Templates | Income Statement / Profit and Loss Statement

Income Statement Template

Income Statement Template

Get a free income statement Excel template (also known as a profit and loss statement) to help clearly summarise your company’s revenue, costs, and expenses.

Get a free income statement Excel template (also known as a profit and loss statement) to help clearly summarise your company’s revenue, costs, and expenses.

Download our excel template today.

Download our free Profit and Loss Statement Template to provide a detailed and accurate account of your company’s financials.

Whether you’re a small business or a growing company, this free printable blank profit and loss statement will help you understand your financial performance at a glance. Use this sample income statement template to make smarter decisions, monitor profitability, and stay on top of your business finances with confidence.

What is an income statement, and is it the same as a profit and loss statement?

You’ve probably heard both terms tossed around. Here’s the good news: Yes, an income statement and profit and loss statement are the same thing. Some people say “P&L,” while others call it an “income statement,” but both refer to the same basic financial report. It’s the one that shows how much money your business brought in, how much went out, and what you were left with at the end of the day.

The income statement usually covers a specific time period—like a month, quarter, or year—and it summarizes your revenues, expenses, and profits (or losses). It’s one of the core financial statements used in any business, alongside the balance sheet and cash flow statement.

Whether you’re running a solo operation or managing a growing team, the income statement gives you a snapshot of how your business is performing. Think of it as your business’s report card for a given time.

How to create a profit and loss statement

Creating a P&L doesn’t have to be complicated, especially if you take it step by step. Whether you’re using accounting software or just starting out with a spreadsheet, here’s the general flow:

- Pick your time frame: Decide whether you want to see monthly, quarterly, or yearly results. If you’re doing this for the first time, start small—a month is manageable.

- List your revenue: This includes all the income your business earned during the period. That could be sales of products or services, interest income, or anything else classified as incoming cash.

- Tally up your expenses: Think rent, salaries, utilities, software subscriptions, advertising—everything it takes to keep your business running. Categorize them in a way that makes sense to you and makes patterns easy to spot later.

- Calculate net profit (or loss): Subtract your total expenses from your total revenue. If the result is positive, congrats—you’ve made a profit. If it’s negative, you’re looking at a loss, and that’s okay too. What matters most is knowing where you stand.

- Review and revise: Once the numbers are in, take a moment to make sure everything looks right. A single typo can throw things off, so double-check categories and totals.

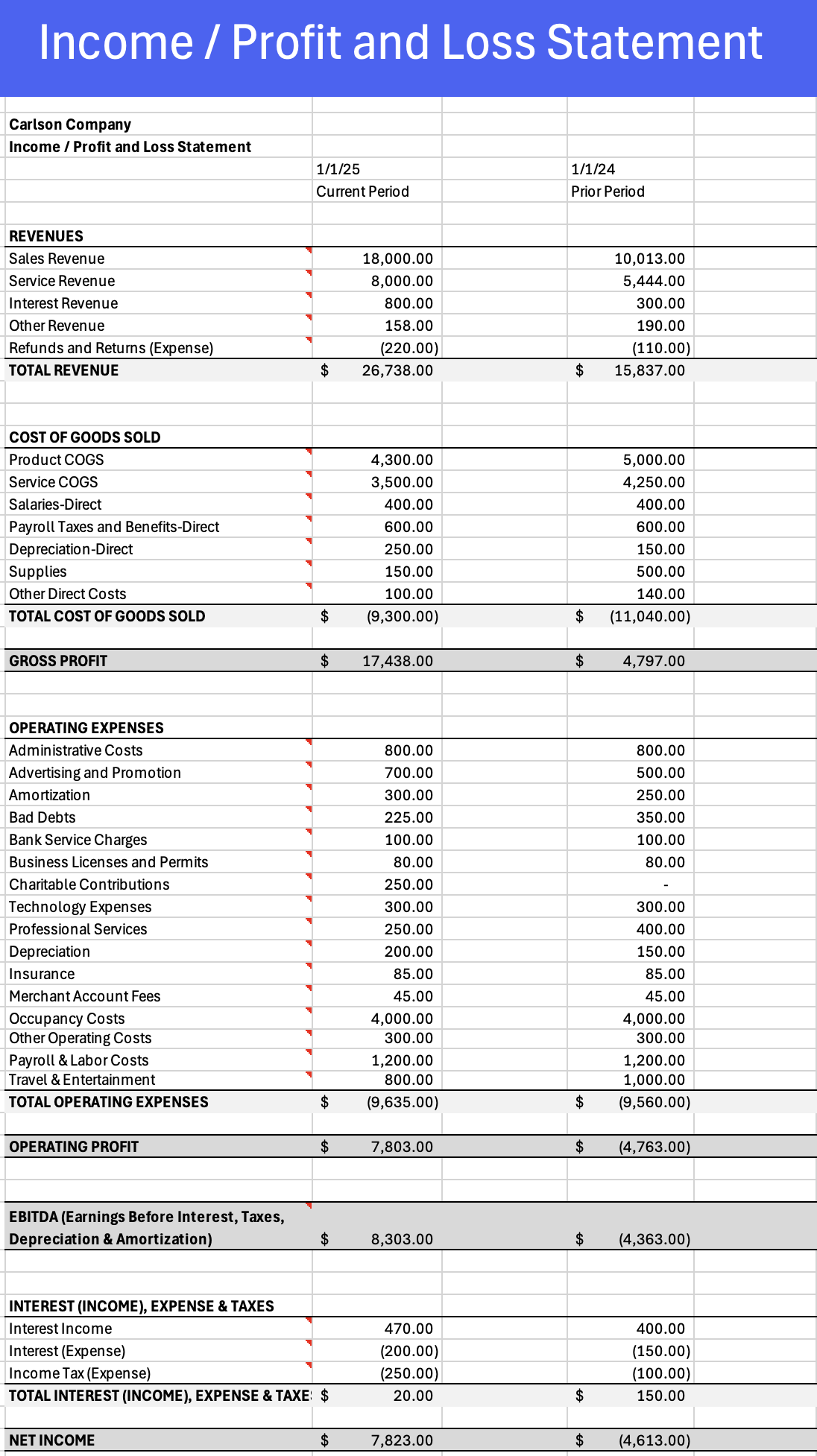

Here is a profit and loss statement example:

You don’t need to be a CPA to build a solid income statement. What matters most is consistency. Use the same structure each time so you can compare periods and track progress.

What is the main thing you can learn from an income statement?

Here’s the heart of it: your income statement tells you if your business is actually making money. That’s the headline takeaway.

Beyond helping to answer the question, “Am I profitable?”, it also helps you spot what’s working and what’s not. Maybe you’re bringing in solid revenue, but overhead is eating away at your profit. Or maybe your expenses are low, but sales are stalling. Either way, the income statement shows you how all the moving parts of your business add up.

It also helps you make better decisions. Want to hire a new employee, raise your prices, or cut a subscription that isn’t paying off? This is the document that backs up those ideas with real numbers.

If you’re the kind of person who’s juggling a lot, an income statement gives you clarity. It’s not just a report for accountants or investors—it’s a tool for you. Whether you’re steering the ship solo or managing a small team, knowing your income and expenses helps you move forward with confidence.