Blog > What Is a Clearinghouse and How Does It Facilitate Safe Transactions?

What Is a Clearinghouse and How Does It Facilitate Safe Transactions?

With transactions occurring every second, the need for a reliable mechanism to facilitate these exchanges becomes increasingly important. This is where a financial clearinghouse acts as an intermediary to ensure smooth transactions between parties.

This article will explore what clearinghouses are, their primary functions, and how they facilitate safe transactions.

What is a clearinghouse?

A clearinghouse is an intermediary organization that facilitates the settlement of transactions, ensuring the accurate and efficient exchange of money, securities, or data between parties in financial or other transactional systems.

Clearinghouses act as neutral third parties that verify, process, and often guarantee transactions to reduce participant risks.

In financial markets, clearinghouses ensure buyers receive their purchased assets and sellers receive payment, managing counterparty risk by stepping in if one party defaults. In industries like healthcare or telecommunications, clearinghouses streamline data exchange, ensuring compliance with standards and enhancing operational efficiency.

Clearinghouses play a vital role in maintaining trust and stability in transactional ecosystems. The following section will explore how they maintain this.

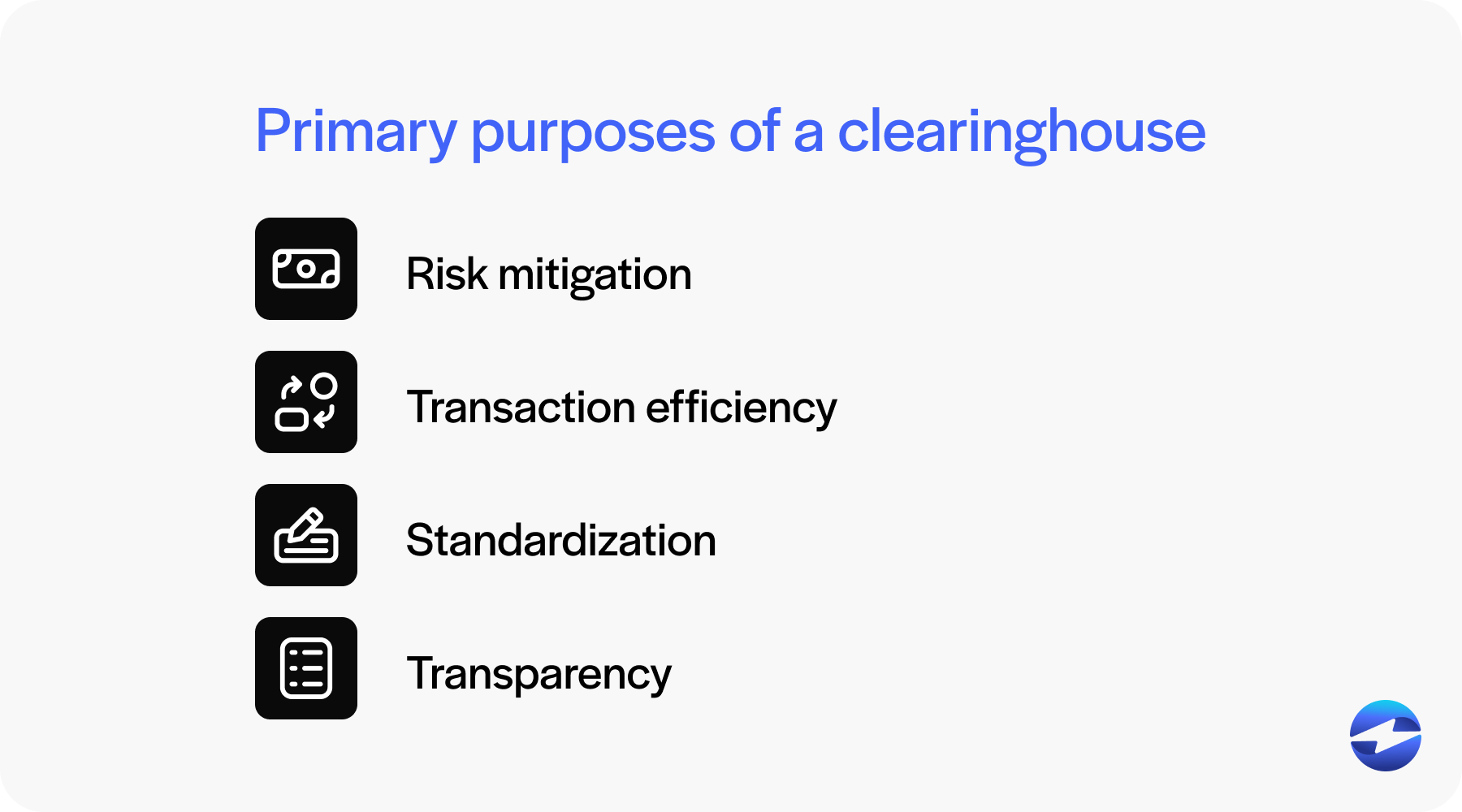

4 primary purposes of a clearinghouse

Understanding the primary functions and purposes of a financial clearinghouse is crucial since these institutions ensure transactions are safe and efficient, reducing the risks associated with exchanging money or information.

Here are four main functions and purposes of clearinghouses:

- Risk mitigation: The clearinghouse aims to mitigate risk by ensuring each party fulfills its obligations to reduce the chances of a party defaulting.

- Transaction efficiency: The clearinghouse enhances transaction efficiency by consolidating multiple transactions, reducing the time and resources needed to complete them. This benefits buyers and sellers by providing quicker settlements.

- Standardization: Clearinghouses work to implement standardization across payments by verifying that all transactions meet specific industry criteria, minimizing errors and discrepancies. In healthcare, this means converting claims from nonstandard to standard formats.

- Transparency: Clearinghouses provide a clear record of all transactions, offering both parties confidence in the accuracy and fairness of the process. Transparency is crucial for maintaining trust in financial systems.

Understanding the primary functions and purposes of a clearinghouse helps illustrate their importance. The following section will dive deeper into how clearinghouses facilitate safe transactions.

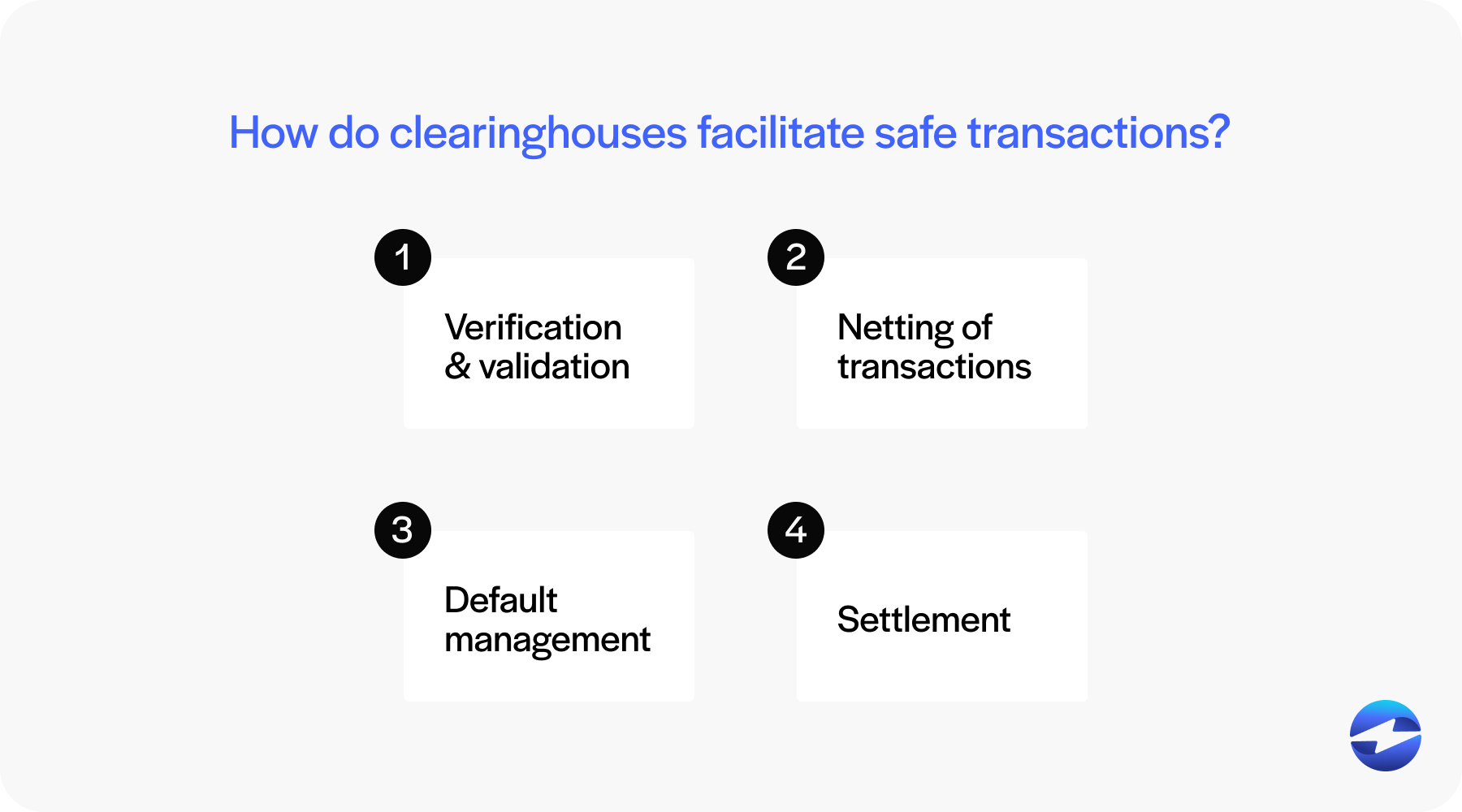

How do clearinghouses facilitate safe transactions?

Facilitating safe transactions involves multiple steps, each designed to ensure accuracy, minimize risk, and uphold trust between parties.

From verifying details to managing defaults and overseeing settlements, these institutions streamline complex exchanges, reduce financial risks, and maintain the integrity of transactional systems.

1. Verification and validation

Clearinghouses confirm the authenticity of all parties involved in a transaction through verification and validation.

Clearinghouses verify the details of each transaction to ensure everything is correct before moving forward to prevent errors and guarantee that claims and payments are accurately processed. An example of this can be seen in the healthcare industry since insurance claims and patient information are verified.

2. Netting of transactions

Netting is when multiple transactions are combined to simplify and reduce the number of payments needed.

For example, if Party A owes Party B $100 and Party B owes Party A $80, netting allows them to settle just the $20 difference. By doing this, clearinghouses minimize the flow of money and reduce risk, making transactions safer and more efficient.

3. Default management

If a party involved in a transaction doesn’t fulfill their responsibilities, clearinghouses can enforce default management strategies to address these situations and protect the other party from loss.

With these protocols in place, default management can protect transactions, even if a party fails to pay or deliver. These strategies may include using reserves or other financial safeguards.

4. Settlement

Settlement is the final step where the actual exchange of funds or securities happens, and clearinghouses verify that both sides of the transaction are accurate and on time and oversee the movement of the agreed-upon assets.

The settlement process ensures all parties receive what they’re due, completing the transaction process safely. This step solidifies trust in the financial, healthcare, and stock systems by concluding the transaction cycle without disputes.

By addressing potential challenges at every stage, clearinghouses streamline operations, build trust, and foster more stability in financial markets, healthcare systems, and more.

Now that you know how clearinghouses facilitate secure transactions, it’s important to familiarize yourself with the different types of clearinghouses.

3 types of clearinghouses

Understanding the various types of clearinghouses, their use cases, and the different individuals and businesses they support will help you navigate these systems more effectively.

The three main types of clearinghouses include payment clearinghouses, futures trading clearinghouses, and stock market clearinghouses.

Payment clearinghouses

Clearinghouses for payments facilitate the processing and settlement of financial transactions between banks, businesses, and individuals.

Payment clearinghouses consist of:

- Automated clearinghouse (ACH): Handles electronic payments such as direct deposits, bill payments, and money transfers. ACH networks process transactions in batches, making them cost-effective and suitable for high volumes.

- Card payment clearing: Facilitates credit and debit card transactions by ensuring funds are transferred from the payer’s bank to the payee’s account.

- Interbank payments: Manages settlements between banks, often through systems like Clearing House Interbank Payment Systems (CHIPS) or central banks. These systems are critical for large-value transactions.

These institutions ensure the timely transfer of funds, reducing errors and enhancing efficiency.

Futures trading clearinghouses

Clearinghouses for futures trading specialize in managing the settlement of futures contracts, which are agreements to buy or sell an asset at a predetermined price on a future date.

Future trading clearinghouses:

- Acts as a central counterparty, guaranteeing the performance of both parties in a trade.

- Handle the daily settlement process (market-to-market), where gains and losses are calculated and adjusted based on market movements.

- Collect margin deposits to ensure trades can fulfill their contractual obligations.

These clearinghouses provide stability and mitigate risk in futures markets.

Stock market clearinghouses

Stock market clearinghouses manage the settlement of trades in equities, ensuring that buyers receive their shares and sellers receive their payments. These clearinghouses are integral to maintaining the integrity and efficiency of financial markets.

Stock market clearinghouses:

- Match and confirm trade details between buyers and sellers.

- Ensure the delivery of shares to buyers and payment to sellers.

- Mitigate counterparty risk by acting as an intermediary in the transaction.

Each clearinghouse plays a vital role in its respective domain, contributing to the efficiency, security, and reliability of transactions in the global financial system.

Understanding different clearinghouse types enables your business to select the right one. Knowing the benefits clearinghouses offer is also essential when making your selection.

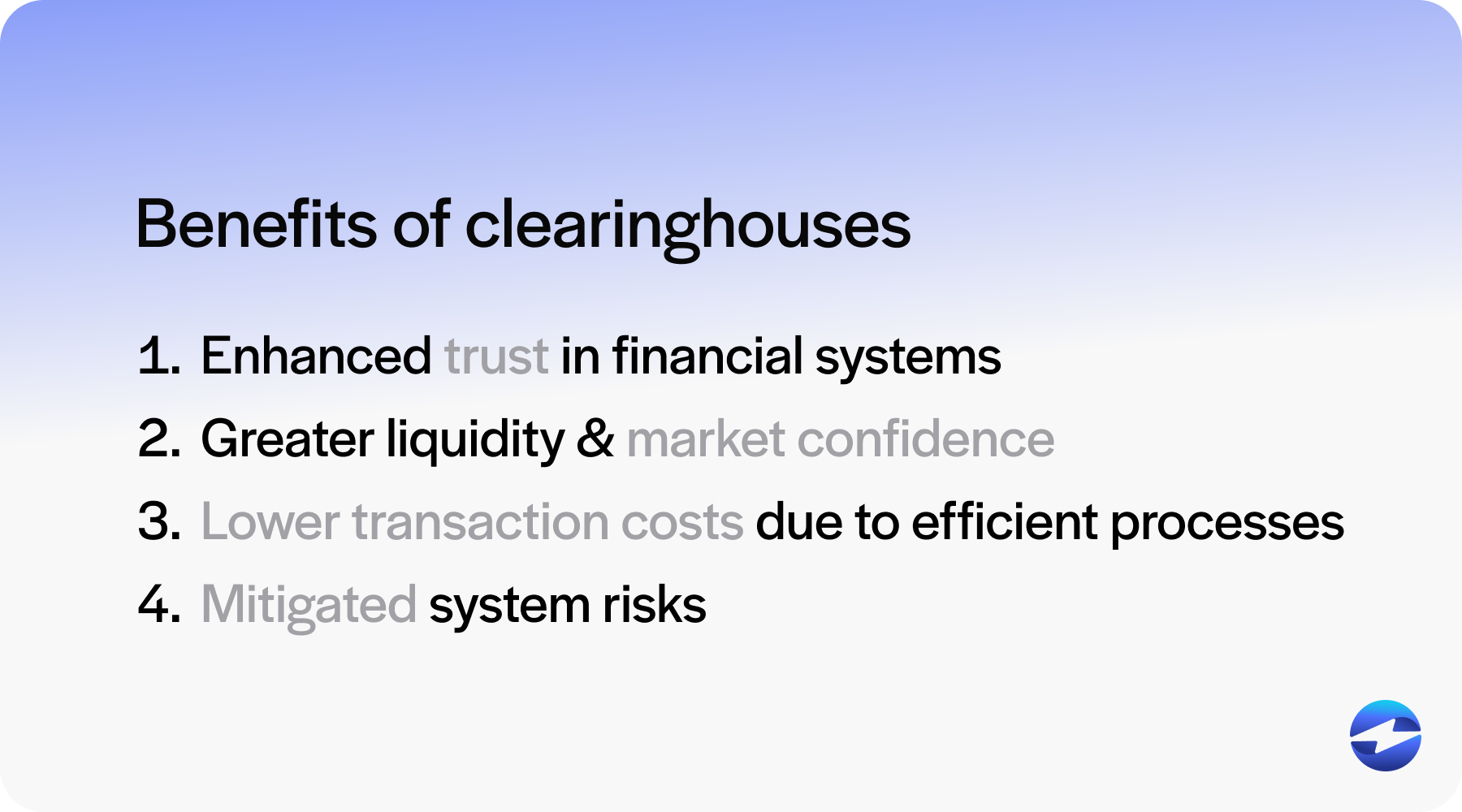

4 benefits of clearinghouses

Clearinghouses can yield many advantages for individual traders and the larger economy since they aim to enhance transactions and settlements.

Here are four key benefits of clearinghouses:

- Enhanced trust in financial systems: Clearinghouses increase trust in financial systems and mitigate the stress of defaulting on payments by facilitating secure transactions and verifying all parties have sufficient funds or assets.

- Greater liquidity and market confidence: Clearinghouses improve market liquidity and confidence by ensuring trades are promptly completed and encouraging traders to participate more frequently. With greater liquidity, markets can function without hitches, which instills more confidence among investors.

- Lower transaction costs due to efficient processes: Clearinghouses streamline processes such as billing services and electronic remittance advice costs while requiring fewer resources, making it easier and more affordable for traders to participate in the market.

- Mitigated system risks: Clearinghouses help mitigate systemic risk by centralizing and standardizing transactions, which prevents issues like double spending or claim errors. They also deal with electronic claims submissions, ensuring claims from providers are correctly forwarded. This standardized format reduces the risk of large-scale financial problems, creating a more stable economic environment.

By fostering trust, improving liquidity, reducing costs, and mitigating systemic risks, clearinghouses provide benefits extending beyond individual transactions to strengthen the financial ecosystem.

To further enhance security, businesses can look to PCI-compliant payment solutions like EBizCharge.

Enhance your payment security with EBizCharge

Alongside the security and seamless settlement processes clearinghouses offer, merchants can leverage reliable payment processing providers like EBizCharge to enhance transactions.

EBizCharge provides robust payment security for businesses accepting credit, debit, and ACH/eCheck transactions by simplifying and securing the process through encryption and secure servers that protect sensitive data.

With PCI-compliant features like encryption to ensure data security during electronic transactions, seamless integrations with existing billing software, efficient processing and automated payments that reduce administrative costs, and a user-friendly interface, EBizCharge helps businesses effectively process and record customer payments.

By prioritizing secure data handling to protect sensitive information, streamlining workflows to reduce manual errors, and ensuring compliance with standardized formats, EBizCharge maintains the integrity and efficiency of financial transactions while supporting clearinghouse processes.