Blog > Swiping vs. Keyed-In Credit Card Transactions: Pros, Cons, & Strategies to Reduce Your Processing Costs

Swiping vs. Keyed-In Credit Card Transactions: Pros, Cons, & Strategies to Reduce Your Processing Costs

Nowadays, there are many ways businesses can accept credit card transactions from their customers to make this process easy and adaptable to their needs.

These credit card transactions can typically be categorized into two methods — swiping the card or keying in the card. While both options are frequently used by various businesses and industries, there are key differences, advantages, and disadvantages between each.

This article will help you clearly outline the differences between swiping vs. keyed-in credit card transactions and allow you to weigh the benefits and drawbacks of each to see which will best fit your business model.

The Short Version: Key Differences Between the Two

Swipe Transactions

- Card is present at time of the transaction

- Card is either inserted, swiped, or “tapped” using a credit card reader or terminal

- Faster, easier, and provides higher security for customer payment info

Keyed-In Transactions

- Card is typically not present at time of the transaction

- Merchant manually enters card info into a credit card reader or terminal

- Slower and typically poses a higher risk of fraud and human error with customer payment info

To quickly summarize, swipe transactions involve physically presenting the card, while keyed-in transactions don’t. Swipe transactions are faster, easier, and more secure. Keyed-in transactions are slower and have a higher risk of errors and fraud.

What are swipe transactions?

Swipe credit card transactions occur when customers insert their credit or debit cards into card (chip) readers, swipe their cards into credit card EMV terminals, or use the “tap to pay” option where they place their cards near the merchant’s field communication-enabled reader or their smartphones to access their mobile wallets to purchase an item or service.

The key component of swipe transactions is that customers and their credit cards are present during the time of the purchase — also known as a card-present (CP) transaction.

How to swipe a credit card?

To swipe a credit or debit card:

- Insert the magnetic stripe into the card reader with the stripe facing down and toward the terminal.

- Move the card quickly and smoothly through the reader in a single motion.

Many modern credit cards also come equipped with a chip, which can be inserted into a chip reader for added security. Some credit cards may also have RFID technology, allowing for contactless payments by simply tapping the card against an RFID reader. It’s important to note that while some new credit cards use chip technology, they may still require card swiping in certain situations.

Be cautious when swiping cards. Potential scams, such as skimming devices, can steal your card information. Always be aware of your surroundings and ensure the card reader looks legitimate before swiping your card.

Advantages of swipe transactions

Since swipe credit card transactions take place when both parties are present, they come with several advantages for both the consumer and merchant.

Three main advantages of swiping credit cards include:

- Enhanced security: Swipe transactions offer more security and come with less risk since the customer is typically present when the payment is processed.

- Less human error: Swiping cards eliminate the need for manual entry and therefore, reduce the possibility of incorrect information being entered.

- Lower processing costs: Since swipe transactions come with more security, less human error, and reduced risk of fraud, they typically accrue lower processing costs.

Despite these benefits, there are downsides associated with swiping a credit card.

Disadvantages of swipe transactions

While swipe credit card transactions are known to be the more secure payment method, they’re not immune to fraud.

Swipe transactions can still be associated with credit card theft and fraudulent charges, thanks to hackers using malicious card machines, RFID scanners, and mobile devices to fish for this information.

What are keyed-in transactions?

A keyed-in transaction occurs when a merchant manually inputs or “keys in” a customer’s credit card information into the physical or virtual card terminal (payment gateway).

Keying in credit cards differs from swipe transactions because they usually involve card-not-present (CNP) payments — merchants key in customers’ card information over the phone, online, or after a customer fills out an online or physical order form.

However, some keyed-in transactions take place in person when a customer’s credit card doesn’t swipe properly, the chip isn’t working, or the tap-to-pay option is malfunctioning.

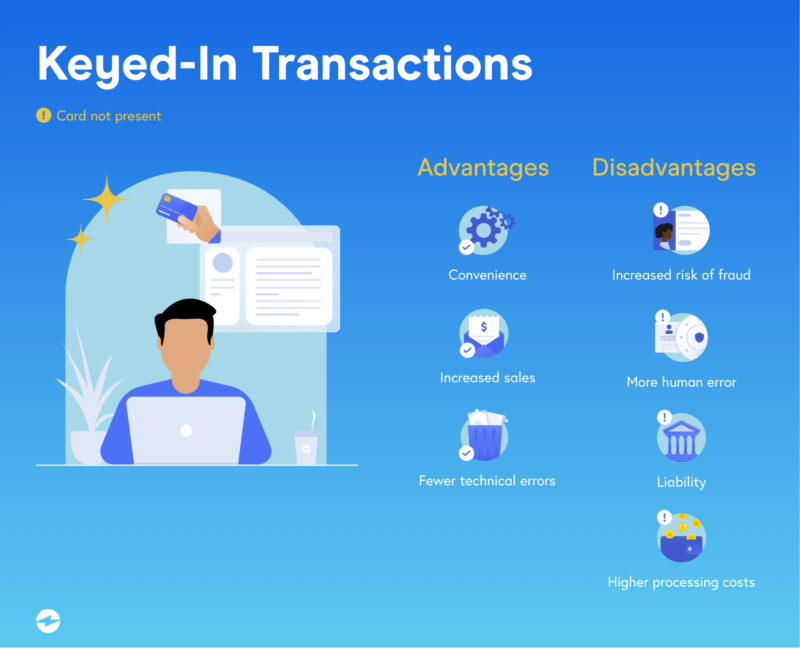

Advantages of keyed-in transactions

Despite credit cards typically not being present during keyed-in transactions, these payments do come with some advantages.

Three main advantages of keying in credit card transactions include:

- Convenience: Keyed-in transactions offer more convenience to consumers because they don’t require them to be present and can be taken online, over the phone, etc.

- Increased sales: Thanks to the convenience of keyed-in transactions, merchants are able to offer more payment methods and adapt to consumer needs to increase their profits.

- Fewer technical errors: Since keyed-in transactions involve manual entry, there’s less risk of a technical error occurring or a device malfunctioning.

Merchants and consumers should also be aware of the cons associated with keyed-in credit card transactions.

Disadvantages of keyed-in transactions

Despite keyed-in transactions creating a more convenient experience for consumers, there are several disadvantages that cannot be ignored when it comes to these payments.

Some of the biggest disadvantages of keying in credit cards include:

- Increased risk of fraud: If a card isn’t present during a transaction, there’s an increased risk of fraud involved because merchants can’t verify if the card actually belongs to the person completing the purchase.

- Higher processing costs: Manually keyed (CNP) transactions come with higher processing costs due to the added risk of fraud. Payment processors and card networks charge more in case of potential fraud or chargebacks.

- Liability: When merchants agree to accept keyed-in credit card transactions, they’re also agreeing to take on the liability if a transaction is flagged for fraud or a chargeback is filed. This means your business is responsible for the cost of the sale, product or service, and any additional chargeback fees.

- Higher processing costs: Manually keyed (CNP) transactions come with higher processing costs due to the added risk of fraud. Payment processors and card networks charge more in case of potential fraud or chargebacks.

- More human error: Since keyed-in transactions are manually entered into a virtual or physical terminal, they can accrue more human error if the card information, cardholder name, billing address, expiration date, or any other information is entered incorrectly.

Using this information, merchants can determine the best and most cost-effective method way to accept swipe transactions or keyed-in credit card transactions.

How to secure the lowest credit card processing fees

With the eCommerce market continuing to grow, merchants may need to expand their payment options to accept swipe transactions and keyed-in credit card transactions to meet consumer needs and demand.

Luckily, there are several ways to help businesses lower credit card processing fees for both.

Before looking into cost-effective processors, merchants can try to limit their keyed-in transactions to reduce their risk of fraud and lower their overall credit card processing fees.

If your business model doesn’t allow you to limit CNP transactions, you can look into organic ways to reduce these costs such as security features like address verification services (AVS), maintaining PCI compliance, and more.

Last but not least, merchants can conduct thorough research and compare rates between credit card processors to find the best provider to secure the lowest credit card processing fees.

The best payment processors are upfront about their pricing, charge no hidden fees, and offer unlimited support, free chargeback management, and complimentary integrations.

Be smart about how you implement swipe transactions and keyed-in credit card transactions

It’s up to you as the merchant to ensure a seamless and reliable payment experience for your consumers, regardless of how you accept credit cards.

Now that you’re aware of the pros and cons of swiping vs. keyed-in credit card transactions, you can adjust your business model to implement the best payment processing provider, security tools, and technology to make these payments easy and secure for your customers.

Frequently Asked Questions

What way do you swipe a card?

When swiping a card, the standard rule is to swipe the magnetic stripe through the reader, facing the card reader.

Do you swipe or insert a credit card?

When using a credit card, consider the convenience and security of swiping or inserting a chip card. Inserting a chip card is generally more secure and may be required for some transactions. Always follow the card company’s requirements to ensure a successful transaction.

What does CP mean?

CP stands for Card Present, meaning the credit card is physically present during the transaction. This type of transaction is considered less risky than Card Not Present (CNP) transactions where the card is not present. Contactless and dip card technologies impact CP transactions, making them a preferred method for many businesses and consumers due to their added security and efficiency.

Summary

- The Short Version: Key Differences Between the Two

- What are swipe transactions?

- How to swipe a credit card?

- What are keyed-in transactions?

- How to secure the lowest credit card processing fees

- Be smart about how you implement swipe transactions and keyed-in credit card transactions

- Frequently Asked Questions