Templates | General Ledger

General Ledger Template

General Ledger Template

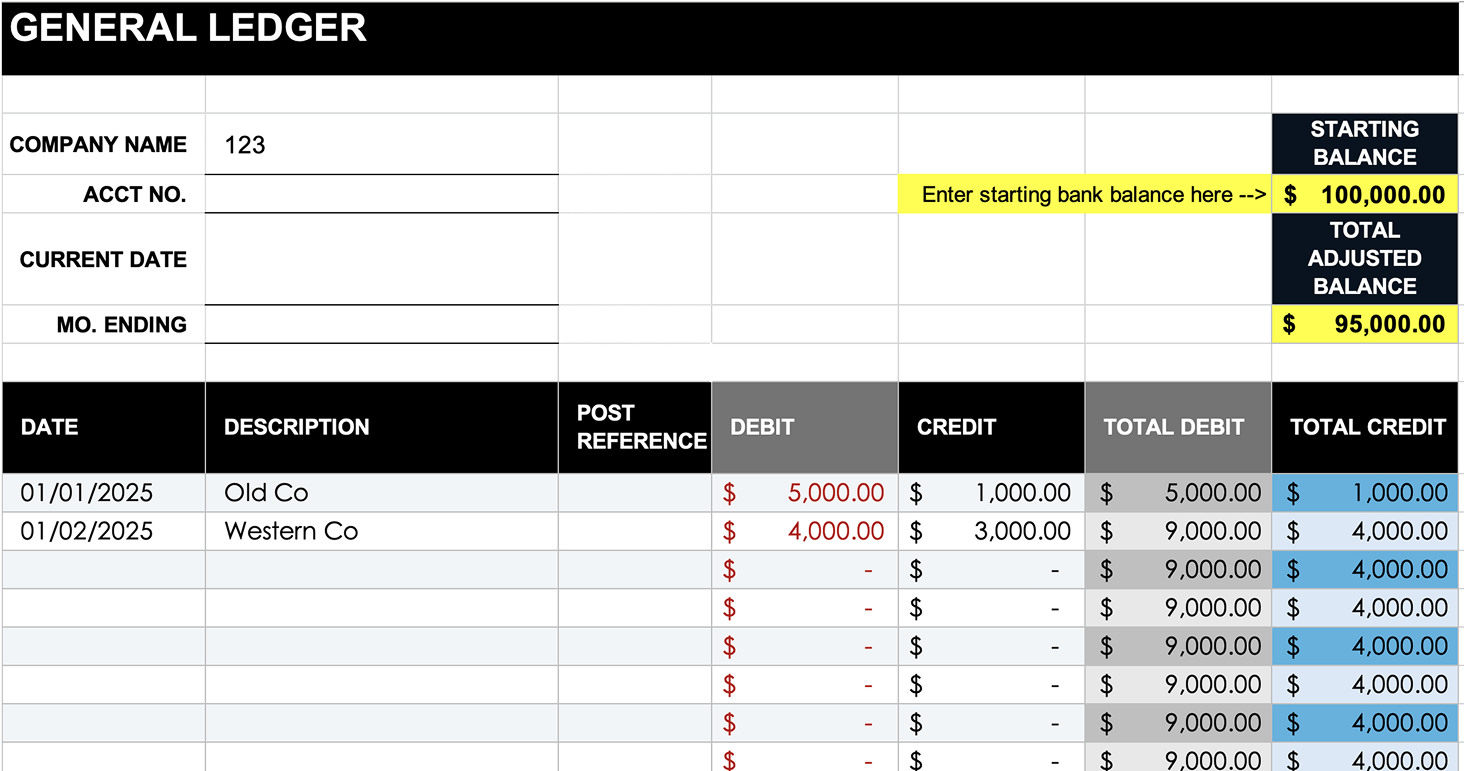

Download a free, customizable general ledger template to track your business finances with ease.

Download a free, customizable general ledger template to track your business finances with ease.

Download our free excel template

What is a general ledger?

A general ledger is the central record of all your company’s financial transactions. It tracks debits and credits across accounts such as cash, accounts receivable, accounts payable, and revenue. By organizing every transaction in one place, the general ledger provides a complete picture of your business’s financial health.

How is the general ledger organized?

A general ledger is typically organized by account type. Each account (for example, cash, sales, or expenses) has its own ledger section that records all related transactions. Entries are listed chronologically, with debit and credit columns, dates, descriptions, and running balances. This structure makes it easy to see account activity and confirm that total debits equal total credits.

How to do general ledger reconciliation

General ledger reconciliation means comparing ledger balances against supporting records like bank statements, invoices, or subledgers. The goal is to identify discrepancies and correct them so your accounts remain accurate. Common steps include:

Compare the general ledger balance to source documents.

Investigate and resolve differences (for example, missing entries, double charges, or timing delays).

Adjust the ledger by correcting journal entries.

Reconciliation is usually done monthly or quarterly to ensure financial statements are accurate.

How to create a general ledger template

To create a general ledger template, set up columns for date, description, journal reference, debit, credit, and balance. Each transaction you record should include:

- The date of the transaction.

- A short description (e.g., “invoice payment received”).

- A debit entry (if money is going into an account).

- A credit entry (if money is leaving an account).

- The updated account balance after the entry.

- Our free template includes these pre-built fields, so you can start filling them out immediately without designing from scratch.

What is a subledger vs a general ledger?

A subledger is a detailed record that supports a specific general ledger account. For example, the accounts receivable subledger lists each individual customer invoice and payment, while the general ledger only shows the total accounts receivable balance. Subledgers provide transaction-level detail, while the general ledger provides the summarized financial picture.