Blog > What’s the Difference Between Accounts Payable and Expenses?

What’s the Difference Between Accounts Payable and Expenses?

Accounts payable and expenses are fundamental concepts in accounting, essential for understanding a company’s financial health. However, they refer to different aspects of a company’s finances.

This article will examine the differences between accounts payable vs. expenses, exploring their unique roles in financial statements and uncovering best practices for managing them efficiently.

What are accounts payable in accounting?

Accounts payable (AP) represents the amount owed to suppliers or service providers when goods or services are bought on credit. This is not to be confused with accounts receivable (AR), which refers to money owed to the company. AP includes invoices that a company is obligated to pay in the near future.

Effective AP management is crucial for maintaining good supplier relationships and ensuring timely payments, which is important for a company’s cash flow and creditworthiness.

On the other hand, expenses represent a different part of a company’s financial statement.

What is an expense in accounting?

Expenses represent the costs of producing and delivering goods and services within an accounting period. These expenses include employee wages and salaries, rent, and utilities, the cost of goods sold, and depreciation.

Under the accrual method of accounting, expenses are matched with revenues on the income statement regardless of when the cash payment occurs.

Expenses provide insights into a company’s operational performance and are instrumental in determining net income. They’re not equivalent to cash outflows, as expenses may include non-cash items such as depreciation or amortized costs. Monitoring expenses is vital for budgeting and assessing a company’s profitability over time.

Although similar, it’s also important not to confuse expenses vs. liabilities. While expenses encompass the costs of business operations, liabilities represent other financial obligations resulting from borrowing, purchases on credit, or legal duties.

While expenses are typically due right away, some can be paid later. These expenses are known as accrued expenses.

What are accrued expenses?

Accrued expenses refer to costs incurred but not yet paid for or reported in financial statements. This concept is the cornerstone of the accrual method of accounting.

Under the accrual accounting method, transactions are recorded when earned or incurred rather than when cash is exchanged. Accrued expenses often represent goods or services that a company has received but has yet to process the invoice or make a cash payment.

Everday accrued expenses include utility bills, employee wages, taxes, and interest. These expenses are recognized before the cash flows out of a business.

In financial statements, accrued expenses are recorded as current liabilities on the balance sheet. They affect the income statement since the expenses are matched with revenues in the accounting period they’re incurred, regardless of when the payment is made.

Accounts payable vs. expenses

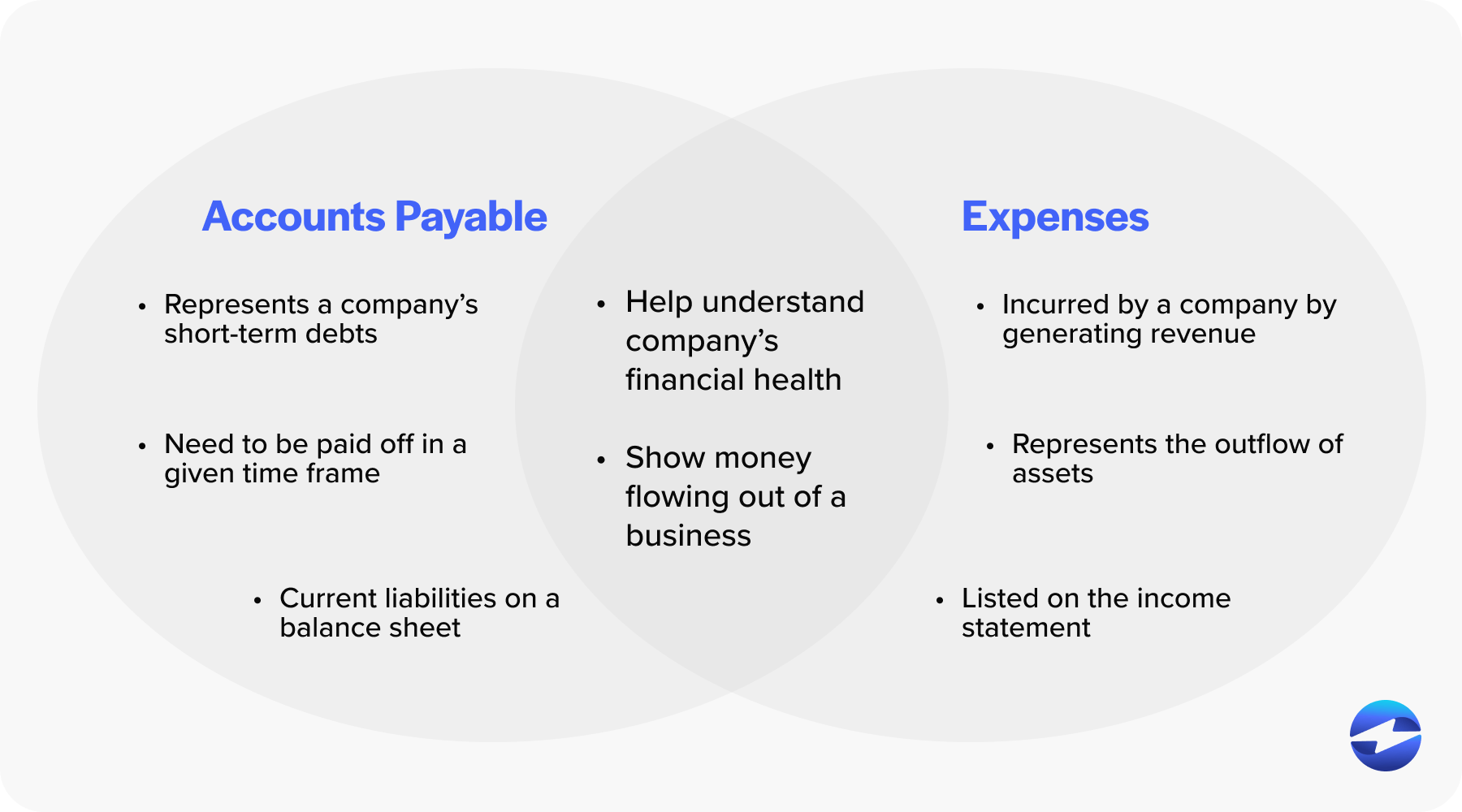

AP and expenses are two fundamental accounting concepts that are essential for understanding a company’s financial health. However, they refer to different aspects of a company’s finances.

AP represents a company’s short-term debts – obligations the company must pay off within a given time frame, typically within one year. Conversely, expenses are those incurred by a company in generating revenue. While both relate to money flowing out of a business, they appear at different places in the financial statements.

Listing AP and expenses on financial statements

Proper placement of AP and expenses on financial statements will provide a more accurate picture of your company’s financial health.

These elements are essential in gauging operational efficiency and your ability to manage short-term debts and day-to-day operations.

Accounts payable

AP is a critical component of current liabilities listed on the balance sheet. This is where a company outlines its outstanding obligations or debts to suppliers or creditors for goods and services received on credit.

AP is a clear indicator of the company’s short-term financial obligations and is crucial in assessing its cash flow and management of payable liabilities.

Expenses

Expenses are listed on the income statement and represent the outflow of assets or incurring of liabilities resulting from the company’s primary operations – costs necessary for earning the revenue reported in the same period.

Expenses include employee salaries, utility expenses, depreciation, and the cost of goods sold (COGS).

By grasping the timing of recognition and the nature of these two concepts, businesses can effectively manage their financial resources, optimize cash flow, and maintain transparent financial statements.

You should also know where to list AP on expenses on financial statements.

Best practices for managing accounts payable and expenses

Effectively managing AP and expenses is crucial to maintaining a company’s financial health and organizing financial obligations.

Strategies for managing these aspects of business finance often overlap, as they both involve the outflow of funds. Nevertheless, specific best practices pertain to each.

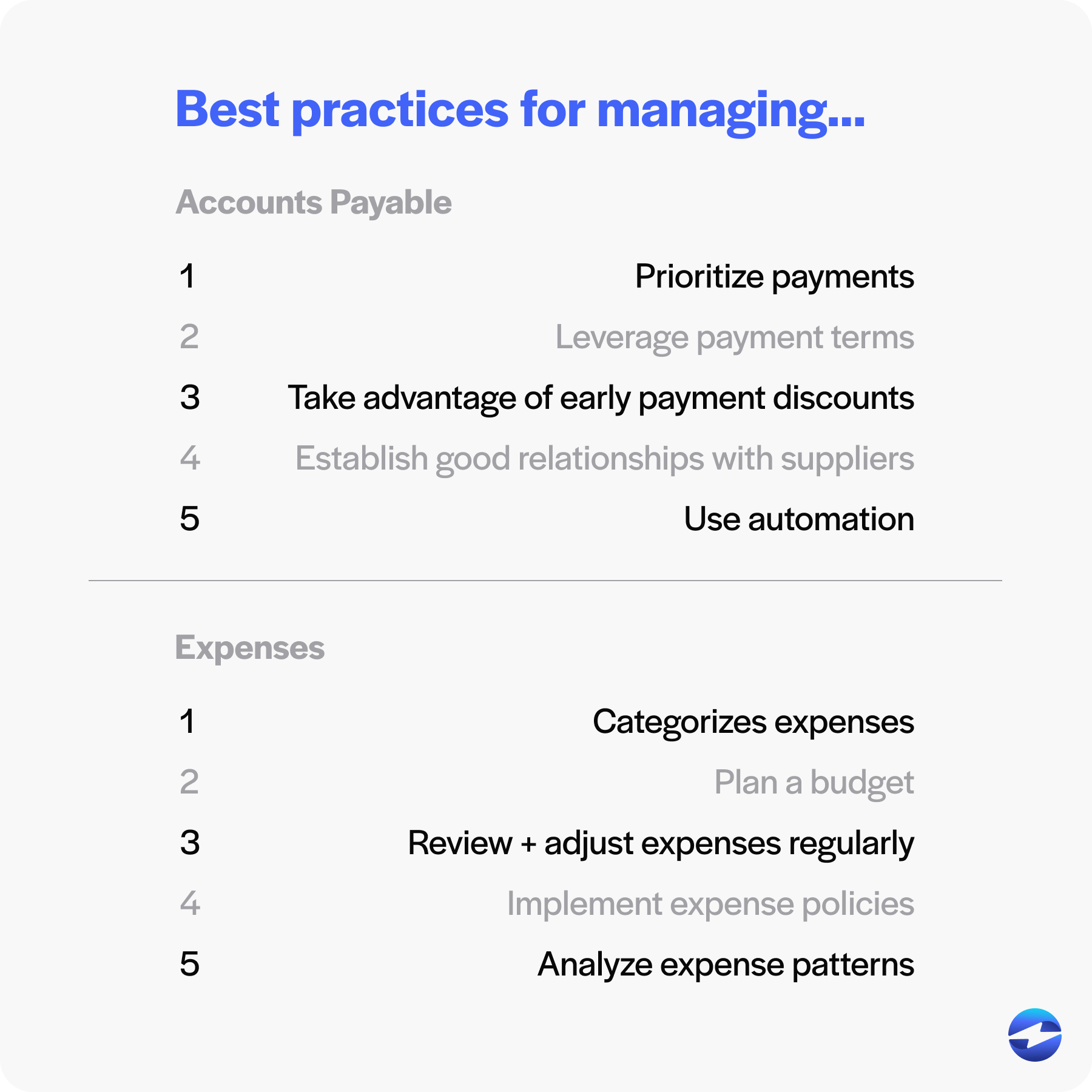

Best practices for managing AP

- Prioritize payments: Determine which invoices should be paid first based on their due dates and potential discounts for early payments.

- Leverage payment terms: Negotiate favorable payment terms with suppliers to extend the time to pay and improve cash flow.

- Take advantage of early payment discounts: Some suppliers offer discounts for early payment, so take the opportunity to reduce costs when possible.

- Establish good relationships with suppliers: Good relationships can lead to better terms and can be valuable in times of financial strain.

- Use automation: Employ AP automation solutions to streamline processes, reduce manual data entry, and minimize the risk of late payments.

Best practices for managing expenses

- Categorize expenses: Break down your expenses into categories for a clearer view of where money is being spent and where it can be saved.

- Budget planning: Create and adhere to budgets for various expense categories to limit overspending and plan for future expenditures.

- Review and adjust expenses regularly: Monitor your expense reports periodically to identify and eliminate unnecessary spending.

- Implement expense policies: Set clear guidelines for employee spending to avoid misuse and compliance with budgets.

- Analyze expense patterns: Employ AP automation solutions to streamline processes, reduce manual data entry, and minimize the risk of late payments. Pairing that with payment processing software that connects with over 100 ERP, CRM, and accounting integrations means your receivables side stays just as organized, giving you a cleaner picture of cash flow across the board.

Optimizing AP and expense management requires diligence, forecasting, and the strategic use of technology. Following these best practices will help you maintain a solid financial foundation and foster growth and longevity in the market.