Blog > What’s the Difference Between Arrears Billing and Paid in Advance?

What’s the Difference Between Arrears Billing and Paid in Advance?

When it comes to business transactions, understanding the different billing methods is crucial for service providers and clients. Two common methods are arrears billing and paid in advance, each with unique implications for cash flow management, financial planning, and operational efficiency.

This article will explore the key differences between these billing practices, the pros and cons of arrears billing, and best practices.

Billing in arrears vs. in advance: What’s the difference?

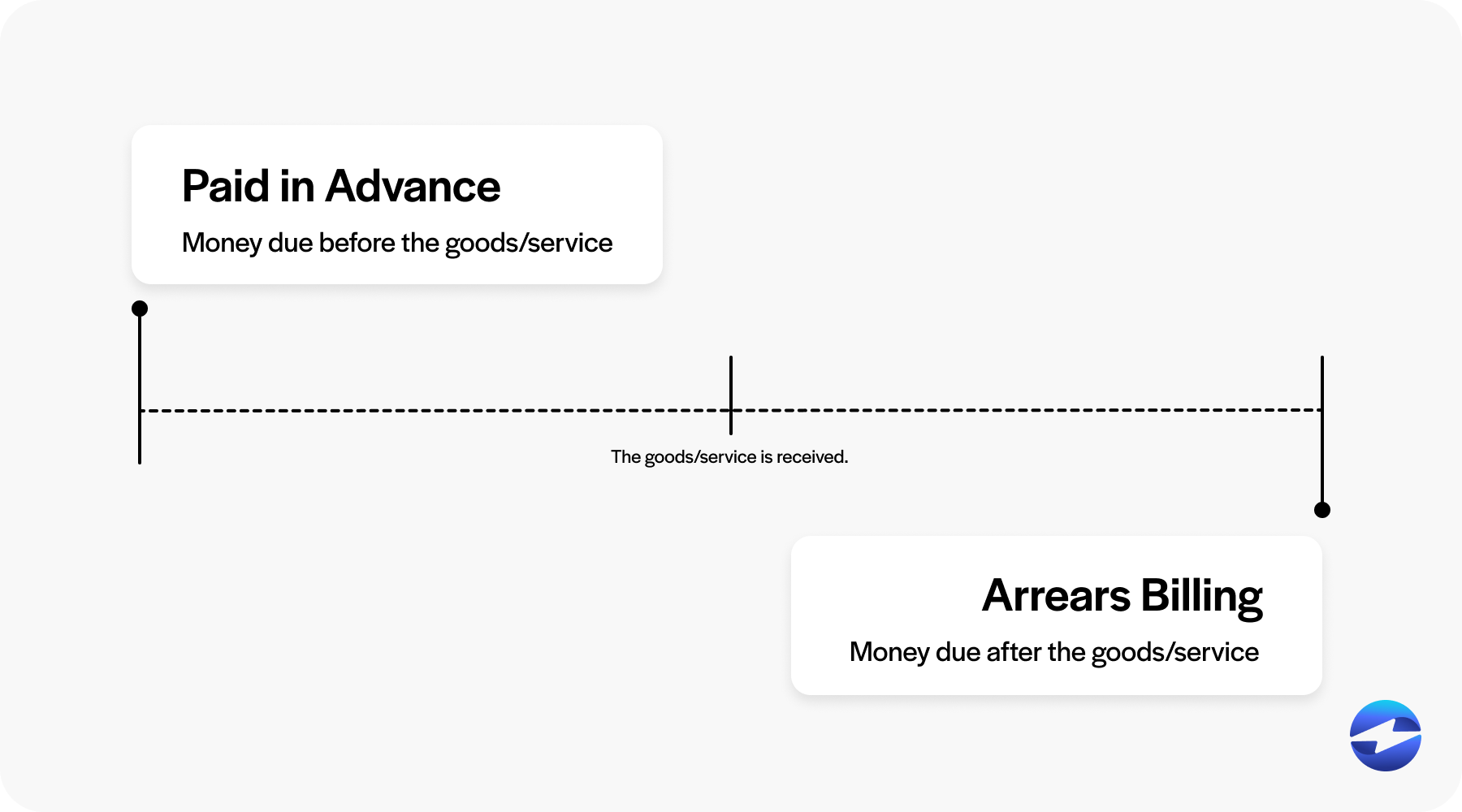

Arrears billing and paid in advance represent two fundamental payment methods when settling invoices, each with different payment timelines based on the goods or services provided. The primary difference hinges on whether the payer remits funds before or after receiving the benefit of a service or product.

With arrears payments, the exchange of money occurs after the provision of services or goods. In the case of paid in advance, the payment is solicited and often required before the service period begins or the good is delivered.

Knowing the difference between these billing practices is essential, as they affect how cash flow is managed, accounts payable (AP) and accounts receivable (AR) are recorded, and for establishing a working relationship based on trust, consistency, and financial security for service providers, suppliers, and clients.

Arrears billing

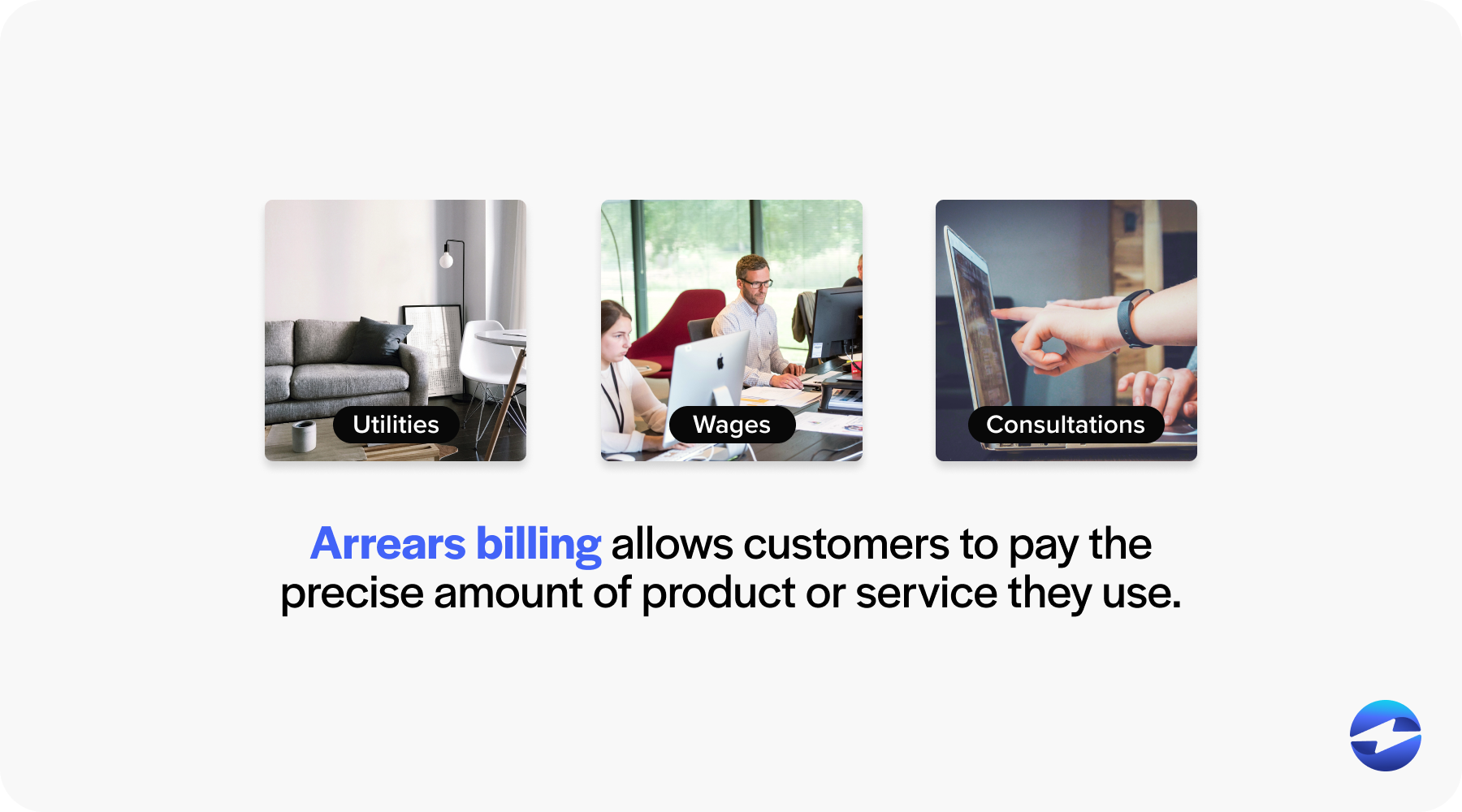

Arrears billing means payment is expected after a service has been rendered or goods have been delivered.

Traditional examples of payments in arrears include utility bills, employee payrolls, or professional consultation fees.

The term arrears doesn’t necessarily imply late payments. Instead, it describes a payment method in which the invoice covers a period of service or goods received in the past, such as the previous pay period.

For example, hourly employees are typically paid in arrears for the hours they worked in the previous pay period. This system allows for precise compensation calculations, including overtime and other adjustments. Meanwhile, service providers may send bills in arrears to account for the exact consumption of services like telephone usage, electricity, or gas.

The practice of billing in arrears is common because it ensures customers pay for the precise amount of product or service they use. However, it also means that providers must manage a delay in receiving payments and be prepared to address potential overdue payments.

Paid in advance

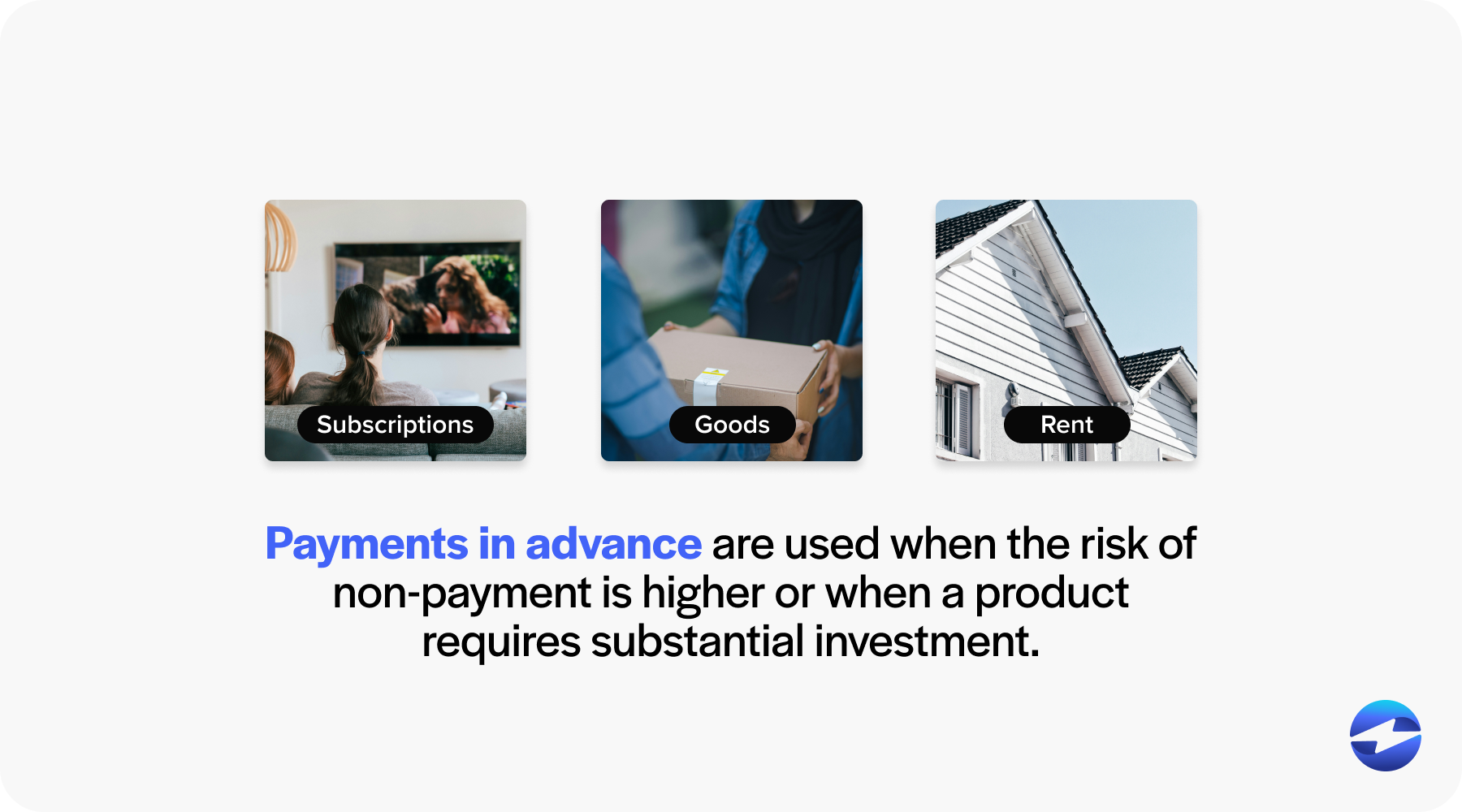

Paid in advance refers to a payment made at the outset of a service period or before goods are delivered. This approach is often used in industries where the risk of non-payment is higher or when the service or product requires a substantial investment on the provider’s part before delivery.

Common instances where advance payment may be applied include subscription services, custom goods orders, or rent payments.

Customers can secure their orders or reservations by paying for the services or goods upfront. For service providers, receiving payments in advance helps protect against cash flow disruptions and reduces the credit risk associated with extending services on credit.

Advance payments may also be helpful when a customer’s creditworthiness is uncertain. In such cases, providers may request advance payment as assurance they won’t have to chase overdue payments later. This payment method can introduce challenges, such as making partial or full refunds if services or products aren’t rendered as expected.

Additional billing methods

Beyond arrears billing and payments in advance, businesses and clients can utilize other billing methods, depending on the nature of their transactions, trust levels, and risk assessments.

Additional billing methods include:

- Retainers: A retainer agreement is a financial arrangement in which a client pays in advance for the provision of services by a service provider or consultant. Payment is typically made regularly (often monthly) to secure the service provider’s availability for a set period or a certain number of service hours. Retainers act as a reservation system where the client reserves time in the service provider’s schedule.

- Scheduled payments: Scheduled payments refer to predetermined and agreed-upon dates when payments for invoices are to be submitted by a payer to a payee. Typically, these payments are outlined in the terms of a contract or a bill and are expected to adhere to the schedule to avoid any penalties or service interruptions. This ensures both parties understand when the payment is due. It allows the payee to manage their cash flow and budget expectations while providing the payer with a clear timeline for financial obligations. Scheduled payments can be set up for various billing frequencies, such as weekly, monthly, quarterly, or annually, depending on the service provided or the agreement between the entities involved.

- Initial deposits: An initial deposit refers to a partial payment made upfront at the beginning of a service period or before a product delivery commences. This amount is typically a fraction of the total invoice value and is required as a show of good faith, indicating the client’s commitment to a purchase or contract. Such deposits help mitigate risk for service providers or sellers as they secure a level of financial commitment from the buyer.

By clearly understanding and choosing the appropriate billing method, businesses can maintain healthy financial operations while fostering positive client relationships. While arrears billing has its share of advantages, it also has some drawbacks.

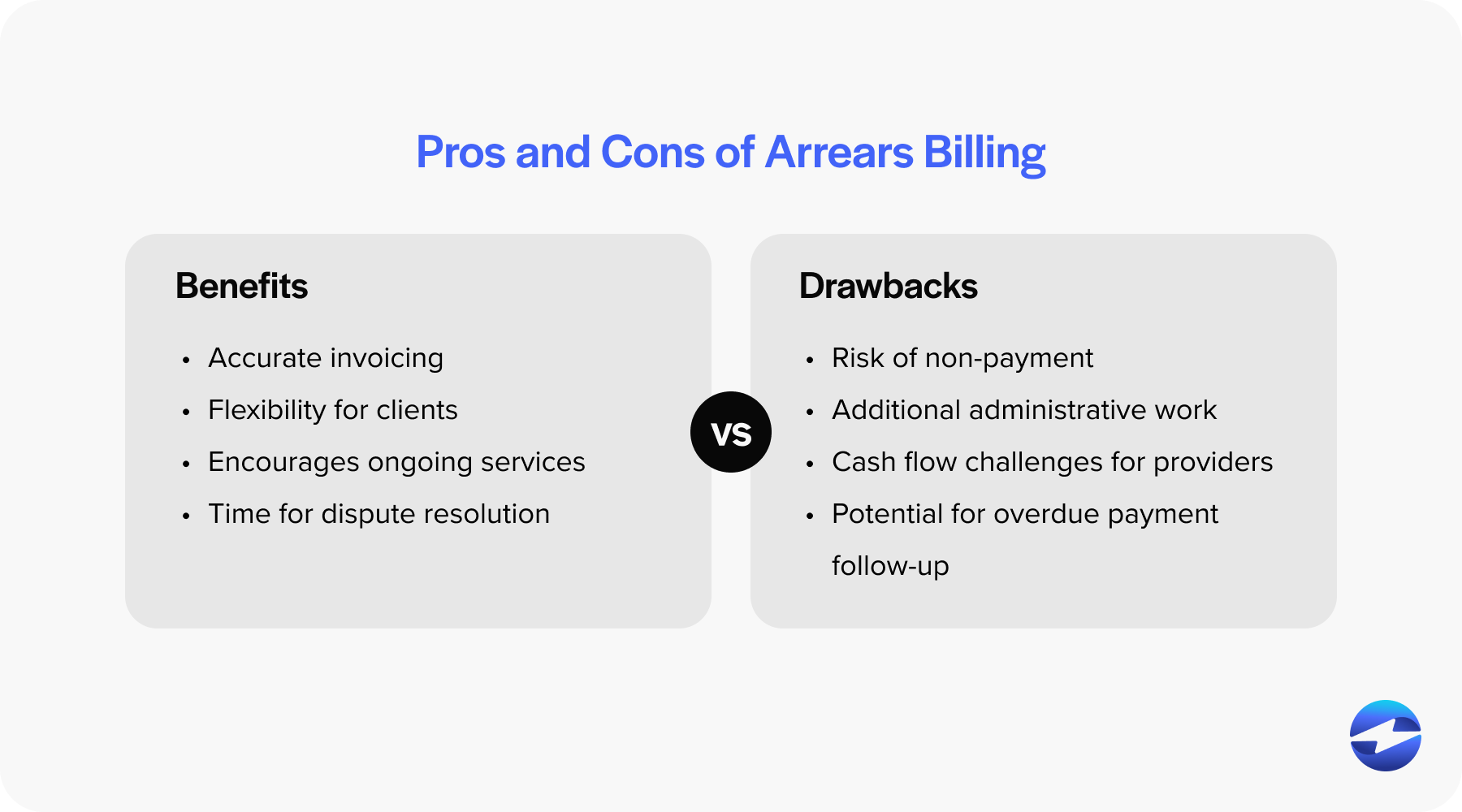

The pros and cons of arrears billing

Billing in arrears comes with its own set of advantages and disadvantages. Businesses should carefully weigh these factors to determine whether arrears billing aligns with their operational needs and financial strategies.

4 benefits of arrears billing

- Accurate invoicing: Payments in arrears allow for accurate invoicing because service providers can bill for actual usage or time worked. This is particularly relevant for hourly employees, where the exact number of work hours may vary from one pay period to another.

- Flexibility for clients: Clients appreciate the flexibility that arrears billing offers, as they pay only for received services. This can help with their cash flow management, as they don’t have to allocate funds before the service is received.

- Encourages ongoing service: In service industries, arrears billing can promote continuous relationships between the client and service provider. Since payment occurs after services are rendered, there’s an implied understanding that the business relationship is ongoing.

- Time for dispute resolution: If there are any discrepancies or disputes regarding services provided or hours worked, there’s time to resolve these issues before the payment is processed, potentially reducing disputes over charges.

4 drawbacks of arrears billing

- Risk of non-payment: The most notable drawback is the risk of late or non-payment. Service providers must trust that clients will pay after the service is completed, but there’s always a risk that the client may delay or default on payment, affecting the provider’s cash flow.

- Additional administrative work: Billing in arrears may result in additional administrative work. Service providers must keep detailed records of services delivered or work performed to ensure accurate billing, which can be more labor-intensive than pre-payment models.

- Cash flow challenges for providers: Delayed payments can lead to cash flow challenges, especially for small businesses or freelancers who may not have financial reserves to operate while waiting for payments in arrears.

- Potential for overdue payment follow-up: When customers don’t pay on time, service providers must spend time and resources following up. This can include sending reminders, making phone calls, or, in some cases, engaging in collections activities, which can result in more costs and frustrations.

Businesses and service providers must weigh these factors carefully to determine if arrears billing is a suitable payment structure for their operations. The choice between billing in arrears vs. in advance often depends on the industry standards, the nature of services offered, and the financial stability of the clientele.

Mitigating the risks of arrears billing

To mitigate the risks associated with arrears payments, businesses can adopt several proactive strategies:

- Perform credit checks: Before offering service on an arrears billing basis, conduct credit checks on new clients to assess their creditworthiness.

- Clear payment terms: Establish and communicate clear payment terms, including due dates and consequences for late payments, to avoid any misunderstanding.

- Regular invoicing: Send invoices promptly after the service period to ensure timely payments.

- Proactive follow-ups: Promptly follow up with customers after invoicing if payments aren’t received on time.

- Offer incentives: Provide incentives for early payments to encourage customers to pay before the due date.

- Automated reminders: Implement an automated system to send payment reminders before and after the payment is due.

- Deposit or advance: Requires a partial payment upfront or a deposit to offset potential losses from delayed payments.

- Enforce penalties: Implement a penalty for overdue payments to discourage delinquency.

- Evaluate payment schedule: Regularly review the payment schedule to identify and address any systematic issues causing payment delays.

- Legal recourse: Establish a legal process in place for consistently late payers, signaling the seriousness of timely payment.

Incorporating these measures can help minimize the drawbacks of billing in arrears, ensuring a more secure and reliable payment stream for service providers and businesses.

For a seamless billing experience, businesses can look to comprehensive payment processing solutions like EBizCharge.

Facilitating arrears billing with EBizCharge

EBizCharge offers comprehensive payment software that streamlines arrears billing and automates invoicing by scheduling and sending out bills once services are rendered or deliverables are completed, ensuring timely client billing.

EBizCharge integrates seamlessly with various accounting and ERP software, automatically posting payments to corresponding invoices, thus simplifying reconciliation. This platform also offers multiple payment methods, such as credit cards and ACH transactions, making it easier for businesses to collect arrears payments.

Through a dedicated client portal, EBizCharge users can give their customers access to view outstanding arrears and make payments, enhancing the overall efficiency of the collection process. Its real-time reporting features enable businesses to monitor payment statuses and track overdue payments effectively. It also provides advanced security features to protect sensitive payment data, minimizing the risk of delayed or defaulted payments.

Overall, EBizCharge helps businesses manage arrears billing efficiently, reducing administrative burdens and allowing them to focus on their core activities.