Templates | Recurring Payment Form

Recurring Payment Authorization Form

Recurring Payment Authorization Form

Looking for a recurring credit card authorization form?

Looking for a recurring credit card authorization form?

Download our free template today.

Easily manage recurring payments with a recurring payment authorization form

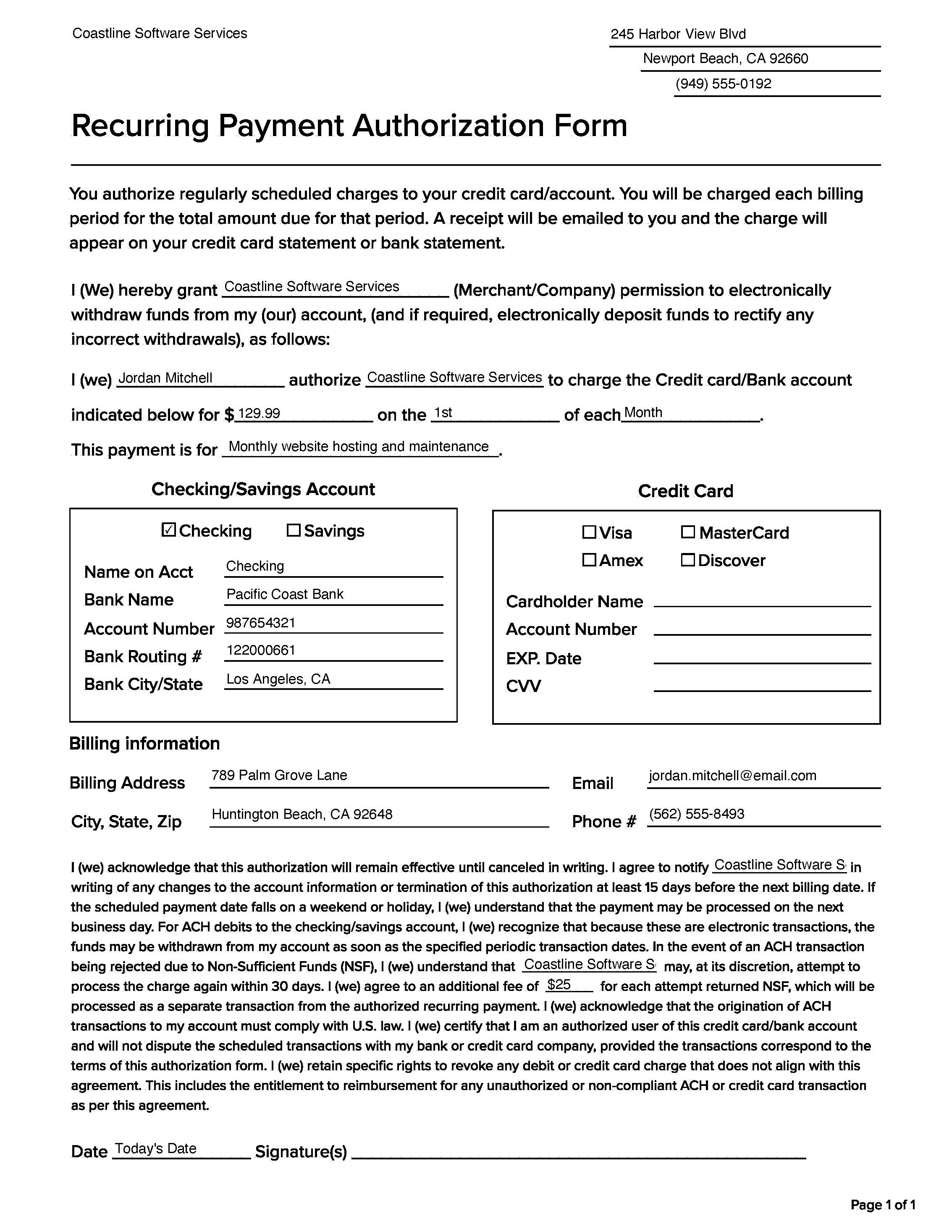

Streamline your billing process by downloading our free, convenient, recurring credit card and ACH payment authorization form. Available in PDF format, these forms ensure secure and hassle-free transactions for both you and your customers.

What is a recurring payment?

A recurring payment is when a customer gives a business permission to charge them on a regular schedule. This automatic payment is billed monthly, quarterly, or annually. It’s the same setup you use when you subscribe to a streaming service or a gym membership. The payment just happens automatically, without anyone needing to pull out a credit card each time.

For businesses, it’s a practical way to get paid on time. For customers, it means one less thing to worry about. A recurring payment means no missed due dates and no extra effort. A true win-win for both parties!

How to set up recurring payments

Setting up recurring payments isn’t complicated, but it does require a few steps to get it right.

- First, you’ll need a payment processor or merchant services provider that supports recurring billing. Most modern systems will have this feature built in, and some even allow you to customize the billing cycle, amount, and start date.

- Then you’ll create a customer profile in your system. This includes collecting the customer’s payment information—usually a credit or debit card—and any preferences around timing or invoice details.

- Once everything is in place, you schedule the payment plan, and the system takes it from there.

Some platforms let you send reminders or confirmations automatically. Others keep it silent unless something fails, like an expired card. It’s up to you how hands-on or hands-off you want to be.

Benefits of recurring payments

Recurring payments can save you time, reduce late payments, and smooth out your cash flow. That’s a big deal, especially if your business relies on ongoing services—like consulting, maintenance, memberships, or subscriptions. They also reduce friction for your customers. The fewer steps it takes to pay you, the better.

When people don’t have to think about logging in, writing checks, or remembering to send money each month, they’re more likely to stick around. Plus, it’s easier to plan ahead when you have predictable income. That kind of stability helps you make smarter decisions about staffing, inventory, and growth.

Why you still need a credit card authorization form

Even though recurring credit card payments are automated, there’s still a trust component to address. You’re asking for permission to charge someone’s card regularly. That’s where a recurring credit card authorization form comes in.

This recurring payment form is essentially written consent from your customer. It lays out the terms—how much you’ll charge, how often, and when the payments will stop. It’s not just a formality; it protects both you and the customer.

If there’s ever a dispute or chargeback, having a signed authorization form can be the difference between keeping the payment and losing it. The payment consent form shows that the customer agreed to the charges upfront. It also makes your billing practices clear, which helps build trust. People are more likely to provide their payment details when they are confident that their information is being handled the right way.