Blog > How to Accept Payments Online: Credit Cards, ACH, eChecks and more

How to Accept Payments Online: Credit Cards, ACH, eChecks and more

With the boom in eCommerce, adopting ways of paying online is vital to healthy cash flow. Businesses that accept online payment methods can streamline the purchasing process for their customers and expand their reach to new audiences.

Since there are numerous ways to accept online payments, it’s essential to understand how each works and the benefits associated with them.

What are the best ways to accept payments online?

Nowadays, adapting to the evolving eCommerce industry is within any business’s reach. In fact, most companies can offer multiple ways of paying online to meet the needs and preferences of their customers.

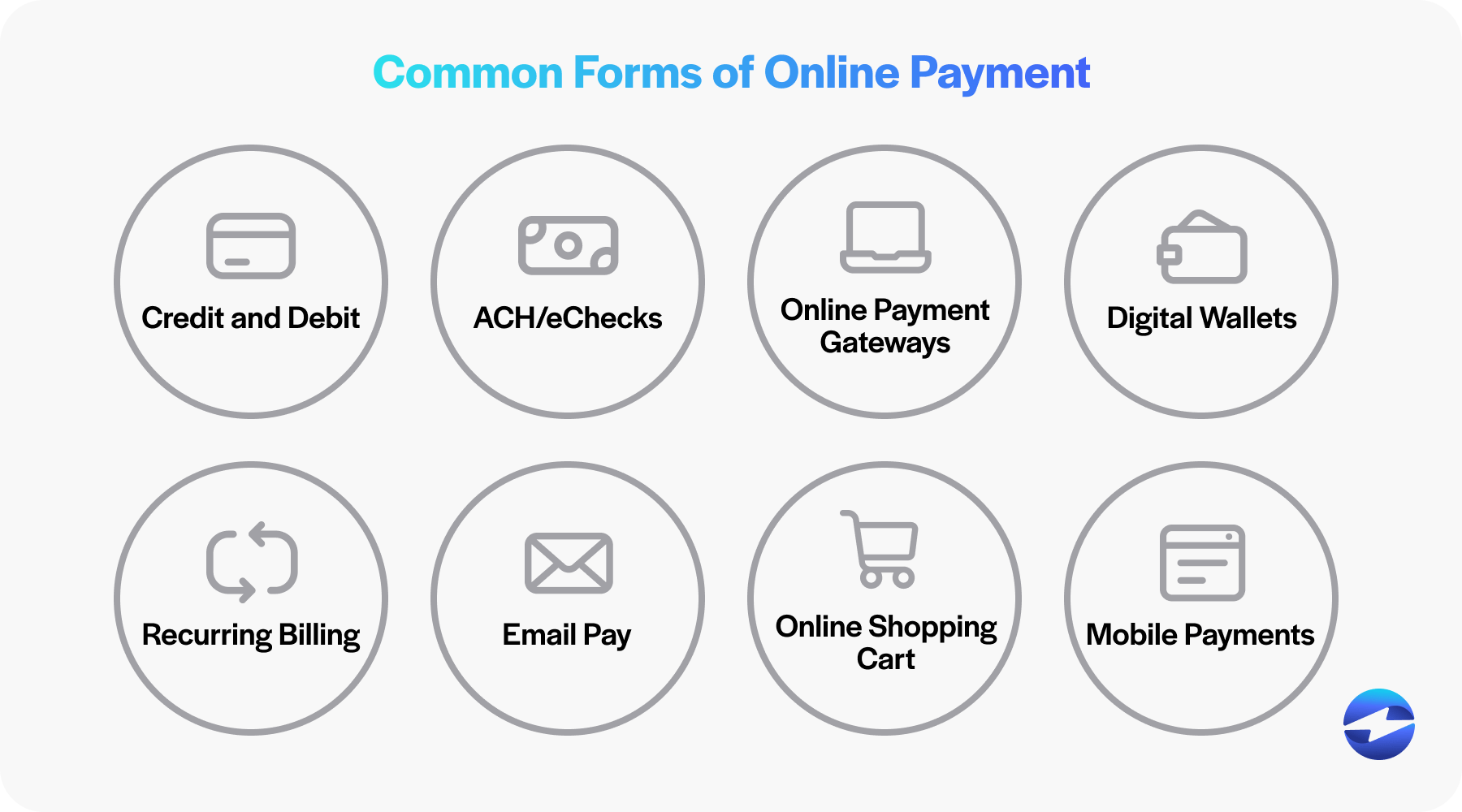

Here are nine common forms of online payment methods used today:

- Credit: Many online consumers prefer to use credit cards for their purchases due to their convenience and security. Credit card payments allow businesses to access funds quickly. Receiving payments rapidly can be particularly beneficial for small businesses needing access to funds to cover expenses or invest in growth opportunities.

- Debit: Processing debit cards is often less expensive than credit cards since these transactions typically have lower processing fees, which can be beneficial for companies looking to minimize their expenses.

- Automated Clearing House (ACH)/eChecks: ACH/eCheck payments help businesses avoid the hassle of processing and depositing paper checks, accelerating and improving customer payments to free up time and resources. ACH/eChecks tend to accrue lower fees because they bypass credit card networks by using the ACH network, which applies batch processing to reduce individual transactions, resulting in lower administrative and processing costs for financial institutions.

- Online payment gateways: Online payment gateways act as intermediaries between merchants and financial institutions. When a customer purchases on a merchant’s website, the payment gateway securely collects and transmits the payment information to the payment processor or acquiring bank for authorization.

- Recurring billing: Recurring billing allows customers to be charged automatically at regular intervals (weekly, monthly, or annually). Recurring billing automates receiving payments, enhances user experience, saves time and resources, ensures consistent revenue streams, and reduces churn rates.

- Email pay: With email pay, customers are sent secure payment links via email to make payments from anywhere and on any device. This payment method can improve cash flow by reducing the risk of late or missed payments.

- Mobile payments: Mobile payments give customers the flexibility of purchasing on the go with their smartphones or tablets. Users can link their preferred payment method (i.e. credit cards, debit cards, bank accounts) to their mobile payment app. Customers simply select the desired payment method and authorize the transaction to purchase. Mobile payments streamline online shopping by providing a more convenient checkout process.

- Digital wallets: Digital wallets allow users to securely store payment card numbers and conduct financial transactions on their smartphone or tablet. With digital wallets, consumers can purchase online or transfer money to other users. Some of the most popular digital wallets include Apple Pay, Venmo, Google Wallet, etc.

- Online shopping cart: An online shopping cart is a virtual software application that allows customers to select and store items they wish to purchase from an eCommerce website. The online shopping cart calculates the total cost of the items, including any applicable taxes, shipping fees, and discounts. Once customers are ready to complete their purchase, they proceed to the checkout page to provide payment and shipping information to finalize the transaction.

Incorporating multiple forms of online payment can benefit businesses by meeting the needs of diverse consumers. So, how can companies discern which online payment options are suitable for them?

Finding the best electronic payment options for you

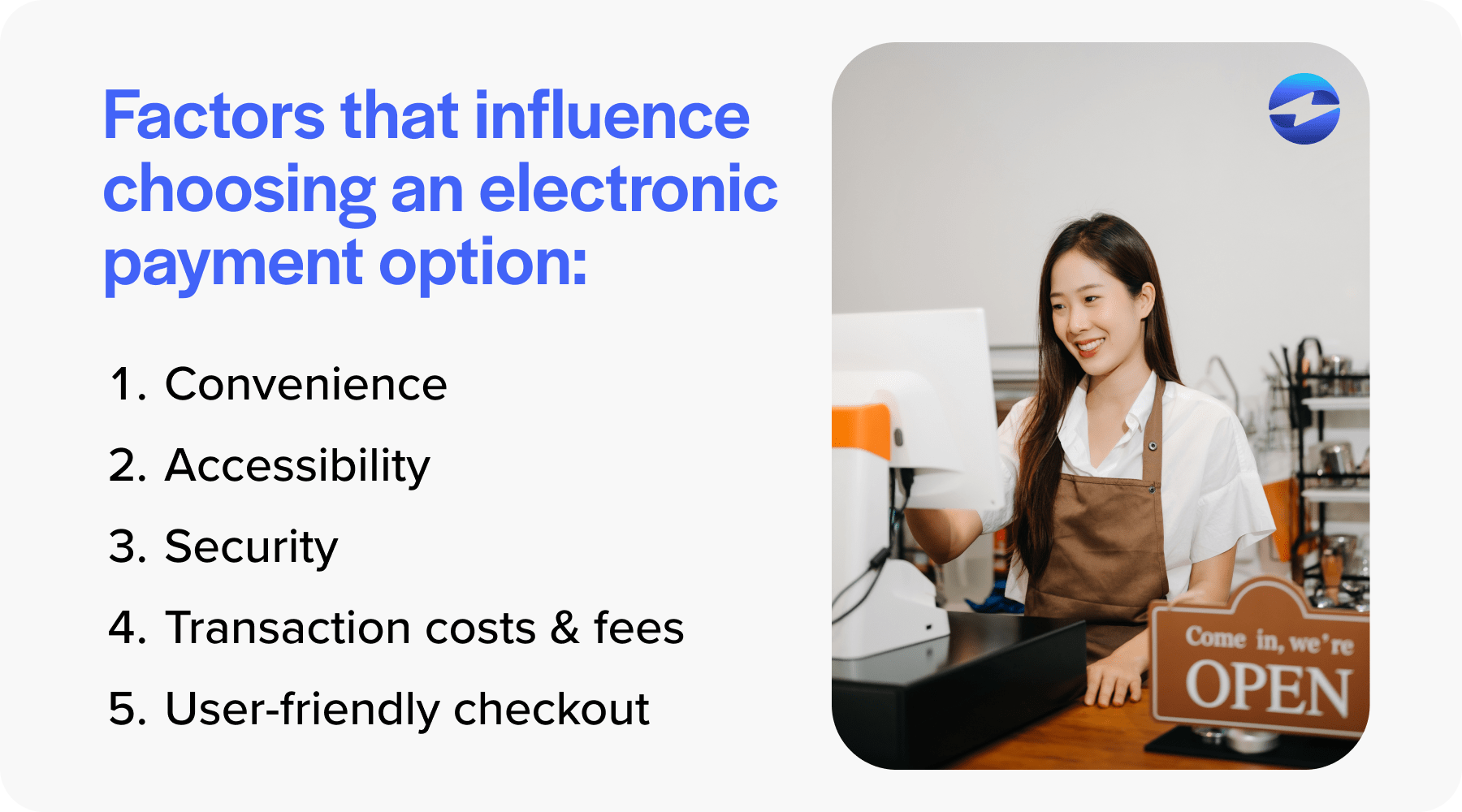

When determining the best payment methods for your business, it’s essential to research and analyze the needs of your consumers and the trends of your target demographic.

Factors like convenience, accessibility, and ensuring customer payment information is safe and secure are more important than ever. Therefore, merchants should offer popular payment options that provide consumers flexibility and robust security features to protect sensitive data. For this, look for payment providers that are compliant with relevant regulations and standards, like the Payment Card Industry Data Security Standard (PCI DSS).

Businesses should also look into transaction costs and fees associated with various payment methods since they can fluctuate drastically. For example, credit and debit card transaction fees can vary by provider and transaction volumes. Whereas ACH payments typically accrue lower transaction fees.

While these factors are important, finding a payment solution with a user-friendly checkout experience that reduces friction and increases conversion rates is also essential. The most effective payment providers will provide reliable customer support and assistance to quickly resolve any issues or technical difficulties.

You can work with reputable payment processors like EBizCharge to ensure a seamless online payment experience that meets all your needs.

Simplify your process of accepting online payments with EBizCharge

EBizCharge is a comprehensive payment processing platform designed to simplify the process of accepting digital payments for businesses.

The top-rated EBizCharge payment processing platform integrates seamlessly with the top accounting/ERP systems, CRMs, and shopping carts, eliminating the need for manual data entry and reducing the risk of errors.

Furthermore, EBizCharge offers advanced security features to protect sensitive customer data and reduce the risk of fraud. With tokenization and encryption technology, businesses can confidently process payments, knowing their customers’ information is safe and secure.

Thanks to its robust payment features and collection tools like customizable online payment portals, secure email payment links, recurring billing options, and advanced security protocols, EBizCharge transforms how businesses collect online payments to ensure more long-term revenue and long-lasting customer relationships.