Templates | Cash Flow

Company Cash Flow Planner

Company Cash Flow Planner

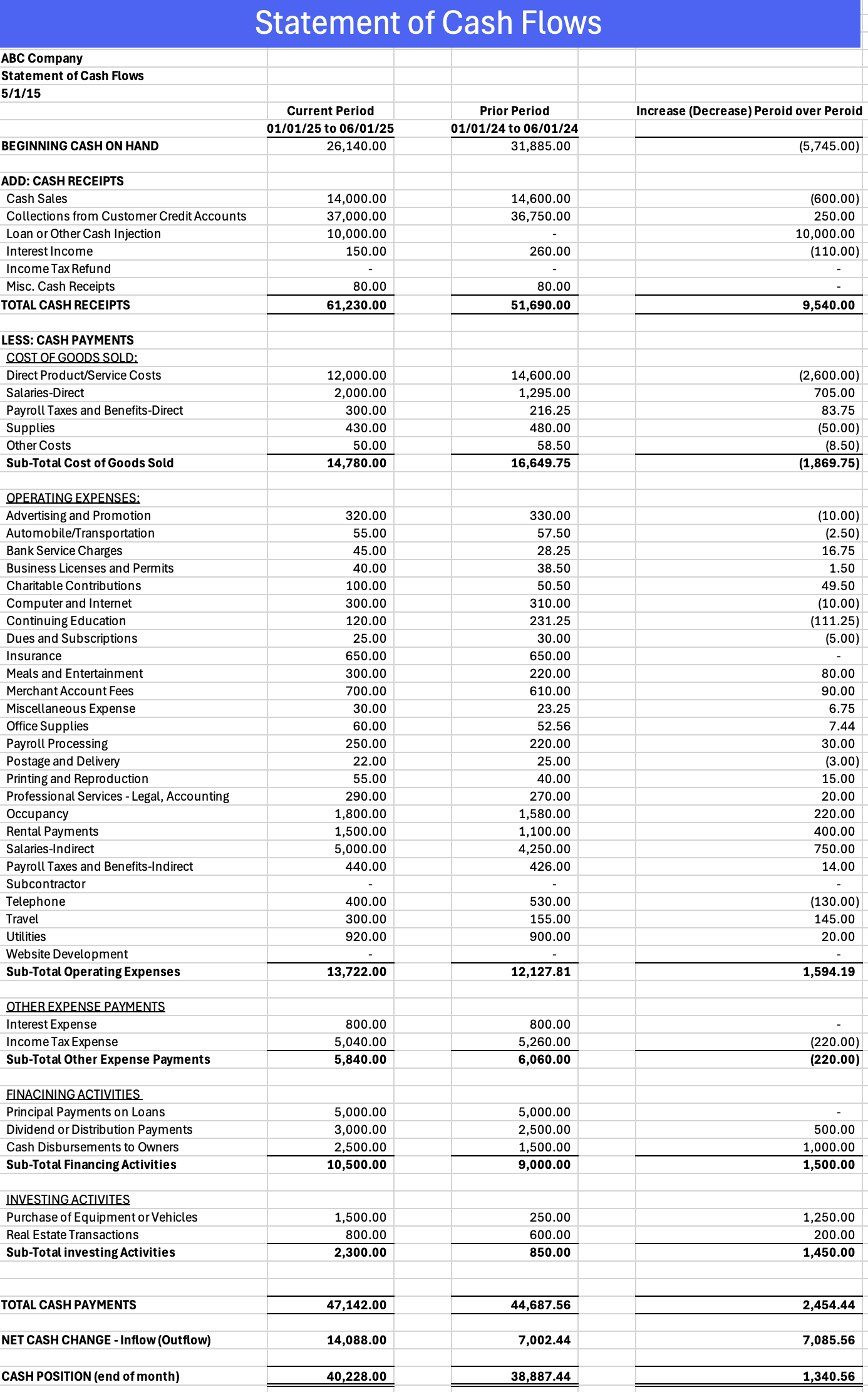

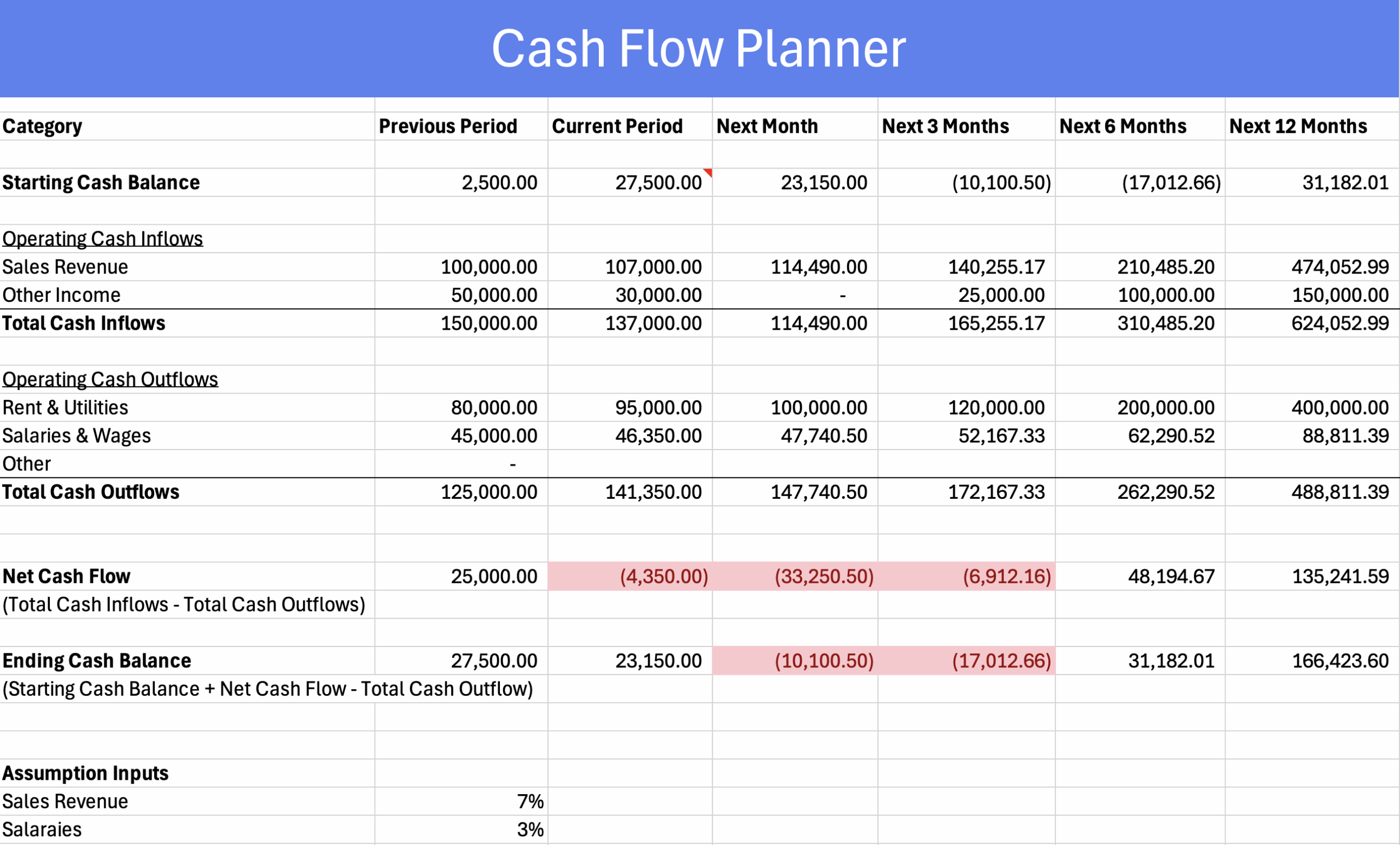

Looking for an excel company cash flow planner or a statement of cash flows template?

Looking for an excel company cash flow planner or a statement of cash flows template?

Download our free excel templates today.

Download your free Excel company cash flow planner and statement of cash flows template to easily track, manage, and forecast your business finances!

Stay in control of your business with our Excel company cash flow planner. Our free, easy-to-use cash flow forecast template helps you track cash inflows, outflows, and ending balances, ensuring you always know where your finances stand. With automated calculations and a structured layout, you can forecast your cash flow and make informed financial decisions. Download now and start planning smarter!

What is cash flow?

Cash flow is just a simple way of looking at the money moving in and out of your business. It tells you if you have enough coming in to cover what’s going out.

It’s not about how much you’re selling or billing—it’s about when money actually hits your account. That timing makes a huge difference. You might have $100,000 in sales this month, but if customers don’t pay for 60 days, and your rent is due next week, that cash flow gap can cause real problems.

That’s where something like a statement of cash flow comes in. It’s a breakdown—usually by month or quarter—of what cash came in, what went out, and what’s left. It gives you a clear view of how your business is really functioning beneath the surface. Not just profit, but cash in hand.

So, when people talk about managing cash flow, they’re really talking about making sure the timing works. A solid cash flow plan makes sure that you’ve got enough on hand to cover your bills, pay your team, and keep the lights on.

Why every business needs a cash flow planner

Even if you’re running a lean, well-organized operation, planning your cash flow isn’t optional—it’s survival.

A cash flow planner helps you see what’s ahead: how much cash you’ll have next week, next month, or next quarter. This matters even more for smaller companies, where a few late payments or an unexpected expense can throw everything off. That’s why tools like a small business cash flow template come in handy—they give you a clear picture of your cash position before problems show up.

Having a plan doesn’t mean everything goes perfectly. But it gives you a heads-up so you can adjust early—like delaying a purchase or following up on overdue invoices—rather than reacting too late.

Short-Term vs. Long-Term Cash Flow Planning

Short-term planning looks at the next few weeks or months. It’s useful for tracking payroll, rent, and recurring bills. Think of it like keeping your car on the road day to day.

Long-term planning, on the other hand, zooms out. It shows you if your business model really works over time. Are your prices sustainable? Will growth lead to cash shortages? This kind of planning helps you make big decisions—like expanding, hiring, or launching something new—with fewer surprises.

Both views matter. Use short-term plans to stay steady and long-term plans to grow smart.

What is a cash flow analysis?

Cash flow analysis is about looking back to understand your patterns. Where did your money come from? Where did it go? How often do you run short, and why?

This kind of review helps you figure out if your business is running smoothly or running into the same cash problems over and over again. Maybe you rely too much on one customer. Maybe your payment terms are too generous. Or maybe your expenses creep up during busy seasons.

Knowing this stuff makes your decisions better—not just for today, but for the next quarter, the next year.

How to do a cash flow analysis

Start simple. Pull your numbers for a specific period—say, the last month. List all your incoming cash (like customer payments, loans, or investments) and all your outgoing cash (like rent, payroll, supplies, taxes).

Now, look at the timing. Did money come in before it needed to go out? Or were you scrambling to cover bills?

You don’t need fancy software to do this (a spreadsheet works just fine). But you do need to be honest and consistent. Over time, you’ll start to see patterns, and that’s when you can really make changes that stick.

Cash flow forecast vs. cash flow analysis: what’s the difference?

A cash flow analysis looks back. It shows you what happened, and why. It helps you understand your patterns and problem areas.

A cash flow forecast looks ahead. It predicts what’s coming—what you expect to earn and spend based on what you know today.

They’re two sides of the same coin. Analysis gives you the insight. Forecasting gives you the plan. And together, they keep your business grounded, prepared, and a lot less reactive.

How to automate cash flow tracking

Manually updating spreadsheets can be time-consuming and prone to errors. The good news? There are plenty of tools available that can automate cash flow tracking and forecasting, saving you time and giving you more accurate insights.

Many accounting software platforms—like QuickBooks, Xero, and FreshBooks—have built-in cash flow tracking features that sync with your bank accounts and automatically categorize transactions. There are also dedicated cash flow forecasting tools that can predict future cash flow based on past trends, helping you see potential shortfalls before they happen.

If you prefer working in Excel, you can still automate parts of your process by using formulas, linking spreadsheets, and even integrating with financial software to pull in real-time data. EBizCharge takes this a step further by automating payment collection and reconciliation directly within your accounting system. With features like Email Pay, Customer Payment Portals, and real-time transaction syncing, you can speed up cash flow, reduce manual data entry, and ensure that incoming payments are reflected in your financial reports instantly.

The key is to set up a system that reduces manual work while giving you a clear picture of where your large or small business stands financially, so you can make informed decisions with confidence.