Blog > What Is an ABA Number?

What Is an ABA Number?

ABA numbers play a crucial role in ensuring the smooth operation of banking and financial transactions. These unique identifiers serve as a direct line that guides money between banks in the U.S.

This article will explore the significance of ABA numbers, their locations on financial documents, and their role in enhancing transaction accuracy and security.

What is an ABA routing number?

An ABA number, or routing number, is a nine-digit code used to identify financial institutions in the U.S. This fundamental component of the banking industry enables the correct routing of funds for transactions such as direct deposits, wire transfers, and electronic funds transfers (EFTs).

Banks and credit unions use ABA numbers to ensure transactions reach the correct institution and account.

In banking, ABA stands for American Bankers Association, which initially designed these numbers to make sorting and delivering checks easier. Over time, their use expanded to include various types of electronic transactions.

ACH numbers are another form of routing numbers, and while similar to ABA, it’s essential to understand the fundamental differences between the two.

ABA vs. ACH routing numbers: What’s the difference?

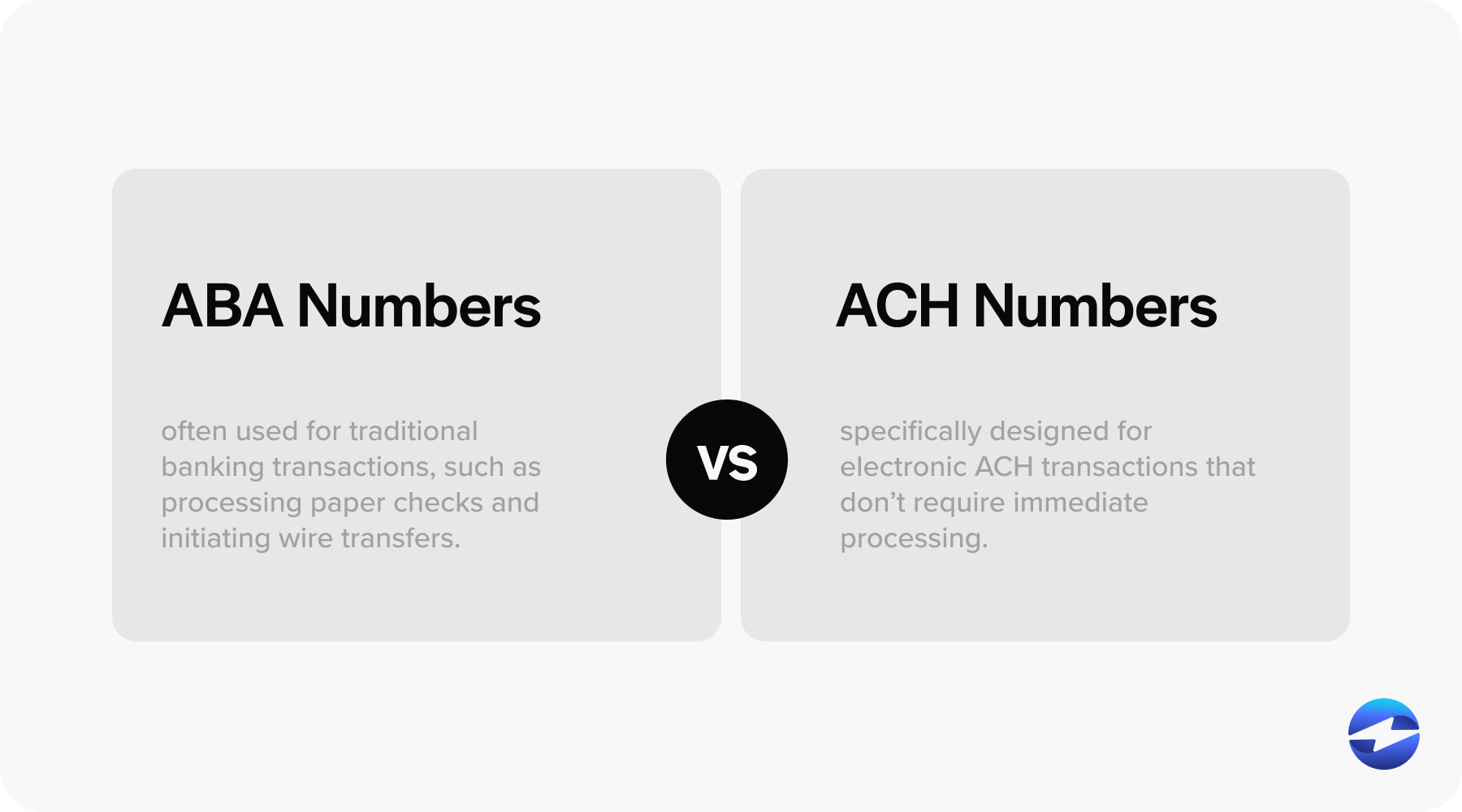

While ABA and ACH routing numbers serve similar purposes in ensuring funds are routed correctly, they differ in their specific functions.

ABA numbers are often used for traditional banking transactions, such as processing paper checks and initiating wire transfers. When you write a check or initiate a domestic wire transfer, the ABA routing number ensures the funds are directed to the right bank. ABA numbers can also be used for electronic transactions but aren’t limited to them.

On the other hand, ACH numbers are specifically designed for electronic Automated Clearing House (ACH) transactions, such as direct deposits, bill payments, and other EFTs that don’t require immediate processing, like wire transfers. ACH transactions often take longer to process since they’re typically batched and cleared in cycles.

In addition to knowing what ABA numbers are used for, you should also know how and where to locate them.

Where are ABA numbers located?

Knowing where to locate ABA numbers is crucial when conducting financial transactions such as setting up direct deposits, making online payments, or transferring funds.

Since financial institutions use these numbers to sort, bundle, and ship transactions to the correct bank, accurate ABA routing numbers ensure transactions are processed swiftly and securely.

You can find ABA numbers on several documents, including checks, bank statements, and online.

Checks

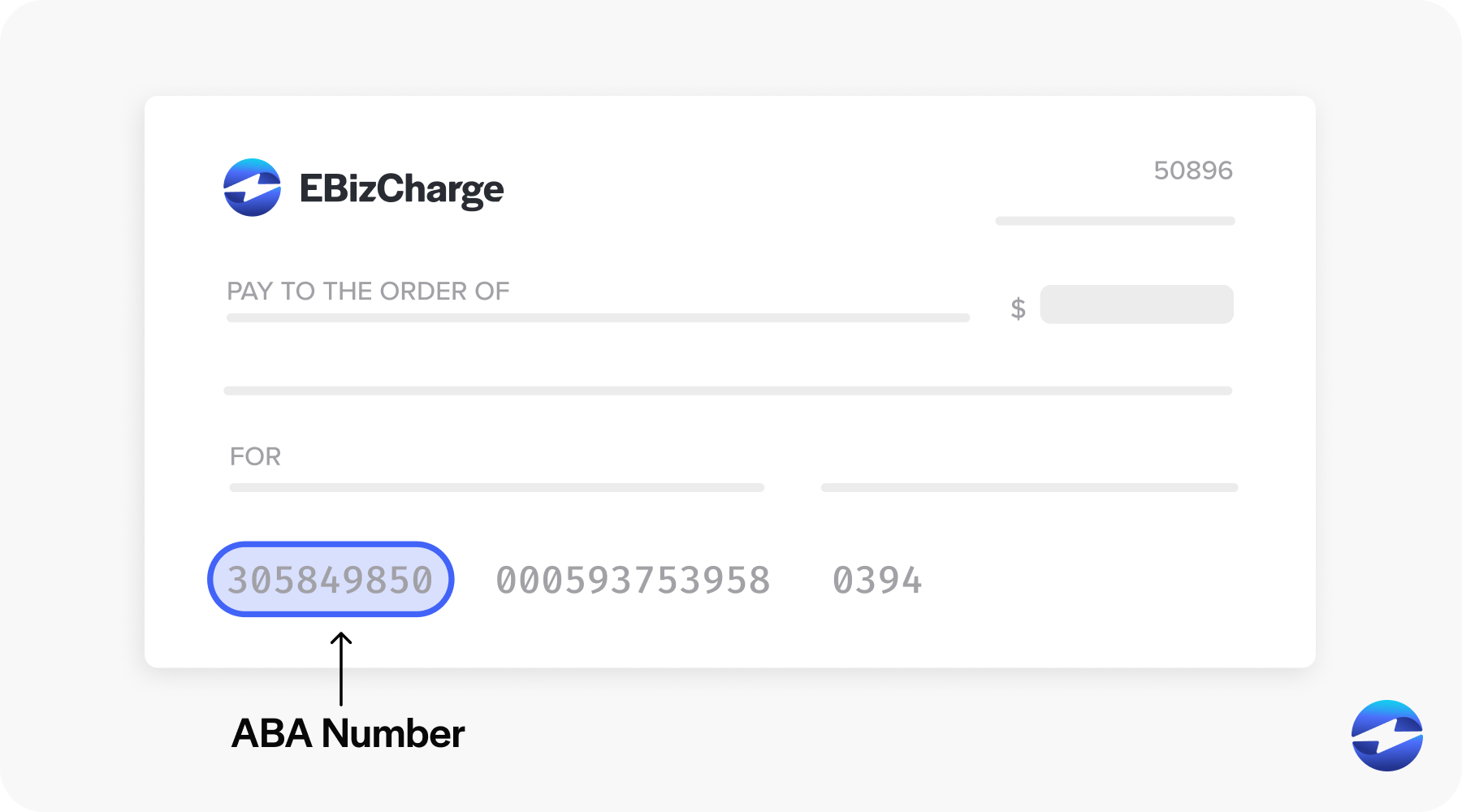

The ABA number is typically found at the bottom left corner of a personal check.

Preceded by a symbol that resembles a colon, the ABA routing number is encoded using magnetic ink character recognition (MICR), which allows the information to be read by electronic check-sorting machines. This nine-digit code is followed by the account number and check number.

It’s important to know that some checks may have additional numbers or symbols preceding the ABA number, but it’s the first nine-digit sequence in that lower left area.

Bank statements

For those who don’t have personal checks at hand, bank statements are another reliable source for finding ABA routing numbers.

Financial institutions often list the ABA number clearly on monthly statements, usually on the first pages summarizing account information. This serves as a reference point for account holders who might need to provide their ABA number for EFTs, direct deposit setup, or services requiring their banking details.

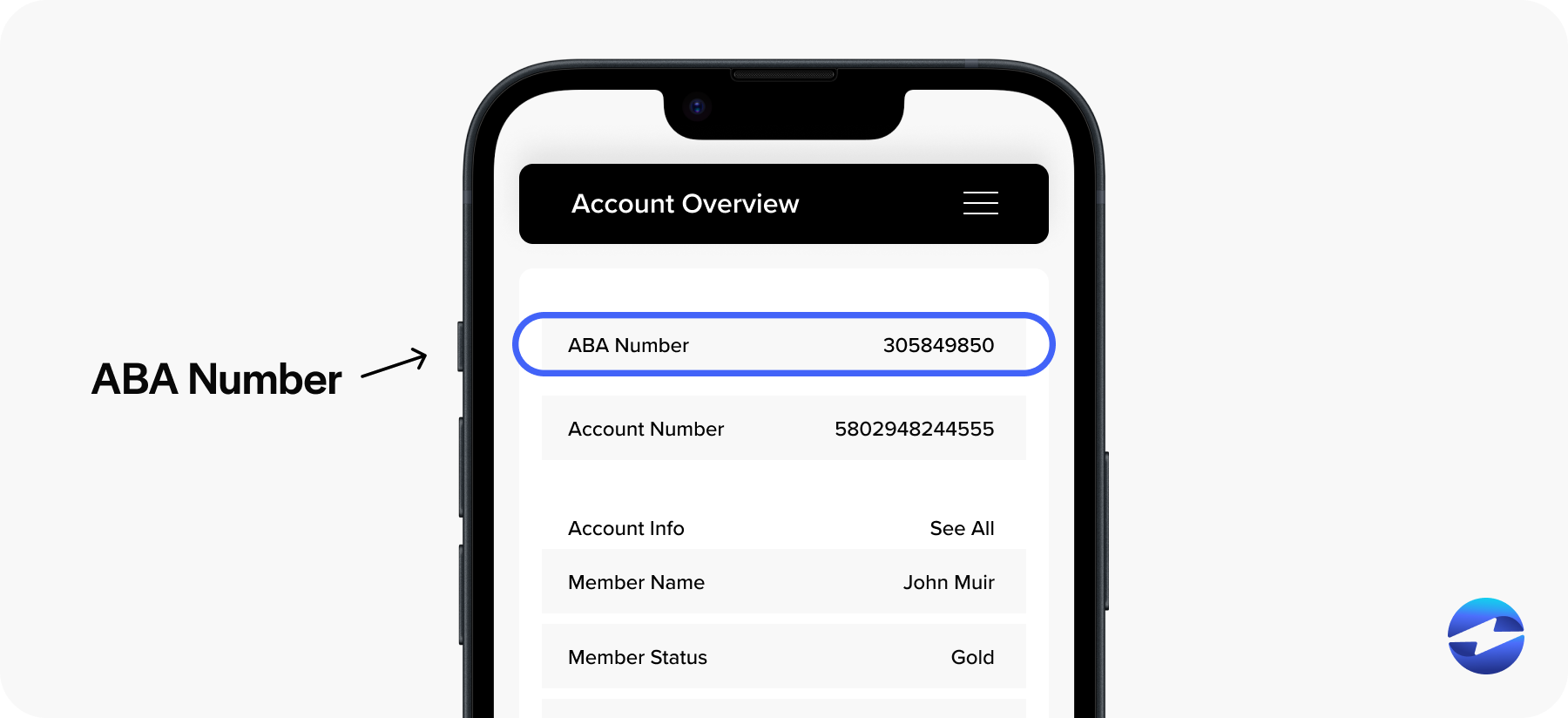

Online banking

With the rise of online banking services, obtaining your ABA number has become more accessible.

Customers can typically find their banking details on their online banking portals by navigating to the Account Details or Account Information sections. Some online platforms also include a specific option for viewing and printing personal checks, which will display the ABA number or may provide a direct link or notation of the routing number for quick reference.

Access to this information may vary slightly between financial institutions, but it’s typically available via mobile app or web browser.

Since incorrect numbers can lead to failed transactions or misrouted funds, individuals and businesses need to know where to find their ABA numbers.

In addition to knowing where and how to find ABA numbers, you should be aware of the importance of these numbers and how they affect daily transactions.

The importance of ABA numbers

Without a standardized system like ABA routing numbers, the efficiency and reliability of banking transactions can be significantly compromised.

ABA routing numbers are important because they offer:

- Financial transaction accuracy: ABA routing numbers contribute to the precision of financial transactions by serving as an essential checkpoint in verifying the destination of funds. When an individual initiates a transaction, such as scheduling a direct deposit, the ABA routing number is used alongside the account number to pinpoint where the funds should be deposited. This eliminates the possibility of mistaking banks with similar names and averts transaction errors that can result in misplaced funds.

- Fraud prevention and security: Since each financial institution is assigned a unique ABA number, ACH and wire transfers can be more easily traced to their origin, making it more difficult for fraudulent transactions to go unnoticed.

- Compliance and regulatory importance: ABA numbers are integral to regulatory compliance within the banking industry. In addition to the Federal Reserve using ABA numbers to process Fedwire funds transfers, they’re required for banks to reconcile accounts and ensure compliance with relevant financial regulations. These numbers must follow a standard format established by the American Bankers Association and the Accredited Standards Committee (ASC), which promotes transparency and consistency for regulatory reporting and auditing purposes.

- Efficient transactions: ABA numbers act as unique identifiers for financial institutions to facilitate efficient transactions that ensure funds are routed accurately and securely. These routing numbers ensure that transaction funds are directed to the correct bank or credit union and are seamlessly processed by enabling financial networks to quickly identify the appropriate institution. With the help of ABA numbers, banks can process traditional and electronic transactions with minimal errors and reduced delays.

- Global perspective: While ABA numbers are used within the U.S., equivalent systems are designed to facilitate international transfers globally. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) codes and International Bank Account Numbers (IBAN) serve as international counterparts to ABA numbers. SWIFT codes areused primarily for international wire transfers and messages between banks, while IBANs provide a structured format for accounts across various countries, enhancing the efficiency of cross-border transactions.

Alongside the importance of ABA numbers, businesses and individuals should stay updated on the rapid evolution of the fintech industry as it poses the potential to change how transactions are routed and tracked.

The future of ABA numbers

The future of ABA numbers will likely be shaped by rapid advancements in the fintech industry, which are already transforming financial transactions.

As digital payment systems and blockchain technology evolve, routing numbers may be supplemented or even replaced by more sophisticated digital identifiers that enhance transaction speed and security. The banking industry is also undergoing significant changes, with new platforms and payment methods emerging that can redefine how routing data is used in the financial system.

Lastly, regulatory bodies may institute new rules as they adapt to the evolving financial landscape that can impact the structure and application of ABA numbers. These technological and regulatory shifts will determine how ABA numbers are affected in the coming years, affecting both businesses and consumers.