Blog > Can Businesses Charge a Fee for Paying with a Credit Card?

Can Businesses Charge a Fee for Paying with a Credit Card?

Many businesses accept credit card payments to establish credibility, boost sales volume, increase cash flow, and more, whereas others are hesitant about the additional processing fees that come with these transactions.

While credit card processing fees can definitely add up, merchants have the ability to charge their customers a convenience fee or a surcharge to offset these costs. A trusted merchant services provider that offers good rates and will partner with your business to promote growth can also improve this process even further.

To determine if accepting credit card payments is right for your business, you need to first familiarize yourself with the rules associated with charging credit card fees.

Rules for charging fees on credit card payments

When deciding if your business will charge customers a fee for paying with credit cards, it’s crucial to ensure you abide by all laws and policies set by stakeholders.

From the perspective of the credit card brands (Visa, Mastercard, American Express, Discover) and consumers, fees on credit card payments are an unnecessary burden on the customer. The card brands frown upon these fees, so they’ve set up a number of rules your business will have to follow. If you break these rules, it could have serious consequences for your business.

To determine if accepting credit card payments is right for your business, you need to first familiarize yourself with the rules associated with charging credit card fees.

Rules for charging fees on credit card payments

When deciding if your business will charge customers a fee for paying with credit cards, it’s crucial to ensure you abide by all laws and policies set by stakeholders.

From the perspective of the credit card brands (Visa, Mastercard, American Express, Discover) and consumers, fees on credit card payments are an unnecessary burden on the customer. The card brands frown upon these fees, so they’ve set up a number of rules your business will have to follow. If you break these rules, it could have serious consequences for your business.

Before deciding whether or not to impose fees on credit card payments, ask the following questions:

1. Are you charging a convenience fee or a surcharge?

There are two different fees you can charge customers: a convenience fee or a surcharge.

Convenience fees are legal in all states but surcharges are not, so it’s important to know the difference.

Convenience fees are extra costs applied to credit card payments that are made using a nonstandard channel. For example, most people buy museum tickets in person at the front desk. If you choose to buy tickets online, it’s considered to be outside the standard payment method, so the museum charges you a convenience fee for using this alternative, more convenient payment method.

On the other hand, a surcharge is a fee imposed on every credit card transaction, regardless of how it’s made. Surcharges are meant to help merchants recoup some or all of the costs of processing credit card payments by transferring these charges to the customer to pay.

Make sure you know whether you’re using a convenience fee or a surcharge before you begin charging your customers.

2. If you’re charging a surcharge, is it legal in your state?

Several states have deemed surcharges illegal. To find out if your state has any restrictions or laws prohibiting surcharges, visit the National Conference of State Legislatures article here.

3. Are you charging the correct amount?

To determine how to accurately implement convenience fees and surcharges, merchants need to review the different policies of each card brand they accept and their specific state regulations.

Each card brand and state will have different rules and regulations on how to apply convenience and surcharge fees.

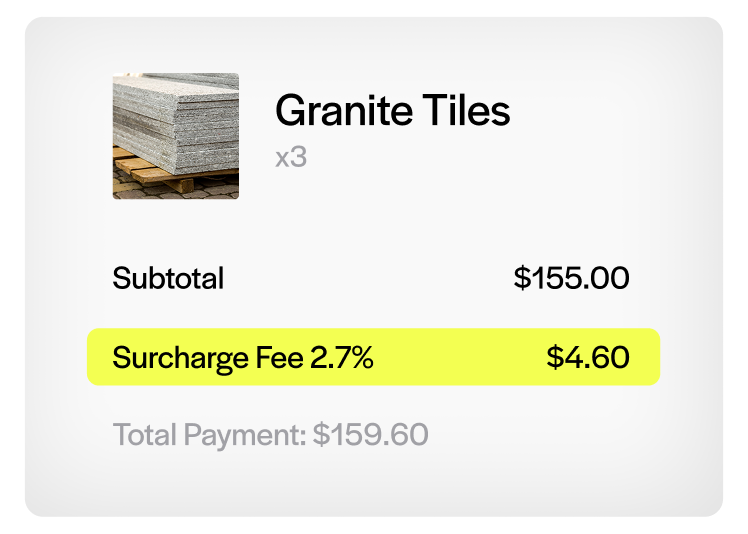

For example, Visa requires convenience fees to be a flat price instead of a percentage of the sale, while Mastercard allows either option. For a surcharge, the fee can’t be higher than your effective rate for credit card processing, and it can’t be more than 4%. This cap prevents merchants from making a profit off surcharging.

4. Did you properly notify everyone involved?

Before you can start charging a convenience fee or surcharge, you must give a credit card fee notice to:

- The credit card association

- Your acquirer

- Your credit card processor

- Your customers

The credit card association, acquirer, and credit card processor require at least 30 days written notice of your intentions to levy a convenience fee or surcharge.

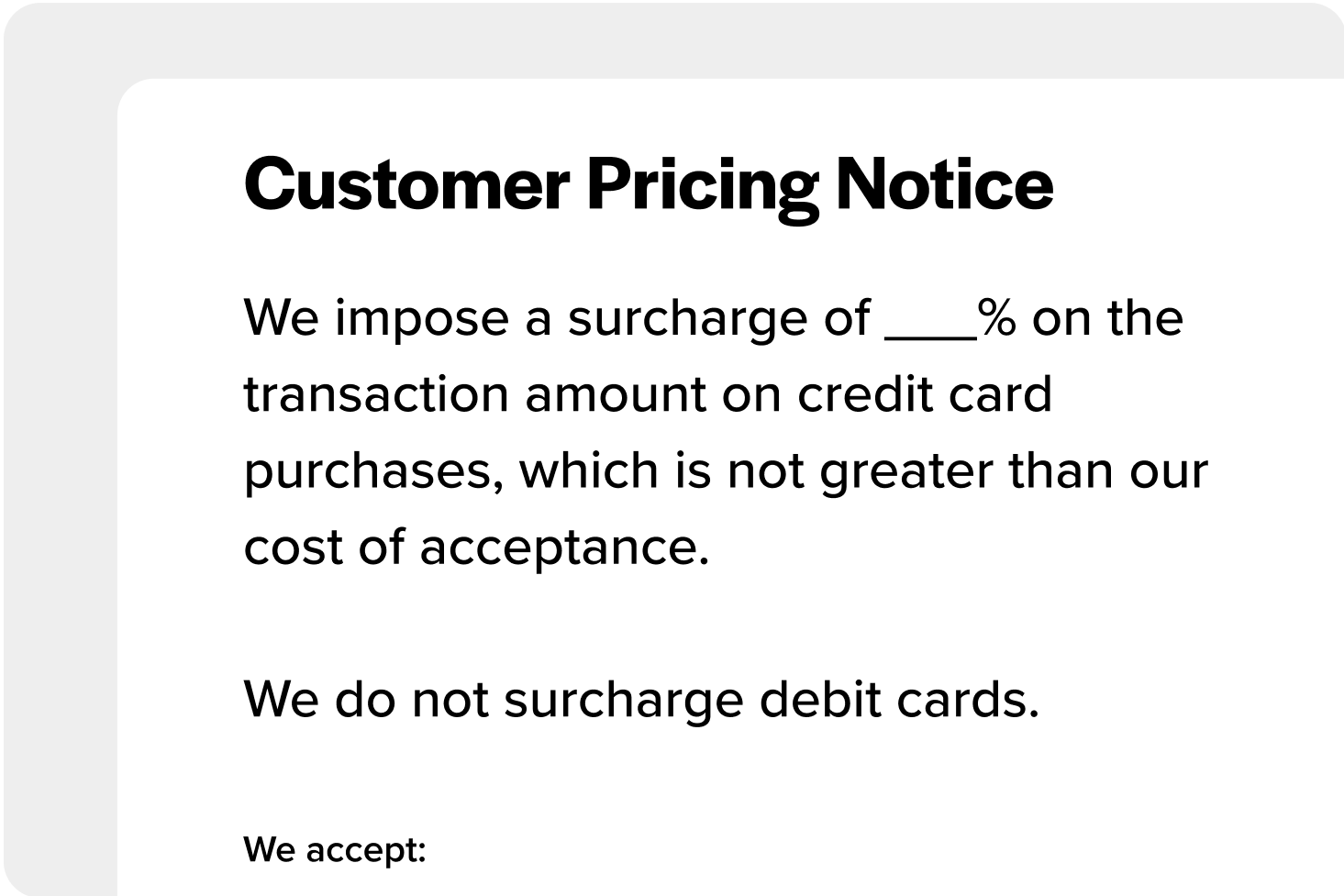

You’ll also need to give your customers advanced notice ahead of the sale. For brick-and-mortar stores, this could include physical signs by the door and cash register.

For eCommerce stores, the customers must be informed about any potential eCommerce charges on credit cards before they complete their purchase. This could be a notice on the checkout page, a banner at the top of the page, or outlined in the terms and conditions of the transaction.

The convenience fee or surcharge must also appear as a line item on the customer’s receipt that clearly states the amount of the fee.

Is it worth it to charge a fee on credit card payments?

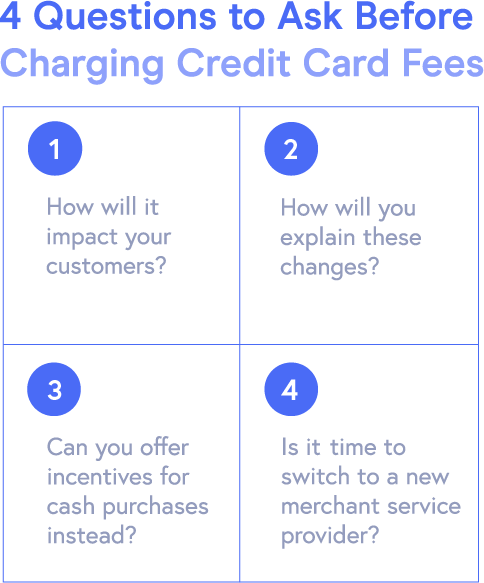

So, to answer the question, can a business charge a credit card fee? The answer is yes! Businesses can charge customers a fee for paying with a credit card, but each card brand/state will have different rules and regulations on applying convenience and surcharge fees. Once you’ve sorted through all the laws and regulations around convenience fees and surcharges, you can decide if charging customers credit card fees will positively affect your business. To help you decide, here are four questions you should consider asking yourself.

How will it impact your customers?

How will you explain these changes?

Can you offer incentives for cash purchases instead?

Is it time to switch to a new merchant service provider?

Will charging customers credit card fees drive away potential business?

Before a business begins to charge a credit card fee, it will need to determine if customers are willing to pay extra for their products and services. You’ll also need to assess what your competitors are doing. If your business is the only one in its industry imposing fees on credit card payments, your customers are more likely to turn to competitors to avoid paying these extra fees.

How will you disclose the new policy to your customers?

Merchants will need to decide on the right strategy to implement this change without damaging existing customer relationships. It is mandated that you give your customers a credit card fee notice. Whether through a credit card service fee sign or another visual method, a business can announce the charge with an explanation or let customers discover this change on their own.

Instead of penalizing customers for using credit cards, how can you incentivize them to use cash?

While convenience fees and surcharges are a way to recoup credit card processing fees for merchants, charging a fee for paying with a credit card can leave a bad taste in customers’ mouths. To avoid these repercussions, merchants can offer discounts to customers who pay with cash instead of charging customers credit card fees. This will also eliminate the hassle of all the laws and regulations associated with convenience fees and surcharges.

Is it worth finding a new merchant services provider instead of charging more fees?

If your credit card processing fees are so high that you’re considering convenience fees or surcharging, the solution might not be to impose extra fees. Negotiating lower processing fees or switching to a better merchant services provider may make more sense. Look for merchant providers offering several pricing options and solutions to help lower your processing costs.

If your company decides to move forward with surcharging or convenience fees, use a payment integration like EBizCharge to automatically add surcharges to all your transactions.

Merchants have the option to charge credit card fees if they feel it’s right for their business

Ultimately, merchants do have the option to charge extra fees to customers who want to pay with credit cards. To make the most informed decision, businesses should thoroughly evaluate the pros and cons associated with these fees, how they will affect your customer base, and what impact they will have on long-term growth. EBizCharge makes implementation straightforward with ERP, CRM, and eCommerce integrations that handle surcharge calculations and posting automatically so the added fee never creates extra work for your team.