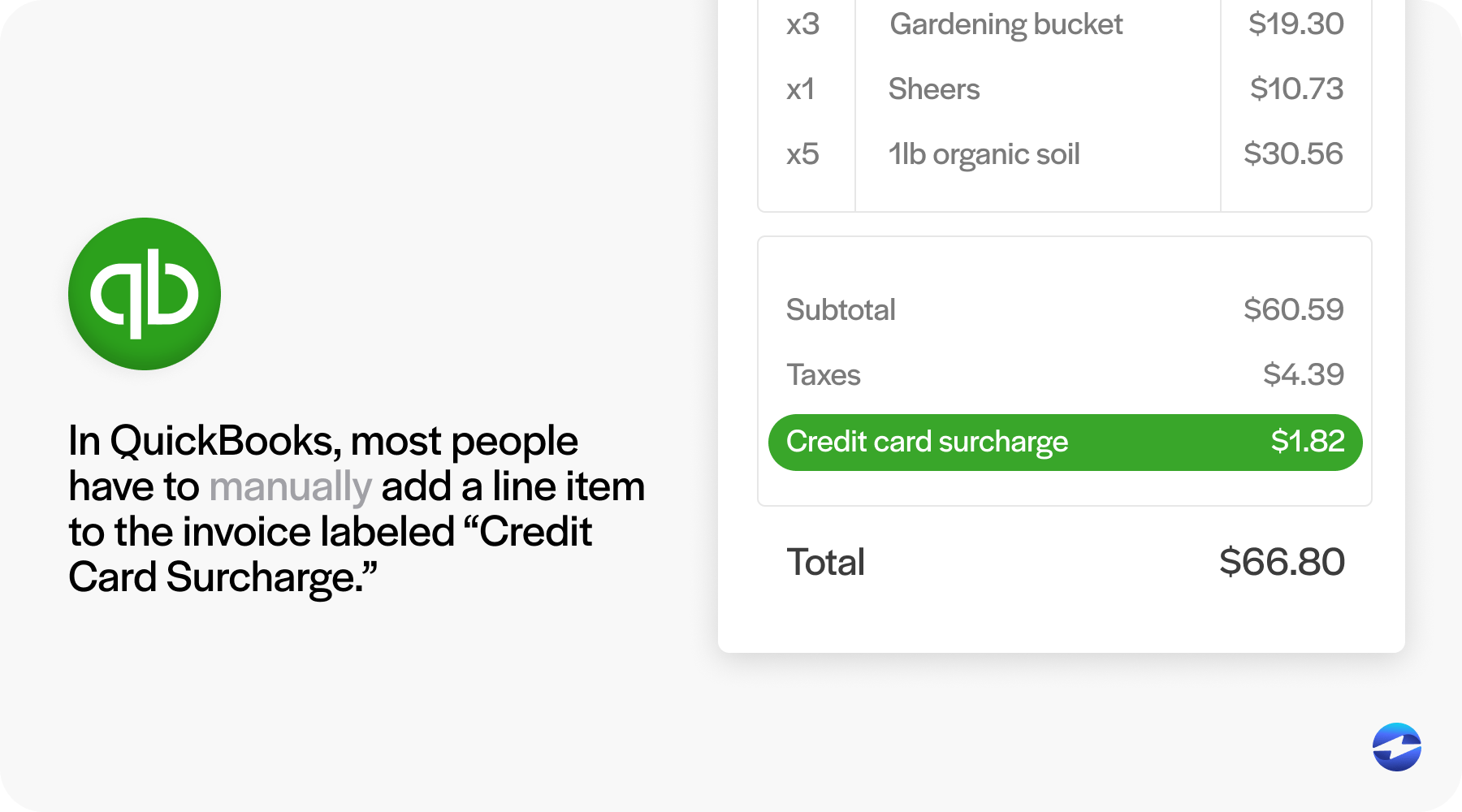

Here’s how most people do it: they manually add a line item to the invoice labeled “Credit Card Surcharge” or something similar. You then calculate the amount yourself and just tack it on. That’s it.

- QuickBooks Desktop gives you a bit more flexibility. You can set up a custom item that calculates a percentage, so it’ll do the math for you, once you’ve created that item and added it to the invoice. It’s still a manual process, but with a little help from the system.

- QuickBooks Online is more limited. You can create a service item for “Credit Card Fee,” but it won’t calculate the percentage for you. You’ll have to do the math every time and key it in yourself. So if you’re sending a lot of invoices, it’s easy to see how this becomes a burden.

There are two other things worth knowing:

- QuickBooks charges you fees on the full invoice amount, even the surcharge. So, if you add a $30 fee to cover your costs, you’ll still get charged a processing fee for that $30.

- Compliance is entirely your responsibility. QuickBooks doesn’t stop you from surcharging in states where it’s restricted (like Connecticut or Massachusetts), or from applying fees to debit cards, which isn’t allowed. It won’t warn you it just lets you do what you want.

In the end, QuickBooks gives you the basic tools to manually add a surcharge, but it doesn’t help you do it right. That’s fine for occasional invoices, but once you start scaling or want to stay compliant, it becomes a real hassle.

Limitations and Pain Points of Managing Surcharges in QuickBooks

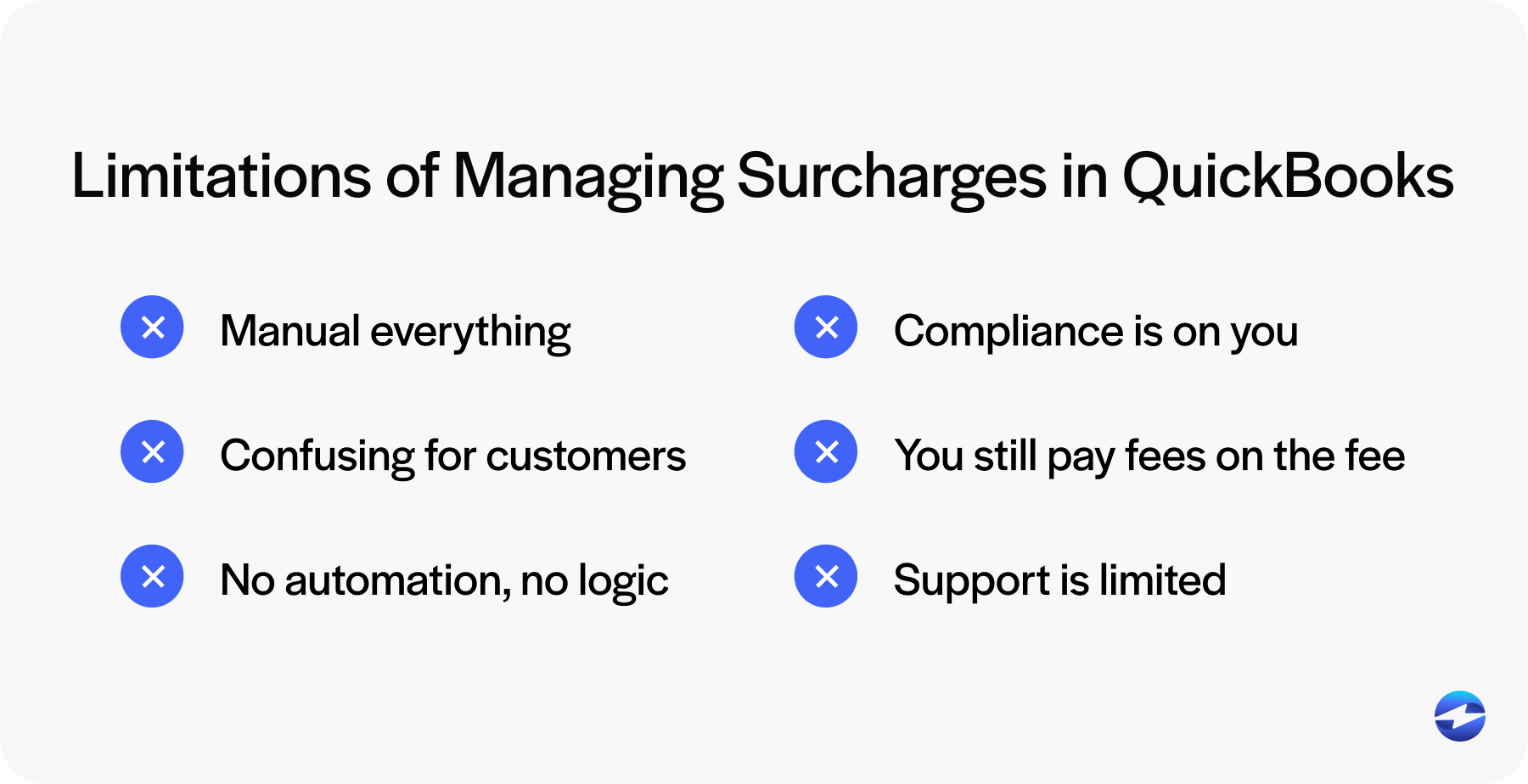

If you’ve tried adding surcharges in QuickBooks, you already know it’s not smooth sailing. The system isn’t built for it, and that creates a lot of little headaches that stack up fast. Here are some common pain points:

- Manual everything. Every time a customer pays by credit card, someone has to calculate the surcharge and manually add it to the invoice. If you’re off by a few dollars, you either eat the difference or risk overcharging (which can cause friction or even legal issues). Now multiply that by dozens of invoices a day, and it’s easy to see why this doesn’t scale.

- Confusing for customers. QuickBooks doesn’t show surcharge info automatically on emailed invoices. You have to get creative and add notes like “3% will be added for credit card payments”. That often means editing the invoice again later if the customer chooses to pay by card. Some businesses even send two versions of every invoice: one with a fee and one without. None of this is ideal.

- No automation, no logic. You can’t tell QuickBooks to “only apply this fee if they pay by credit card.” You either add the fee upfront and hope they don’t choose ACH or wait until payment and scramble to edit. QuickBooks Desktop lets you create a percentage-based item, but even that doesn’t adjust based on how the customer pays. It’s just a flat rule you apply manually.

- Compliance is on you. QuickBooks won’t stop you from surcharging debit cards or charging customers in states like Massachusetts or Connecticut where surcharges are banned. It won’t warn you if you exceed the card brand’s 4% cap either. If someone on your team messes up, it’s your business that could face penalties.

- You still pay fees on the fee. Let’s say you invoice $1,000 and add a $30 surcharge. QuickBooks Payments will apply its ~2.9% fee on the full $1,030. This means you’re paying a processing fee on the very charge that was supposed to cover your processing fee. In the end, you recoup most of the cost, but not all. To truly break even, you’d have to slightly overcharge (which violates the “no profit” rule on surcharges).

- Support is limited. If you call QuickBooks support with surcharge questions, you’ll likely hear: “That’s not something we support.” Their help docs suggest adding fees manually, but they don’t guide you through automation or how to stay compliant. Many users end up cobbling together workarounds or just giving up.

QuickBooks users end up shouldering all the work and all the risk. For small shops, that might be manageable. But if you’re a growing B2B business sending lots of invoices or handling high-value orders, this manual system becomes a bottleneck. That’s usually when companies start looking elsewhere for help.

EBizCharge: A Better Way to Handle Surcharges with QuickBooks

If you’ve been wrestling with workarounds in QuickBooks, EBizCharge is worth a serious look. It’s a payment platform that integrates directly with QuickBooks Desktop, Online, and Enterprise. One of its most valuable features is the built-in, automated surcharging with full compliance.

What Makes EBizCharge Different:

Automatic surcharge calculation.

No more manual math. EBizCharge calculates and adds your preset credit card fee (say 3%) at the time of payment. If a customer pays a $5,000 invoice by card, the system adds $150 automatically. The customer sees the full amount, including the surcharge, before they pay. It’s accurate, fast, and keeps your invoices clean.

Built-in compliance.

EBizCharge knows when to apply the fee and when not to. It detects debit cards, identifies restricted states like Massachusetts or Connecticut, and enforces card brand limits (usually up to 4%). It even handles the behind-the-scenes stuff like notifying Visa or MasterCard that you’re surcharging. So,you can stay compliant without becoming a surcharge law expert.

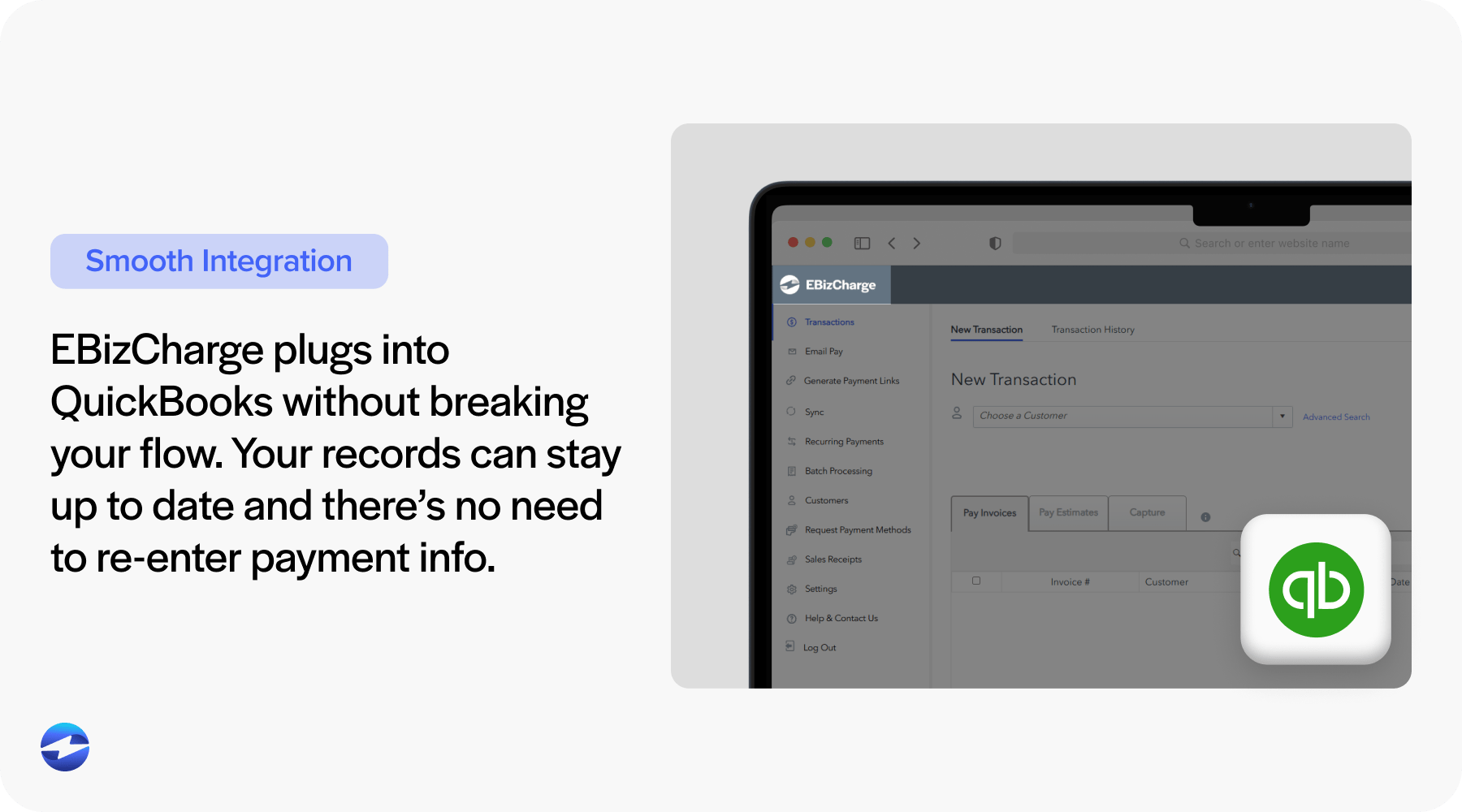

Smooth QuickBooks integration.

EBizCharge plugs into QuickBooks without breaking your flow. In QuickBooks Desktop, you can take payments directly inside the app. With QuickBooks Online, it syncs through a secure portal. Either way, your records stay up to date, and there’s no need to re-enter payment info. It feels like a natural extension of QuickBooks, not a bolt-on workaround.

Customer-friendly experience.

When customers go to pay, they clearly see any surcharge before confirming. And if they switch to a debit card or ACH? The fee drops off. That transparency helps prevent surprises and disputes. In B2B, where relationships matter, that level of clarity goes a long way.

Big savings over time.

With EBizCharge, you keep 100% of the invoice amount because the credit card fee gets passed to the customer. For large transactions, that adds up fast. Even if you decide not to surcharge certain clients, EBizCharge often provides better base rates than QuickBooks Payments. Some businesses report savings of 20–40% on processing fees after switching.

Better support.

EBizCharge is known for responsive, in-house support. If something goes wrong, you talk to someone who understands both payment processing and QuickBooks, not just a generic call center.

If you’re a B2B business using QuickBooks and tired of patching together a surcharge process, EBizCharge is built to solve that. It automates the work, keeps you compliant, and makes credit card fees predictable and passable. Also, because it integrates so closely with QuickBooks you don’t have to overhaul your accounting setup to make it work.

QuickBooks vs. EBizCharge: Key Differences at a Glance

If you’re using QuickBooks Payments and trying to manage surcharges, here’s how that experience compares with EBizCharge:

| Area | QuickBooks | EBizCharge |

|---|---|---|

| Surcharge Automation | No built-in automation. You have to manually calculate and add the fee to each invoice. Easy to miss, and time-consuming. | Fully automatic. EBizCharge calculates and applies the correct fee when a customer chooses to pay by card. No extra work on your part. |

| Compliance Handling | You’re on your own. QuickBooks won’t stop you from surcharging debit cards or in states where it’s not allowed. | Built-in compliance. EBizCharge enforces card brand rules and state laws, skips debit cards, and caps fees where required. It even handles card network registration. |

| Workflow Ease | Manual, clunky. You’ll need to adjust invoices, track who’s paying how, and send updates. No automation tied to payment method. | Integrated and clean. Whether you’re on Desktop or Online, EBizCharge syncs with QuickBooks, applies fees, and posts payments all in the background. |

| Customer Experience | Inconsistent. Customers may not see the fee upfront, or might be surprised by a second invoice. It’s all up to you to communicate clearly. | Transparent. Customers see the fee before paying, and they can avoid it by using ACH or debit cards. This helps reduce disputes and builds trust. |

| Cost Impact | You eat the fees. Even if you add a surcharge, QuickBooks still charges you the full total including the fee itself. | Customers cover the cost. You keep the full invoice amount. Plus, EBizCharge offers lower rates and B2B optimizations (like Level 2/3 data) to reduce fees overall. |

| Support & Stability | Support is limited. Mostly chat–based, with mixed reviews. Updates can disrupt payment flow without warning. | Dedicated support from people who know QuickBooks and payments. Users often cite better service, more reliability, and fewer headaches. |

The takeaway?

EBizCharge takes what’s manual and fragile in QuickBooks and replaces it with automation, compliance, and control. Yes, it’s a third-party system, but for most B2B users, the payoff in time saved and fees avoided is well worth it.

If you’re wondering what the setup looks like or how to roll it out, it can be simpler than you think.

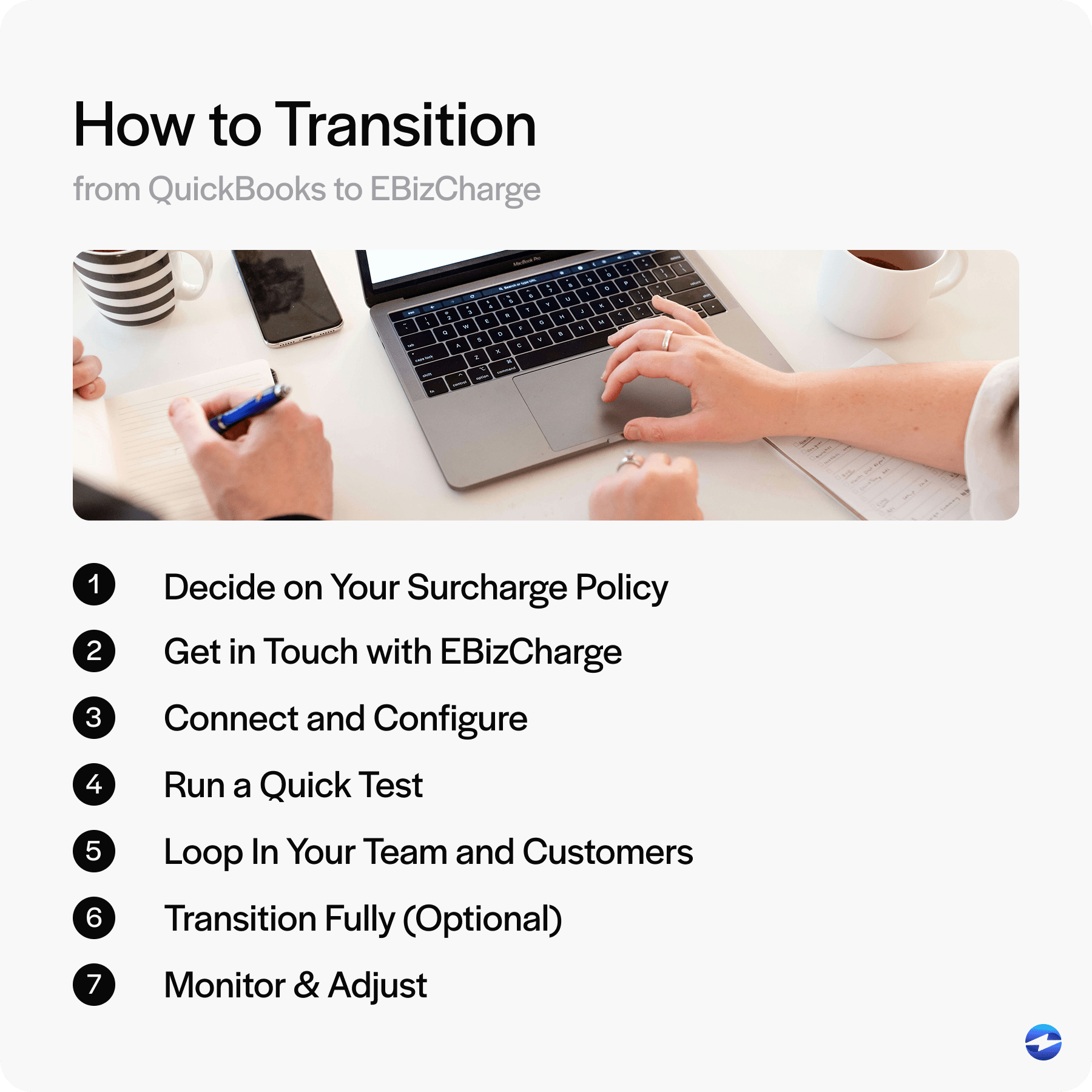

How to Transition from QuickBooks to EBizCharge (Without the Headache)

Switching how you process payments might feel like a big leap, but adding EBizCharge to QuickBooks is straightforward. Here’s a condensed, step-by-step way to make the move:

Step 1: Decide on Your Surcharge Policy

Figure out what percentage you’ll charge (e.g., 3%) and whether you’ll offer ACH as a no-fee option. Check your state’s surcharge rules and prep messaging, so your customers won’t be surprised.

Step 2: Get in Touch with EBizCharge

Book a demo or ask for a quote. You’ll set up a merchant account with EBizCharge, like you did with QuickBooks Payments. There’s no integration fee, and since customers usually cover card fees through the surcharge, you’re not paying out of pocket.

Step 3: Connect and Configure

Install the EBizCharge module (for Desktop) or authorize a secure cloud connection (for Online). Then set your surcharge rate, ensure debit cards and restricted states are excluded, and customize how the fee appears to customers.

Step 4: Run a Quick Test

Send a few test invoices. Make sure the surcharge shows up as expected, and that it syncs properly with QuickBooks. This helps fine-tune settings and builds confidence.

Step 5: Loop In Your Team and Customers

Update your AR or sales teams so they know how to use EBizCharge and communicate the fee clearly. The day-to-day process won’t change much, but alignment is key.

You should also consider a short message to explain the change to your customers: “We’ve added a 3% surcharge on credit card payments to cover rising processing costs. Debit, ACH, and checks remain fee-free.” Most B2B clients understand when you’re upfront.

Step 6: Transition Fully (Optional)

Once everything’s working smoothly, consider turning off QuickBooks Payments so customers don’t accidentally skip the surcharge. Some businesses keep both systems temporarily, but a clean switch avoids confusion.

Step 7: Monitor & Adjust

Watch your reports to make sure surcharges are posted correctly and customers are responding well. Many see savings quickly, whether through surcharges or by encouraging more ACH payments.

Pro tip: Make sure the surcharge shows up as a line item or memo for transparency and easier tracking in QuickBooks.

With EBizCharge, you’re not ditching QuickBooks; you’re upgrading it. You’ll still do your accounting the same way, just with smarter payment processing that handles what QuickBooks alone can’t.

Taking Control of Your Credit Card Fees

QuickBooks is great at accounting, but if you’re absorbing fees or constantly adjusting invoices, you’re doing more work than you should.

EBizCharge automates surcharges, compliance, and integrates directly with QuickBooks. You keep using the system you know, but with fewer headaches and more control.

Most B2B businesses can’t avoid credit cards, but with the right setup you don’t have to eat the fees. If you’re ready to stop patching workarounds and start recovering your costs, EBizCharge is a simple next step worth exploring.