Blog > What is an Integrated Accounting System?

What is an Integrated Accounting System?

Since efficiency and accuracy in financial management have never been more essential, integrated accounting systems offer a streamlined approach combining various financial functions into a cohesive platform. This innovative technological solution allows organizations to maintain real-time insights into their financial health.

Understanding how integrated accounting works is critical for organizations looking to optimize their financial operations.

What is integrated accounting?

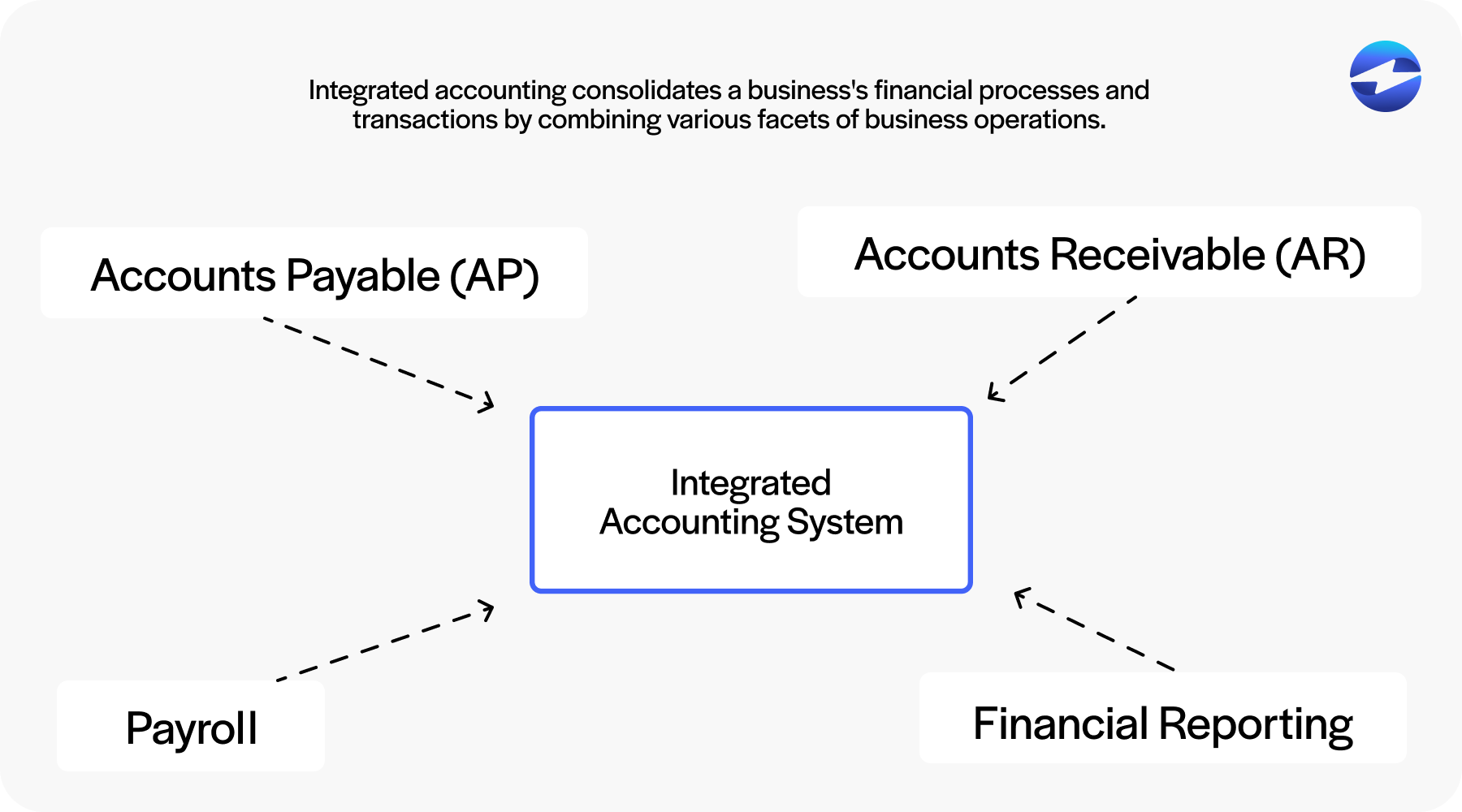

Integrated accounting consolidates a business’s financial processes and transactions by combining various facets of business operations, including accounts payable (AP), accounts receivable (AR), payroll, and financial reporting, into a unified, cohesive structure.

Integrated accounting systems are designed to seamlessly connect with various business functions such as customer relationship management (CRM), inventory control, and enterprise resource planning (ERP). By linking these modules, ERP systems help ensure that financial transactions, inventory updates, and customer data remain consistent and up to date across the entire organization. This level of integration improves accuracy, reduces manual work, and supports better decision-making through real-time insights.

By integrating these operational elements, an integrated accounting system facilitates seamless data flow between them, reducing the need for manual data entry and minimizing the risk of human errors.

Integrated accounting systems streamline financial operations, provide accurate financial reporting and real-time insights into a company’s financial health, and aid in better decision-making practices across all levels of the organization, which can significantly enhance operational efficiency and effectiveness.

How does integrated accounting work?

Integrated accounting systems connect accounting applications, software solutions, and various financial processes within a business, enabling a seamless data flow that provides real-time visibility into all financial transactions.

Here’s a simplified step-by-step overview of how integrated accounting often works:

- Data input: Financial data is entered into the system through automated data feeds or manual entry. This includes transactions related to sales, purchases, expenses, and payments.

- Data processing: Once inputted into the system, data is automatically processed according to the predefined accounting rules and policies. This can include calculating taxes, updating account balances, and generating invoices.

- Synchronization: Data is then synchronized across various departments and systems. For example, a sale recorded in the CRM is simultaneously registered in the AR and inventory management systems.

- Reporting: The system generates financial reports by aggregating and summarizing data. These reports offer real-time insights and are crucial for financial management, performance tracking, and strategic planning.

- Compliance & audit trail: Integrated accounting systems often provide features that ensure compliance with various accounting standards and create an audit trail that helps track each financial transaction end-to-end.

- Decision support: By syncing financial data in one place, finance teams can easily analyze this information, spot trends, forecast future performance, and make data-driven decisions.

Now that you know how integrated accounting works, you can learn more about the specific features involved to better understand these systems.

9 key features of integrated accounting systems

Integrated accounting systems consist of vital features that empower businesses to manage their financial processes efficiently, whether automating complex accounting tasks or providing customizable interfaces and real-time financial insights.

Here are nine integral features that integrated accounting systems offer:

- Sales tax management

- Extensive security features

- Customizations

- General ledger (GL) automation

- Simplified billing and invoicing

- AP automation

- Project accounting

- Inventory and sales management

- Out-of-the-box financial dashboards

1. Sales tax management

Sales tax management features are essential for businesses operating across multiple regions with varying tax rates and regulations. These features automatically calculate and apply the correct tax rates based on the location of the transaction, ensuring that businesses remain compliant with local, state, and federal tax laws.

By automating tax calculations, businesses reduce the risk of errors that can lead to costly penalties and audits. Additionally, these features often provide detailed reporting and documentation, making it easier for businesses to file accurate tax returns and maintain transparency with tax authorities.

2. Extensive security features

Integrated accounting systems ensure data security through extensive security features like encryption, role-based access controls, and audit trails.

These systems also provide regular software updates, multi-factor authentication (MFA), and secure cloud storage, further safeguarding sensitive financial information from unauthorized access and cyber threats.

With the proper security measures, integrated accounting systems can enhance your overall payment security and financial data integrity.

3.Customizations

Since tailoring the accounting system to a company’s needs is fundamental, integrated accounting systems often offer complete customizations.

These customizations enable businesses to modify reports, dashboards, and processes to match their accounting workflows and metrics for more personalized financial management.

4. General ledger (GL) automation

General ledger (GL) automation refers to using software to streamline and manage the complex processes of recording accounting data. This technology specifically targets the general ledger, which tracks a business’s financial transactions.

Automated GLs can easily integrate with other systems, such as AP, AR, and inventory management, optimizing data flow across the entire financial management landscape.

GL automation also reduces manual data entry and risk of error, enhances operational efficiency to generate more accurate financial data more accurate that’s readily available, and improves financial reporting for businesses to make more informed decisions.

Furthermore, automation enables finance teams to focus on analysis rather than data entry, fostering a deeper understanding of their business operations and cash flow. It also affirms real-time visibility of financial information, allowing businesses to respond proactively to economic conditions.

5. Simplified billing and invoicing

Integrated accounting software simplifies billing and invoicing by creating streamlined processes to generate, send, and track invoices with minimal effort.

This simplicity saves businesses time and ensures accurate billing, which can improve cash flow by encouraging timely customer payments.

6. AP automation

AP automation involves leveraging technology to enhance the efficiency and effectiveness of a company’s outgoing payment process.

With an automated AP approach, your business can simplify tasks such as invoice processing, payment approvals, and record-keeping, ultimately improving overall operational performance.

By automating AP, businesses can make more informed decisions, reduce the burden on staff, and allow for a smooth data transfer that bolsters their financial processes.

7. Project accounting

For businesses that work on a project basis, project accounting is an essential feature of integrated accounting systems.

Project accounting enables merchants to track financials on a per-project basis, providing insights into each project’s profitability and informed decision-making regarding resource allocation and management.

8. Inventory and sales management

Integrated accounting systems often include inventory and sales management tools that assist in tracking product levels, orders, sales, and deliveries.

By offering inventory and sales management, integrated accounting systems facilitate valuable and instant insights into inventory turnover, stock reordering, and pricing strategies.

9. Out-of-the-box financial dashboards

Integrated accounting systems come with out-of-the-box financial dashboards that provide real-time visibility into a company’s finances.

These dashboards display key metrics and analytics in an easily digestible format, which is crucial for finance teams to quickly assess the financial standing and make prompt, data-driven decisions.

Now that you know the various features involved in integrated accounting, you can learn how to implement these systems in your business.

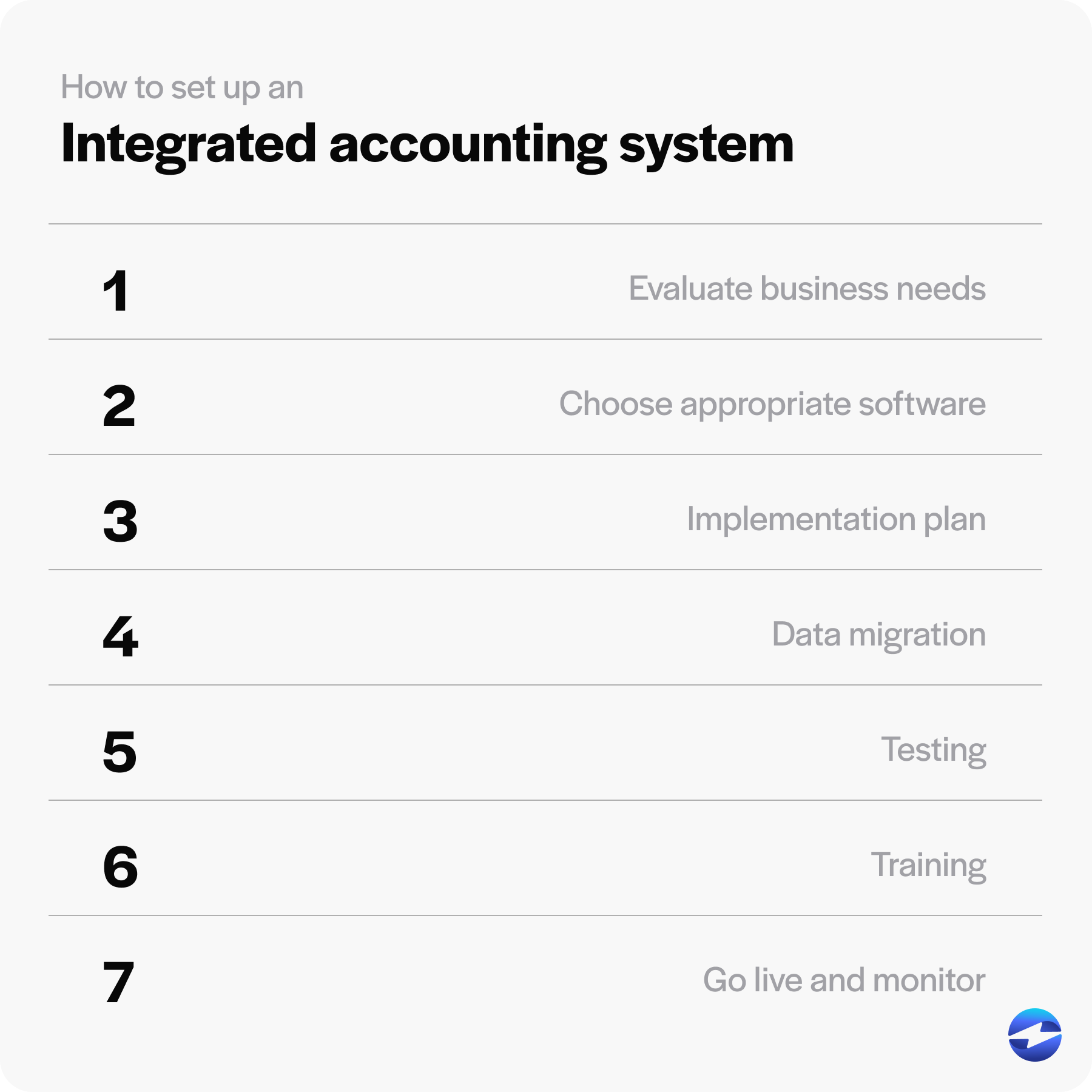

How to set up an integrated accounting system

Setting up an integrated accounting system requires careful planning and execution to ensure it aligns with your business needs.

To set up such a system, consider the following seven steps:

- Evaluate business needs: Understand the specific financial operations of your business and the requirements for integration.

- Choose appropriate software: Select accounting software that aligns with your business initiatives and facilitates efficient data processing between various financial systems.

- Implementation plan: Develop a plan outlining the integration process, including timelines, technical steps, and responsible parties.

- Data migration: Carefully transfer data from current systems to the newly unified framework, ensuring up-to-the-minute transparency and streamlined operations.

- Testing: Conduct thorough testing to identify and correct any issues, ensuring that all financial transactions are accurately reflected.

- Training: Educate finance teams on how to use the new system effectively, thus supporting informed decisions.

- Go live and monitor: After going live, continuously monitor the system to ensure it meets financial reporting requirements and supports the overall financial management of the enterprise.

Businesses can follow these steps to implement an integrated accounting system that yields various benefits, enhancing efficiency, accuracy, and overall financial management.

6 benefits of integrated accounting software

Since integrated accounting software consolidates multiple financial tasks into a single, unified platform, it offers numerous benefits that lead to streamlined finances and operations.

Here are six key benefits of integrated accounting software:

- Reduction of manual data entry: Integrating AP and AR systems significantly reduces the need for manual data entry, lowering the likelihood of errors associated with human input.

- Improved financial reporting: With real-time insights from integrated data, finance teams can produce accurate financial reports promptly, aiding informed decisions.

- Enriched operational efficiency: Integration facilitates seamless data flow between accounting and other business areas, such as inventory and customer relationship management, boosting overall operational efficiency.

- Increased visibility: Real-time visibility into financial transactions and cash flow ensures businesses can manage their resources more effectively and respond quickly to market changes.

- Error minimization: The risk of errors is significantly reduced since data is automatically synced across systems, ensuring consistency and reliability in financial processes.

- Enhanced decision-making abilities: Immediate access to financial data enables businesses to make faster decisions to improve growth and adapt quicker to emerging challenges.

While integrated accounting software offers numerous benefits, it’s essential to recognize that it also has limitations you should consider before implementing.

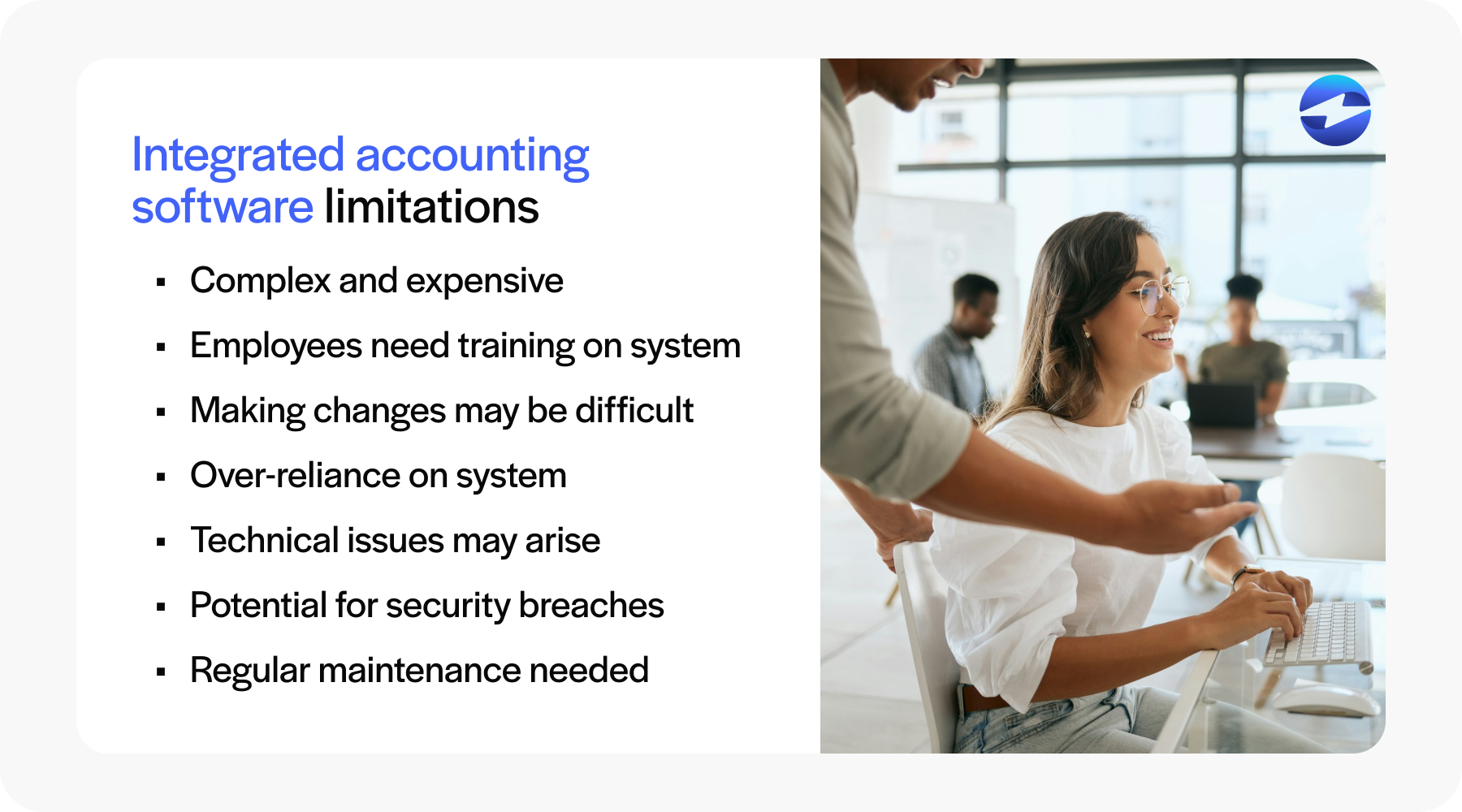

Limitations of integrated accounting software

While integrated accounting software serves as the backbone of financial operations for businesses to improve accounting processes, these systems have certain limitations.

Here are six limitations of integrated accounting software:

- Complexity and cost: Setting up an integrated accounting system can be complex and expensive. Initial costs include purchasing the software, training employees, and altering existing business processes.

- Training requirements: Employees need training to use these systems effectively, which can be time-consuming and costly.

- Rigidity: Once an integrated system is in place, making changes can be difficult. Businesses may need help to update the system for new accounting practices or business models.

- Over-reliance: Dependence on automated systems may lead to a lack of understanding of financial details among staff.

- Technical issues: With any software, technical problems can arise. These disruptions can lead to delays in financial reporting and operational inefficiency.

- Data security: Integrated systems, while typically secure, can pose a substantial risk if a security breach occurs, as they contain sensitive financial data.

- Upgrades and maintenance: Regular upgrades and maintenance are necessary to ensure the system’s ongoing effectiveness, which can be costly and may lead to operational delays.

Understanding the limitations of integrated accounting software is essential when evaluating options. With the various benefits and challenges in mind, your business can determine which system will best meet its needs.

Choosing the right integrated accounting system

Choosing the right integrated accounting system is crucial for enhancing financial operations.

When selecting an integrated accounting system, consider the following factors:

- Compatibility: Ensure the system integrates seamlessly with existing business software, including CRM, inventory management, and ERP platforms.

- Real-time insights: Prioritize a system that provides real-time visibility into all financial transactions to leverage this data for better strategic initiatives.

- Full integration: Choose a solution that can handle all financial processes from AP to AR to enhance data transmission and communication channels between systems.

- Automation: The system should automate accounting processes to reduce the need for manual entry and facilitate timely financial operations.

- Scalability: Ensure the software can adapt and scale to the growing needs of your business and its customers.

- Support: After-sales support is crucial for dealing with any issues that may arise during integration or use.

Overall, you’ll want to work with an integrated accounting system that provides reliable financial management, nurtures more cash flow, and empowers finance teams to focus on strategy and analysis rather than manual errors and data rectification.

Transform customer payments by integrating EBizCharge into your accounting system

Integrated accounting systems offer robust software solutions that consolidate financial transactions and accounting tasks, such as AP, AR, financial reporting, and inventory management, into a single framework.

Accounting software integrations are integral in aiding businesses in navigating the complexities of financial management and control.

Thankfully, there are top-rated payment processing platforms like EBizCharge that integrate into over 100 accounting, ERP, CRM, and eCommerce systems to help your business simplify its accounting process, manage payments more effectively, and transform its financial operations.

Summary

- What is integrated accounting?

- 9 key features of integrated accounting systems

- How to set up an integrated accounting system

- 6 benefits of integrated accounting software

- Limitations of integrated accounting software

- Choosing the right integrated accounting system

- Transform customer payments by integrating EBizCharge into your accounting system

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.