Blog > Level 1 PCI Compliance: What It Is & What You Need to Know

Level 1 PCI Compliance: What It Is & What You Need to Know

Many businesses know the stress that goes along with handling and securing credit card data, especially since these payments continue to be a big target of cyberattacks and fraud.

To mitigate these threats, the PCI Security Standards Council (PCI SSC) enforced the Payment Card Industry Security Standards (PCI DSS) which merchants are recommended to comply with to better protect cardholder data.

PCI standards are essential to understand and comply with because they serve a vital role in securing credit card transactions and laying the groundwork for payment security.

What is PCI Compliance?

Payment Card Industry Security Standards are a set of 12 requirements that merchants are expected to follow to ensure they’re actively securing their customers’ payment information.

PCI Compliance is enforced and managed by the major credit card networks — Visa, MasterCard, American Express, Discover, and JCB International —which comprise the Security Standards Council. To ensure you’re adhering to the PCI rules and regulations implemented by the Council, your business should complete a self-assessment to evaluate if, and how, each requirement is being met.

When merchants properly implement and maintain these security measures — both technical and operational — to secure their cardholders’ data, they’re considered to be PCI compliant.

Levels of PCI Compliance

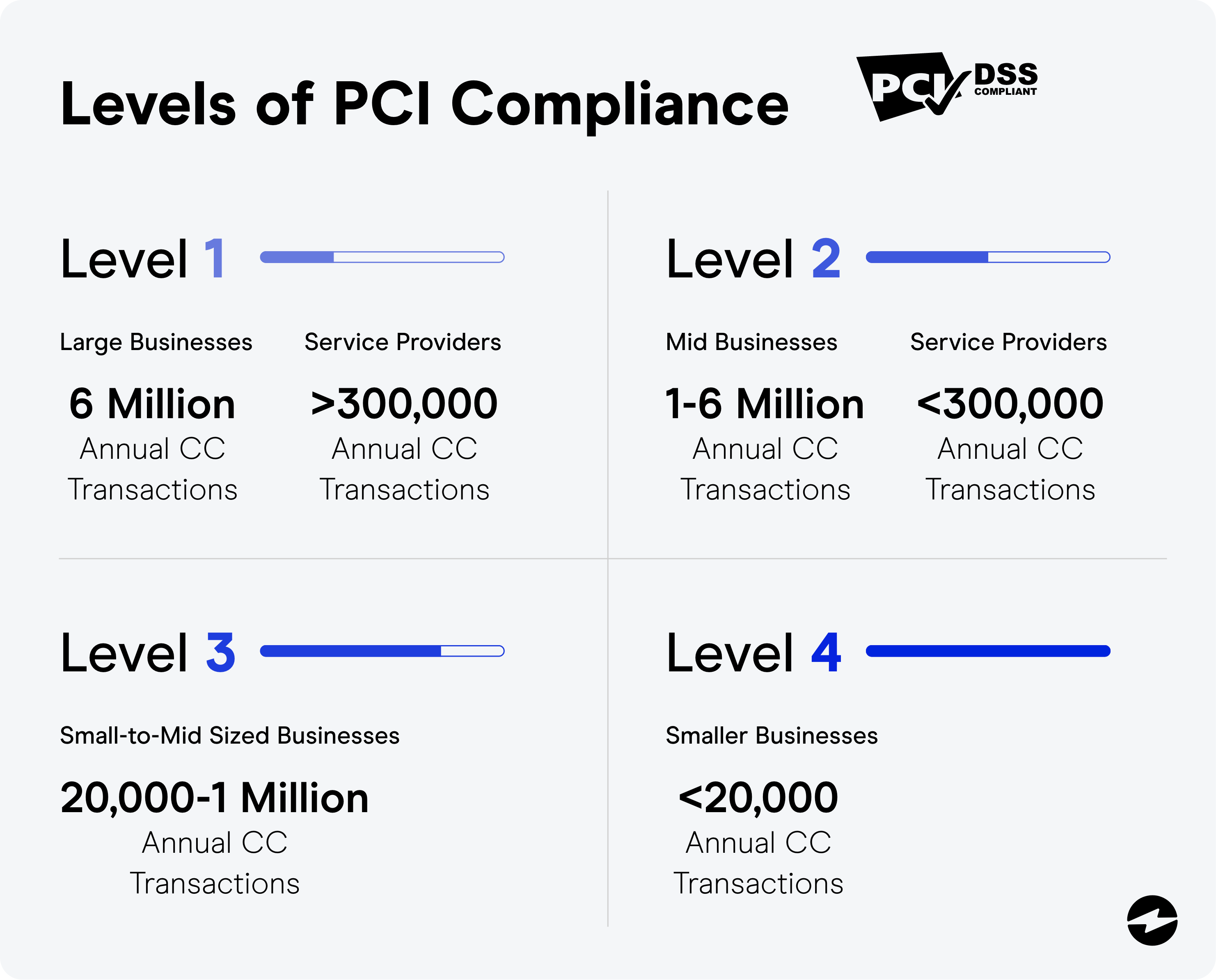

PCI compliance is broken down into different levels depending on your annual transaction volume and business size.

Merchants trying to obtain and maintain PCI DSS should be aware of the level of compliance they fall under. PCI levels for merchants can be categorized into 4 tiers:

- PCI Compliance Level 1: Large businesses that process six million credit card transactions annually and service providers that process over 300,000 transactions annually.

- PCI Compliance Level 2: Mid-to-large-sized businesses that process one to six million credit card transactions annually and service providers that process less than 300,000 transactions annually.

- PCI Compliance Level 3: Small-to-mid-sized businesses that process anywhere from 20,000 to one million credit card transactions annually.

- PCI Compliance Level 4: Smaller businesses that process less than 20,000 credit card transactions annually.

Compliant merchants may be subject to annual or quarterly PCI validation requirements such as Report on Compliance (PCI ROC) forms, Self-Assessment Questionnaires (PCI SAQ), and more.

These validation methods differ by PCI level, especially for merchants with Level 1 PCI Compliance.

What is PCI DSS Level 1?

PCI DSS Compliance level 1 is the highest security standard for merchants processing over 6 million Visa or Mastercard transactions annually. This is the highest level of compliance and payment security standards merchants can comply with to securely store, transmit, and process credit card information. This level naturally applies to larger businesses with high transaction volumes, subjecting them to stricter validation requirements.

Companies that fall under other PCI merchant levels may only need to conduct an SAQ, whereas Level 1 security is more demanding.

How to get level 1 PCI compliance

To get PCI compliance, organizations must adhere to the 12 requirements outlined in the Payment Card Industry Data Security Standard (PCI DSS). These requirements range from building and maintaining a secure network, implementing strong access controls, regularly monitoring and testing networks, and maintaining an information security policy. Level 1 PCI Compliance is the highest level of compliance established by the PCI DSS and is subject to annual assessments and validation by a Qualified Security Assessor (QSA).

Once the organization has implemented the 12 necessary security measures, they must undergo an external PCI audit, which includes:

- A Report on Compliance (ROC) by a Qualified Security Assessor (PCI QSA) or Internal Security Assessor (ISA)

- Quarterly PCI scans by Approved Scanning Vendors (ASV)

- An annual penetration test to check for possible vulnerabilities

- A PCI Attestation of Compliance (PCI AOC) by a QSA

The QSA will thoroughly review the organization’s systems and processes to verify compliance with the PCI DSS requirements. The assessment typically includes a review of documentation, interviews with key personnel, and an on-site inspection of the physical infrastructure.

After the assessment, the organization must submit a Report on Compliance (ROC) to the relevant credit card brand. The ROC details the organization’s compliance status and provides evidence of adherence to the PCI DSS requirements. This report must be submitted annually.

In addition to the annual assessment, organizations must also conduct penetration testing regularly. This testing helps identify any system vulnerabilities that cyber attackers could potentially exploit.

Lastly, organizations must be prepared to provide documentation of their PCI DSS compliance upon request. This includes maintaining records of all assessments, penetration tests, and any other documentation related to their security practices.

Achieving Level 1 PCI compliance requires a commitment to security, adherence to the requirements of the PCI DSS, and ongoing assessments and testing by a QSA. Completing these forms and protocols not only helps merchants uphold and maintain PCI Level 1 Compliance but can also yield other benefits.

What does PCI Level 1 Compliance mean for your business?

PCI Level 1 Compliance can bring a lot of value to your business when it comes to enhancing your payment security and securing better relations with your customers.

PCI DSS Level 1 enables merchants to reduce threats of fraud and stolen credit card information by safely processing large volumes of credit card transactions. Offering this high-level payment security can also build more trust with your customers and in turn, encourage more sales and more revenue over time.

Businesses that are certified as PCI Level 1 merchants can also avoid hefty PCI non-compliance fines and lawsuits.

Optimize your payment security with a PCI Level 1 Compliance service provider

Solidifying PCI Level 1 compliance for your business will result in many benefits but the burden of payment security doesn’t only have to fall on your shoulders. Luckily, merchants can optimize their payment security by enlisting the help of a PCI Level 1 service provider to ensure customers’ credit card data is fully secure.

Level 1 PCI Compliance service providers like EBizCharge will ensure full compliance and provide security features like tokenization, encryption, off-site data storage, fraud management tools, and more.

Is you business PCI compliant? Take this 1-min quiz to find out.

Is you business PCI compliant? Take this 1-min quiz to find out.