Blog > Credit Card Surcharge Signs: Compliance, Design, and Best Practices

Credit Card Surcharge Signs: Compliance, Design, and Best Practices

With the prevalence of credit card use in 2024 comes the often-overlooked detail of physical credit card surcharge signs, which provide transparency of the fees merchants charge their customers to use credit card payments to purchase.

Understanding the purpose behind credit card surcharge signs is crucial since they’re used to inform customers while ensuring businesses adhere to legal standards.

What are credit card surcharges?

Credit card surcharges are the processing fees that merchants pass to their customers when they use credit cards to purchase goods or services. These fees are intended to cover the cost associated with credit card processing fees, which merchants pay to credit card companies such as Visa, MasterCard, or American Express for each transaction to purchase goods or services.

Traditionally, businesses absorb credit card processing costs, but with surcharging, they pass the fees directly to consumers. The surcharge amount typically reflects a percentage of the purchase price and is clearly stated as a separate line item at the time of sale.

Surcharging legal rules

Surcharging fees are regulated by major card brands like Visa, American Express, and other credit card companies.

Legally, merchants can add a credit card surcharge in many jurisdictions, but they must adhere to specific rules laid down by card brand rules and state laws. These rules typically include the following:

- Disclosure Requirements: Merchants must disclose the surcharge to customers before completing the transaction.

- Surcharge Limits: The surcharge cannot exceed a certain percentage of the transaction amount, usually capped at 4%.

- Equal Treatment: The surcharge must be applied uniformly to all credit card transactions.

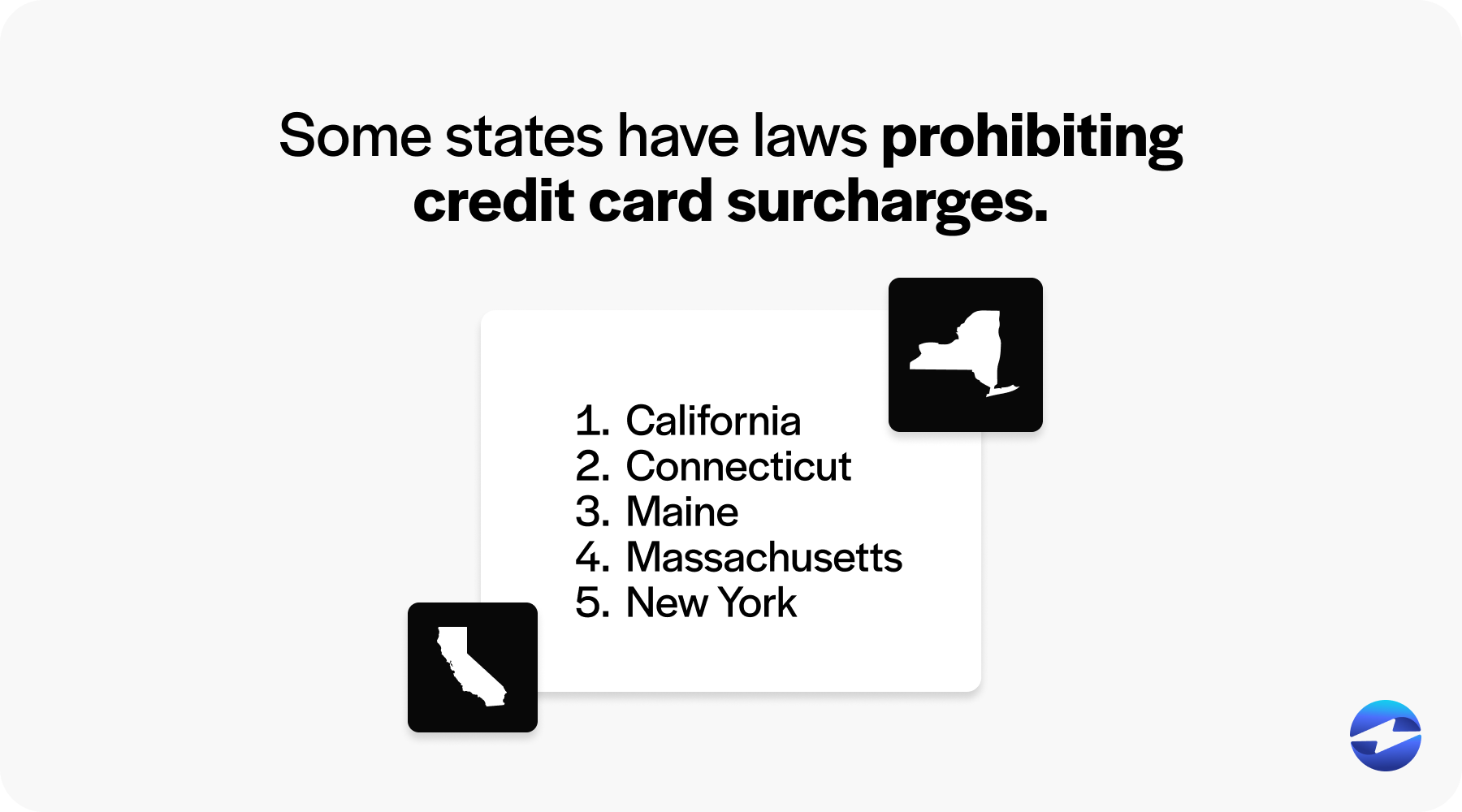

- Prohibited States: Some states, like California and New York, have laws prohibiting credit card surcharges.

It’s common practice for businesses to calculate surcharge fees based on an average of credit card processing fees, which includes interchange fees and additional expenses related to accepting credit card purchases.

Merchants must also disclose surcharge fees on every receipt, ensuring transparency in credit card transactions. Following these legal rules is crucial for compliance, preventing potential legal consequences, and maintaining customer trust.

Why display credit card surcharge signs?

Displaying credit card surcharge signs is a legal requirement for merchants who add an extra fee to transactions made with a credit card. These signs inform customers about the additional charges associated with using credit cards for payments.

The signage is crucial because it clearly communicates to customers before they commit to a credit and debit card transaction. The absence of such notifications may lead to misunderstandings or the appearance of hidden fees, which can erode trust and customer satisfaction.

Furthermore, presenting surcharge information upfront complies with card brand rules and can protect merchants from potential legal disputes.

Compliance requirements for surcharge signs

Merchants must adhere to specific regulations when displaying credit card surcharge signs to ensure patrons are adequately informed about additional fees for using credit cards.

Compliance mandates clear visibility and legibility of such information at the point of sale. These signs should indicate the surcharge amount and that it only applies to credit card payments, not debit card transactions.

Failure to meet these standards can result in discrepancies with the card networks and customer dissatisfaction due to a lack of transparency regarding these costs.

Specific requirements by region (U.S., EU, Australia, etc.)

In the U.S., credit card surcharge regulations can vary by state. Numerous states, such as California, Florida, and Texas, allow surcharging, while it remains prohibited in others, like Connecticut and Massachusetts.

Merchants must notify card brands and customers at least 30 days prior to implementing surcharges. Additionally, the surcharge amount can’t exceed the merchant’s cost to accept credit cards, typically capped at 4%.

The European Union took a different approach. Under the Payment Services Directive (PSD2), European merchants are prohibited from adding surcharges to credit card transactions. This applies to most cards, ensuring consistent fees across member states.

In contrast, Australia allows merchants to apply surcharges but has stipulations to protect consumers. The Australian Competition & Consumer Commission (ACCC) enforces that surcharges must not exceed the credit card transaction cost, including bank fees and terminal costs. Merchants are required to disclose surcharge fees to customers.

Each region’s approach to credit card surcharge regulations reflects varied efforts to balance the interests of consumers, merchants, and credit card companies.

Consequences of non-compliance

Non-compliance with credit card surcharge regulations and signage policies can have significant consequences for businesses.

It’s imperative that your company first adheres to credit card surcharging rules, as non-compliance can result in penalties from credit card companies. Additionally, if customers aren’t properly informed about surcharge fees through visible signage, they can dispute the extra charges, leading to chargebacks. This creates an administrative burden and can lead to financial losses due to refunded transactions and chargeback fees.

Moreover, there’s a risk of damaging the business’s reputation, as customers may perceive non-compliance as dishonest business practices. This can result in a loss of customer trust and, ultimately, customer patronage.

To avoid these outcomes, businesses must remain vigilant and adhere to the rules set forth by card brands and the law regarding the display of credit card surcharge information.

Design tips for effective surcharge signs

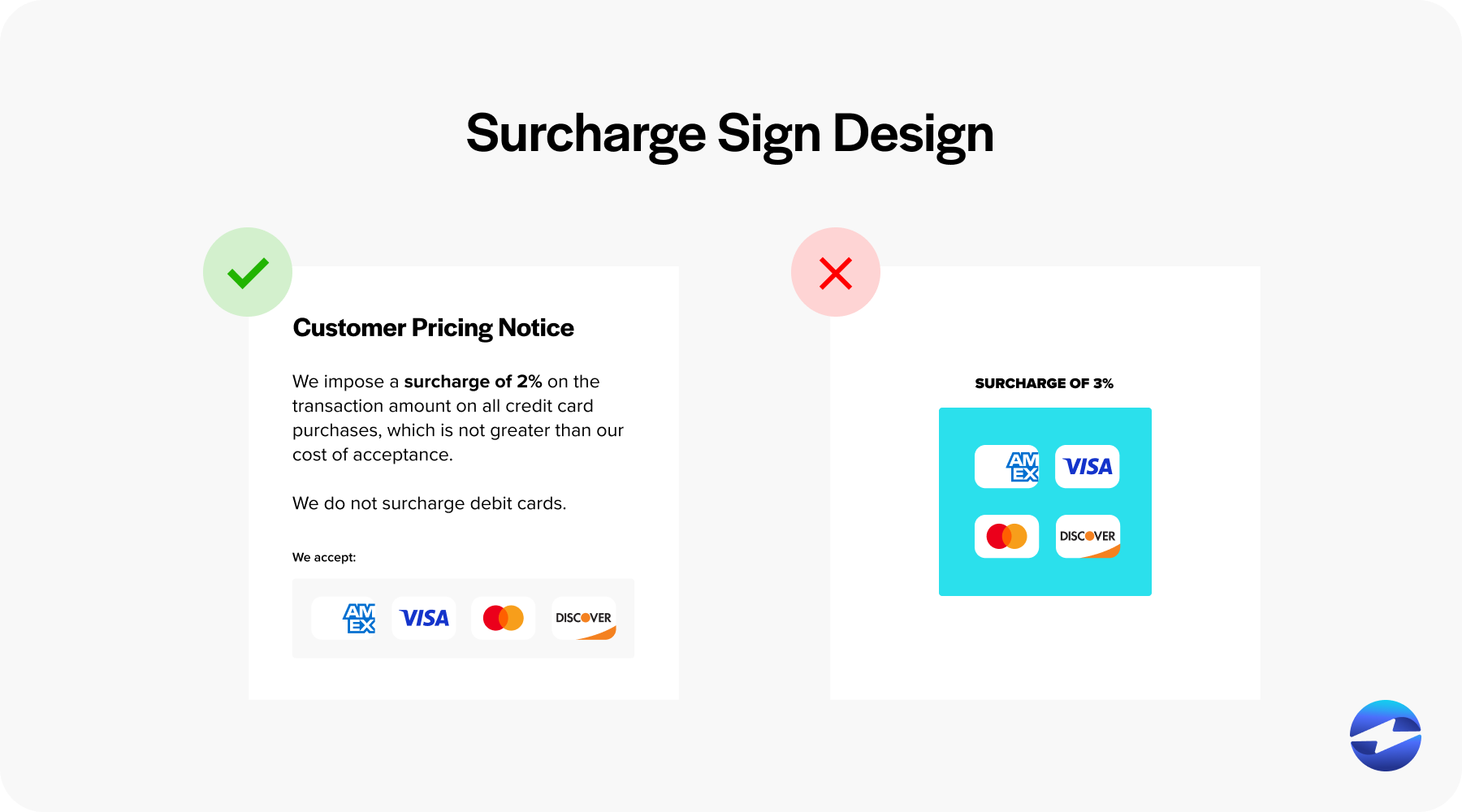

Creating impactful credit card surcharge signs relies heavily on design principles that enhance visibility and comprehension.

When designing these signs, it’s crucial to reflect the brand’s professionalism while communicating the surcharge policy to the customers. Good design ensures that the surcharge information is noticed and understood without confusion.

Your business can successfully post surcharge signs by following tips regarding placement, fonts and readability, effective wording, and essential details to include.

1. Placement of signs (entry points, point of sale, website)

When setting up credit card surcharge signs, it’s essential to place them in prominent locations to adhere to card brand rules.

Signage must be strategically displayed at all business entry points, alerting customers to the surcharge before any credit card transactions occur. This ensures the customer acknowledges the fee before engaging in a purchase.

Signs are necessary at the point of sale (POS) system where credit card payments are processed. The signage must clearly state the credit card surcharges, typically a percentage of the total price. Moreover, the surcharge should be itemized separately in the receipt, indicating the exact surcharge fee applied.

For eCommerce businesses, the website must prominently feature the surcharge notice. It should be visible before the final checkout, ensuring customers are aware of any extra costs associated with credit card purchases.

In summary, effective credit card surcharge signs should be visible at business entry points, POS systems, and on websites before checkout.

This approach aligns with standard practices and ensures customers understand the actual costs associated with their payment method, upholding common practice and compliance with relevant legislation.

2. Font size, color, and readability

When creating credit card surcharge signs, choosing effective font sizes, colors, and general readability is essential for compliance.

Signs should feature large, legible font sizes that ensure visibility and comprehension from a reasonable distance. Small fonts may cause customers to overlook important surcharge information, leading to confusion at the point of sale.

The color contrast between the background of the sign and the text is equally important. High contrast colors, such as black text on a white background, guarantee that the message stands out and is accessible to all customers, including those with visual impairments.

Readability extends beyond font and color. The overall design should avoid clutter and complex language. Precise, concise wording devoid of jargon should clearly convey your message.

For example, a well-designed credit card surcharge sign might feature:

- A bold sans-serif font of at least 10-point size for clarity

- A color scheme with high contrast (black on white or blue on yellow)

- Brief, understandable phrases making it evident that a surcharge applies to credit card transactions

Ensuring these design elements are in place makes it easier for customers to understand the costs associated with their payment method choices.

3. Clear and concise wording

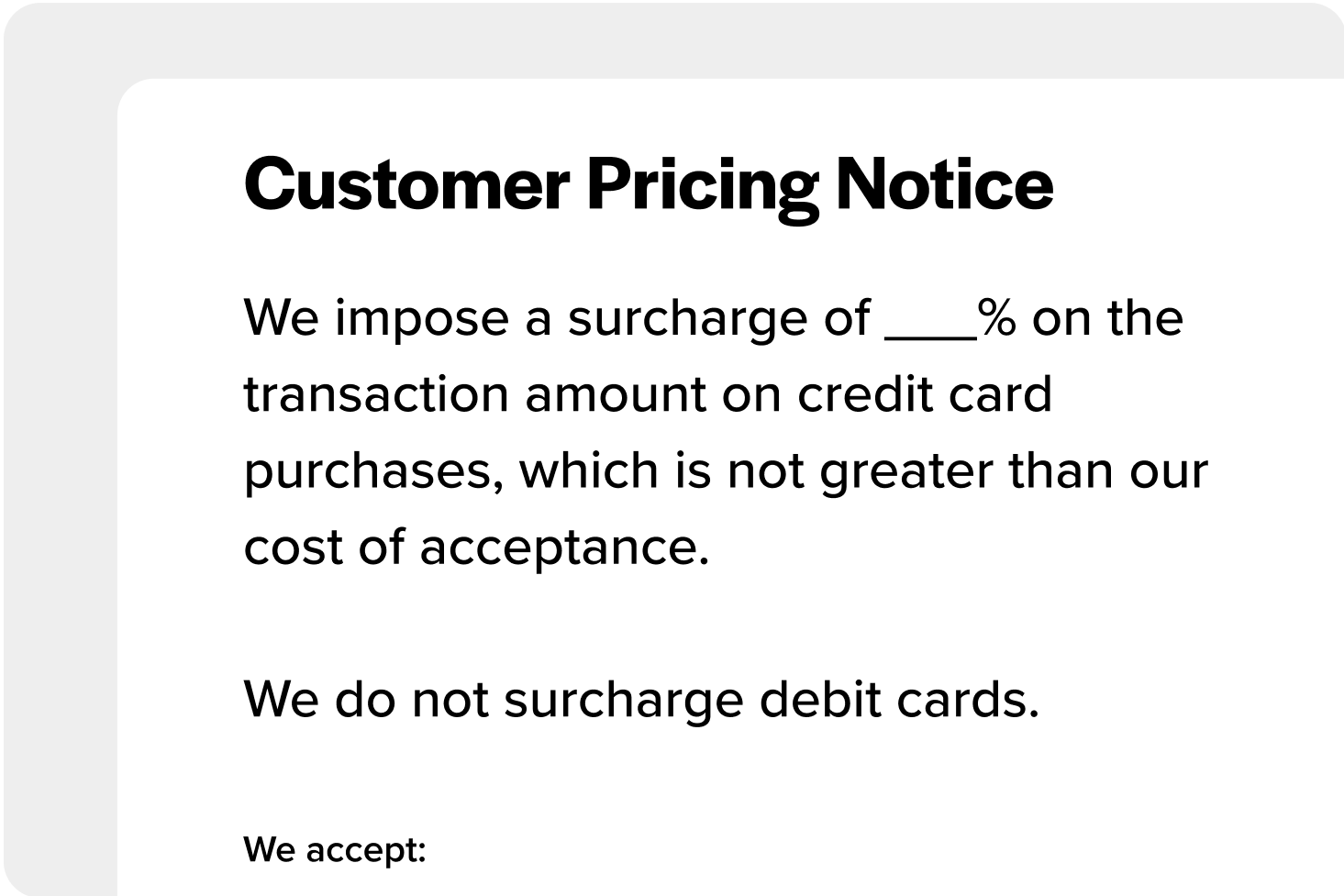

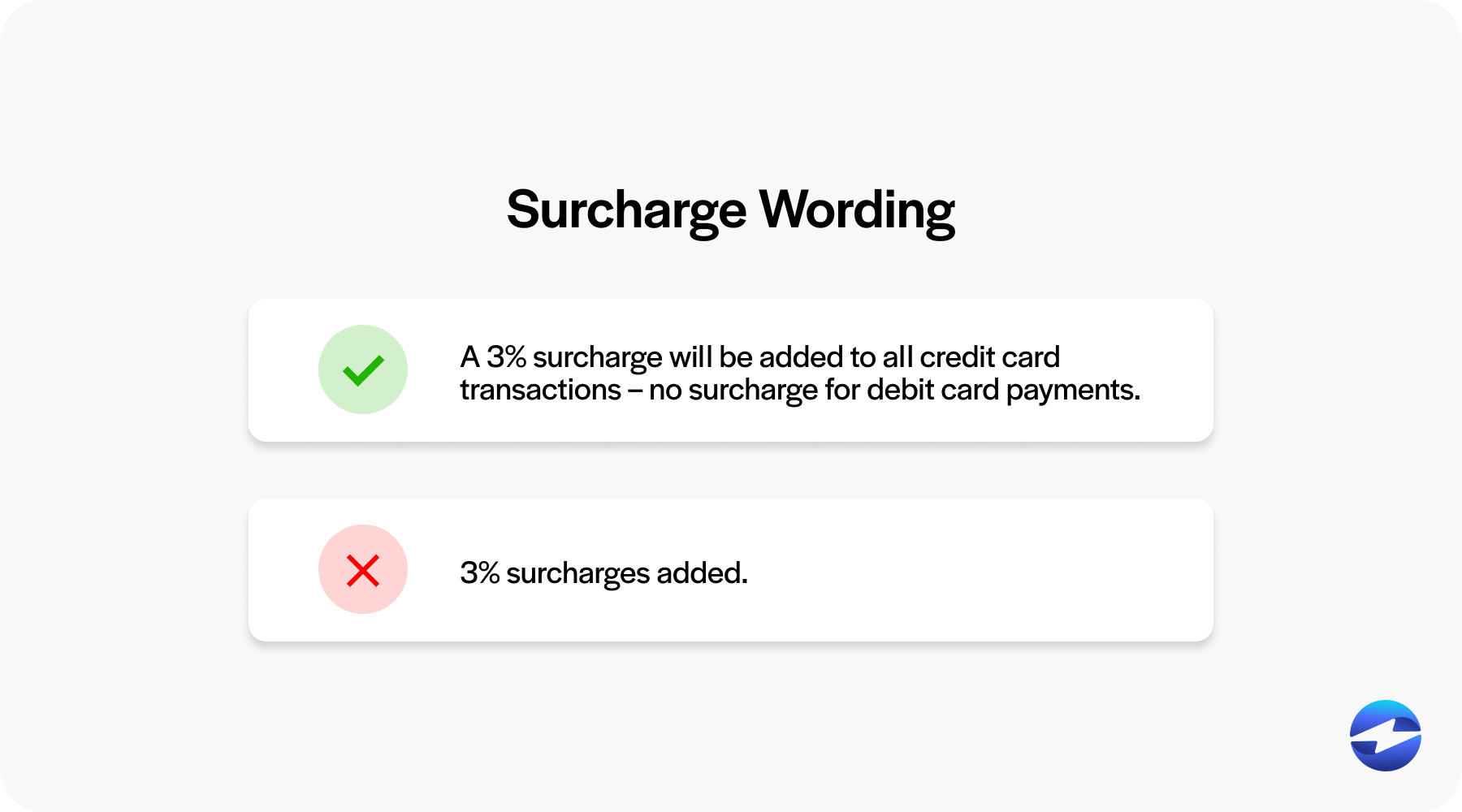

When creating credit card surcharge signs, the importance of clear and concise wording can’t be overstated. The text must unmistakably communicate the additional charges for credit card transactions.

Rather than using complex terms, opt for straightforward, easily understandable language. Here are three elements to include:

- Surcharge amount: Specify the exact percentage added to credit card purchases or a flat fee, ensuring it reflects actual costs.

- Applicable payments: Clearly distinguish between credit cards and debit cards, as surcharge rules vary.

- Card types affected: Indicate if the surcharge applies to all credit cards or only specific cards like American Express.

For example, effective signage may read: A 3% surcharge will be added to all credit card transactions – no surcharge for debit card payments.

4. Including necessary details (surcharge percentage, alternative payment options)

When displaying credit card surcharge signs, it’s crucial to include all necessary details to ensure compliance with regulations.

First, the exact surcharge percentage must be clearly stated on the signage. This will inform customers about the additional cost they’ll incur when using credit card payments instead of other payment methods.

The sign should also list alternative payment options that don’t include a surcharge fee, such as cash, checks, or debit card transactions. By providing this information, customers can make informed decisions and avoid any unexpected charges.

Clearly presenting these details will ensure adherence to surcharge laws and can make customers feel respected and well-informed, contributing to a positive experience. You can find examples of surcharge signs online if you need guidance on how to get started.

Alternatives to credit card surcharges

When businesses are looking to offset processing fees without applying credit card surcharges, several alternatives can be considered.

One prominent option is offering discounts for customers who pay with cash or debit cards, effectively rewarding non-credit transactions. This is a reverse strategy from adding a fee for credit card payments but achieves a similar financial objective for the merchant.

Another tactic is to raise the overall prices of goods or services slightly to cover the credit card processing costs. By doing so, the business absorbs the transaction fees into its pricing structure, essentially spreading out the cost among all customers, regardless of payment method.

Implementing a minimum purchase amount for credit card transactions is also a commonly used strategy. This discourages small purchases that may not justify the processing fees for the business.

Lastly, some businesses opt for a zero fee credit card processing service, which passes on the cost directly to the customer as a service fee, separate from a traditional surcharge. However, merchants should always ensure such practices align with the rules of credit card companies and local regulations.

Whichever approach your business takes, connecting your payment solution to your accounting software ensures surcharges and fees are tracked accurately. A QuickBooks credit card integration can automatically apply compliant surcharge amounts and record them as separate line items in your books. For mid-market businesses, a Sage Intacct payment gateway provides the same automation within your ERP, so your finance team always has a clear picture of how much is being collected in surcharges versus product revenue. Both options help keep you compliant without adding manual reconciliation to your workflow.

Mastering credit card surcharge signs

Businesses must observe and adhere to the proper guidelines when implementing credit card surcharge signs. Ensuring compliance with card brand rules and state regulations where surcharging is permissible protects against potential legal issues. You can easily find a printable credit card fee sign online or you can design your own using the guidelines listed above.

Implementing clear and professional design in signage facilitates better customer understanding and enhances your company’s reputation and brand image.