Blog > Understanding the Cash Application Process: Tips for a Smooth Process

Understanding the Cash Application Process: Tips for a Smooth Process

The cash application process is fundamental in ensuring that cash circulates efficiently. But what exactly is it, and why is it crucial for your business?

The cash application is the foundation of financial reconciliation, determining the health of your accounts receivable (AR). Understanding this process is pivotal for businesses wanting to maintain a seamless financial ecosystem and prevent bottlenecks that hinder their cash flow.

What is cash application?

Cash application is crucial for a company’s financial operations, specifically within the accounts receivable sector.

The cash application process involves matching incoming customer payments to the correct invoices. When a company issues an invoice and a customer makes a payment, that payment doesn’t automatically get attached to the outstanding invoice. It requires reconciliation to ensure the customer’s account reflects the proper payment status.

This reconciliation process is critical because it affects a company’s cash flow. Accurate and efficient cash applications ensure that your financial records are up-to-date and that your business has a clear view of its revenue stream.

Why does cash application matter?

Cash application matters because it directly influences a company’s liquidity and operational efficiency.

A streamlined cash application process can result in several benefits:

- Improved cash flow: By applying cash promptly, companies can use funds faster, which is essential for healthy financial operations and positive cash flow.

- Reduced days sales outstanding (DSO): A quick and accurate cash application process speeds up the time to close incoming payments, consequently lowering the DSO metric and improving the cash cycle.

- Fewer errors: An optimized process reduces the risk of human error, which can lead to misapplied payments and customer dissatisfaction.

Improving the cash application process is vital for maintaining financial health and positive customer relationships. With less time spent on manual cash application processes, the receivables team can focus on other crucial tasks that add value to the business.

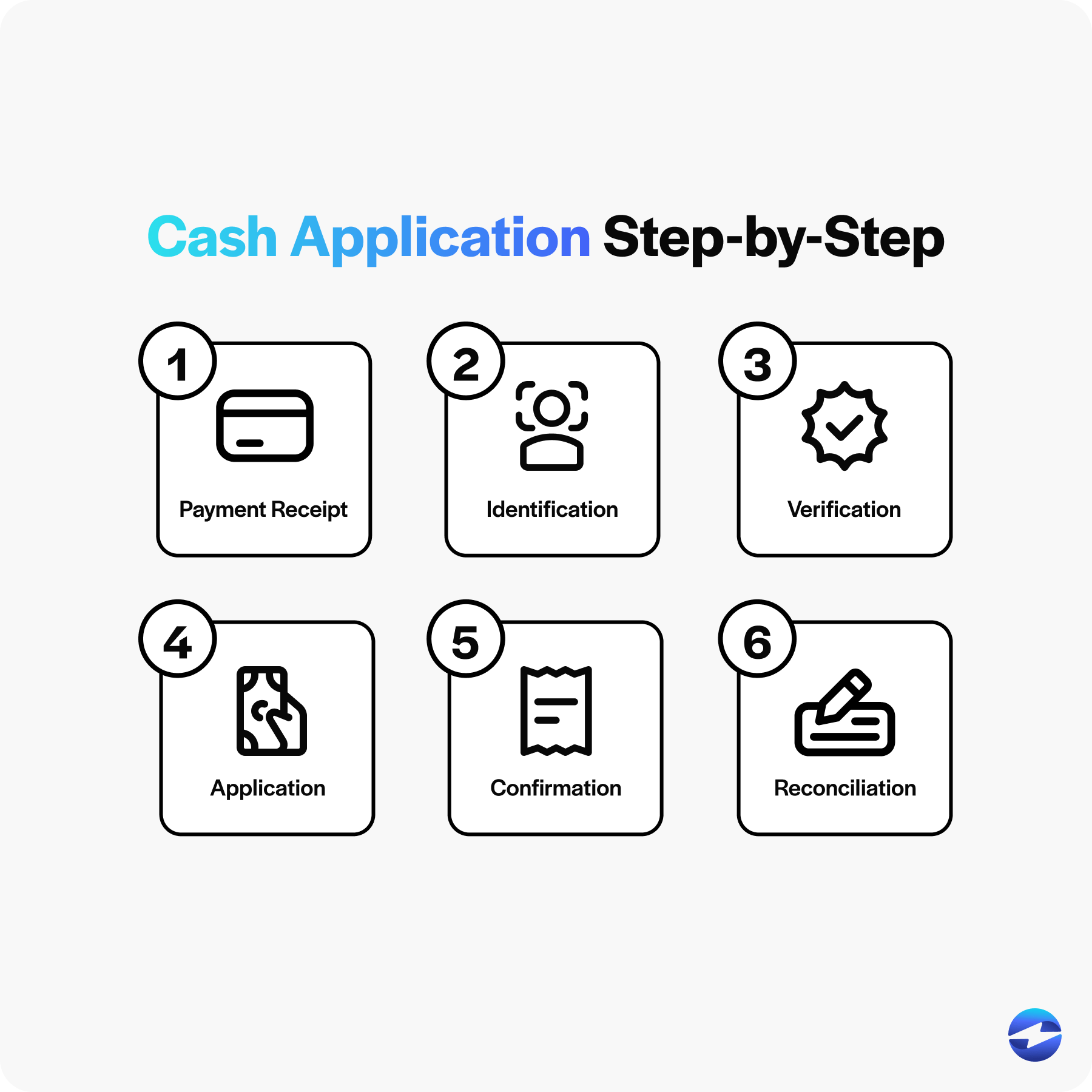

6 steps involved in the cash application process

The cash application process enhances financial operations and cash flow by matching incoming payments to the appropriate customer accounts and outstanding invoices.

Here is a simplified step-by-step list of how the cash application works:

- Receipt of payment: The process starts when a business receives a customer payment. Payments can be made electronically or via paper checks or credit cards.

- Identification. Upon receiving the payment, the AR team identifies which account it belongs to. This may involve cross-referencing payment details and customer information.

- Verification: Next, your business can verify the amount paid to ensure it matches the correct invoices. Notate if a payment is partial or exceeds the invoice amount.

- Application: Once verified, the payment is applied to the customer’s account. An accurate application is crucial to maintaining correct AR records.

- Confirmation: After the payment is applied, the customer typically receives confirmation of the transaction, indicating their payment has been received and applied.

- Reconciliation: Lastly, the cash application team reconciles the payment received with their financial records, ensuring all accounting is accurate and up to date.

By carefully following these steps, businesses can manage their cash application process more efficiently and minimize discrepancies.

What are common issues that slow down cash application?

The journey from incoming payments to reconciled accounts can face several roadblocks when discussing the cash application process.

Here are some common issues that often slow down this financial operation:

- Inefficient manual processes: Hand-keying payment details and matching them to correct invoices can be incredibly time-consuming and lead to more mistakes.

- Electronic payment variations: Various payment channels, such as paper checks or credit cards, may require different handling processes, complicating the cash application.

- Partial payments: Tracking and applying payments that don’t cover the full invoice amount can complicate account reconciliation.

- Volume of transactions: High volumes of incoming payments can overwhelm finance professionals, leading to backlogs in cash applications.

To improve cash flow and minimize DSO, companies must address these challenges.

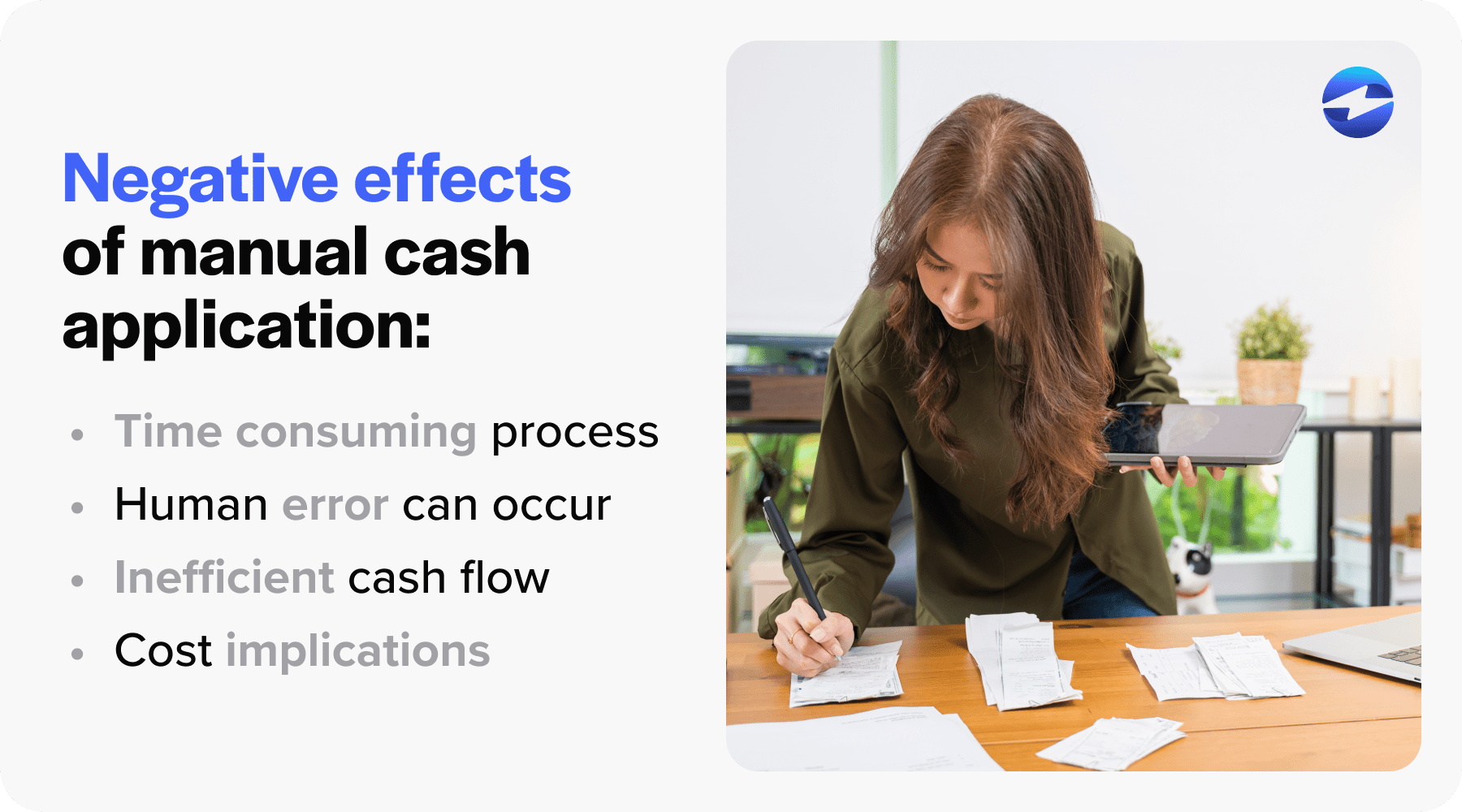

4 reasons why manual cash application processes do more harm than good

Manual cash application processes are outdated practices that can negatively impact businesses.

Here are four reasons why they can be more harmful than beneficial:

- Time consumption: Manually matching payments to the correct invoices involves a lot of paperwork and can be a lengthy process for your receivables team that diverts focus from more strategic tasks.

- Human error: Human error is a significant risk when processing payments manually. Missed or incorrectly applied payments can lead to AR discrepancies, often requiring additional resolution time.

- Inefficient cash flow: Manual processes can delay recognizing incoming payments, hindering cash flow. This can also impact financial reporting and the timely execution of financial operations.

- Cost implications: Manual cash application requires a larger workforce, leading to more labor costs. Also, errors and delays can lead to higher DSO, indirectly increasing operational costs.

Companies with manual cash applications may interrupt their overall efficiency and financial well-being, emphasizing the need for modern cash application solutions to streamline and secure payment management.

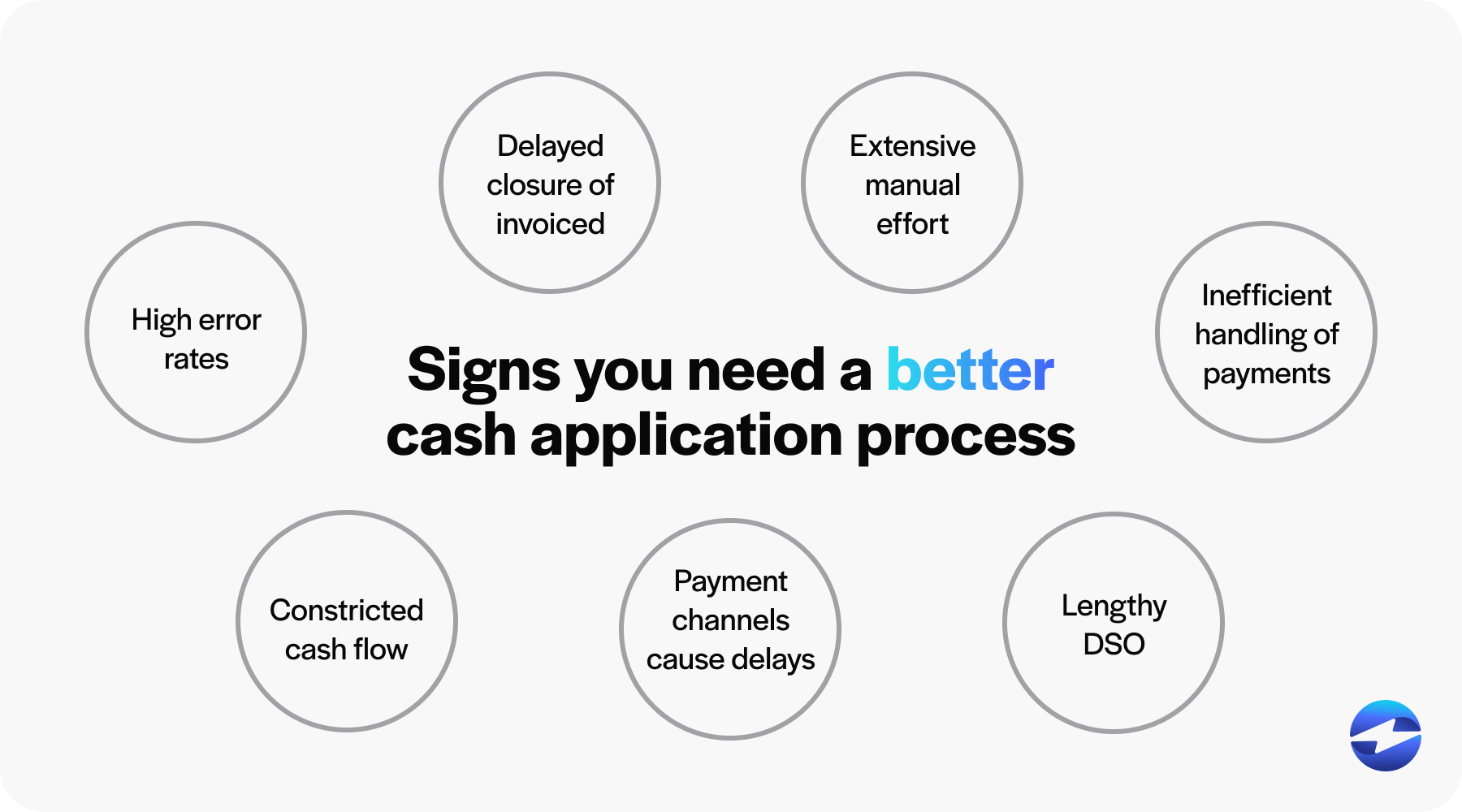

Signs you need to improve your cash application process

Identifying the need for an enhanced cash application process is crucial for maintaining healthy business operations.

Here are some signs for implementing a better cash application process:

- High error rates in payment matching

- Delayed closure of outstanding invoices

- Extensive manual effort and paperwork

- Inefficient handling of partial payments

- Lengthy DSO

- Diverse payment channels causing bottlenecks

- Constricted cash flow due to payment application delays

If your business is showing some of these signs, then it’s time to improve your cash application process and find the best provider for your business.

How to find the best cash application provider for your business

Finding the best cash application provider is crucial for streamlining your financial operations and enhancing cash flow.

Here’s a concise guide with practical tips:

- Identify need: Thoroughly review your business’s needs by evaluating your current cash application process and identifying improvement areas.

- Research providers: Look for providers specializing in cash application automation software, which can reduce manual effort and human error.

- Check compatibility: Ensure the software integrates seamlessly with your existing financial systems and can handle all payment channels, including credit cards, electronic payments, and paper checks.

- Look for features: Essential features should include handling partial payments, automatically matching payments to the correct invoices, and reconciling incoming payments.

- Evaluate customer support: Good customer support can simplify implementation and maintenance. Look for in-house and responsive 24/7 customer service.

- Assess reviews: Read case studies and user testimonials to gauge the software’s effectiveness and the experience of other finance professionals.

- Consider cost: Compare pricing but remember that lower costs may mean compromised functionality. Find a solution that offers a good balance between cost and features.

- Test software: Request demos or trial periods to test the user interface and assess if it aligns with your AR team’s workflow.

Choosing the right cash application provider can affect how quickly and accurately payments are applied and enhance your DSO and finances.

Simplify your cash application process with EBizCharge

Optimizing the cash application process is essential for businesses to manage payments better. With automation software like EBizCharge, finance professionals can achieve faster cash application, boost productivity, and produce more accurate financial reporting.

EBizCharge automates the AR process, including cash application, while integrating into the top accounting and ERP software to simplify reconciliation. EBizCharge offers numerous payment collection tools like secure email payment links, recurring billing, and an online portal, allowing customers to easily pay invoices and your business to increase its cash flow.

- What is cash application?

- 6 steps involved in the cash application process

- What are common issues that slow down cash application?

- 4 reasons why manual cash application processes do more harm than good

- Signs you need to improve your cash application process

- How to find the best cash application provider for your business

- Simplify your cash application process with EBizCharge