Templates | Cash Flow Forecast

Cash Flow Forecast Template

Cash Flow Forecast Template

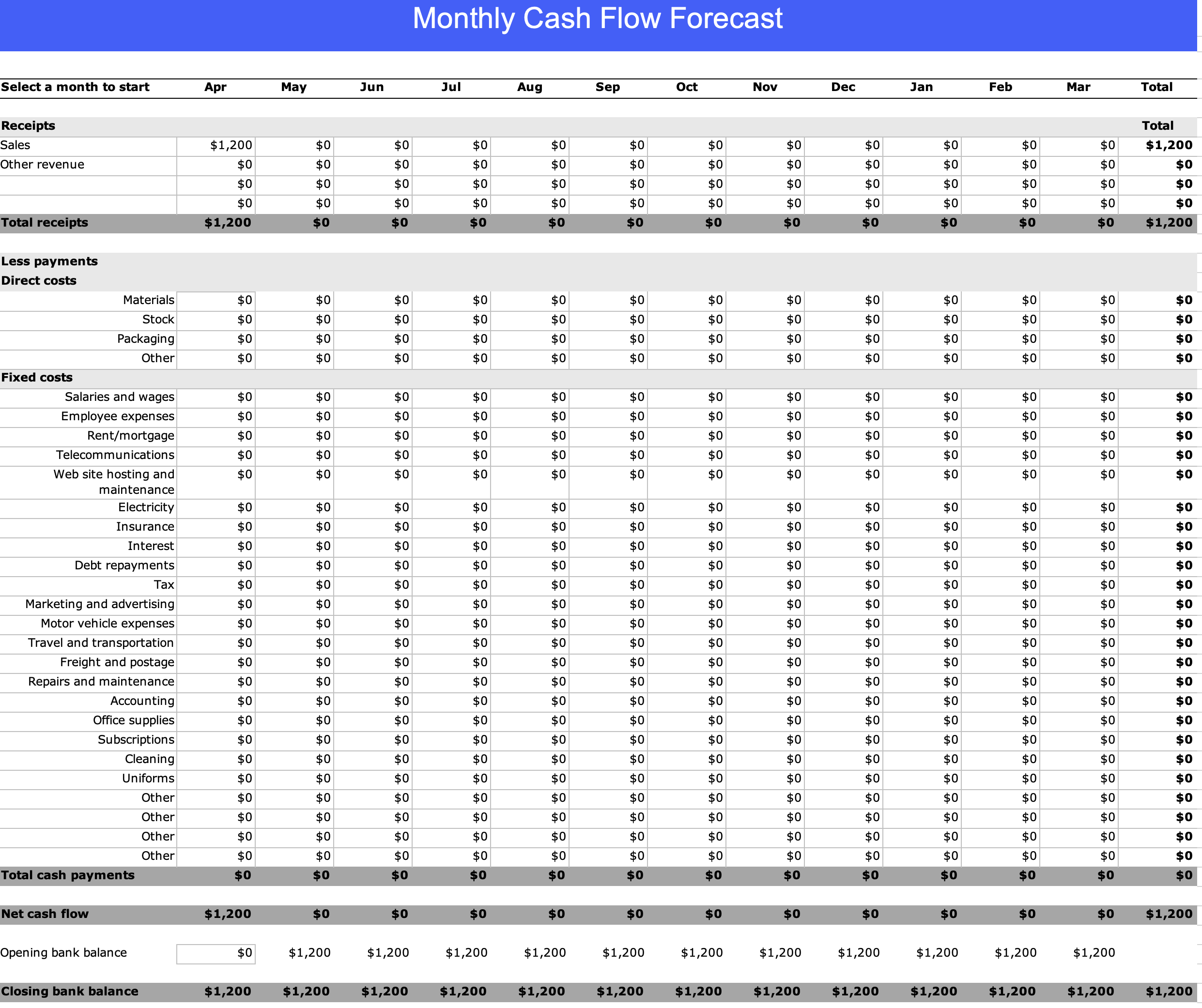

Get a free Cash Flow Forecast Excel Template to help you track incoming and outgoing cash, spot shortfalls early, and plan ahead with confidence.

Get a free Cash Flow Forecast Excel Template to help you track incoming and outgoing cash, spot shortfalls early, and plan ahead with confidence.

Download our free excel template today.

Download our cash flow forecast template to help you stay organized, spot potential gaps early, and make smarter financial decisions.

Improve your cash flow by planning ahead with our easy-to-use printable cash flow forecast template, designed to give you a clear view of your incoming and outgoing money.

What is a cash flow forecast?

A cash flow forecast is simply a way to look ahead and estimate how much money will be coming in and going out of your business over a certain period of time. Think of it as a map for your money. It helps you spot potential cash shortages before they happen, and it gives you a better handle on when you’ll have extra cash you can reinvest or save.

At its core, a forecast isn’t about perfection—it’s about preparation. Even a rough projection is better than flying blind, especially if you’re juggling payroll, vendor payments, and other recurring expenses. If you’ve ever been surprised by an empty bank account, a cash flow forecast is your early warning system.

How to do a cash flow forecast

There’s no one “correct” way to build a cash flow forecast, but here’s a practical approach you can use:

- Pick a time frame: Most small businesses start with a weekly or monthly forecast covering the next 3 to 12 months.

- List all cash inflows: These are payments you expect to receive—customer payments, loan proceeds, refunds, etc. If you invoice clients, make sure to factor in realistic payment timelines, not just when you sent the bill.

- List all cash outflows: Include fixed costs like rent and payroll, plus variable expenses like supplies, subscriptions, and one-off purchases.

- Calculate net cash flow: Subtract outflows from inflows for each period. This shows whether you expect to have a surplus or shortfall.

- Track your cash balance: Starting with your current bank balance, roll forward the net cash flow each period to see how your balance changes over time.

That’s it. You can do it in a spreadsheet or use accounting software—whatever helps you stick with it consistently.

How to improve a cash flow forecast

Even if you already have a forecast, there’s always room to sharpen it. A few tips:

- Be realistic, not optimistic: It’s tempting to assume every client will pay on time and every deal will close. Don’t. Base your forecast on patterns, not hopes.

- Update it regularly: A forecast isn’t something you do once and forget. Revisit it weekly or monthly, and adjust for actuals. The more often you check in, the more useful it becomes.

- Build in some buffer: Things rarely go exactly as planned. Including a safety margin for unexpected costs or delayed payments makes your forecast more durable.

- Segment your inflows and outflows: Break them down by category or client, if possible. It gives you clarity on where your money is really coming from—and where it’s going.

- Watch your assumptions: Are your projections based on historical data or wishful thinking? Check your math and your mindset.

Why a cash flow forecast actually matters

Let’s be honest: a forecast won’t change your cash position on its own. But it gives you something far more powerful—awareness.

When you know where your cash is headed, you can make better decisions. You’ll feel more confident negotiating payment terms, timing purchases, or deciding whether it’s the right moment to hire. You can catch problems before they snowball into crises.

For business owners, operators, or finance folks wearing multiple hats, a cash flow forecast is less about being perfect—and more about being prepared. It’s one of those tools that seems small until it saves you big. If you’re reading this, you probably care enough about your business to make smart, forward-looking choices. A good forecast is one of the most practical ways to do just that.