Templates | Aging Report

Accounts Receivable Aging Report

Accounts Receivable Aging Report

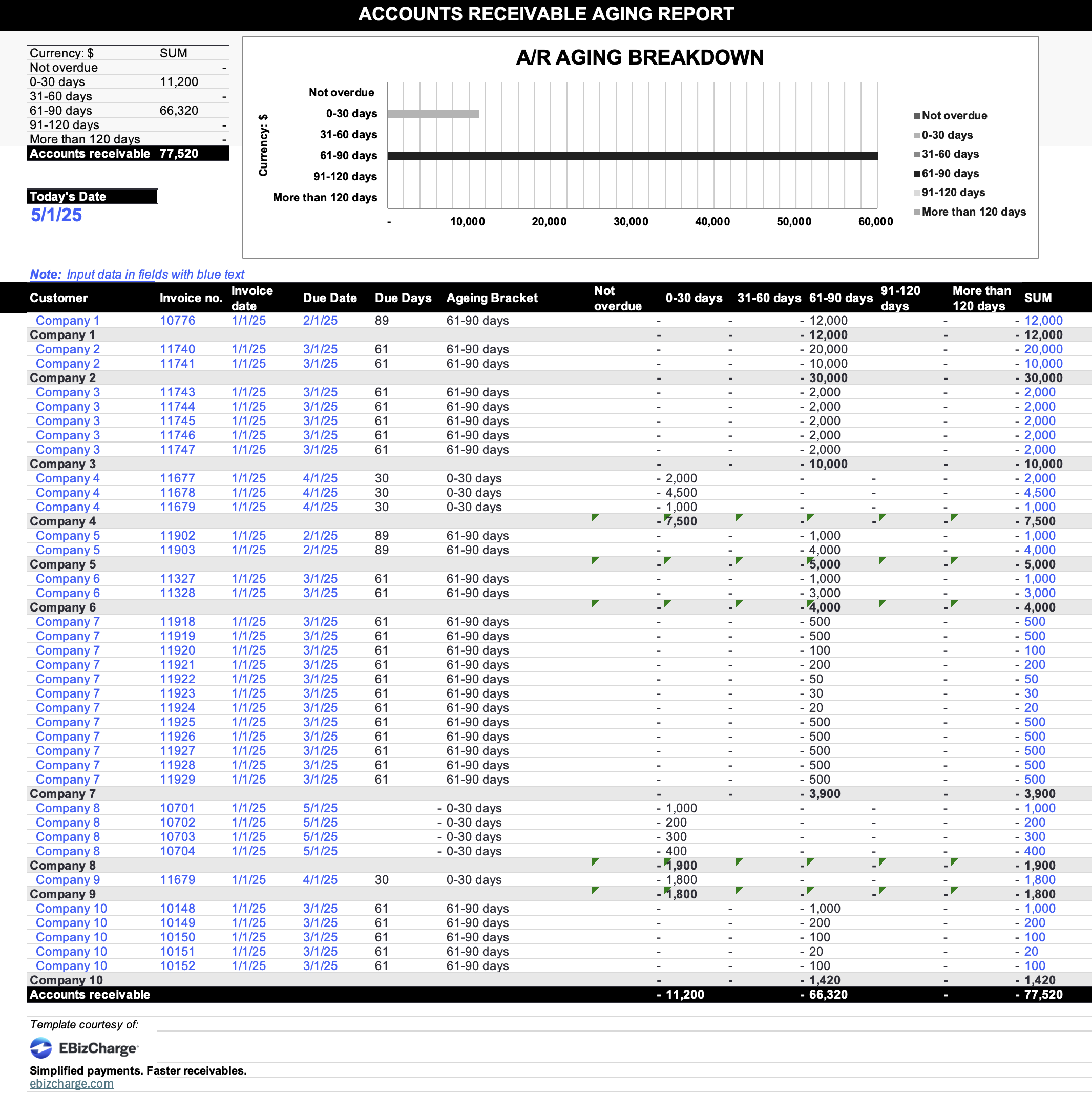

Get a free Accounts Receivable Aging Report Template to easily track overdue invoices, spot potential cash flow issues early, and stay on top of customer payments.

Get a free Accounts Receivable Aging Report Template to easily track overdue invoices, spot potential cash flow issues early, and stay on top of customer payments.

Download our free Excel template today.

Download our free AR aging template to quickly organize outstanding invoices, identify late-paying customers, and improve your collections process.

This accounts receivable aging report sample gives you a clear snapshot of who owes you money, how much they owe, and how long those balances have been outstanding—so you can prioritize follow-ups and keep your cash flow steady.

What is an aging report?

An aging report—specifically an accounts receivable aging report—is a simple but powerful tool that shows you which customers owe you money, how much they owe, and how long those invoices have been sitting unpaid. It organizes your outstanding receivables by how overdue they are—typically in buckets like 0–30 days, 31–60 days, and so on.

Why does this matter? Because when you’re running a business, cash flow is everything. An aging report helps you see potential trouble spots before they hit your bank account. If a few customers are regularly sliding into the 60- or 90-day column, that’s a red flag. The report gives you clarity and a starting point for conversations you might need to have.

How to prepare an accounts receivable aging report

You don’t need fancy software to build one. A spreadsheet will do just fine—though many accounting platforms have aging reports built in, which saves you time.

Here’s how to create one step-by-step:

- Start with a list of all open invoices: Include the customer name, invoice number, total amount due, and invoice date.

- Calculate how overdue each invoice is: This is just the difference between today’s date and the invoice date.

- Sort invoices into aging buckets: Common categories are

- Current (not yet due)

- 1–30 days overdue

- 31–60 days overdue

- 61–90 days overdue

- Over 90 days

- Total the amounts in each bucket: This helps you quickly see how much of your receivables are aging—and how fast.

- Review it regularly: Updating it weekly or at least monthly keeps you proactive instead of reactive.

When you see this report laid out, it’s like turning the lights on in a dark room. You’ll know which customers are consistent, and which ones need nudging—or firmer action.

Best ways to collect outstanding AR

Let’s be real: collecting past-due invoices can be awkward. No one loves chasing payments. But there are ways to do it that are respectful, effective, and keep the relationship intact.

Here are a few that work:

- Start early: Don’t wait until an invoice is 60 days late. Send a friendly reminder a few days before the due date, and follow up shortly after if payment hasn’t come through.

- Be consistent: Create a simple process. For example: first reminder at 3 days past due, second at 10 days, then a phone call at 15. When you follow a pattern, customers are more likely to take you seriously.

- Make it easy to pay: Include clear payment instructions in every invoice and reminder. Offer multiple payment options if possible—ACH, credit card, etc.

- Stay polite but firm: Be respectful, but don’t beat around the bush. You’ve delivered a product or service, and you deserve to be paid.

- Know when to escalate: If a customer goes radio silent or keeps dodging, it might be time to pause future work, assess late fees, or even involve a collections partner. It’s not fun, but sometimes necessary.

If you’re a business owner or bookkeeper reading this, you’re not alone. Everyone deals with this at some point. The key is to have a system, keep it consistent, and use your aging report as a guide instead of letting overdue invoices sneak up on you.