Templates | Remittance Advice

Remittance Advice Template

Remittance Advice Template

Looking for a Remittance Advice example?

Looking for a Remittance Advice example?

Download our free PDF form today.

Streamline your payments and ensure accuracy with our easy-to-use Remittance Advice Template – keep track of transactions with confidence!

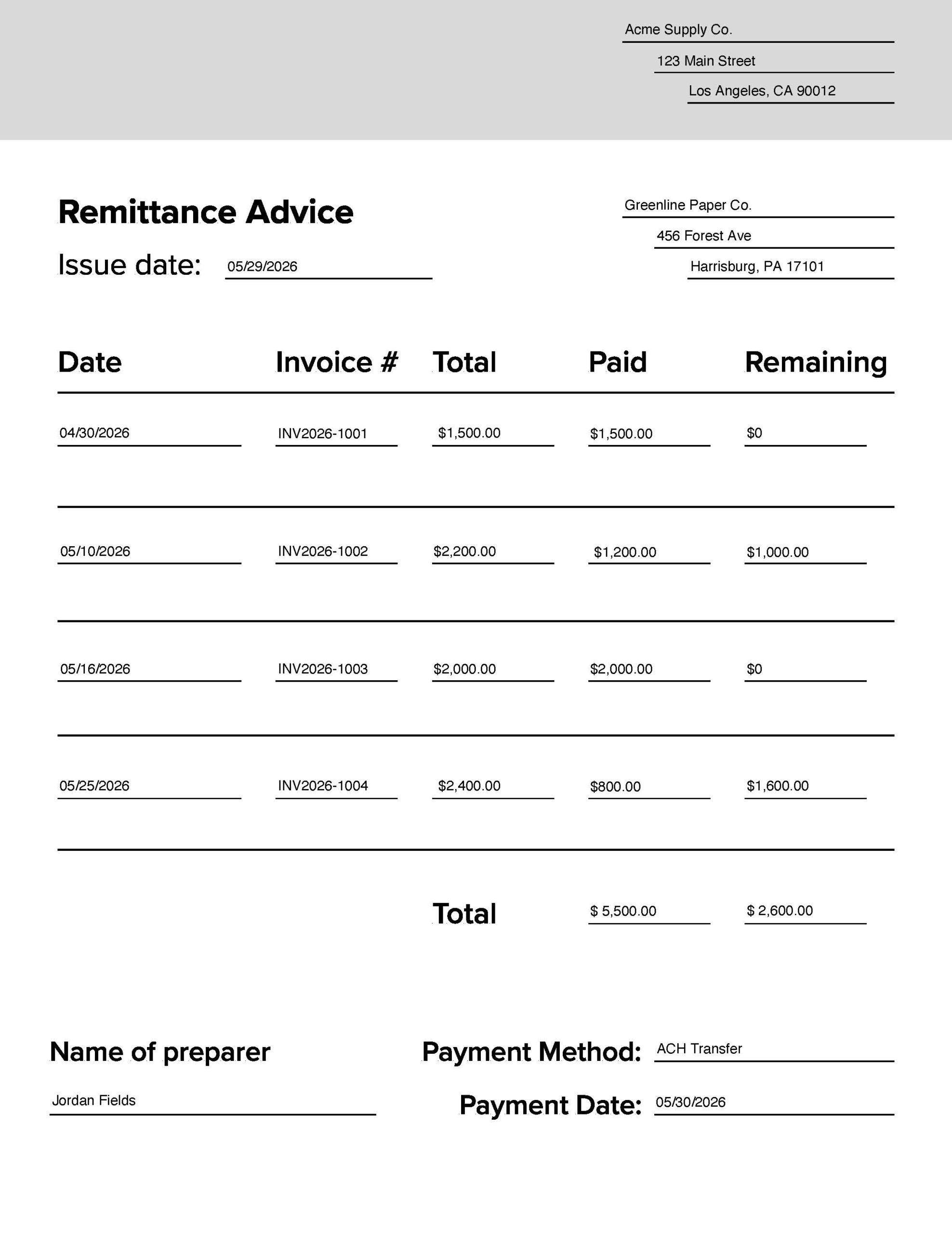

Our free remittance advice template helps you track and manage payments. Whether you’re handling invoices, processing payments, or reconciling accounts, this example provides a clear, professional document for communicating payment confirmation. Download it today and customize it to fit your business needs.

When you send a payment to a vendor or supplier, it helps to include a note explaining what the payment is for. That’s really all remittance advice is—a simple document that lays out the details. It tells the recipient which invoices you’re paying, how much you’re paying, and how the payment was made. It’s not required, but it makes life easier for both sides.

What is remittance advice and what is the purpose?

Remittance advice is a simple document that you send to a vendor or supplier when making a payment. It outlines what the payment is for—usually by listing invoice numbers, amounts paid, and any remaining balances.

You can think of it like a receipt in reverse. Instead of receiving it after a purchase, you’re the one sending it along with the payment. The goal is to make sure the person on the other end knows exactly how to apply the money.

This becomes especially helpful when you’re paying multiple invoices at once or making a partial payment. Without remittance advice, the vendor might not know how to split the funds or which invoices you’re trying to settle.

For the recipient—often someone in accounting or accounts receivable—remittance advice makes things smoother. It helps them update records quickly, apply the payment accurately, and avoid errors. It also saves both sides from needing to follow up with emails asking things like, “What was this payment for?” or “Did you mean to short-pay this invoice?”

How to fill out a remittance advice document

Filling one out is pretty straightforward once you know what to include. Whether you’re using a template, creating one in Excel, or generating it from your accounting software, the goal is the same: clearly communicate what the payment is for.

Here’s a step-by-step guide:

1. Start with your business information.

Include your company’s name, address, phone number, and email. This gives the recipient a way to contact you if they have questions, and it ensures they know exactly who the payment is coming from.

2. Add the recipient’s information.

Include the name and contact details of the vendor or supplier you’re paying. Double-check this part—it’s easy to copy and paste from a past document and accidentally leave in old info.

3. Include the payment date and method.

List the date the payment was made (or will be made) and how it was sent—ACH, wire, check, credit card, etc. If there’s a reference number, like a check number or ACH confirmation code, include that too.

4. Break down the invoices.

This is the heart of the document. For each invoice you’re paying, include:

- The invoice number

- The invoice date

- The original invoice amount

- The amount you’re paying toward that invoice

If you’re only making a partial payment on an invoice, make that clear. If you’re paying multiple invoices, list each one separately.

5. Include any notes or explanations.

If something is out of the ordinary—like a discount, a credit memo applied, or a short pay—add a note to explain it. You don’t need to write a novel here. Just a line or two so the recipient understands why the payment doesn’t match the invoice exactly.

6. Double-check and attach.

Before you send it off, take a moment to review everything. Make sure it matches the payment you’re sending. Then attach the remittance advice to your payment, or email it to your vendor’s accounts receivable team.

If you’re handling payments regularly, getting into the habit of sending remittance advice can be a real game-changer. It builds trust with your vendors, helps prevent mix-ups, and keeps your books clean. And if you’re on the receiving end, encouraging your customers to send remittance advice can save you hours of tracking down payments and reconciling accounts.

No need to overthink it—just focus on being clear, accurate, and consistent. That’s what keeps everything running smoothly.

Is remittance advice typically sent electronically, mailed physically, or delivered in person?

If you’re handling payments or managing invoices, you’ve probably wondered how remittance advice is usually sent. The truth is, these days most remittance advice are sent electronically. Electronic remittance advice (ERA) is sent digitally, often via email or a secure online portal. ERA is commonly used for quicker processing and easier record-keeping, especially for large organizations or high-volume transactions. Email is quick, easy, and gives everyone involved a clear record to refer back to. It’s convenient for both the sender and the receiver, especially when you need to keep track of payments without digging through piles of paper.

That said, not everyone has fully switched to digital yet. Paper remittance advice is a physical document sent through the mail alongside payment, detailing the payment breakdown. Some companies still prefer mailing physical copies, especially if their accounting systems rely on paper documents. In certain cases, especially in smaller businesses or local partnerships, remittance advice might even be handed over in person. While less common, it can be a helpful way to make sure the right person actually receives the payment details and there’s no confusion.

For most of you reading this, sending a remittance advice by email will be the fastest and most efficient way to keep things moving.

Email remittance best practices

When you do send a remittance advice email, there are a few best practices that can make a big difference.

- Start by including all the key details: payment amounts, invoice numbers, dates, and any reference codes. This helps the recipient match your payment with the right invoices without needing to chase you down for clarification.

- Keep your message simple and friendly. Remember that these emails help maintain good business relationships.

- Double-check that you’re sending your remittance advice to the right contact person or department. It might sound obvious, but it’s easy to accidentally send these emails to the wrong place.

- Attach a remittance advice document or template that summarizes the payment information clearly. This little extra step often saves time and confusion on both ends.

By following these straightforward tips, your remittance advice emails will do their job smoothly, keeping payments clear, timely, and well-documented.