Blog > Exploring The Different Types of Reconciliation

Exploring The Different Types of Reconciliation

With several types of accounting reconciliation, each serves a distinct purpose, whether it be cash-based methods or more intricate multi-step processes. Understanding these different types is vital for effective financial management and decision-making.

This article will explore the various types of reconciliation, detailing their unique features and applications while also offering best practices to enhance accuracy and efficiency in your financial processes.

What is reconciliation?

Reconciliation is a financial process that ensures that two sets of records align accurately, such as internal financial records and external statements.

The reconciliation process helps identify discrepancies between the records, such as between a company’s bank statement and its cash balance in the accounting system. The goal is to confirm that all transactions are accounted for and properly recorded.

Accounting reconciliation is critical for maintaining financial accuracy and involves different types, such as bank and credit card reconciliation. Regular reconciliation helps identify errors or inconsistencies due to human error or overlooked financial transactions, thus ensuring the integrity of financial reporting.

It’s important to understand that reconciliation comes in different shapes and sizes, with several scenarios employing various methods of reconciliation.

What are the different types of reconciliation?

Understanding different types of reconciliation is essential for maintaining precise financial records and ensuring success since each type addresses specific financial aspects to identify discrepancies and enhance overall financial accuracy.

This knowledge can aid businesses in selecting appropriate methods that align with their specific needs.

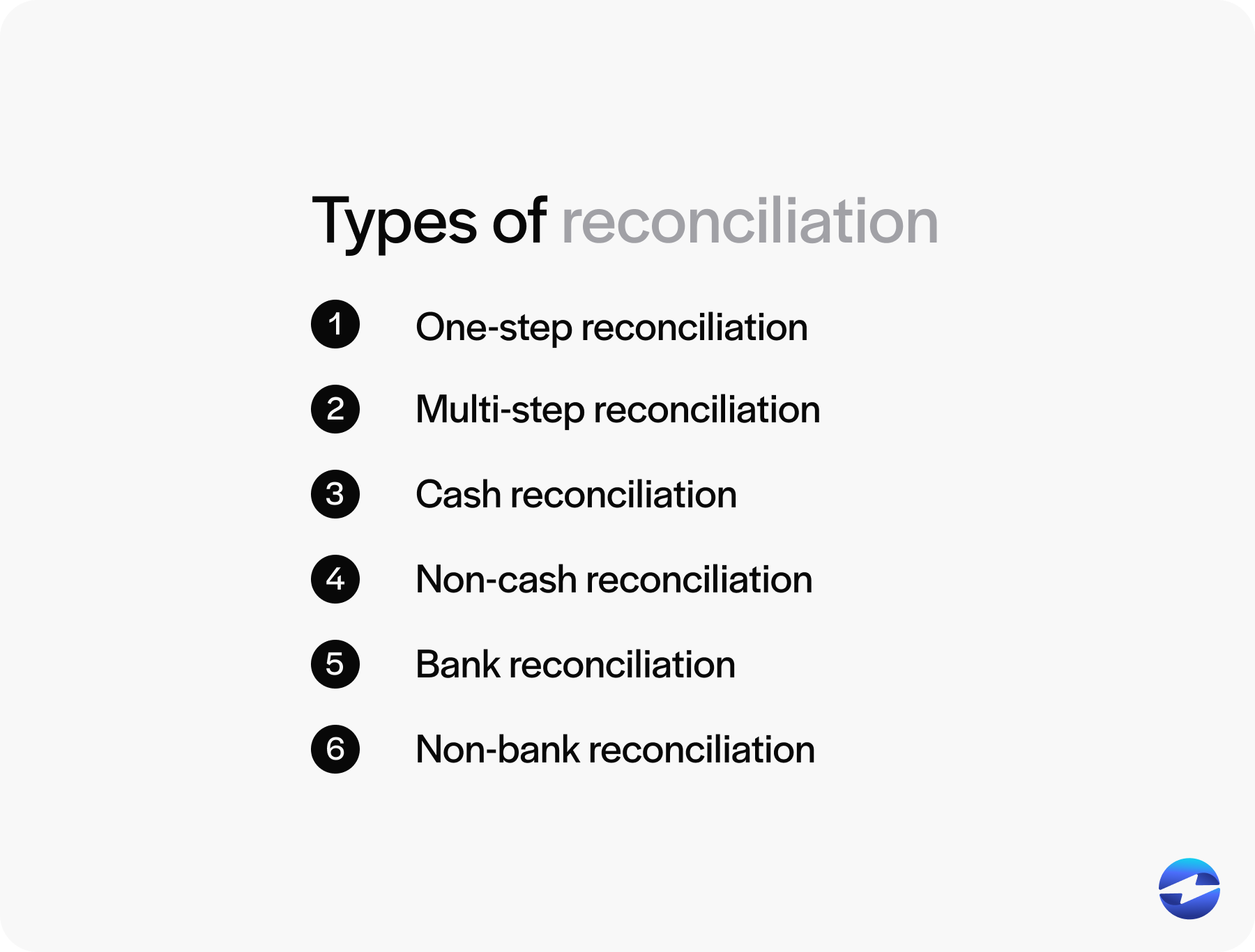

Six methods of reconciliation include:

-

One-step reconciliation:

One-step reconciliation compares two sets of records (such as bank statements and accounting records) in a single step to ensure they align. This process helps verify that all transactions, balances, and adjustments are recorded accurately and consistently across both records.

-

Multi-step reconciliation:

Multi-step reconciliation involves breaking down the reconciliation process into multiple stages. This method is helpful for complex financial systems where transactions require deeper analysis and is beneficial for large organizations with intricate financial activities.

-

Cash reconciliation:

Cash reconciliation focuses on verifying cash transactions and ensuring that recorded amounts match actual cash on hand or in the bank. This process identifies any discrepancies due to errors or unrecorded transactions, maintaining the accuracy of a company’s cash position.

-

Non-cash reconciliation:

Non-cash reconciliation deals with transactions not involving immediate cash flow, such as accounts receivable (AR) and accounts payable (AP). This ensures that credit transactions and outstanding balances are accurate and accounted for within financial records.

-

Bank reconciliation:

Bank reconciliation involves comparing a company’s recorded transactions with its bank statements to ensure all transactions recorded in its ledger align with the bank’s report. This type of reconciliation is critical to identifying unrecorded bank charges or deposits in transit.

-

Non-bank reconciliation:

Non-bank reconciliation refers to reconciling records not involving bank transactions, such as internal accounts or inventory records. This ensures accuracy across various business operations and is crucial for maintaining integrity across all financial reporting.

Businesses can significantly enhance their financial integrity by understanding and implementing these reconciliation types.

Now that you know the main types of reconciliation, you can look to best practices to conduct effective reconciliation.

10 best practices for reconciliation

By implementing best practices in reconciliation, businesses can achieve greater accuracy, minimize errors, and streamline their accounting processes.

Here are 10 best reconciliation practices to improve your accounting operations:

- Automate where possible: Use accounting software that uses an automated reconciliation process. Automation can reduce human error, increase speed, and allow real-time reconciliation for high-volume transactions.

- Reconcile frequently: Performing monthly or daily reconciliations for high-transaction businesses helps catch problems early and maintain record accuracy. Regular reconciliation also makes the month-end and year-end closing processes smoother.

- Standardize procedures: Establish a standardized, documented reconciliation process with clear steps, timelines, and responsibilities. This consistency improves accuracy and ensures everyone follows the same protocols.

- Segregate duties: Divide responsibilities among different employees. For example, separate those who record transactions from those who perform reconciliations. This can reduce errors and fraud by creating an internal check-and-balance system.

- Use supporting documentation: Always keep documentation for every transaction, such as receipts, invoices, and bank statements. This makes it easier to verify entries and resolve disputes during reconciliation.

- Investigate and resolve discrepancies promptly: Address any discrepancies immediately, which may involve correcting errors, adjusting for fees, or understanding timing issues. Prompt resolution prevents minor issues from escalating into more significant accounting problems.

- Review suspense accounts regularly: For transactions that can’t immediately be matched or categorized, place them in a suspense account. Reviewing and clearing these accounts frequently is essential to avoid inaccurate reporting.

- Establish approval protocols: Have a review and approval process for completed reconciliations, especially for high-stakes accounts like cash, inventory, and receivables. This extra layer of oversight ensures accuracy and accountability.

- Reconciliation training for staff members: Equip team members with the knowledge and skills to use reconciliation tools effectively. Training fosters consistency, accuracy, and efficiency within the reconciliation process.

- Conduct periodic audits: Schedule routine audits to examine reconciliations and ensure established processes are followed. Audits also help detect areas for improvement and ensure compliance with accounting standards and regulations.

Prioritizing these best practices will assist businesses in upholding financial integrity and delivering more informed financial reporting.

To take advantage of automated reconciliation, look for top-rated payment solutions like EBizCharge.

Enhance the reconciliation process with EBizCharge

EBizCharge is a top-rated payment software that transforms the reconciliation process by seamlessly integrating with over 100 accounting, ERP, CRM, and eCommerce systems.

These robust EBizCharge integrations enable merchants to securely accept and process payments directly within their existing software, eliminating the need for manual data entry and reducing the risk of errors.

By automating the reconciliation process, EBizCharge ensures that every payment updates the corresponding invoice balance automatically. This automation saves accounting teams significant time and effort, enabling them to focus on more strategic tasks.

Additionally, EBizCharge offers a comprehensive set of AR collection tools, including a virtual terminal, email payment links, auto-pay, and recurring billing. These features further simplify payment collection and reconciliation, enhancing overall operational efficiency.

Overall, EBizCharge enhances the reconciliation process and improves financial accuracy and efficiency by integrating into existing business systems, automating data entry, and providing robust payment collection tools.