Blog > What Are Billbacks and How Do They Work?

What Are Billbacks and How Do They Work?

Billbacks are a common pricing and billing mechanism widely used in various industries involving additional charges or fees that are invoiced after a transaction has taken place.

Understanding billbacks is crucial for businesses that either charge or pay these fees, as they can significantly impact the bottom line. This article will explain what billbacks are, how they work, and best practices for managing them.

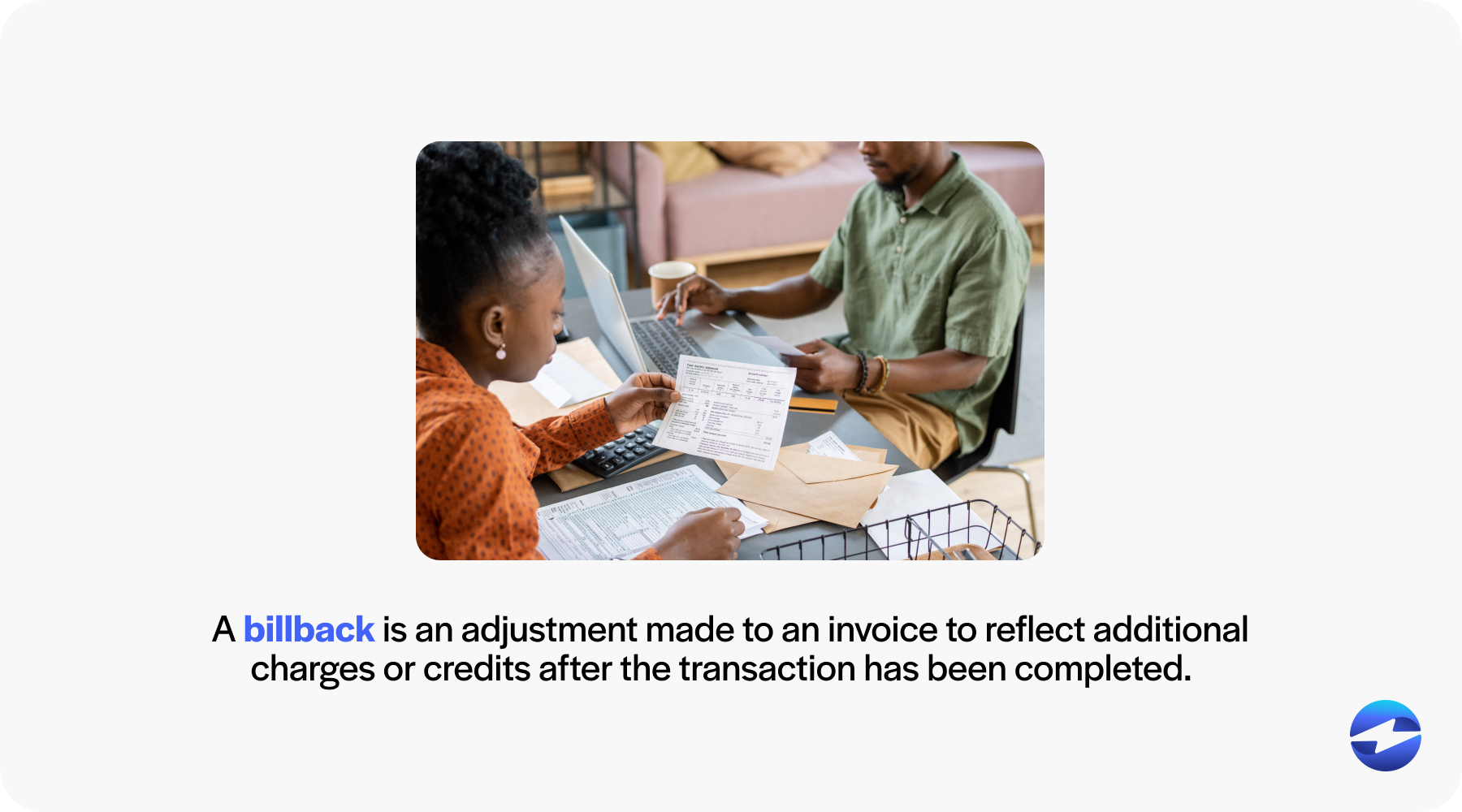

What is a billback?

A billback is an adjustment made to an invoice to reflect additional charges or credits after the transaction has been completed.

In practice, billbacks often occur in credit card transactions, where additional fees like interchange fees are charged to the merchant after the transaction has been completed. The billback process involves calculating these fees and issuing a billback invoice to the merchant, who is then responsible for paying the additional costs.

Billbacks often complicate the accounting process as they require retroactive adjustments to the revenue, leading businesses to use billback software or third-party billing software.

How do billbacks work?

Understanding how billbacks work allows businesses to accurately manage and predict their processing costs, ensuring there are no unexpected fees. This knowledge helps maintain transparency in financial practices, fosters clients’ trust, and aids in effective budgeting and cost control.

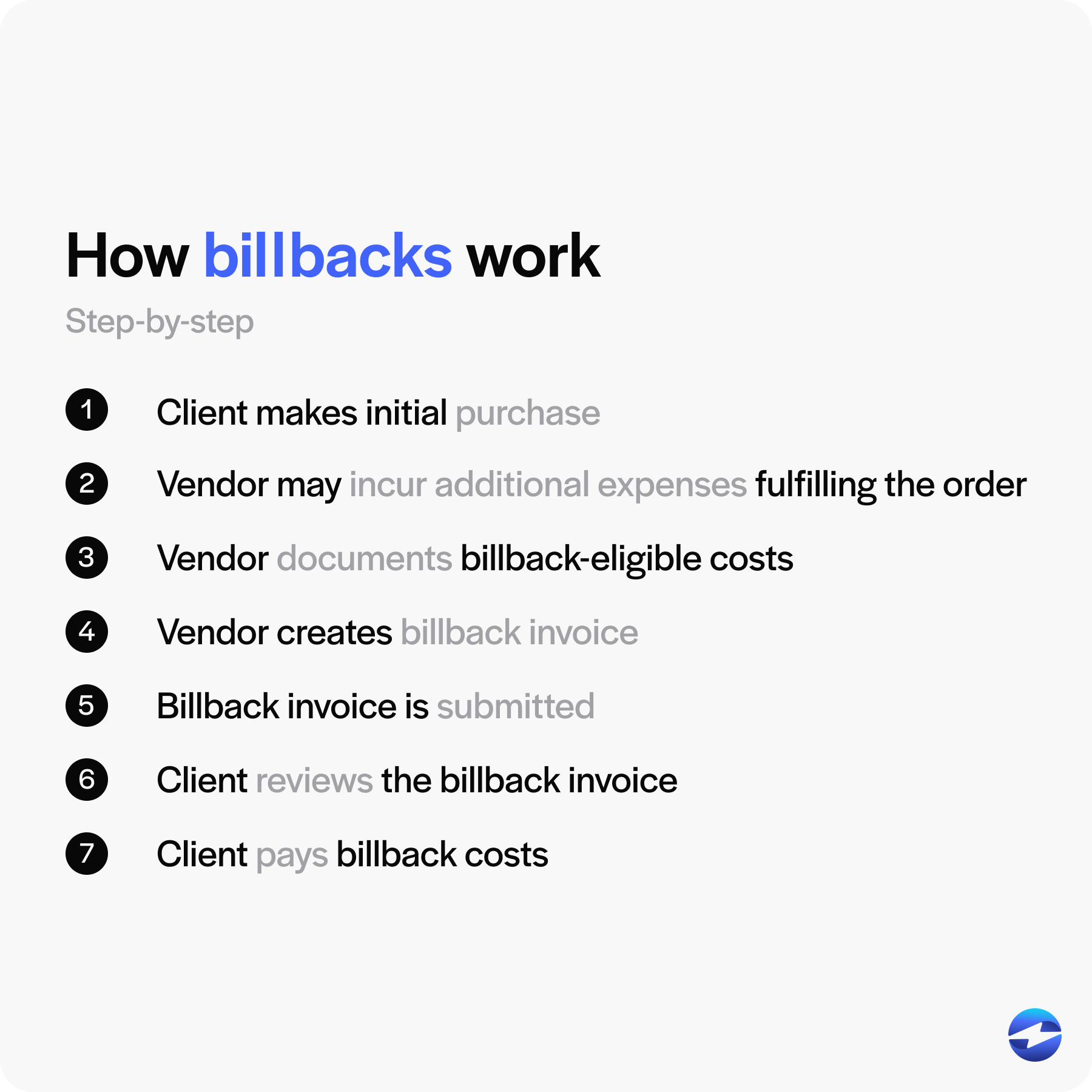

Here’s a quick breakdown of how the process works:

- Initial purchase: The client makes a purchase with the understanding that certain costs may be billed back later.

- Incurring billback costs: As the vendor fulfills the client’s order, they may incur additional expenses that qualify for billbacks.

- Documentation: The vendor documents all the billback-eligible costs accurately.

- Billback invoice creation: Using billback software or a billback system, the vendor generates a billback invoice for the additional costs.

- Invoice submission: The billback invoice is then submitted to the client for payment.

- Review and approval: The client reviews the billback invoice, ensuring it aligns with the contractual agreement.

- Payment: The client then pays the billback costs, finalizing the billback process.

Now that you’re familiar with the basic process, it’s important to note that there are two types of billbacks: standard and enhanced billbacks.

What are enhanced billbacks?

Enhanced billbacks are a slightly more complex iteration of the standard billback process. While traditional billbacks typically involve charging the client for direct expenses incurred during a transaction, enhanced billbacks are additional fees or charges related to service levels, administrative costs, or other value-added services the vendor provides. These can include performance-based fees, management services, or complex allocations of overhead costs.

The aim is to align the pricing more closely with the actual service provided or the value received by the client, which sometimes requires sophisticated calculations and detailed tracking of services rendered.

How to know if you’re under a regular billback or an enhanced billback

To determine whether you’re under a regular billback or an enhanced billback, you can check the interchange fee section on your monthly statement. Billbacks are listed as BB, while enhanced billbacks are listed as EBB.

By carefully reviewing these codes on your statement, you can gain a clearer understanding of your fee structure. This transparency allows you to verify that the fees you’re being charged align with your agreement. Additionally, you can contact your payment processor for clarification if you have any questions or discrepancies.

Being informed about these charges can help you make better decisions regarding your payment processing services and ensure you aren’t overpaying. It’s also important to understand that billbacks carry common challenges that businesses should familiarize themselves with.

Common challenges with billbacks

Billbacks come with challenges that can disrupt smooth financial and operational workflows. These challenges include the potential for overbilling, complex tracking processes, and contractual issues.

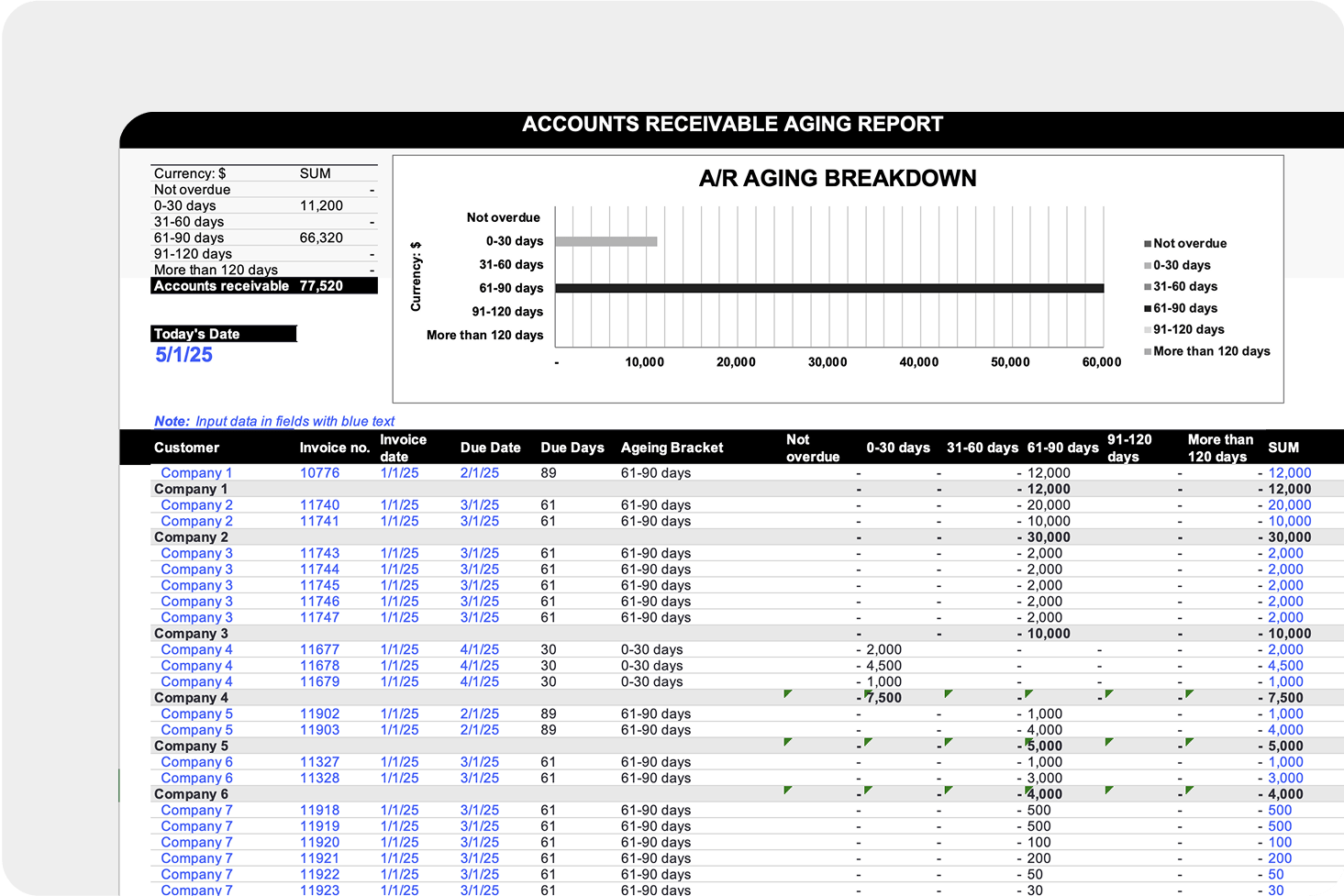

Complexity: Billbacks often involve multiple transactions over different periods, necessitating meticulous record-keeping to maintain accuracy. Without a robust tracking system, ensuring all transactions are correctly accounted for becomes difficult.

Overbilling: With the complexity of calculating billbacks comes the potential for overbilling. Miscalculations can occur, leading to errors that may result in overcharges.

Contractual issues: When contract terms are unclear or inconsistently applied, it can cause delays and misunderstandings between parties. These issues emphasize the need for clear, consistent contracts and effective communication to ensure smooth billback operations.

These challenges make staying informed on best practices for managing billbacks imperative.

Best practices for managing billbacks

Managing billbacks effectively is crucial for maintaining healthy financial operations, especially for businesses with complex billing processes. To ensure a smooth billback process, businesses should adhere to these best practices:

Clear communication: It’s essential to have a detailed billback agreement that clearly outlines billback instructions, fees, rates, and obligations. This provides a clear understanding of the charges to avoid any surprises or misunderstandings.

Accurate billback data: Accuracy is imperative; this means meticulously tracking all expenses eligible for billback to clients, such as utility costs and service fees, and maintaining comprehensive and itemized billback summaries.

Automation: Automation can greatly enhance the billback process. Using billback systems helps minimize errors, enabling timely and accurate billback invoices. Solutions like EBizCharge offer QuickBooks credit card integration and NetSuite payment gateway capabilities, so every transaction syncs directly to your accounting software — no retroactive adjustments or manual reconciliation required. Consistent communication with clients about billback parameters like cost recovery methods, billback restrictions, or any billback rate plans is critical to avoid misunderstandings. This transparency helps preserve trust and ensures all parties understand their billback obligations.

For the billing process, be clear on your invoices, displaying all the necessary details that justify the billback fees. It’s also beneficial to regularly audit the billback invoices to identify any discrepancies or inefficiencies. Adopting these methodologies will aid in maximizing profit margins and strengthening accounts receivable practices while establishing a reliable billback solution.

Frequently asked questions

How often are billback adjustments made?

Billback adjustments are usually made at the end of each billing cycle, typically monthly.

Can billback fees be disputed?

Yes, if you believe there’s an error in the billback fees, you can contact your payment processor to review and dispute the charges.

What should I do if I don’t understand the billback fees on my statement?

If you don’t understand the billback fees on your statement, contact your payment processor for clarification and ask for a detailed explanation of the charges.