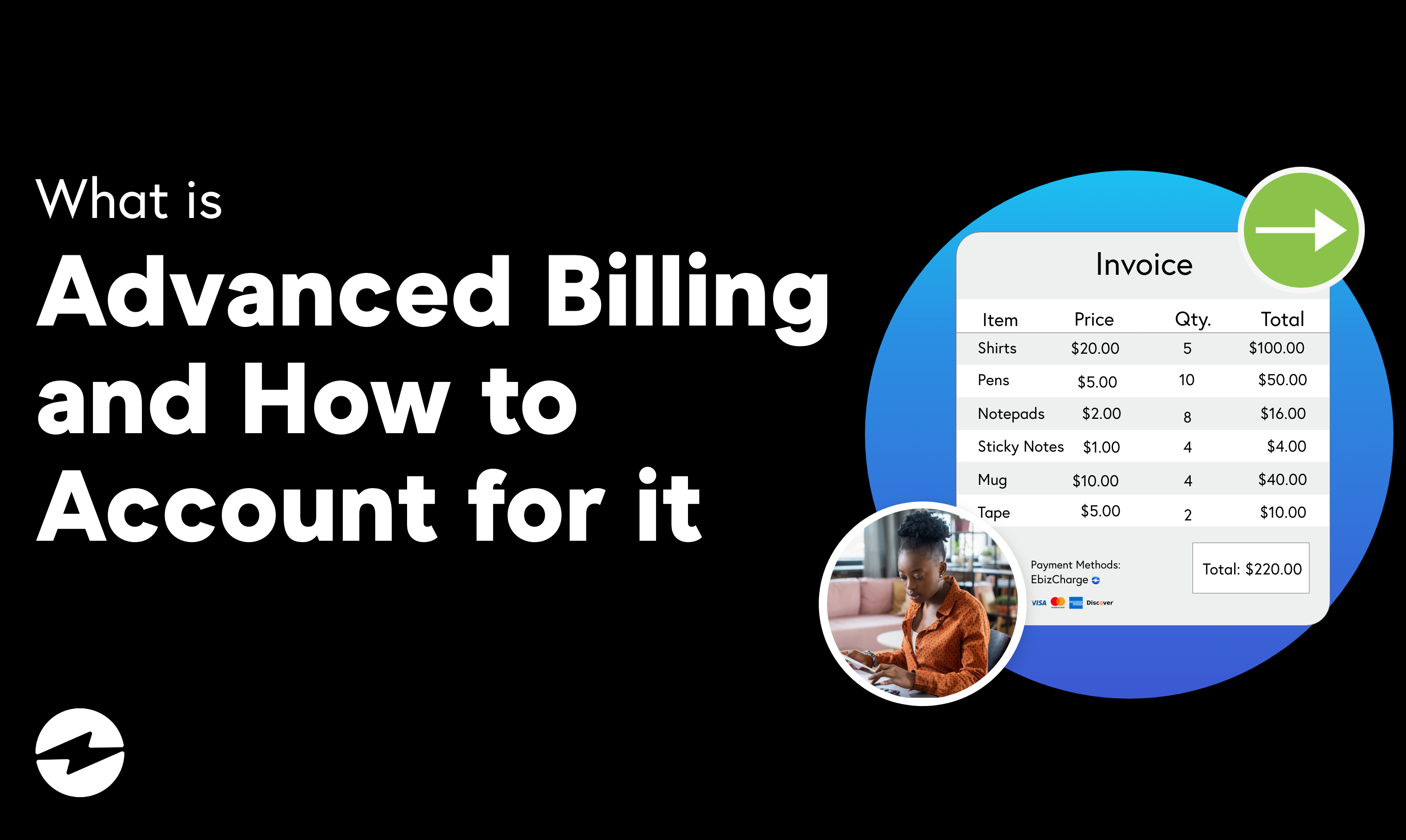

Blog > What is Advance Billing and How to Account for it

What is Advance Billing and How to Account for it

Running a business in today’s environment is already a difficult endeavor, and collecting payments from your customer may make this task even more complicated. Thankfully, advance billing can ease this stress by allowing your business to receive funds upfront before products or services are delivered.

What is advance billing?

Advance billing is the process of sending an invoice in advance to your customers before their purchased services or products are received. Sending this invoice in advance helps increase cash flow for your company and makes it easy for your customers to set up recurring payments. This billing method is beneficial for companies that require more time to complete a product, or when the cost of goods sold is significant for the product or service.

Advance billing adds an extra layer of security for companies to ensure customers pay their invoices before receiving any goods or services. Implementing advance billing can be especially helpful when dealing with customers with poor credit, as it can help businesses reduce and avoid late or missed payments on invoices.

Examples of advance billing include:

- Deposits: A customer may make a deposit to secure goods or services at a future date. For example, a customer can make a deposit on a custom piece of furniture that requires time to be completed and delivered.

- Seasonal billing: Seasonal billing is used by some companies to meet the demand of busier seasons by requiring customers to pay upfront for a product or service before an upcoming season. For example, lawn mowing companies could charge you in advance for a service to be completed in a season where more frequent mowing is required.

- Subscriptions: Subscriptions are recurring payments that require customers to pay at the beginning of a service that will be continued monthly, quarterly, or annually.

The process of advance billing is a simple concept but it has many complicated factors, especially in regard to how it’s accounted for in your company’s financial statements. The next section will cover how advance billing is organized.

How is advance billing organized?

Advance billing is organized by allowing your company to take a payment from a client, and while completing the products or services, revenue is recognized in your financial statements.

By recognizing revenue throughout the entire process of the service, your company can identify the project’s income and costs in the same general ledger period.

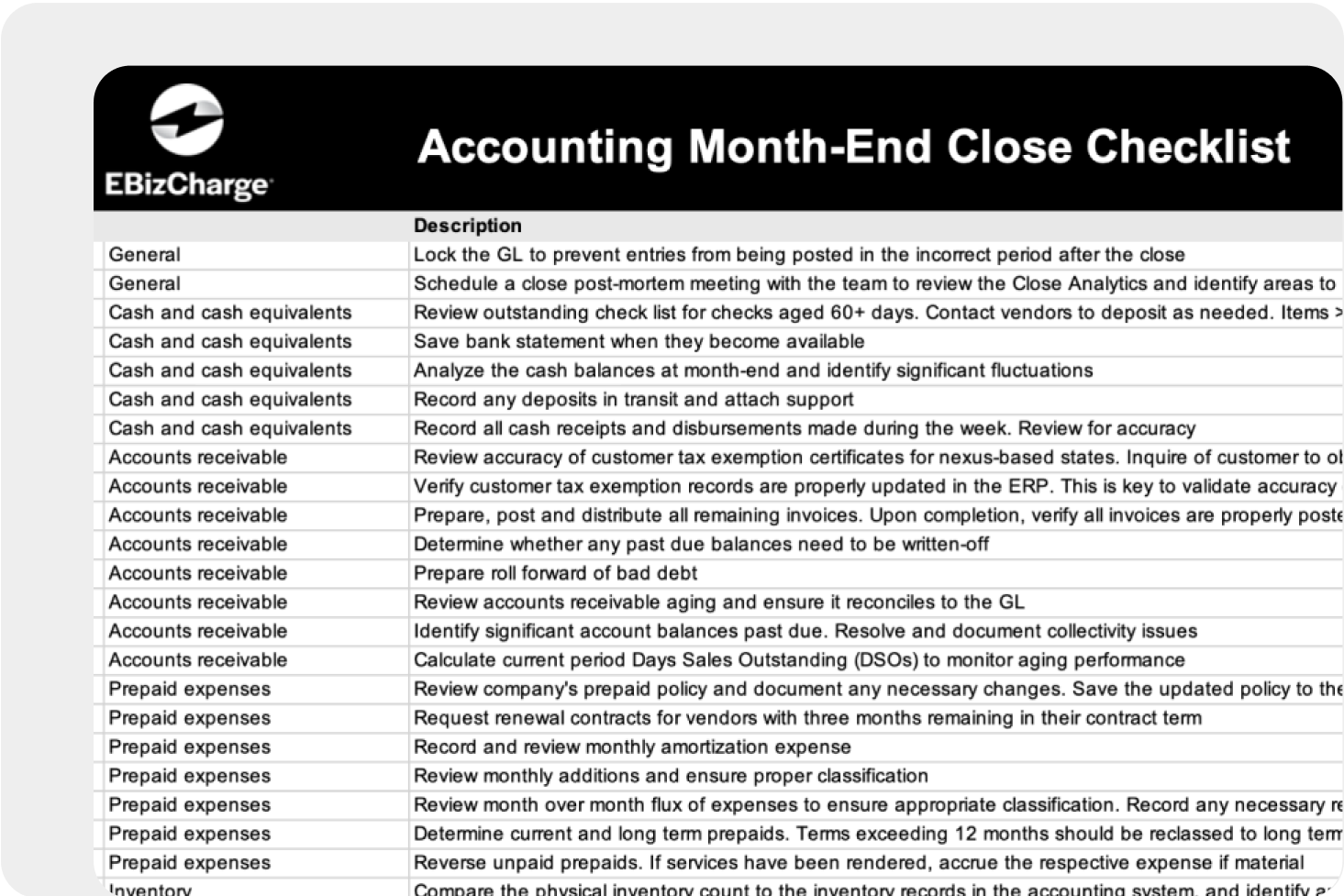

The advance billing invoice generally consists of two individual parts:

- Accounts Receivable (AR): The AR section of advance billing will show on your AR aging report and act as a normal invoice. Instead of crediting revenue for the amount of the invoice, it will be posted on your company’s designated deferred income accrual account.

- Accruals: Advance payments work similarly to a credit memo and are recorded as assets on the balance sheet. Accruals work as a record of revenue or expenses that have been received or accrued but not yet accounted for in the business’s financial statements.

It’s important to note, receiving and accounting for advance billing can be slightly tricky and may require more attention to the way journal entries are made in your company’s accounting records. The process starts with qualifying the type of advance payment received and then accounting for it on the general ledger. This allows the advance payment to be applied properly and the goods and services related to the payment are invoiced.

The next section will cover how to determine the specific type of advance payment.

Determining the type of advance payment

To determine the type of advance payment, you first need to qualify the type of advance payment. This is dependent on whether or not the goods or services have been delivered to the customer.

When recording the advance payment in your accounting records, you need to determine which of the two main types of advance payments to record. The main types of advance payments are:

- Earned revenue: Earned revenue is a type of advance payment recorded in the general ledger that accounts for goods and services that have been partially or completely delivered to the client but have not yet been invoiced.

- Unearned revenue: Unearned revenue is a type of advance payment for goods and services that will be delivered and invoiced at a later date — your company has not provided any benefits to the customer.

Next, you’ll need to create your deferred revenue account. Because your company still owes a product or service to the customer, the initial deposit is marked as a liability to your business.

Lastly, ensure that the advance payment is accounted for in the correct customer account. If the customer is a new client, create a new account in the accounting records. The details of whether it was earned or unearned revenue should be posted in the customer account.

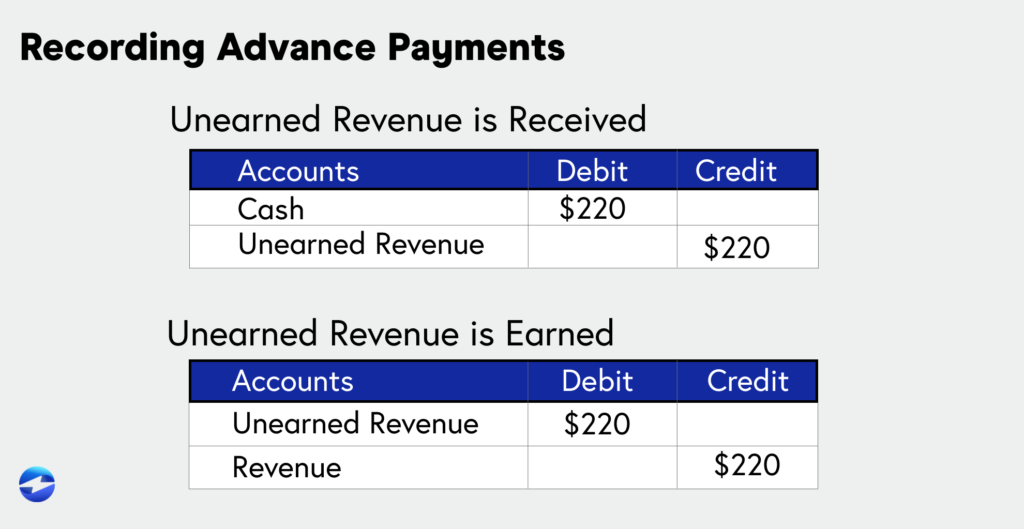

Account for the advance payment

To record the advance payment in your accounts, debit the cash account and credit the customer deposits account for the same value. Debit increases expenses, assets (cash or equipment), and dividend accounts, while credit decreases these accounts and increases liability and equity accounts for your company.

After the products or services have been completed, send an invoice to your customer if there’s any outstanding balance they need to pay. Revenue is recognized when the services are delivered and the customer has paid, not just when the money is received initially.

Finally, record the entire transaction in your accounting journal:

- Credit revenues

- Debit accounts receivable

- Debit customer deposits

Now that you know how to properly account for advance payments, you can learn how to report them in financial statements.

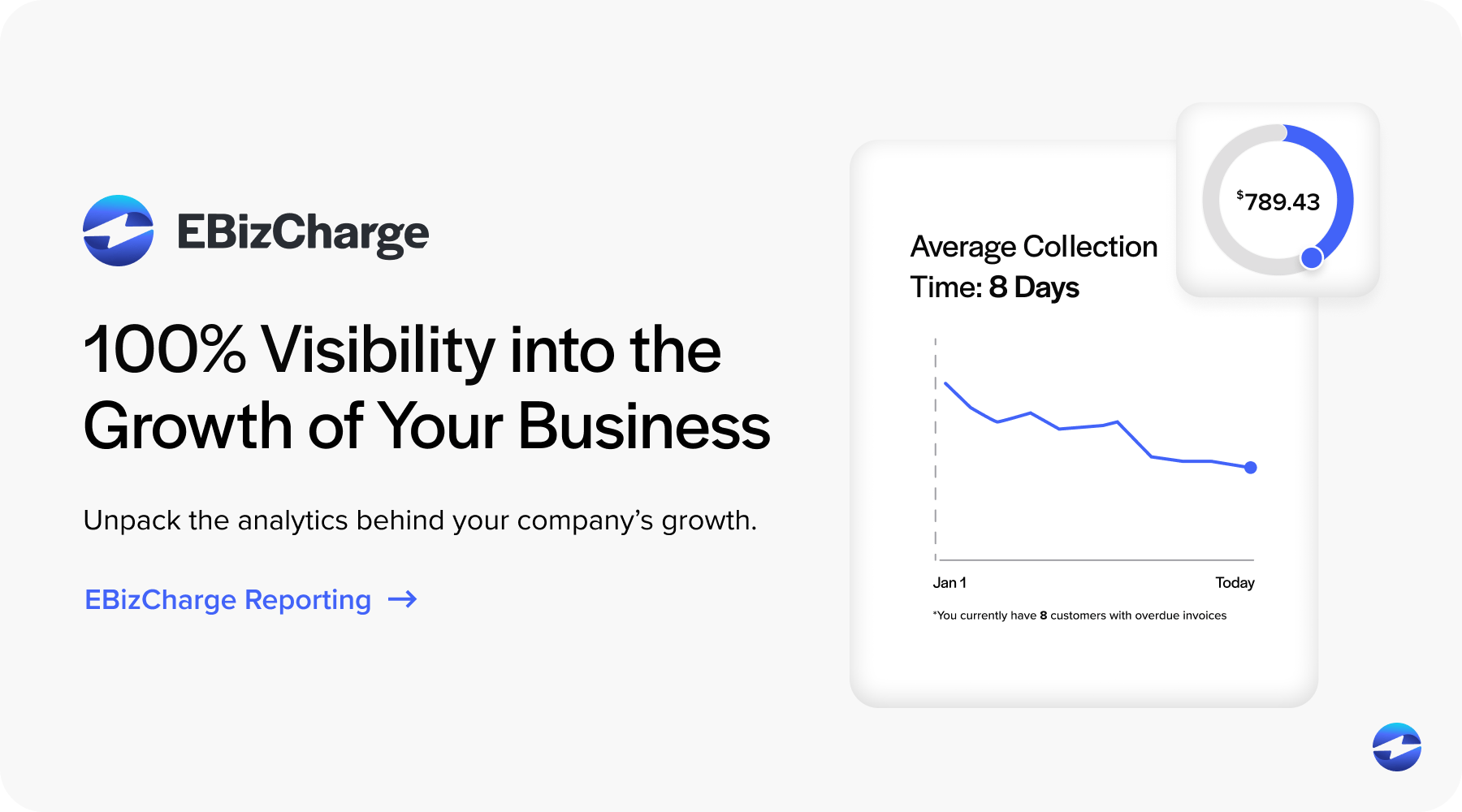

Reporting

During the reporting process, you will record the payment on the balance sheet or the income statement based on the type of advance payment.

For unearned revenue, this amount is posted to the company’s balance sheet as a liability under the unearned income line. For earned revenue, this amount is posted to your company’s income statement once the invoice has been posted.

After the invoice has been posted, the transaction can be completed in your accounting records. This means unearned revenue is moved from the balance sheet because it’s now counted as payment on an invoice and part of the accounts receivable for the period. Whereas, earned income is moved from an outstanding line item on the P&L statement and applied to the balance of the invoice.

Benefits of advance billing

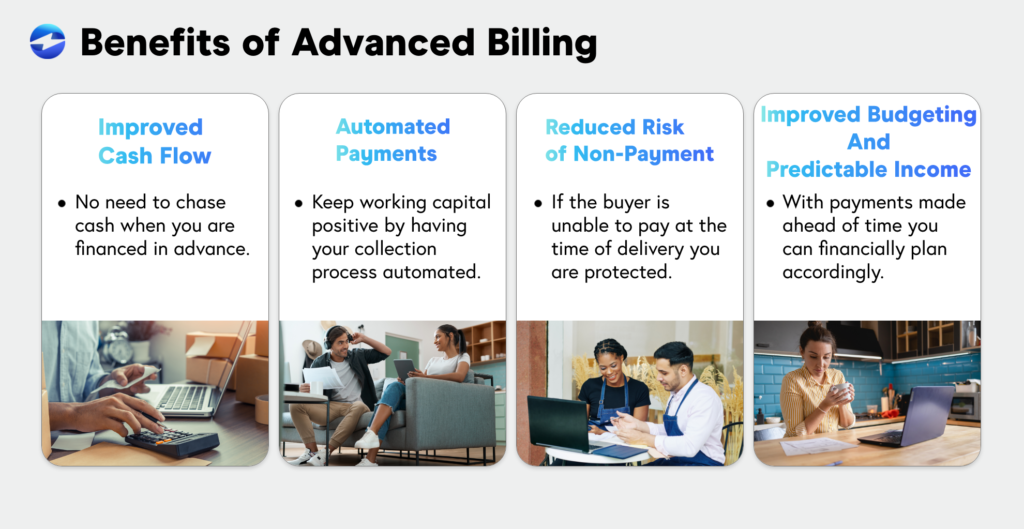

There are several benefits of using advance billing which include:

- Improved cash flow: When you receive money at the beginning of the transaction, your company sees an immediate increase in cash flow.

- Automated payments: It’s easy to automate the billing process for your customers, creating a more efficient and faster collection process.

- Reduced risk of non-payment: Since a customer pays upfront for a product or service to be delivered and completed at a later date, the risk of a customer not paying is eliminated.

- Improved budgeting and predictable income: Since customers pay in advance for products or services, your business can record when the income is expected to come in on its financial statements. This allows you to get ahead of budgeting and properly allocate resources for the following financial period.

While there are many advantages of advance billing, there are also several challenges associated with this payment collection feature.

Challenges of advance billing

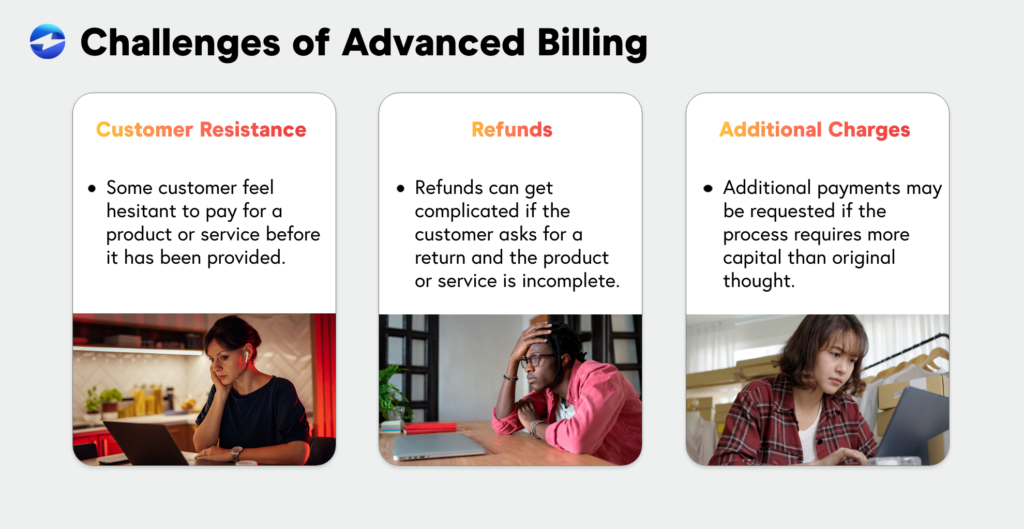

Some disadvantages of advance billing include:

- Customer resistance: Many customers may feel uncomfortable paying for a product or service before it’s been produced or delivered.

- Refunds cause complications: Issuing refunds with advance billing is more complicated because a business can be halfway finished with a product or service when a customer asks for a refund. By stopping a project before its completed, the refund to the customer can cost your company unnecessary time and resources.

- Additional charges: If the process of creating the goods or services requires more attention and time, there may be additional separate invoices sent out. This can complicate and delay payment processing.

Importance of understanding and properly accounting for advance billing

It’s crucial to understand and properly account for advance billing for a number of reasons.

Properly accounting for advance billing allows your company to accurately recognize revenue. Accurately recognizing revenue and properly maintaining accurate financial statements is important because failing to do so can greatly skew earnings reports and hinder the business.

Failing to properly account for advance billing can lead to your company’s financial statements being inaccurate. The inaccuracy of financial statements may lead to more severe consequences such as hefty regulatory fines.

Lastly, accurately accounting for advance billing can provide valuable insights into cash flow and revenue generation which can help your company make more calculated decisions in the long term.

Improving cash flow with advance billing

Despite the time-consuming process of setting up invoices and ensuring accurate revenue figures are reported, advance billing offers businesses an excellent opportunity to improve cash flow and better manage payments from their clients for one-time purchases and recurring services.

Frequently Asked Questions

Frequently Asked Questions

Summary

- What is advance billing?

- How is advance billing organized?

- Determining the type of advance payment

- Account for the advance payment

- Reporting

- Benefits of advance billing

- Challenges of advance billing

- Importance of understanding and properly accounting for advance billing

- Improving cash flow with advance billing

- Frequently Asked Questions