Blog > Understanding the Maximum ACH Transfer Limit

Understanding the Maximum ACH Transfer Limit

An Automated Clearing House (ACH) transfer limit is the maximum amount of money that can be spent or received through the ACH network in a single transaction or within a specified period.

Understanding the parameters of electronic payments and the ACH system is vital, as these transfers allow for convenient and efficient movement of funds between banks.

This article will shed light on what ACH transactions are, the nature of their limits, and the influencing factors.

What is an ACH transfer?

ACH transfers are electronic funds transfers (EFT) that allow money to be moved between different bank accounts across the U.S.

ACH transfers are managed by the National Automated Clearing House Association (NACHA), which ensures a safe and efficient way to make various financial transactions, including direct deposits, direct payments, tax payments, and other business payments without the need for physical or cash.

The ACH transfer process involves the coordination between originating and receiving financial institutions, and transactions are usually settled in batches at specific times throughout the business day.

The two types of ACH transfers are ACH credit, where funds are pushed into an account, and ACH debit, where funds are pulled from an account. These reliable and cost-effective transfers are integral to the modern financial landscape, facilitating high-volume, low-cost transactions that are often processed on a next-day or same-day ACH transfer basis.

That said, ACH transfers do come with some limitations.

What is an ACH transfer limit?

An ACH transfer limit is a cap placed on the amount of money that can be transferred via the ACH network in a single transaction or within a certain period, often a business day. Financial institutions set these limits to mitigate risk and ensure regulatory compliance.

ACH transfer limits can vary substantially between different banks and account types and depend on whether the transfer is a direct deposit, direct payment, tax payment, or for other purposes like business payments or insurance claim payments.

While a standard ACH transfer limit between consumer accounts can be $6,000, the limit for a business account with the same financial institution can be $25,000. It’s important to check with your financial institution to verify your ACH daily limit.

Besides account types, there are a few other factors that determine your transfer limit.

4 factors that influence ACH transfer limits

Customers must navigate maximum ACH transfer limits when making electronic payments since several factors can dictate these limitations.

Four main factors that can influence ACH transfer limits include the rules and policies specific to each financial institution, the type of transaction taking place, the timing of the transfer, and overarching regulatory and risk considerations.

Understanding how these factors interact can help account holders plan their transactions accordingly and avoid the frustrations of declined transfers or schedule disruptions.

Financial institution policies

Financial institutions set ACH transfer limits based on their internal policies, which are shaped by their risk tolerance and operational capabilities.

Each bank or credit union may evaluate their customer’s transaction history, account type, and overall banking relationship to determine the appropriate ACH payment limit. Consequently, two customers at the same bank may have access to different bank transfer limits. Banks also periodically review and adjust policies to match any updates to ACH limits.

Transaction types

The maximum ACH transfer may vary depending on the nature of the transaction.

For instance, ACH direct deposits, such as payroll, government benefits, or tax refunds, often have higher limits than direct payments for bills or purchases.

Additionally, ACH daily limits for personal transactions may differ from business or commercial transactions, reflecting the differing needs and risks associated with these activities. Understanding how these types of transactions influence limits can help plan larger financial transfers.

Transfer timing

The timing in which a transaction is initiated is another factor that can influence ACH transfer limits.

Transfers intended for same-day ACH processing, which provide expedited settlement, may be subject to lower limits than traditional, next-day ACH transfers.

Financial institutions may also set different limits for weekday transactions than those initiated on weekends or holidays when transaction volumes are lighter but processing times are slower.

Regulatory and risk factors

Financial regulatory bodies may impose specific caps to prevent fraud and money laundering, which must be adhered to by banks and credit unions and can affect ACH transfer limits.

Banks also assess their own risk when setting transfer limits, considering factors like potential for fraud, operational capacity, and customer service considerations. They strive to find a balance between ensuring customer convenience and mitigating potential losses due to unauthorized or fraudulent transactions.

Now that you know which factors affect your transfer limit, here are a few steps you can take to increase that limit.

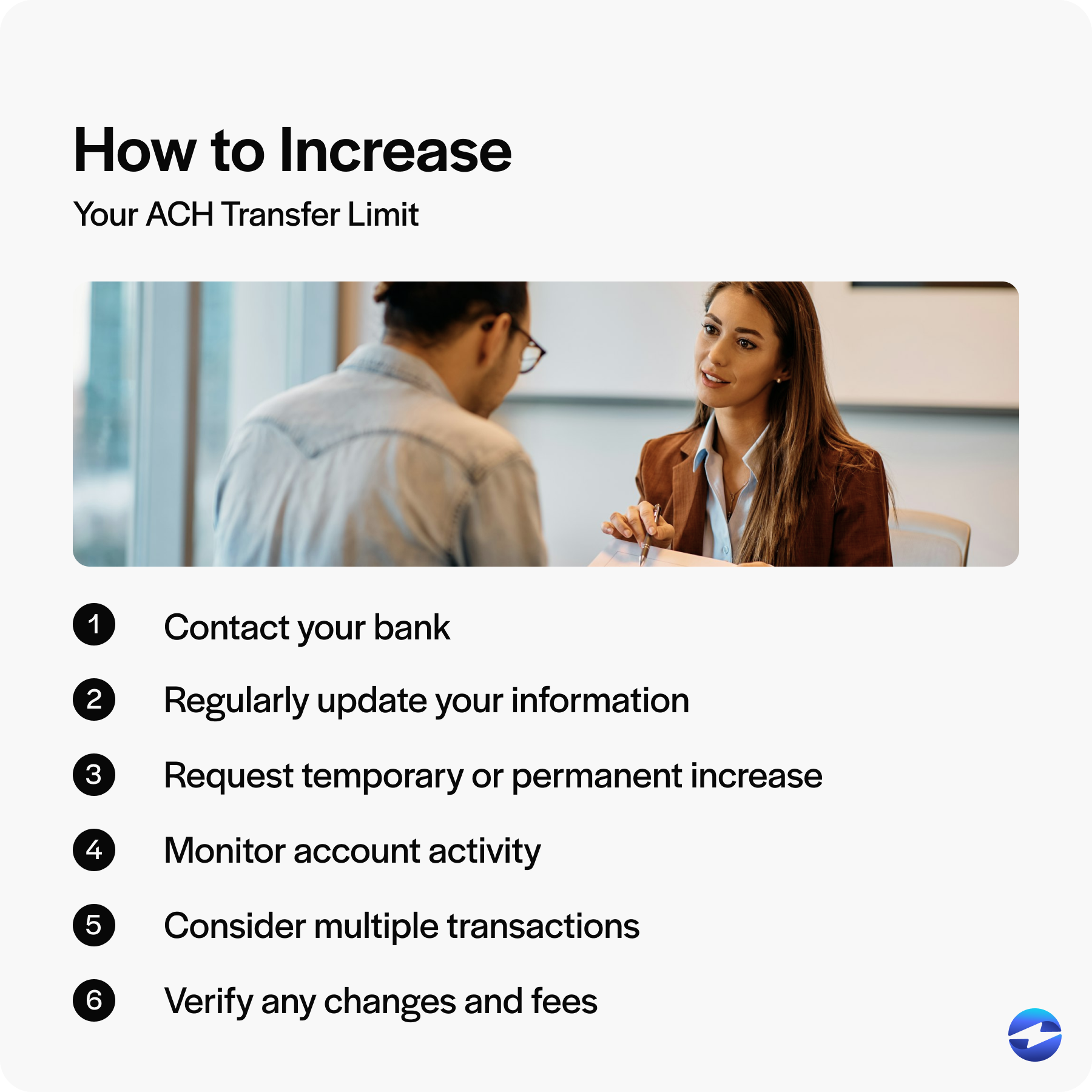

How to increase your ACH transfer limit

If you find that the current maximum ACH transfer limit doesn’t meet your needs, there are several ways you can increase your daily transfer limit.

Here are six steps you can take to increase your ACH transfer limit:

- Contact your bank: Call or visit your bank to discuss increasing your limit. Be prepared to provide any necessary information about your financial situation or transaction needs.

- Regularly update your information: Ensure that your account information is current. Banks may review customer profiles when considering limit increases.

- Request temporary or permanent increase: Depending on your needs, request a temporary increase for a one-time transfer or a permanent increase for ongoing transactions.

- Monitor account activity: Show consistent, responsible account usage, which may influence the bank to raise your limit.

- Consider multiple transactions: If the bank doesn’t approve an increase, plan to divide your payments into smaller amounts within the existing limit.

- Verify any changes and fees: Once an increase is approved, confirm all details, including potential fee changes.

These steps can help businesses increase their daily transfer limit. For a more seamless ACH transaction experience, look to top-rated payment solutions that can facilitate these transactions and provide comprehensive tools and features to make the experience as smooth as possible.

Streamline your ACH transactions with EBizCharge

Understanding ACH transfer limits is crucial for businesses and individuals who rely on electronic payments to efficiently manage their finances. The flexibility and security offered by ACH transactions make them an essential tool in today’s financial landscape, but knowing the limits imposed by financial institutions is key to avoiding disruptions.

By staying informed about the factors influencing ACH limits and exploring options to increase these limits when needed, businesses can optimize their payment processes.

Payment processors like EBizCharge also offer a reliable way to process credit cards and ACH/eChecks, providing enhanced security, efficiency, and the tools necessary to manage large transaction volumes.

As businesses navigate the evolving world of electronic payments, having the right tools and working with trustworthy providers like EBizCharge can ensure a more efficient experience for all parties.